-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - December 2024

MNI US OPEN - CNH Slippage Puts Rate in Range of Record Lows

MNI China Daily Summary: Tuesday, December 31

MNI EUROPEAN OPEN: China Assets Modestly Firmer On Further Policy Support

EXECUTIVE SUMMARY

- PBOC CUTS FX RRR TO SHORE UP THE YUAN - MNI BRIEF

- CHINA EQUITY CHALLENGES RISE, MORE STIMULUS NEEDED - MNI

- CAIXIN CHINA AUG MANUFACTURING PMI RISES TO 51 - MNI BRIEF

- JAPAN Q2 CAPEX DOWN Q/Q; GDP SEEN REVISED LOWER - MNI BRIEF

- BOJ SESS SOLID CONSUMPTION DESPITE WEAK SIGNS - MNI BRIEF

- CHINA WOES TO HAVE LIMITED IMPACT ON AUSTRALIA - EX-RBA - MNI

- CHEVRON LNG WORKERS REJECT PAY OFFER, OPENING WAY FOR TALKS - BBG

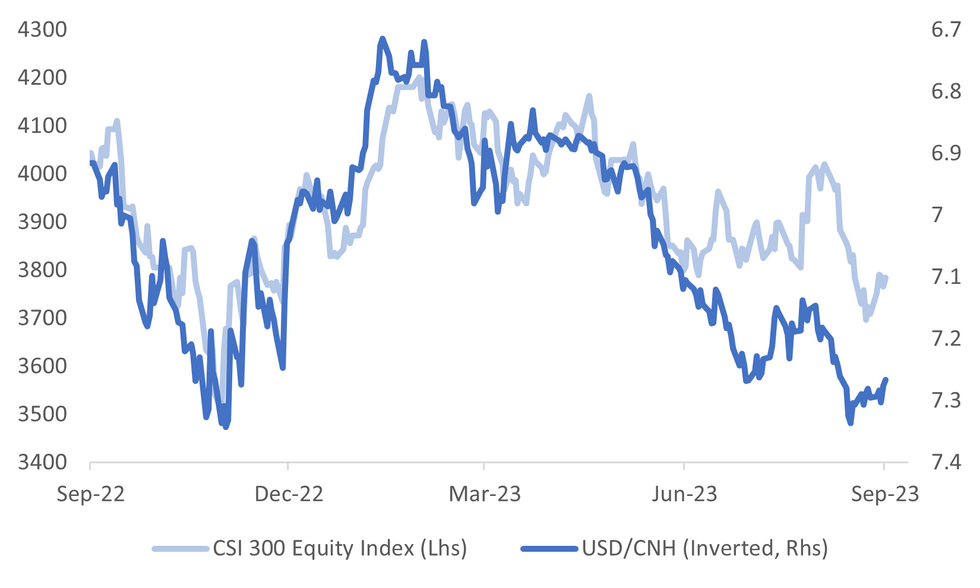

Fig. 1: China CSI 300 & USD/CNH (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: Almost two million people in Britain are using buy-now-pay-later credit to cover groceries, bills and other necessities, according to the Money and Pensions Service. While electronics and clothes are the most common purchases with short-term debt, one in five people who use BNPL paid for essentials, according to a survey carried out for the consumer body in March. Half of all users surveyed said cost-of-living pressures had changed how they used BNPL. (BBG)

EUROPE

UKRAINE: Ukraine told critics of the pace of its three-month-old counteroffensive to "shut up" on Thursday, the sharpest signal yet of Kyiv's frustration at leaks from Western officials who say its forces are advancing too slowly. (RTRS)

RUSSIA: United Nations Secretary-General António Guterres said on Thursday that he had sent Russian Foreign Minister Sergei Lavrov "a set of concrete proposals" aimed at reviving a deal that allowed the safe export of Ukrainian grain via the Black Sea. (RTRS)

U.S.

