-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID & Georgia Dominate, Even As Sino-U.S. Tensions Cool

EXECUTIVE SUMMARY

- JOHNSON HITS ENGLAND WITH FULL LOCKDOWN (BBG)

- UK VACCINE ROLLOUT HAMPERED BY RED TAPE AND LACK OF BACK-UP STOCKS (FT)

- FED'S BOSTIC: BOND-BUYING 'RECALIBRATION' COULD HAPPEN IN 2021 (RTRS)

- FED'S EVANS: MAY RECONSIDER ADJUSTING QE IN SPRING (MNI)

- FED'S MESTER: POLICY WILL STAY ACCOMMODATIVE FOR 'QUITE SOME TIME' (RTRS)

- NYSE NO LONGER PLANS TO DELIST CHINA TELCO GIANTS (BBG)

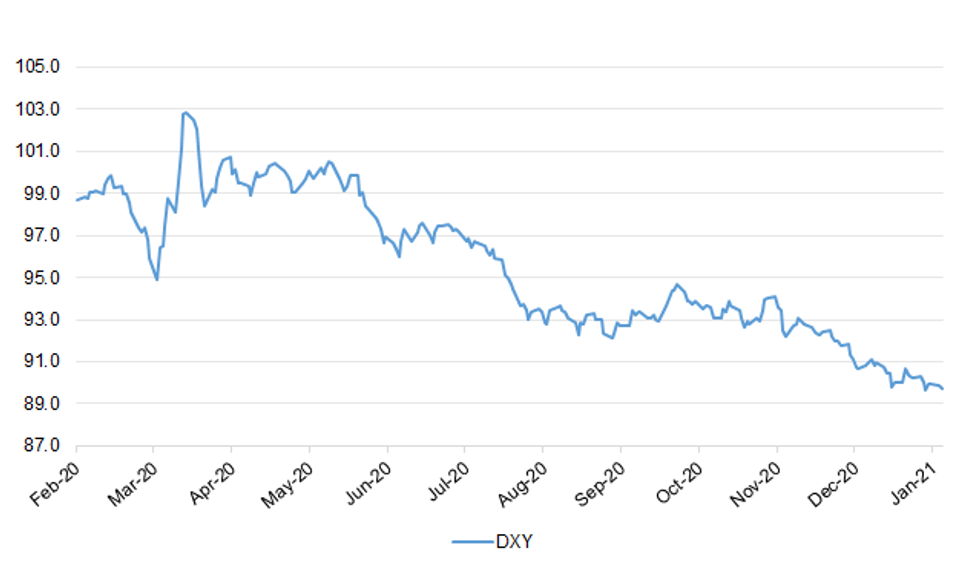

Fig. 1: USD Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: U.K. Prime Minister Boris Johnson imposed a third coronavirus lockdown across England, shutting schools and ordering the public to stay at home, amid dire warnings that the National Health Service is being pushed to breaking point. The full emergency lockdown will start immediately and last until at least Feb. 15, potentially devastating retail and hospitality businesses and threatening to push the economy into a double-dip recession, as medics try to get a grip on the pandemic. In a televised address to the nation, the prime minister insisted he had no option but to close down all social activities, education and non-essential travel in the face of a sudden and severe surge in infections. (BBG)

CORONAVIRUS: Northern Ireland's devolved government is to put the COVID-19 'stay at home' message into law, the first minister has announced. The nation is already in the second week of a six-week lockdown in which non-essential retail is closed, as well as pubs, bars and restaurants - apart from takeaway services - and there is an 8pm curfew for homes and businesses. But Arlene Foster said rising numbers of cases and repeated reports of large social gatherings meant the message needed to be tougher. (Sky)

CORONAVIRUS: Daily admissions of Covid-19 patients have surpassed the peak seen in April to reach a record, according to data released on Monday as the UK government prepared to tighten restrictions on millions of Britons. A total of 3,145 people were admitted to hospital on January 2 — higher than the previous peak of 3,099 seen on April 1. (FT)

CORONAVIRUS: Red tape and a lack of back-up stocks are affecting the rollout of the UK's mass Covid-19 vaccination programme, people familiar with the process told the FT, as ministers face questions over the speed with which they are protecting people from a new, more contagious strain of the virus. (FT)

