-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Seen Holding Off From Big Fiscal Stimulus

EXECUTIVE SUMMARY

- CHINA SEEN HOLDING OFF FROM BIG FISCAL STIMULUS - MNI

- CHINA GROWTH FORECASTS CUT INTO NEXT YEAR DESPITE LIKELY SUPPORT- BBG

- IMF CHIEF ECONOMIST SUGGESTS BOJ MOVE AWAY FROM YIELD CONTROL - YAHOO FINANCE

- AUSSIE JUNE CPI PRINTS AT 6%, SERVICES Up To 6.3% - MNI BRIEF

- SLOWING AUSTRALIA Q2 INFLATION LESSENS RATE HIKE PRESSURE - RTRS

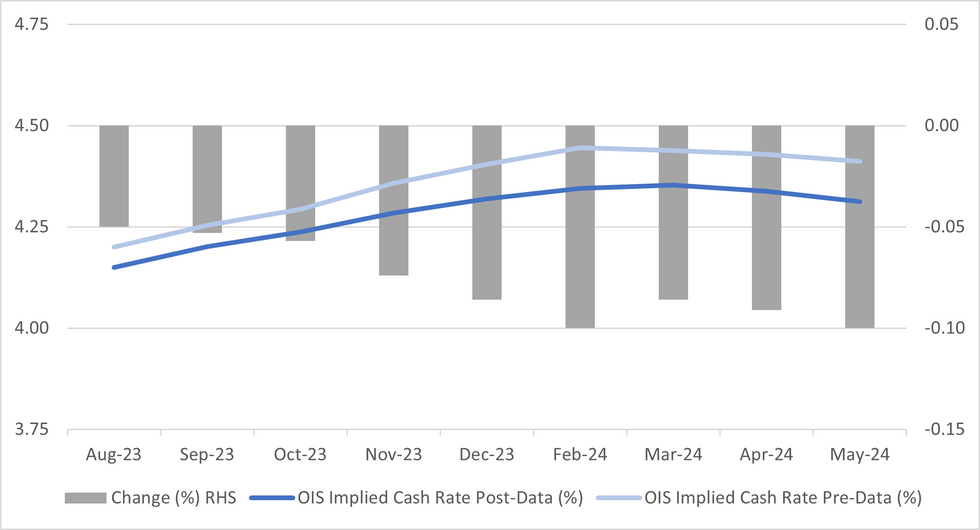

Fig. 1: RBA Market Pricing (OIS) Dips Post CPI Miss

Source: MNI - Market News/Bloomberg

U.K.

BoE: The Bank of England will raise its Bank Rate by a quarter-point to 5.25% on August 3, making borrowing the costliest since early 2008, and hike twice more by the year-end as price pressures persist, a Reuters poll showed. (RTRS)

EUROPE.

RUSSIA/CHINA: Russian President Vladimir Putin intends to visit China in October, planning his visit to coincide with a "One Belt, One Road" forum, Kremlin foreign policy adviser Yury Ushakov told reporters on Tuesday, according to the Russian state news agency TASS. (RTRS)

U.S.

EQUITIES: Google parent Alphabet Inc. reported second-quarter revenue that exceeded analysts’ expectations, boosted by advertising on the company’s flagship search business, which is withstanding new competition from artificial intelligence chatbots. (BBG)

BANKING: PacWest Bancorp is being bought by smaller rival Banc of California as it seeks to navigate a bout of upheaval that brought down a handful of its peers. The deal includes a $400 million investment from Warburg Pincus and Centerbridge Partners, which obtain about 20% of the combined company and receive warrants to buy more shares, the banks said Tuesday. (BBG)

US/CHINA: The Senate attached a measure to the annual defense policy bill that would subject some US investments in China to new requirements, complementing restrictions being weighed by the Biden administration amid increased concern in Washington over China’s development of advanced technology. The measure, approved 91 to 6 on Tuesday, would require firms to notify the government about certain investments in China and other countries of concern, although they wouldn’t be subject to review or possible prohibition. (BBG)

OTHER

AUSTRALIA: Australia’s consumer price index rose 6.0% y/y over the June quarter, decelerating from the March quarter’s 7% increase, while trimmed mean annual inflation printed at 5.9%, compared to the previous period’s 6.6% read, according to the Australian Bureau of Statistics data released Wednesday. The lower prints mark the second consecutive quarter of lower annual inflation from the peak of 7.8% recorded in the December 2022 quarter (see chart). However, services inflation – a key factor for the Reserve Bank of Australia’s monetary policy decisions – gained 6.3%, up from March’s 6.1% read, its highest read since 2001. (MNI Brief)

AUSTRALIA: Australia’s inflation rate slowed more than expected in the three months through June, reflecting global trends and bolstering the case for the Reserve Bank to pause again at next week’s policy meeting. (BBG)