US/CHINA: US and Chinese military officials met at a defense chiefs conference in Fiji this month, in a rare direct engagement between the armed forces of the two superpowers. Admiral John Aquilino, who leads the US Indo-Pacific Command, held a meeting with a senior Chinese official at the event held Aug. 14-16, the Pentagon said. Chinese Defense Ministry spokesperson Wu Qian told reporters in Beijing Thursday that General Xu Qiling, deputy joint chief of staff of the People’s Liberation Army, met US representatives there. Neither side gave further details on the discussions. (BBG)

LABOR: Members of the International Longshore and Warehouse Union approved a new six-year labor contract covering cargo handling operations at 29 ports up and down the West Coast. Three-quarters of ILWU members voted to back a tentative contract agreement reached in June after negotiations with their employers dragged on for over a year. The union certified the results Thursday. (BBG)

WAGES: Ford said it has presented an offer on the upcoming contract that would provide its hourly employees with 15% guaranteed combined wage increases and lump sums. (BBG)

OTHER

JAPAN: Bank of Japan officials believe the recovery of private consumption will remain firm despite high prices, which will support an economic recovery, MNI understands. Continuous solid spending will drive firms to raise prices and strengthen the wage- and price virtuous cycle. Nominal wages have continued to rise but real income remains in negative territory amid price rises, which has impeded some spending. (MNI Brief)

JAPAN: Combined capital investment by non-financial Japanese companies excluding soft-ware fell 1.6% q/q in Q2 2023, decelerating from Q1's 2.8% in Q1, a quarterly survey released by the Ministry of Finance showed on Friday. (MNI BRIEF)

AUSTRALIA: China’s economic slowdown could reduce demand for Australia’s commodity exports and further weaken the Australian dollar, adding inflationary pressure, but the overall impact should be limited or even positive depending on the strategy Chinese authorities implement to bolster the economy, former Reserve Bank of Australia economists told MNI. (MNI)

AUSTRALIA: Australia’s housing-market momentum accelerated in August as demand from a growing population vacuumed up new supply and outweighed the impact of the central bank’s aggressive policy tightening campaign. (BBG)

COMMODITIES: Employees at two Chevron Corp. liquefied natural gas facilities in Australia voted down the company’s pay package proposal, according to a union body, opening the way for a resumption of talks in the standoff that threatens global supply. (BBG)

NEW ZEALAND: New Zealand house prices posted their smallest monthly decline this year, adding to signs that an 18-month property market slump could be in its final stages. (BBG)

NEW ZEALAND: Consumer confidence in New Zealand rose by one point in August as the country's central bank continued to indicate interest rates have peaked. Consumer confidence rose one point in August to 85.0, with the lift driven by an increase in the question of whether it is a good time to buy a major household item, which rose from -39% to -31%, according to a survey by the ANZ Bank and pollster Roy Morgan. (DJ)

SOUTH KOREA: South Korea, Japan and China are discussing to arrange a trilateral summit this year, Yonhap News says, citing a South Korean presidential official. (BBG)

CHINA

YUAN: The People's Bank of China cut the FX reserve requirement ratio for banks on Friday to help support the yuan which has weakened over recent months. The central bank reduced the FX RRR by 200bp from 6-4%, the first cut since Sept 2022, making it effective from Sept 15th. The PBOC said it would “improve financial institutions' capacity to use foreign funds." (MNI BRIEF)

YUAN: Authorities recent efforts to boost the economy will strengthen the Yuan towards the end of the year, according to Guan Tao, former director of State Administration of Foreign Exchange. Guan said recent government measures like the reduction in stamp duty for securities trading and providing tax incentives for individuals who sell and repurchase homes within one year will improve economic fundamentals which lends support to the Yuan. (Yicai)

EQUITIES: China’s latest efforts to support the equity market will likely have limited impact, while share sale and IPO restrictions may increase financing difficulties for some companies, market experts and policy advisors told MNI. Chinese regulators launched a slew of rules to support the sluggish equity market on Aug 27, following a 5.19% slump in the A-shares over the month. The measures focus on slowing the pace of IPO approval, restraining major investor share sales and refinancing of underperforming firms, and a stamp duty reduction on securities transactions. (MNI)

EQUITIES: Chinese insurance companies have room to increase their investment in stocks as they embrace regulators’ recent calls to boost the proportion of equity in their portfolios, the Securities Daily reports Friday.(BBG)

DEPOSIT RATES: Five of China's biggest banks on Friday cut interest rates on a range of deposits in a coordinated effort to ease pressure on their shrinking margins as lenders move to lower mortgage rates to prop up a struggling property sector and a faltering economy. (RTRS)

PMI: China's Caixin manufacturing PMI rebounded 1.8 points to register 51 in August from July, rising back to the expansionary zone above the breakeven 50 mark again after briefly dipping below 50 in July, the financial publisher said Friday. Both manufacturing supply and demand resumed expansion, with the production and new orders sub-indices rebounding above 50. However, external demand remained weak, with the new export orders index rising slightly in the contraction territory. (MNI BRIEF)