CORONAVIRUS: Best Western is spearheading a plan to turn as many as 500 hotels into "cottage hospitals" that could ease the pressure on the NHS as it reels from surging Covid cases. The reconfigured sites would handle pre-surgery assessments, IV treatments such as for antibiotics or dialysis as well as MRI and CTI scans and post-Covid recovery support, according to proposals sent to the Cabinet Office this week. (Telegraph)

CORONAVIRUS: Ministers are finalising proposals to tighten up entry into England from abroad with plans to introduce pre-flight PCR tests for anyone entering the country. The announcement, expected later this week, will mean that anyone hoping to travel to England will have to receive a negative coronavirus test no more than 72 hours before travelling. (FT)

BREXIT: The three biggest venues in London that handle European shares saw almost all of this business shift into the European Union on the first trading day since Brexit. Aquis Exchange Plc Chief Executive Officer Alasdair Haynes told Bloomberg TV on Monday that 99.6% of its European stock trading moved to its parallel venue in Paris. Cboe Europe saw 90% shift to its Amsterdam venue, while 92% of such trades on London Stock Exchange Group Plc's Turquoise platforms were inside the bloc by 3 p.m. in London. The moves represent about 4.6 billion euros ($5.6 billion) of trades, according to data from Cboe Global Markets Inc. "Europe has clearly won the battle for its own share trading," Haynes said. The shift "is a spectacular own goal as Britain is now losing its very strong position in trading of European equities in London," he said. (BBG)

FISCAL: Boris Johnson faced calls for further financial support for companies – from both business groups and union leaders – after announcing England's toughest set of restrictions since last spring. The prime minister's message to the general public to stay at home, with schools shut until mid-February, came amid fast-rising rates of coronavirus infections. Adam Marshall, director-general of the British Chambers of Commerce, said companies would understand why Mr Johnson felt compelled to act. (FT)

EUROPE

CORONAVIRUS: The European Union's drug regulator said a decision on the safety and efficacy of Moderna Inc.'s Covid vaccine would come on Wednesday at the earliest. There had been speculation that a decision would come during a meeting Monday, but a spokesman for the European Medicines Agency said the discussion had not concluded and will continue Wednesday. Approval would give the EU a second cleared shot, after one from Pfizer Inc. and BioNTech SE got the go-ahead in December. (BBG)

ITALY: Italian Prime Minister Giuseppe Conte extended through mid- January some Covid-19 restrictions imposed during the holiday season to counter the risk of a resurgence, as the country struggles to speed up vaccinations. A cabinet meeting hosted by Conte on Monday prolonged a ban on people moving around Italy beyond Jan. 6. A limit of two guests per household will also be extended, according to a cabinet statement. The rules for so-called "orange zones" -- considered medium risk -- will be extended to the whole country on the weekend of Jan. 9-10, shuttering bars and restaurants across Italy. Authorities also revised rules for Italy's system of targeted virus curbs, changing the thresholds for regions to be classified as higher risk. (BBG)

IRELAND: Ireland has curbed hospital services in an effort to free up capacity as coronavirus infections surge to record levels. (FT)

U.S.

FED: The Federal Reserve could begin to trim its monthly asset purchases this year if distribution of coronavirus vaccines boosts the economy as expected, Atlanta Fed President Raphael Bostic said on Monday in what amounted to a bullish outlook for the coming months. "I am hopeful that in fairly short order we can start to recalibrate," the $120 billion in U.S. Treasury and mortgage-backed securities that the U.S. central bank is currently buying each month, Bostic said in an interview with Reuters. (RTRS)

FED: MNI BRIEF: Fed's Evans: May Reconsider Adjusting QE in Spring

- Chicago Federal Reserve President Charles Evans said Monday he's comfortable with the current QE program and it will be until around spring before there's enough evidence of the economy's progress to see if it needs to be adjusted. The Fed could adjust the pace or duration of assets being targeted, Evans told reporters after a speech. The economy could grow 4% this year and unemployment decline to around 5%, depending on how the pandemic progresses, said Evans, who joined the FOMC voting group this year - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: U.S. economic growth could surge later this year if most Americans are vaccinated against the coronavirus, but the gains would unlikely be enough for the Federal Reserve to withdraw its support, Cleveland Fed President Loretta Mester said on Monday. The economy is likely to struggle in the near term after a rise in coronavirus infections led to more restrictions, both voluntary and mandated, Mester said. While the "medium" term outlook was more promising, with vaccines likely to help people feel safer doing certain activities, she expects the economy to remain far from the Fed's inflation and full employment goals. (RTRS)

