-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Edges Higher Ahead Of U.S. CPI

- The gap between Chinese PPI & CPI widened further in October.

- USD sits atop G10 FX in Asia.

- U.S. CPI headlines the broader docket on Wednesday.

BOND SUMMARY: Tight Asia Trade Ahead Of U.S. CPI

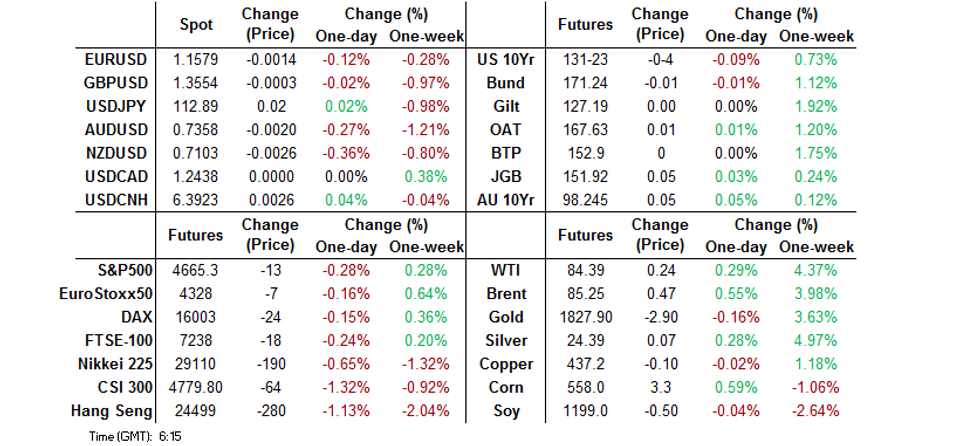

U.S. Tsys saw some very light pressure on the back of firmer than expected Chinese inflation data but have moved off Asia cheaps, aided by a downtick in Chinese equities. TYZ1 last -0-04 at 131-23, operating within a 0-05 range in Asia hours. Cash Tsys run 0.5-1.0bp cheaper across the curve. China's NBS noted that the weather and commodity prices impacted October's CPI reading, while the PPI reading was driven by tight supply in the energy and materials spaces. It is probably a case of these being known factors when it comes to the broader inflationary picture, as well as a sense of the market having bigger fish to fry later today i.e. U.S. CPI. 30-Year bond supply provides the other notable risk event on Wednesday's local docket, coming in the wake of two tailing Tsy auctions which experienced lower than average cover ratios, even with the notional size on offer being cut vs. prev. auctions. Elsewhere, focus will fall on whether or not Evergrande makes a payment covering coupons on US$-denominated debt before the grace period ends later today.

- The JGB space was a little more resilient than U.S. Tsys, with futures last +5, while cash JGBs run little changed to ~1.5bp richer across the curve, with light bull flattening in play. Offer/cover ratios at the latest round of BoJ Rinban operations (covering 1- to 10-Year paper) nudged slightly higher, but the degree of the upticks witnessed proved to be inconsequential for markets.

- Range bound trade was the order of the day in Sydney, with the curve holding flatter, YM -1.0 & XM +5.0 at the close. The relative stability of the market vs. what was seen a couple of weeks ago has allowed corporate/SSA issuance to trickle back in over recent sessions. Elsewhere, we saw another smooth enough round of ACGB supply, at least on the pricing front, with the weighted average yield printing 0.39bp through prevailing mids (per Yieldbroker), although the cover ratio slipped just below the 3.00x marker.