HOUSING: Chinese first-time homebuyers can negotiate with lenders to reduce the interest rates of their outstanding mortgages, either by changing the mortgage contracts, or refinancing existing mortgages starting Sept 25, according to a statement on the People's Bank of China website on Thursday. The adjusted rates should be no lower than the policy floor of first-home mortgages that the local city adopted when the original loan was issued, the central bank said. (Financial News)

CHINA MARKETS

MNI: PBOC Net Drains CNY120 Bln Friday via OMO

The People's Bank of China (PBOC) conducted CNY101 billion via 7-day reverse repos on Friday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY120 billion after offsetting the maturity of CNY221 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:53 am local time from the close of 2.2498% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 60 on Thursday, compared with 39 on Wednesday.

PBOC Yuan Parity Lower At 7.1788 Friday Vs 7.1811 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1788 on Friday, compared with 7.1811 set on Thursday. The fixing was estimated at 7.2880 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND: ANZ AUGUST CONSUMER CONFIDENCE INDEX 85.0; PRIOR 83.7

NEW ZEALAND: ANZ AUGUST CONSUMER CONFIDENCE INDEX M/M 1.6%; PRIOR -2.1%

AUSTRALIA JUDO BANK AUGUST F MANUFACTURING PMI 49.6; PRIOR 49.4

AUSTRALIA JULY HOME LOANS VALUE M/M -1.2%; MEDIAN 0.0%; PRIOR -1.6%

AUSTRALIA JULY OWNER-OCCUPIER LOAN VALUE M/M -1.9%; PRIOR -1.6%

AUSTRALIA JULY INVESTOR LOAN VALUE M/M -0.1%; PRIOR 1.3%

JAPAN Q2 CAPITAL SPENDING Y/Y 4.5%; MEDIAN 8.3%; PRIOR 11.0%

JAPAN Q2 CAPITAL SPENDING-EX SOFTWARE Y/Y 4.4%; MEDIAN 7.5%; PRIOR 10.0%

JAPAN Q2 COMPANY PROFITS Y/Y 11.6%; MEDIAN -0.1%; PRIOR 4.3%

JAPAN Q2 COMPANY SALES Y/Y 5.8%; MEDIAN 4.3%; PRIOR 5.0%

JAPAN AUGUST F JIBUN BANK MANUFACTURING PMI 49.6; PRIOR 49.7

SOUTH KOREA AUGUST EXPORTS Y/Y -8.4%; MEDIAN -11.8%; PRIOR -16.4%

SOUTH KOREA AUGUST IMPORTS Y/Y -22.8%; MEDIAN -23.4%; PRIOR -25.4%

SOUTH KOREA AUGUST TRADE BALANCE $870M; MEDIAN -$560M; PRIOR $1652M

SOUTH KOREA AUGUST S&P MANUFACTURING PMI 48.9; PRIOR 49.4

CHINA AUGUST CAIXIN MANUFACTURING PMI 51.0; MEDIAN 49.0; PRIOR 49.2

MARKETS

US TSYS: Narrow Ranges In Asia, NFP In View

TYZ3 deals at 110-29, -0-04, a 0-04+ range has been observed on volume of ~62k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys firmed off session lows alongside pressure on the USD after the PBOC cut the forex reserve requirement ratio by 2ppts.

- The move didn't follow through, perhaps the proximity to the NFP limited activity, and tsys dealt in a narrow range for the remainder of the session.

- The highlight of today's session is the August NFP print, the MNI preview is here. ISM Mfg also crosses.

- Fedspeak from Atlanta Fed President Bostic and Cleveland Fed President Mester is also due.

JGBS: Futures & Longer-Dated JGBs Spike Higher In Afternoon Trade, No Obvious Driver

In the Tokyo afternoon session, JGB futures spiked to a session high of 147.08, +26 compared to settlement levels, after trading in a narrow range in the Tokyo morning session. There was no obvious driver or headline. Currently, JBU3 is trading at 147.03.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Q2 capex and company profits data, which were mixed relative to expectations, and an unchanged print for the Jibun Bank Manufacturing PMI.