ECONOMY: The National Retail Federation said Monday that overall economic activity is not expected to return to pre-pandemic levels until late 2021, and employment to pre-pandemic levels until well into 2022 or possibly 2023, as the retail industry keeps reeling from the effects of the Covid crisis. (CNBC)

FISCAL: A handful of states have begun issuing a $300 weekly boost to unemployment benefits or signaled workers will get the payments starting this week. Others expect the aid to kick in later this month. Workers in Arizona, California, New York and Rhode Island will receive the first batch of enhanced payments this week, according to state labor agencies. California and New York are the No. 1 and 2 states, respectively, relative to the number of workers receiving jobless benefits. (CNBC)

FISCAL: A day before Georgians head to the polls to decide control of the Senate, President-elect Joe Biden sought to cast the election as a choice between immediate stimulus relief or months of gridlock, promising that victory by Raphael Warnock and Jon Ossoff would mean $2,000 stimulus checks would be sent out "immediately." (Forbes)

CORONAVIRUS: The number of people in US hospitals with coronavirus hit a new peak on Monday, underpinned by record numbers of patients in the southern and western regions of the country. Hospitalisations hit 128,210, according to data from Covid Tracking Project, surpassing the previous record of 125,562 on Sunday. (FT)

CORONAVIRUS: Anyone who receives the Moderna or Pfizer vaccine must get two full doses, two top US Food and Drug Administration officials said Monday. They also dismissed other ideas for stretching the vaccine supply and said people who are speculating about the possibility of making do with just one dose or cutting doses in half are misinterpreting the data. (CNN)

CORONAVIRUS: The US Food and Drug Administration on Monday issued an alert to patients and healthcare providers warning them of a risk of false negative results with a SARS-CoV-2 laboratory-based test from San Dimas, California-based Curative. (Genome Web)

CORONAVIRUS: New York State has found its first case of the U.K. variant of coronavirus, Governor Andrew Cuomo said. (BBG)

CORONAVIRUS: New York Governor Andrew Cuomo called on the state's public and private hospitals to administer coronavirus vaccines more quickly, warning of fines of as much as $100,000 for those who don't comply. The 194 hospitals in the state have received about 46% of the state's total vaccine allocation, he said at a briefing Monday. "I need those public officials to step in and manage those systems. You have the allocation; we want it in people's arms as soon as possible." The state health department this week notified providers that if they don't use the allocations they already have by the end of the week, they will be fined up to $100,000. Moving forward, the providers will be required to use the vaccines within seven days of receipt, he said. Those providers who are "seriously deficient" can be subject to sanctions, including limited allocations in the future, he said. The governor also said New York is going to supplement and expedite the federal program to vaccinate nursing-home residents. (BBG)

CORONAVIRUS: Minnesota Governor Tim Walz will announce a loosening of virus restrictions on indoor dining and other settings Wednesday, according to a report from the Minneapolis Star-Tribune that cited the governor's spokesman. The statement cited an improvement in case numbers "following the pause on activities around the holidays." (BBG)

POLITICS: The Democratic and Republican Senate candidates in Georgia are in a statistical tie heading into Tuesday's pair of runoff elections, according to a new poll conducted for a Republican super PAC. (Axios)

POLITICS: Republican Sens. Kelly Loeffler and David Perdue, facing tight runoff elections Tuesday in Georgia, have received a late surge of donations from the real estate and financial industries. Their Democratic challengers, Raphael Warnock and Jon Ossoff, respectively, have otherwise enjoyed a fundraising edge in the races, which will determine whether Democrats or the GOP will hold an edge in the Senate. (CNBC)

POLITICS: Georgia Secretary of State Brad Raffensperger told ABC's "Good Morning America" that an Atlanta-area district attorney's office could investigate a phone call Saturday during which President Trump asked Raffensperger to "find 11,780 votes" to overturn President-elect Biden's victory in the state. (Axios)

POLITICS: President Donald Trump made a series of "provably false" claims during his controversial phone call to pressure Georgia's secretary of state to reverse President-elect Joe Biden's win there, a top elections official said Monday. Gabriel Sterling, Georgia's voting system Implementation manager, gave a point-by-point refutation of Trump's allegations at a press conference, which came two days after Trump leaned on Secretary of State Brad Raffensperger during an unprecedented hour-long phone call to "find" the president enough votes to beat Biden. (CNBC)

POLITICS: Two House Democrats are asking FBI Director Christopher Wray to open a criminal probe into Trump after a phone call revealed him pleading with Georgia Secretary of State Brad Raffensperger to "find" enough votes to overturn his loss in the state's presidential election. (ABC)