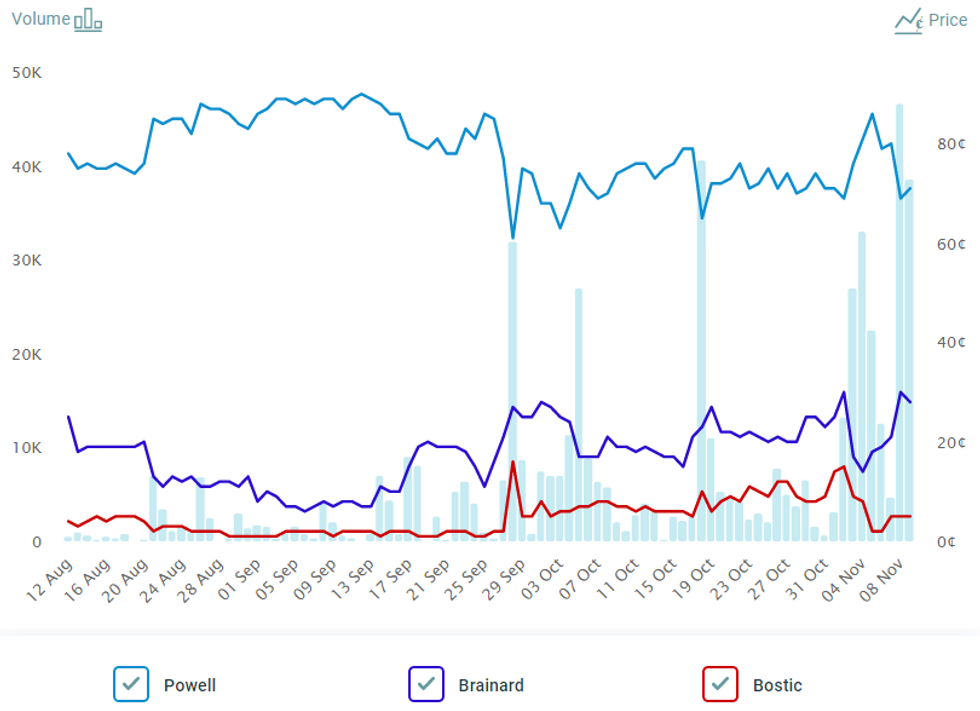

FED: Powell Still The Clear Favourite For Fed Chair In Betting Markets

Note that the odds surrounding the likelihood of a second term for Fed Chair Jay Powell took a hit on the back of the BBG sources piece which hit in Asia hours on Tuesday (a reminder that the piece suggested that Fed Governor Lael Brainard is a "serious rival" for Powell in the race to sit atop the central bank), although his odds recovered from the intraday trough and remain within the range observed in recent times.

Fig. 1: Odds re: Whom Will The Senate Next Confirm As Chair Of The Federal Reserve?

Source: PredictIt

Source: PredictIt

FOREX: Caution Dominates As Inflation Data Take Centre Stage

Defensive flows were evident as Chinese inflation data took focus, albeit the release failed to elicit much reaction in broader FX space. Offshore yuan was unfazed as consumer price growth marginally surpassed expectations, while factory-gate inflation was considerably faster than forecast.

- Antipodean currencies went offered. The preliminary ANZ Business Outlook data showed a deterioration in NZ firms' sentiment, as "all forward-looking indicators except employment intentions fell," which may have sapped some strength from the kiwi. The Aussie was pressured by a slump in iron ore prices.

- The yen outperformed as participants sought safe haven assets. USD/JPY edged lower but remained within the confines of yesterday's range.

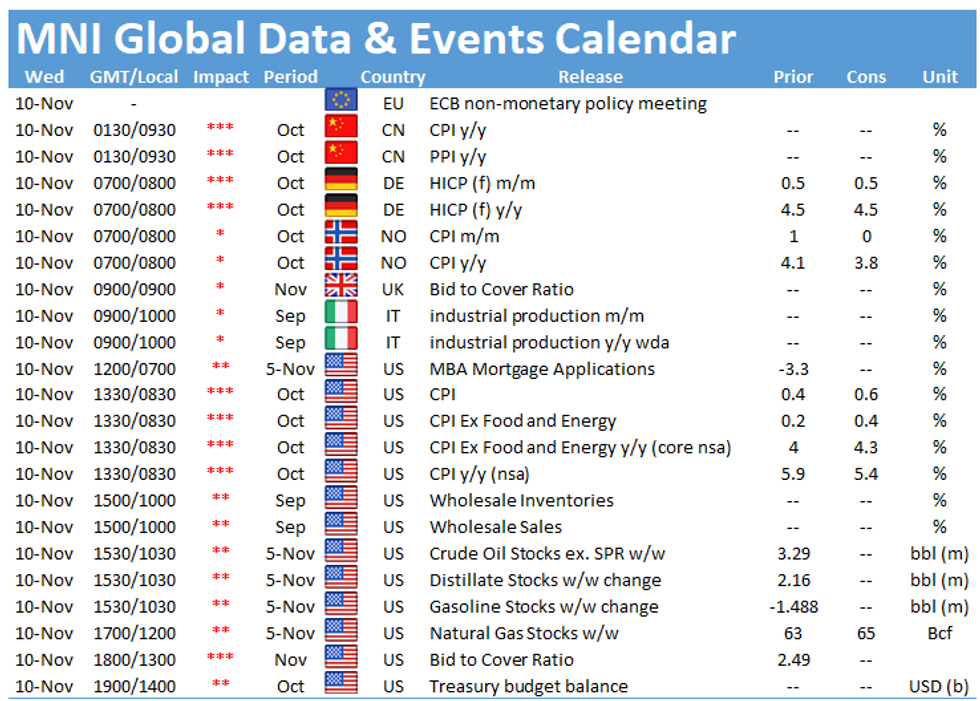

- U.S. CPI steals the limelight today, with German and Norwegian counterparts also due. Weekly U.S. jobless claims also hit today, as the nation will observe a market holiday on Thursday. Central bank speaker slate features ECB's Elderson, BoE's Tenreyro and Riksbank's Breman.