AUSTRALIA: Australian inflation slowed more than expected in the second quarter thanks to falls in the cost of domestic holidays and petrol, suggesting less pressure for another hike in interest rates and sending the local dollar sharply lower. (RTRS)

JAPAN: The International Monetary Fund said Japan’s inflation risks are on the upside, and it recommends the Bank of Japan to be flexible and perhaps move away from its yield curve control program. (Yahoo Finance)

JAPAN: The International Monetary Fund on Tuesday raised its forecast for Japan’s gross domestic product this year to 1.4% from April's 1.3% but left its 2024 growth forecast unchanged at 1.0%. (MNI BRIEF)

JAPAN: The pace of gains in Japan’s service prices for businesses slowed in June by the most since October 2020, ahead of the central bank’s policy decision meeting this week. (BBG)

JAPAN: The number of Japanese fell in all the country’s 47 prefectures for the first time since the data has been tracked, according to a study released by the government, even as the number of foreign residents inched up to a record. (BBG)

SOUTH KOREA: SK Hynix Inc. reported better-than-expected revenue, declaring the memory chip market is recovering because of surging interest in artificial intelligence. The supplier of memory chips to Apple Inc. reported sales of 7.31 trillion won ($5.7 billion) in the June quarter, down 47% from a year ago but beating an average projection for 6.05 trillion won. (BBG)

CHINA

FISCAL: China will hold off from major fiscal stimulus for the second half of the year, with authorities concentrating on making existing programmes more efficient in order to encourage market forces, given that the economy remains on track to meet its 5% growth target for 2023, advisors and analysts told MNI. (MNI)

GROWTH: China’s economic outlook is deteriorating into next year, with no clear consensus from analysts that the business environment will improve despite Beijing’s push to restore confidence and its efforts to foster US ties. That’s the takeaway from a new Bloomberg survey of economists, who downgraded their growth projections for 2023 to 5.2% from an earlier median estimate of 5.5%. Gross domestic product is seen expanding 4.8% in 2024, slightly below an earlier median expectation of 4.9%. (BBG)

PBOC: China’s newly appointed central bank Governor Pan Gongsheng comes with a strong record of tackling financial risks, from managing the currency to cracking down on the property market. (BBG)

EQUITIES: Ant Group Co. is planning a restructuring that will break off some operations that aren’t core parts of its China financial-related business, according to people familiar with the matter, paving the way for the company to revive an initial public offering in Hong Kong. (BBG)

CAPITAL MARKETS: China will further deepen capital market reform and opening up in H2, according to the China Securities Regulatory Commission. At a recent meeting, China’s top securities regulator said authorities would develop the real-estate investment trust market, build the Beijing Stock Exchange and support private firms to achieve high-quality growth through the capital markets. Policymakers will further stimulate the capital market to better serve high-quality development and work to maintain financing channels for real-estate companies. (21st Century Herald)

CHINA MARKETS

PBOC Net Injects CNY79 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY104 billion via 7-day reverse repos on Wednesday with the rate unchanged at 1.90%. The operation has led to a net injection of CNY79 billion after offsetting the maturity of CNY25 billion reverse repo today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8502% at 09:37 am local time from the close of 1.8571% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, compared with the close of 46 on Monday.

PBOC Yuan Parity At 7.1295 Wednesday Vs 7.1406 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1295 on Wednesday, compared with 7.1406 set on Tuesday. The fixing was estimated at 7.1355 by BBG survey today.

OVERNIGHT DATA

SOUTH KOREA JULY CONSUMER CONFIDENCE 103.2; PRIOR 100.7

SOUTH KOREA JUNE RETAIL SALES Y/Y 6.6; PRIOR 5.7%

SOUTH KOREA JUNE DEPARTMENT STORE SALES Y/Y 0.3; PRIOR -0.2%

SOUTH KOREA JUNE DISCOUNT STORE SALES Y/Y 0.3; PRIOR 1.7%

JAPAN PPI SERVICES JUNE Y/Y 1.2%; MEDIAN 1.5%; PRIOR 1.7%

AUSTRALIA Q2 CPI Q/Q 0.8; MEDIAN 1.0%; PRIOR 1.4%

AUSTRALIA Q2 CPI Y/Y 6.0; MEDIAN 6.2%; PRIOR 7.0%

AUSTRALIA Q2 TRIMMED MEAN Q/Q 0.9%; MEDIAN 1.1%; PRIOR 1.3%

AUSTRALIA Q2 TRIMMED MEAN Y/Y 5.9%; MEDIAN 6.0%; PRIOR 6.6%

AUSTRALIA Q2 WEIGHTED MEDIAN Q/Q 1.0%; MEDIAN 1.1%; PRIOR 1.3%

AUSTRALIA Q2 WEIGHTED MEDIAN Y/Y 5.5%; MEDIAN 5.4%; PRIOR 5.9%

AUSTRALIA JUNE CPI Y/Y 5.4; MEDIAN 5.4%; PRIOR 5.5%

MARKETS

US TSYS: Narrow Ranges In Asia, FOMC In View

TYU3 deals at 111-24, +0-04+, a 0-04+ range has been observed on volume of ~61k.