POLITICS: The top federal prosecutor in Atlanta left his position Monday, a day after an audio recording was made public in which President Donald Trump called him a "never-Trumper." Byung J. "BJay" Pak, who was appointed by Trump, announced his resignation as U.S. attorney for the Northern District of Georgia in a news release. The statement did not say why Pak was leaving or what he plans to do next. (Associated Press)

POLITICS: Bracing for possible violence, the nation's capital has mobilized the National Guard ahead of planned protests by President Donald Trump's supporters in connection with the congressional vote expected Wednesday to affirm Joe Biden's election victory. Trump's supporters are planning to rally Tuesday and Wednesday, seeking to bolster the president's unproven claims of widespread voter fraud. "There are people intent on coming to our city armed," D.C. Acting Police Chief Robert Contee said Monday. (Associated Press)

POLITICS: Major U.S. business leaders on Monday urged that Congress this week certify President-elect Joe Biden's Electoral College victory over President Donald Trump, who has refused to recognize his loss in the 2020 election. Business groups including the U.S. Chamber of Commerce, the National Association of Manufacturers, and the Partnership for New York City separately issued statements calling for an end to efforts to undermine Biden's win. (CNBC)

POLITICS: Sen. Kelly Loeffler (R-Ga.) announced in a statement Monday she will "vote to give President Trump and the American people the fair hearing they deserve and support the objection to the Electoral College certification process." (Axios)

AIRLINES: A group representing major U.S. airlines on Monday backed a proposal by public health officials to implement a global testing program requiring negative tests before most international air passengers return to the United States, according to a letter seen by Reuters. (RTRS)

OTHER

U.S./CHINA: NYSE Regulation no longer intends to move forward with the delisting action in relation to China Telecom, China Mobile and China Unicom (Hong Kong), according to a statement. Issuers will continue to be listed and traded on the NYSE. NYSE Regulation will "continue to evaluate the applicability of Executive Order 13959 to these issuers and their continued listing status". (BBG)

CORONAVIRUS: Moderna Inc. said it will make at least 600 million doses of its Covid-19 vaccine in 2021, with a goal of finishing the year with as many as 1 billion doses produced. The shares rose. The announcement increased the bottom end of the company's production forecast by 100 million doses. Moderna is "continuing to invest and add staff" to produce the two-shot vaccine, according to a statement by the Cambridge, Massachusetts biotech company on Monday. (BBG)

CORONAVIRUS: BioNTech and partner Pfizer warned on Monday that they had no evidence that their jointly developed vaccine will continue to protect against Covid-19 if the booster shot is given later than tested in trials. (RTRS)

JAPAN: MNI BRIEF: Japan To Declare Covid Emergency Thursday: Nikkei

- Japanese Prime Minister Yoshihide Suga is expected to declare a state of emergency on Thursday following the surge in coronavirus infections, which will lead to shorter business hours although schools will remain open, the Nikkei reported - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: Japan mulls suspending all foreign arrivals. (Asahi)

AUSTRALIA: Prime Minister Scott Morrison says he is hopeful border restrictions between Victoria and NSW can be eased soon, with both states appearing to be well on top of their COVID-19 outbreaks. The Prime Minister said he had spoken to Victorian Premier Daniel Andrews on Monday night "to see if we can get a better pathway for Victorians home as soon as possible". He told radio station 3AW on Tuesday morning that wastewater testing in NSW had indicated the state's regions – excluding greater Sydney – were COVID-free. He said he hoped people who had not visited hot zones would soon be allowed through Victoria's hard border. (Sydney Morning Herald)

AUSTRALIA/CHINA: Several major Chinese cities have reportedly gone dark as authorities limit power usage, citing a shortage of coal. Analysts said prices of the commodity in the country have shot up due to the reported crunch. The reports also follow rising trade tensions between Beijing and Canberra, leading some analysts to tie the coal shortages and blackouts to the unofficial ban on Australian coal. (CNBC)

SOUTH KOREA: South Korean President Moon Jae-in says the spread of coronavirus is being slowly contained after reaching a peak considering the reproduction rate is falling. (BBG)

SOUTH KOREA: South Korean President Moon Jae-in says coronavirus spread is being slowly contained after reaching peak as reproduction rate is falling. Vaccine inoculation possible as early as Feb.; domestic treatment development imminent. To focus on job security and increase in housing supply. South Korea should achieve "fast and strong" economic recovery. (BBG)