- Accordingly, local participants have likely been eyeing US tsys ahead of US Non-Farm Payrolls data later today. US tsys firmed off session lows alongside pressure on the USD after the PBOC cut the forex reserve requirement ratio by 2ppts. The move didn't follow through, with benchmarks little changed in Asia-Pac trade. ISM Mfg also crosses today.

- The cash JGB curve has twist-flattened, pivoting at the 2s, with yields 0.2bp higher to 3.2bp lower. The benchmark 10-year yield is 1.9bp lower at 0.632%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- Swaps rates are lower, with pricing 0.3bp to 1.8bp lower. Swap spreads are wider out to the 30-year.

- Monday’s local calendar is light, with only Monetary Base data due. The BoJ will also conduct Rinban operations covering 1-5-year and 10-25-year+ JGBs.

AUSSIE BONDS: Slightly Richer Ahead Of US NFP, RBA Policy Decision On Tuesday

ACGBs (YM +2.0 & XM +3.5) sit in the middle of the Sydney session ahead of US Non-Farm Payrolls data later today. There hasn't been much in the way of potential domestic drivers today outside the housing finance miss.

- Local participants have likely been on headlines and US tsys watch. US tsys are near Asia-Pac lows, flat to 1bp cheaper.

- Cash ACGBs are 3bp richer, with the AU-US 10-year yield differential 4bp lower at -11bp.

- Swap rates are 3bp lower.

- The bills strip has slightly bull-flattened, with pricing flat to +3.

- RBA-dated OIS pricing is flat to 3bp softer across meetings out to May’24.

- Next week the local calendar sees the MI Inflation Gauge (Aug), Inventories (Q2), Company Profits (Q2) and ANZ-Indeed Job Ads (Aug) on Monday, ahead of Judo Bank PMIs (Aug F), Balance of Payments (Q2) and Net Exports (Q2) on Tuesday and GDP (Q2) on Wednesday.

- The RBA policy decision is on Tuesday, with consensus unanimous in expecting the cash rate to be left unchanged at 4.10% for the third consecutive month. A 3% chance of a 25bp hike is currently priced for next week’s meeting.

- The AOFM plans to sell A$700mn of the 3.50% Dec-34 bond on Wednesday.

NZGBS: Richer But Off Best Levels Ahead Of US Payrolls

NZGBs closed 2-5bp richer, but off session bests, as global bond markets await the release of US Non-Farm Payrolls data later today. An increase in payrolls of 170k is expected in August versus 187k in July. The unemployment rate is forecast to be unchanged at 3.5%.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined ANZ consumer confidence data, which printed a rise of 1.6%.

- Accordingly, local participants have likely been on headlines and US tsys watch. US tsys are flat to 1bp cheaper across the major benchmarks in Asia-Pac dealing. Ranges have been narrow.

- Swap rates are 1-4bp lower, with the 2s10s curve flatter and implied swap spreads wider.

- RBNZ dated OIS pricing is little changed.

- Next week the local calendar sees Terms of Trade (Q2) on Monday, ANZ Commodity Prices (Aug) on Tuesday, Volume of All Buildings (Q2) on Wednesday and Mfg Activity (Q2) on Thursday.

- Also, next Thursday, the NZ Treasury plans to sell NZ$225mn of the 4.5% May-30 bond, NZ$175mn of the 2.0% May-32 bond and NZ$100mn of the 2.75% Ap-37 bond.

EQUITIES: China Equities Modestly Firmer As Policy Support Steps Up

Major regional equity indices are mostly tracking higher as the US NFP print comes into view. Much focus has been on China stocks, as the authorities look to boost sentiment via a number of avenues. Markets are firmer, but away from session highs. At the stage US equity futures are tracking modestly higher. Eminis last near 4522, (+0.13%), while Nasdaq futures are near 15550, also a touch firmer.

- For China, local banks have cut deposit rates, while downpayments for home loans and mortgage rates are coming down as well. We also saw renewed efforts to stabilize/boost the yuan, with the reserves on FX deposits that local banks have to put aside reduced to 4% (from 6%)

- The CSI 300 sits higher, +0.51% at the lunch time break. Earlier moves above 3800 (+1%) weren't sustained, the index back to 3788.4 now. The real estate sub index is up 2.35% at this stage, reversing part of yesterday's 5.32% dip. This index is tracking higher for the week though.

- Note Hong Kong markets have been closed today due to a typhoon.

- Elsewhere, Japan stocks are firmer, with the Topix up 0.80% at this stage. Gains in Sony a standout. The Kospi (+0.25%) and Taiex (+0.25%) are seeing more muted gains.