- Cash tsys sit little changed from opening levels across the major benchmarks.

- Tsys have observed narrow ranges in Asia with little follow through on moves, perhaps the proximity to today's FOMC rate decision limited activity.

- Flow-wise the highlight was a block seller in FV (2,177 lots).

- FOMC dated OIS remain stable, a 25bps hike is priced into today's meeting. A terminal rate of 5.44% is seen in November with ~60 cuts by June 2024.

- There is a thin docket in Europe today, before the FOMC rate decision is due further out. The MNI preview of the event is here. June Home Sales will also cross .

JGBS: Futures Reverse Higher In Afternoon Trading, Cash Curve Twist Flattens

JGB futures are firmer in afternoon trade, +13 compared to settlement levels, after trading in negative territory in the morning session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined June PPI data that surprised on the downside. While the data generated little initial market reaction, afternoon strength is consistent with the message embedded in the data. That being, the pace of gains in Japan’s service prices for businesses slowed in June by the most since October 2020. Service prices are seen by economists as an indication of how price gains are spreading in the wider economy. (See link)

- The leading and coincident indices (final for May) will print soon.

- The cash JGB curve has twist flattened in the Tokyo afternoon session, pivoting at the 3-year zone with yields ranging from 0.5bp higher (2-year) to 1.7bp lower (20-year). The benchmark 10-year yield is 0.7bp lower at 0.459%.

- The swap curve has swung from a bear steepening in the morning session to a bull flattening after the lunch break. Swap spreads are narrower across the curve after being wider in the morning.

- Tomorrow the local calendar sees International Investment flow data (Jul 21) ahead of Tokyo CPI and the BoJ Policy Meeting on Friday.

- Tomorrow also sees the MoF sell Y2.9tn 2-year JGBs.

AUSSIE BONDS: Richer After CPI Miss

ACGBs (YM +7.0 & XM +2.5) sit richer, but well off session bests, after Q2 headline and underlying inflation came in lower than RBA forecasts, thus it is on track to meet the target by mid-2025.

- Trimmed mean was lower at 0.9% and 5.9% after an upwardly revised 1.3% q/q and 6.6% y/y. Services inflation rose less than goods on the quarter up 0.8% q/q compared with goods at 0.9% but the annual rate rose 6.3% up from 6.1%.

- June inflation moderated to 5.4% from 5.5% in May. Importantly, 3-month momentum continues to ease towards the top of the RBA’s band and was 3.7% in June.

- Cash ACGBs are 6-7bp richer after the data with the AU-US 10-year yield differential -4bp at +11bp.

- Swap rates are 6-7bp lower after the data to be 3-8bp lower on the day with the 3s10s curve 5bp steeper.

- The bills strip bull steepens with pricing +4 to +10.

- RBA-dated OIS pricing is 5-9bp softer across meetings after the data. The market now attaches a 33% chance of a hike by the RBA in August versus 58% pre-data.

- Tomorrow the local calendar sees Terms of Trade data for Q2.

- Later today, the market’s focus will be firmly tuned to the FOMC meeting decision.

NZGBS: Closed On A Positive Note After AU CPI Sparks A Rally

NZGBs closed on a positive note with benchmark yields 3-5bp lower than session highs. The move away from session cheaps was assisted by a rally in ACGBs following lower-than-expected Q2 CPI data. By the close, the cash 2/10 curve had twist steepened with yields 1bp lower to 2bp higher. NZ/AU 10-year yield differential widened 4bp to +64bp.

- Swap rates closed mixed with rates -1bp to +1bp and the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed. Terminal OCR expectations sit at 5.66% versus 5.70% late last week.

- Tomorrow the local calendar is empty. The next key release is ANZ Consumer Confidence (Jul) on Friday.

- Later today, the market’s focus will be firmly tuned to the FOMC meeting decision. While the market has already priced in a 25bp hike for the FOMC meeting today, there remains significant uncertainty about the Fed's outlook. Investors are keenly waiting for comments from Fed Chair Powell during the press conference following the rate decision. His statements may provide valuable insights into the central bank's plans for further interest rate increases.

- Tomorrow the NZ Treasury plans to sell NZ$225mn of the 0.5% May-26 bond, NZ$225mn of the 1.5% May-31 bond and NZ$50mn of the 2.75% May-51 bond.