SOUTH KOREA: Finance Minister Hong Nam-ki says government will carefully manage market liquidity while closely paying attention to possibility that sharply increased liquidity would create herd behavior into asset markets. Hong made the comments in a New Year speech delivered to financial industry. Needs to think about "orderly" normalization for soft-landing in future process of normalizing financial supports made during pandemic crisis. Separately, Bank of Korea Governor Lee Ju-yeol said in a speech "latent" risks from liquidity supplied so far and the postponement of interest payments are expected to manifest this year. (BBG)

SOUTH KOREA: The chief of South Korea's central bank said Tuesday that debt restructuring may be needed once the coronavirus pandemic wanes. Along with debt distress, Bank of Korea (BOK) Gov. Lee Ju-yeol said the nation's economy must address the issue of liquidity hoarding in asset markets in the aftermath of the pandemic. (Yonhap)

MEXICO: Mexico approved the Oxford-AstraZeneca coronavirus vaccine for emergency use Monday, hoping to spur a halting vaccination effort that has only given about 44,000 shots since the third week of December, about 82% of the doses the country has received. The Pfizer vaccine had been the only one approved for use in Mexico, until Mexican regulators approved the AstraZeneca shot Monday. (Associated Press)

MEXICO: Mexico's government has issued its first "Formosa bond" with an offering of 50-year notes in U.S. dollars on the Taiwanese market and raised $3 billion, the finance ministry said on Monday. The issuance was more than three times oversubscribed, the finance ministry said, drawing interest from 210 international institutional investors. "Mexico opened the international markets of 2021 with a successful transaction in Formosa, Taiwan," deputy finance minister Gabriel Yorio said on Twitter. The transaction covered 35% of the foreign currency funding requirements for Mexico's 2021 budget, he added. (RTRS)

BRAZIL: Brazilian health regulator Anvisa has received data regarding the AstraZeneca COVID-19 vaccine being produced in India from the vaccine maker's partners in Brazil, the agency said in a statement on Monday. Based on the data presented by Brazilian biomedical center Fiocruz, along with more information to be presented by the Serum Institute of India, Anvisa said it will evaluate how comparable the vaccine is to the shot produced in the U.K. before it decides on possible approval for emergency use. (RTRS)

SOUTH AFRICA: South African medical-insurance companies, business organizations and the government are developing a program in which the private sector will help fund Covid-19 vaccines for people not covered by insurance. Legislation has been amended to allow the companies to fund shots for people who don't have medical insurance and talks are now focused on the number of those who may benefit, said Stavros Nicolaou, head of the Health Workgroup for B4SA, a grouping of South Africa's biggest business organizations. In addition to medical insurers, companies such as miners may contribute funds so their workers can be covered, he said. "We are looking at a model of some cover for uncovered patients," he said in an interview on Monday. "For every funded person, there will be a contribution to the unfunded." (BBG)

IRAN: The United States criticized Iran's statement that it had begun the process of enriching uranium to 20%, well above the limit set in the 2015 nuclear deal that Washington abandoned, as a form of "nuclear extortion." (RTRS)

IRAN: The U.S. State Department called on Iran on Monday to immediately release a South Korean-flagged tanker that it seized in the Gulf and accused Tehran of threatening freedom of navigation as a way to extract relief from economic sanctions. (RTRS)

MIDDLE EAST: The U.S. has granted Iraq a 90-day waiver for its energy trade with Iran, which takes it months into the incoming Biden administration that is likely to take a less hardline stance on punishing sanctions against Iran. (Iraq Oil Report)

MIDDLE EAST: Kuwait has said that Saudi Arabia is reopening its land and sea borders to Qatar in a breakthrough in a long-running dispute that has pitted Qatar against several of its Gulf neighbours. The move comes ahead of a summit of the Gulf Co-operation Council to be held in Saudi Arabia on Tuesday. A senior US official said an agreement to end the rift would be signed. Qatar's neighbours imposed an embargo on Qatar three-and-a-half years ago, accusing it of supporting terrorism. (BBC)