- The ASX 200 is down 0.30%, while in SEA, most markets are modestly firmer at this stage. Thailand stocks are around flat, after a strong rally through the second half of August.

FOREX: Antipodeans Marginally Pressured In Asia, NFP In View

The Antipodeans are marginally pressured in Asia, AUD and NZD were unable to hold gains seen after the PBOC cut the forex reserve requirement ratio and Caixin PMI was stronger than forecast.

- AUD/USD is the weakest performer in the G-10 space at the margins down ~0.2%, last printing at $0.6470/75. A gain of as much as 0.2% was reversed through the session. The trend condition of the pair remains bearish, Support comes in at $0.6365, low from Nov 17 and bear trigger. Resistance is at $0.6522 the Aug 30 high.

- Kiwi has also trimmed early gains to sit softer, last printing at $0.5955/60. ANZ Consumer Confidence ticked higher in August rising 1.6% M/M to 85.0. Bears look to break the low from 25 Aug ($0.5886) which opens $0.5841 (low from 10 Nov 22).

- Yen is little changed and has dealt in narrow ranges in Asia today. Technically the uptrend remains intact, resistance is at ¥147.37 (Aug 29 high) and support is at ¥145.01 (20-Day EMA).

- Elsewhere in G-10 ranges have been narrow with little follow through on moves. EUR and GBP are both a touch lower.

- Cross asset wise; US Tsy Yields are little changed as is BBDXY. E-minis are up ~0.1% and Hong Kong Exchange has cancelled morning trading after a Typhoon warning.

- The NFP print headlines Friday's docket, the MNI preview is here.

OIL: Up Strongly This Week, WTI Outpacing Brent

Oil has continued to track higher in the first part of Friday trade. Brent sits above $87/bbl in recent dealings, close to session highs. We are ~0.20% firmer for the session, following Thursday's +1.16% gain. Brent is comfortably up for the week at this stage, +3%. WTI is just above $83.80/bbl in recent dealings, which puts the benchmark nearly 5% higher for the week at this stage.

- The prospect of tighter supply has aided the latest move higher in oil. Russia stated it has agreed with OPEC+ partners to further cut oil exports, with more details set to be announced next week. At the same time Saudi Arabia is expected to a extend a 1-million-barrel supply cut into October (this was first introduced in July).

- This comes amid signs of tightening US supply, given declining inventory levels.

- Better China related asset sentiment has also likely helped crude. Efforts to improve housing demand are in focus, whilst manufacturing PMIs in China have beaten expectations over the past two days.

- For Brent, early August highs of $88.10/bbl are within sight, while recent lows rest just under $82/bbl. For WTI August 10 highs around $85/bbl are the topside focus.

GOLD: Near Unchanged Ahead Of US Non-Farm Payrolls

Gold is little changed in the Asia-Pac session. The precious metal closed near unchanged at $1940.19 on Thursday after dipping slightly intraday amidst a recovery for the US dollar.

- Nevertheless, bullion is headed for a second weekly gain, buoyed by lower US Treasury yields after weak employment data earlier in the week.

- On Thursday, US inflation data met economists’ forecasts, easing pressure on the Federal Reserve to continue raising rates. The core PCE deflator printed at +4.2% y/y but showed a slight acceleration from the +4.1% seen in June.

- The market’s attention now turns to the release of the US Non-Farm Payrolls data later today. An increase in payrolls of 170k is expected in August versus 187k in July. The unemployment rate is forecast to be unchanged at 3.5%.

- On Thursday, Fed Funds implied rates showed cumulative hikes of +3bp for Sep and +11.5bp for Nov to a terminal 5.45%, followed by 51bp of cuts to Jun’24 and a cumulative 122bp of cuts to Dec’24.

- According to MNI's technicals team, gold continues to sit close to resistance at Wednesday’s high of $1949.05.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/09/2023 | 0630/0830 | *** |  | CH | CPI |

| 01/09/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/09/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 01/09/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/09/2023 | 0900/1100 | ** |  | IT | PPI |

| 01/09/2023 | 1000/0600 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/09/2023 | 1000/1100 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 01/09/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2023 | 1230/0830 | *** |  | US | Employment Report |

| 01/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/09/2023 | 1345/0945 |  | US | Cleveland Fed's Loretta Mester | |

| 01/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2023 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.