FOREX: AUD Pares Post-CPI Losses, FOMC In View

The AUD has pared its post-CPI losses in Asia after Q2 headline and core CPI were below estimates. AUD/USD printed a low at $0.6731 before finding support and ticking away from session lows.

- The pair now sits at $0.6760/65, a touch below its pre-CPI levels. RBA-dated OIS sit 5-9bps softer across meetings and RBA-watcher McCrann noted that the CPI print may be enough to keep the RBA on hold in August.

- Kiwi was pressured on spillover from the post-CPI move lower in AUD before support was seen below $0.62. NZD/USD now sits ~0.1% lower on the day, and well within recent ranges.

- Yen is little changed, the pair is see-sawing around ¥141 handle in narrow ranges.

- Elsewhere in G-10 NOK is down ~0.3% however liquidity is generally poor in Asia. EUR and GBP are a touch lower however ranges remain narrow.

- Cross asset wise; BBDXY is up ~0.1% and US Tsy Yields are little changed across the curve. E-minis are flat and the Hang Seng is down ~0.8%.

- The highlight of todays session is the latest FOMC rate decision, the MNI preview is here.

EQUITIES: No Positive Follow Through To Yesterday's Hong Kong/China Equity Surge

Regional equities have been mixed ahead of the upcoming US Fed decision. US equity futures are close to flat paring early losses. Eminis were last near 4596.5, Nasdaq futures a touch weaker at 15657. We are down from late Tuesday session NY highs, amid a mixed earnings backdrop post the US close.

- Hong Kong and China equities haven't been able to rally further after posting strong gains yesterday. Losses are relatively modest at this stage, but the market may have been hopeful of further positive momentum in the wake of the recent Politburo meeting.

- At the break the HSI is down 0.79%, with the tech sub index down 1.38%, although we were 6.04% higher yesterday for this index. Jack Ma's backed Ant Group is planning a restructuring that will potentially pave the way for reviving the Hong Kong IPO.

- The CSI is off by 0.34% at the break, with the Shanghai Composite down by a similar amount. The properties sub index has continued to recover though, adding a further 0.87% so far, which follows yesterday's +8% gain.

- Japan stocks are close to flat at this stage. South Korean shares are among the weakest performers. The Kospi is down over 1%. Samsung has been weaker, along with motor vehicle companies. Offshore investors have net sellers of local stocks today (-$116.2mn).

- Australian stocks have outperformed, the ASX 200 +0.80%. The weaker than expected Q2 CPI print has aided sentiment around the RBA outlook.

- In SEA sentiment is mixed, with Thailand and Philippines bourses lower, but positive trends elsewhere.

CRUDE: Crude Down Slightly As Waits For Fed

Oil has been trading in a narrow range of less than 50c during the APAC session. The recent gains that brought crude to a three-month high have been sustained with prices down only 0.4% today, but the upcoming Fed decision and accompanying comments risk these gains. WTI hasn’t been able to break $80 and is currently around $79.28/bbl while Brent is $83.30. The USD index is up slightly.

- Crude has been trading sideways as it waits for the Fed decision. WTI reached a low of $79.17 followed by a high of $79.43. Brent’s intraday low was $83.12 and the high $83.42.

- Later the Fed is widely expected to hike rates 25bp and retain its tightening bias but the comments following will be key to the rate outlook and for oil developments. Despite the recent rally, crude markets remain concerned about demand from both the US and China. A hawkish Fed is likely to increase US recession fears (see MNI Fed Preview - July 2023 here).

- Bloomberg reported that API US crude inventories rose 1.319mn in the latest week, according to those familiar with the data. Official EIA data is released later today and expected to post a fall.

- In terms of data, there is only US June new home sales.

GOLD: Firmer On Tuesday, Awaiting The FOMC Decision

Gold is little changed in the Asia-Pac session, after closing higher (+0.5%) on Tuesday, recovering some of the losses experienced in recent days, which had pushed prices to their lowest level in a week. The market's focus was on the upcoming Federal Reserve interest rate decision scheduled for Wednesday, as well as monetary policy decisions from the ECB and BoJ later in the week.

- While the market has already priced in a 25bp hike for the FOMC meeting today, there remains significant uncertainty about the Fed's outlook. This uncertainty contributed to a rise in US Treasury yields over recent days, as there is a concern that the Fed's stance could turn out to be more hawkish than anticipated.

- Investors are keenly waiting for comments from Fed Chair Powell during the press conference following the rate decision. His statements may provide valuable insights into the central bank's plans for further interest rate increases. Any indication that the Fed is considering additional rate hikes beyond July, such as at its September meeting or later, might exert downward pressure on gold prices.

- Currently, gold has been buoyed by recent inflation data, which indicated that price pressures are easing more rapidly than initially expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 26/07/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2023 | 0800/1000 | ** |  | EU | M3 |

| 26/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/07/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/07/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 26/07/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.