OIL: OPEC and its partners will extend their talks to Jan. 5, with countries still at loggerheads over February production levels but hoping to avoid the brinkmanship of last spring when the pact briefly collapsed, crashing oil prices. A full day of negotiations, including first a ministerial monitoring committee meeting, followed by the full OPEC+ conference, failed to budge Russia off its position that the coalition should increase crude production by 500,000 b/d in February to reclaim market share lost to the coronavirus pandemic. The vast majority of members were in favor of rolling over January quotas, wary of the slow ramp-up of vaccines and the scrambling by many countries to get skyrocketing infection rates under control with renewed lockdown measures, delegates said. (Platts)

CHINA

YUAN: The yuan may strengthen further after surging past 6.45 against the dollar given China's stronger recovery and exports, a weakening dollar and strong momentum for investment in Chinese securities markets, the Shanghai Securities News reported. The conclusion of China-EU trade talks and weakening U.S. exports may continue to reduce the dollar's strength against the yuan, the newspaper reported. (MNI)

POLICY: China must develop its technological advantages and strengthen its industrial and supply chains to compete against other major powers in the years ahead, the Enterprise Observer reported citing Liu Yuanchun, an advisor to the central government and the vice dean of Renmin University of China. China may not regain its 4% annual growth momentum even after fully recovers from the Covid-19 pandemic, Liu said, citing China's aging population, a lack of revolutionary technologies and anti-globalization as factors which may impede growth. (MNI)

EQUITIES: Stamp duties on trading stocks in China may be cut or removed after the State Council took over jurisdiction from the Ministry of Finance, the Securities Times reported citing speculation by market participants. The rate of stamp tax, a tool to control the volume of trading, was adjusted twice in 2008 to the current 1%, the Times said. A senior policy advisor Huang Qifan, who is the former city mayor of Chongqing, advocated in 2018 to cancel the tax, according to the newspaper report. (MNI)

OVERNIGHT DATA

JAPAN DEC VEHICLE SALES +7.4% Y/Y; NOV +6.0%

JAPAN DEC MONETARY BASE +18.3% Y/Y; MEDIAN +18.0%; NOV +16.5%

JAPAN DEC MONETARY BASE END OF PERIOD Y617.6TN; MEDIAN Y615.2TN; NOV Y605.9TN

JAPAN NOV LOANS & DISCOUNTS CORP +8.05% Y/Y; OCT +7.79%

AUSTRALIA DEC ANZ JOB ADVERTISEMENTS +9.2% M/M; NOV +13.5%

ANZ Job Ads continued its impressive recovery in December, rising 9.2% m/m (seasonally adjusted), surpassing its pre-pandemic level to record the highest result in 18 months. The ongoing strength was likely supported by Victoria, where the labour market still has ground to make up. December's COVID spike in New South Wales is unlikely to have had a material effect on Job Ads so far. (ANZ)

CHINA MARKETS

PBOC NET DRAINS CNY130BN VIA OMOS TUES

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net drain ofCNY130 billion given the maturity of CNY140 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:31 am local time from 1.8552% for Monday's close.

- The CFETS-NEX money-market sentiment index closed at 38 on Monday vs 34 on last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT6.4760 TUES VS 6.5408

The People's Bank of China (PBOC) set the dollar-yuan central parity rate 648 pps lower at 6.4760 on Tuesday - the strongest rate since Jun 21, 2018.This compares with the 6.5408 set on Monday, marking the highest daily rise onrecord.

MARKETS

SNAPSHOT: COVID & Georgia Dominate, Even As Sino-U.S. Tensions Cool

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 123.14 points at 27135.24

- ASX 200 down 2.349 points at 6681.9

- Shanghai Comp. up 7.596 points at 3510.554

- JGB 10-Yr future up 16 ticks at 152.04, yield down 1.1bp at 0.010%

- Aussie 10-Yr future up 3.5 ticks at 99.005, yield down 3.6bp at 0.981%

- U.S. 10-Yr future -0-01+ at 138-02+, yield up 0.66bp at 0.920%

- WTI crude down $0.04 at $47.58, Gold down $3.99 at $1938.90

- USD/JPY down 17 pips at Y102.96

- JOHNSON HITS ENGLAND WITH FULL LOCKDOWN (BBG)

- UK VACCINE ROLLOUT HAMPERED BY RED TAPE AND LACK OF BACK-UP STOCKS (FT)

- FED'S BOSTIC: BOND-BUYING 'RECALIBRATION' COULD HAPPEN IN 2021 (RTRS)

- FED'S EVANS: MAY RECONSIDER ADJUSTING QE IN SPRING (MNI)

- FED'S MESTER: POLICY WILL STAY ACCOMMODATIVE FOR 'QUITE SOME TIME' (RTRS)