FOREX OPTIONS: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1400(E641mln), $1.1495-00(E1.2bln), $1.1550-55(E1.1bln), $1.1565-75(E2.1bln), $1.1595-00(E1.2bln)

- USD/JPY: Y111.40-55($1.1bln), Y111.80-85($501mln), Y112.20-30($643mln), Y113.00($810mln), Y113.65-85($992mln), Y114.00($1.3bln)

- GBP/USD: $1.3400(Gbp784mln), $1.3550(Gbp787mln), $1.3595-00(Gbp628mln)

- EUR/GBP: Gbp.0.8490-00(E587mln)

- AUD/USD: $0.7340-50(A$866mln), $0.7375(A$635mln)

- USD/CAD: C$1.2450-55($1bln), C$1.2500($1bln)

- USD/CNY: Cny6.4000($820mln), Cny6.5000($1.1bln)

ASIA FX: Won Slips On Risk-Off Feel & Uptick In Jobless Rate, Yuan Stable After Inflation Data Beats

Familiar jitters surrounding global inflation developments inspired caution, as China's and U.S. price growth rates take focus in mid-week.

- CNH: Offshore yuan remained stable, shrugging off domestic inflation data. The gap between CPI and PPI inflation continued to widen, as price growth topped expectations across both measures. Elsewhere, the situation around Taiwan remained tense, albeit it was reported that the virtual Xi/Biden summit might take place next week.

- KRW: The won went offered and underperformed all of its regional peers, as broader defensive flows kicked in. A larger than expected uptick in South Korea's unemployment rate amplified pressure to the won.

- IDR: The rupiah was a tad softer, even as the results of a monthly survey from Danareksa Research Institute showed improvement in consumer confidence.

- MYR: The ringgit softened amid limited domestic headline flow.

- THB: Spot USD/THB was rangebound ahead of the announcement of BoT monetary policy decision. There is broad agreement among BoT watchers that policymakers will stand pat today.

- PHP: The peso was slightly firmer, as Q3 GDP data released yesterday beat expectations, while Health Sec Duque suggested that Metro Manila could move into Alert Level 1, if daily cases fall below a key threshold.

EQUITIES: Lower

Wednesday's Asia-Pac session saw the major regional indices and U.S. e-mini futures move lower, with Chinese inflation data fanning worry on the price front (lessening any residual hope of relatively imminent easing from Chinese policymakers). The Chinese property developer space continued to garner attention, with the resumption of trade for Fantasia and the shadow from the impending end of the grace period on a missed US$-denominated coupon covering bonds issued by Evergrande providing a couple of sources of weight. This left the CSI 300 & Hang Seng at the bottom of the pile, with both shedding a little over 1%.

GOLD: Marking Time

Our weighted U.S. real yield monitor closed at fresh all-time lows on Tuesday, while the DXY struggled for meaningful net direction. This combination allowed gold to threaten a challenge of key technical resistance (3 Sep high at $1,834.0/oz), although a meannginful challenge was not staged, with spot subsequently ticking away from resistance to last trade $1,826/oz, a handful of dollars lower on the day.

OIL: Most Of Post-Settlement Gains Unwound

WTI & Brent sit ~$0.10 & ~$0.25 above settlement levels at typing after pulling back from session highs as Chinese equity markets struggled on Wednesday. The early gains were witnessed in the wake of a surprise drawdown in headline crude stocks in the latest round of API inventory estimates.

- A quick reminder that Tuesday saw the latest EIA STEO reveal a 130K bpd cut to the Agency's '22 world oil demand growth forecast, while its estimate for '21 was marked higher by 60K bpd. Subsequently, the White House noted it had no announcement on the potential release of SPR stocks on Tuesday, which allowed crude to add to gains into settlement, while the Biden admin pointed to continued dialogue with other nations (including OPEC+) re: crude supply.

- Elsewhere, Asia-Pac hours saw Russia stress a continued need to monetise its resources, with the country's Energy Minister noting that "it's too early to talk about the end of the oil era."

- The latest weekly DoE inventory release headlines on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.