- NYSE NO LONGER PLANS TO DELIST CHINA TELCO GIANTS (BBG)

BOND SUMMARY: Core FI Sees Tight Ranges Prevail In Asia

Core FI has looked through the latest round of headlines re: Sino-U.S. tensions, which seemed to represent at least a marginal de-escalation as the NYSE walked back its previously declared intentions re: the de-listing of 3 large Chinese telecoms firms. T-Notes stuck to a narrow 0-03+range, last -0-02 at 138-02, while the cash Tsy curve saw some light bear steepening, with 30s cheapening by ~1.0bp in Asia-Pac hours. Indonesia's marketing of 10-, 30- & 50-Year USD bonds caught some attention, while light instances of downside screen interest via TYG1 136.00 puts and EDU2/U4 steepeners dominated on the flow side, as participants await the results of the Georgia Senate run-off.

- JGB futures reclaimed the 152.00 level, last +16 on the day, as participants looked to local COVID-19 worry and steady to softer offer/cover ratios in the latest round of BoJ 1-10 Year Rinban ops for support (even as the Bank bought Y50bn less of 1-3 Year paper vs. prev).

- The Australian curve bull flattened in the wake of the move seen in U.S. Tsys after Sydney closed on Monday, with little in the way of idiosyncratic headline flow noted, outside of a handful of cases of the UK's more aggressive COVID strain being detected in one of Western Australia's travel quarantine hotels. YM +0.5, XM +3.5.

JGBS AUCTION: Japanese MOF sells Y5.9400tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.9400tn 3-Month Bills:- Average Yield -0.0861% (prev. -0.0942%)

- Average Price 100.0210 (prev. 100.0253)

- High Yield: -0.0820% (prev. -0.0893%)

- Low Price 100.0200 (prev. 100.0240)

- % Allotted At High Yield: 82.5825% (prev. 98.8790%)

- Bid/Cover: 2.856x (prev. 2.658x)

BOJ: Rinban Tweaked

The BoJ offers to buy a total of Y1.29tn of JGB's from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity (prev. 500bn)

- Y420bn worth of JGBs with 3-5 Years until maturity (unch.)

- Y420bn worth of JGBs with 5-10 Years until maturity (unch.)

EQUITIES: Little Cohesion Overnight

The major Asia-Pac equity indices trade either side of unchanged, with little in the way of a cohesive sense of direction observed.

- The Chinese telecom sector was supported by headlines noting that the NYSE no longer plans to de-list the three major Chinese TelCos previously outlined. This came after earlier headlines run on RTRS re: guidance issued by the U.S. Treasury noted that President Trump's executive order forbidding investment into Chinese "military-controlled" companies does not require a divestment of current holdings.

- E-minis initially nudged higher after Monday's round of pressure, before pulling back from best levels of the session with Tuesday's Georgia Senate run-off elections eyed.

- Nikkei 225 -0.5%, Hang Seng -0.3%, CSI 300 +0.6%, ASX 200 -0.3%.

- S&P 500 futures -2, DJIA futures -50, NASDAQ 100 futures -10.

OIL: Respecting Monday's Ranges

WTI & Brent last deal around settlement levels, after recovering from worst levels of the Asia-Pac session, although the benchmarks have stuck to the confines of the respective ranges established on Monday.

- To recap, Monday ultimately saw broader COVID jitters and OPEC+ squabbling pressure crude, outweighing geopolitical tension surrounding Iran.

- Re: OPEC+, Russia is pushing for a 500K bpd increase for cumulative group production in February, while most of the group supported a rollover of the current production levels, per source reports. The disagreement means that participants reconvene on Tuesday with focus on the aforementioned divide as Russia looks for OPEC+ to regain market share, while others remain wary of the impact of increased supply in a fragile, COVID-hampered environment. This highlights the impact that OPEC+ fractures can have, which has been magnified by the now monthly meeting schedule for production pact participants.

GOLD: The Road To Georgia

The pull lower in U.S. real yields as 10-Year breakevens topped 2.00% for the first time since 2018 allowed bullion to firm in early dealing this week, as did a cautious start to broader trade in '21, with COVID-19 matters remaining front & centre. Spot last deals around the $1,940/oz mark, little changed vs. Monday's closing levels.

- Tuesday's Senate run-offs in the state of Georgia will likely provide the key short-term input for bullion, with the outcome key to the U.S. fiscal trajectory.

- From a technical perspective, key resistance is located at the Nov 9 high of $1,965.6/oz, while initial support comes in at the Dec 31 high of $1,900.9/oz.

FOREX: NYSE Announcement Bolsters Yuan, Chinese State Banks Buy USD

The yuan picked up a bid after the NYSE said it ditched plans to delist three Chinese telecom giants and USD/CNH dipped to CNH6.4118, a level not seen since mid-2018. Recovery came quickly thereafter amid chatter that Chinese state banks bought the greenback at CNY6.43. USD/CNH wiped out the bulk of its earlier losses as a result, but remained below neutral levels.

- Yuan strength added strain to the greenback, which underperformed in G10 FX space amid reduced demand for safe havens & ahead of Georgia runoff elections. JPY and CHF also struggled for any meaningful impetus, with the former limited by Gotobi day flows.

- The Antipodeans topped the G10 pile, drawing support from the NYSE's announcement. AUD/USD staged a foray above the $0.7700 mark and NZD/USD crossed above the $0.7200 figure.

- TWD surged in sync with CNY, with USD/TWD dropping below the TWD28.00 level for the first time since 1997.

- KRW underperformed in the Asia EM basket after USD/KRW failed to make substantial headway beyond its cycle low yesterday.

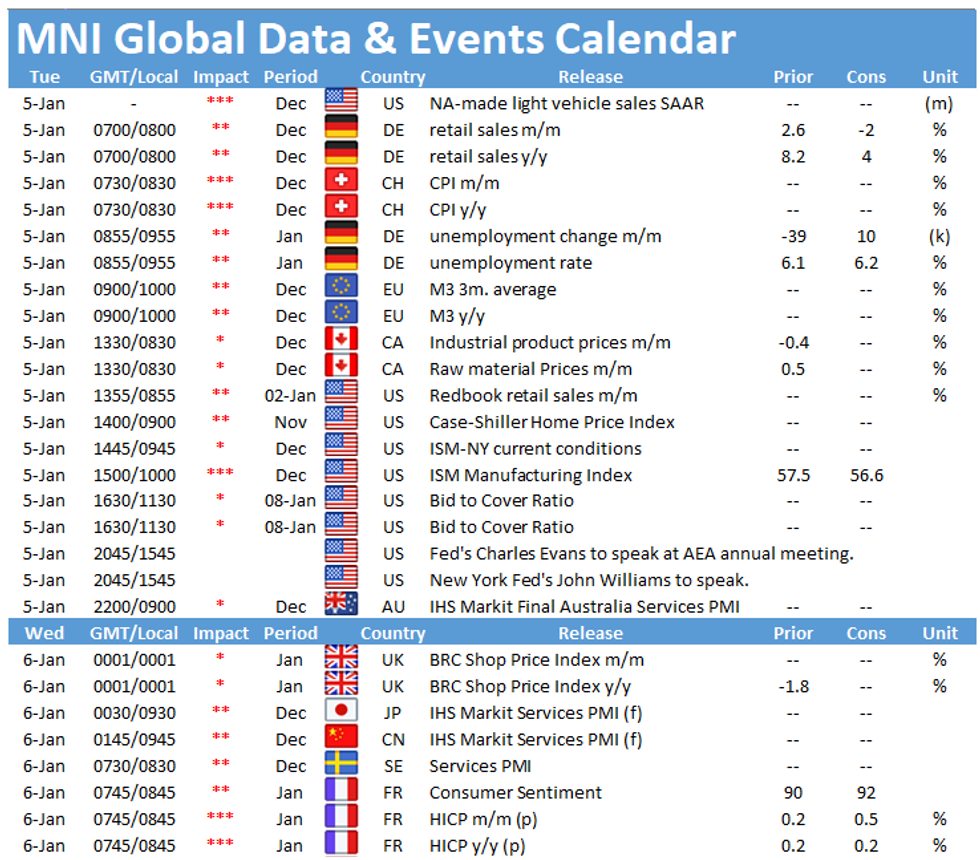

- Coming up today we have U.S. ISM M'fing, German retail sales & unemployment, flash French CPI and comments from Fed's Evans & Williams.

FOREX OPTIONS: Expiries for Jan05 NY cut 1000ET (Source DTCC)

- AUD/JPY: Y79.10-20(A$569mln-AUD puts)

- AUD/NZD: N$1.0485(A$960mln-AUD puts), N$1.0665(A$480mln-AUD puts)

- USD/CAD: C$1.2965-75($519mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.