-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: CPI On The Mind

EXECUTIVE SUMMARY

- US, CHINA DIPLOMATS WEIGH FIRST MEETING AFTER BALLOON DRAMA (BBG)

- CHINA, U.S. TO PARTICIPATE IN FIRST MEETING OF NEW DEBT ROUNDTABLE ON FEB. 17 (RTRS)

- BIDEN WILL NAME FED’S LAEL BRAINARD AS HIS TOP ECONOMIC ADVISER (BBG)

- NEW BREXIT DEAL NEARS AS NORTHERN IRELAND DEADLOCK COMES TO AN END (TELEGRAPH)

- JAPAN NAMES ACADEMIC UEDA AS NEXT CENTRAL BANK GOVERNOR (RTRS)

- UEDA'S YCC CONCERNS HINT AT BOJ POLICY SHIFT (MNI)

- BULLOCK, WILKINSON NAMED AMONG POTENTIAL RBA SUCCESSORS TO LOWE (BBG)

- US TO SELL 26 MILLION MORE BARRELS FROM STRATEGIC OIL RESERVE (BBG)

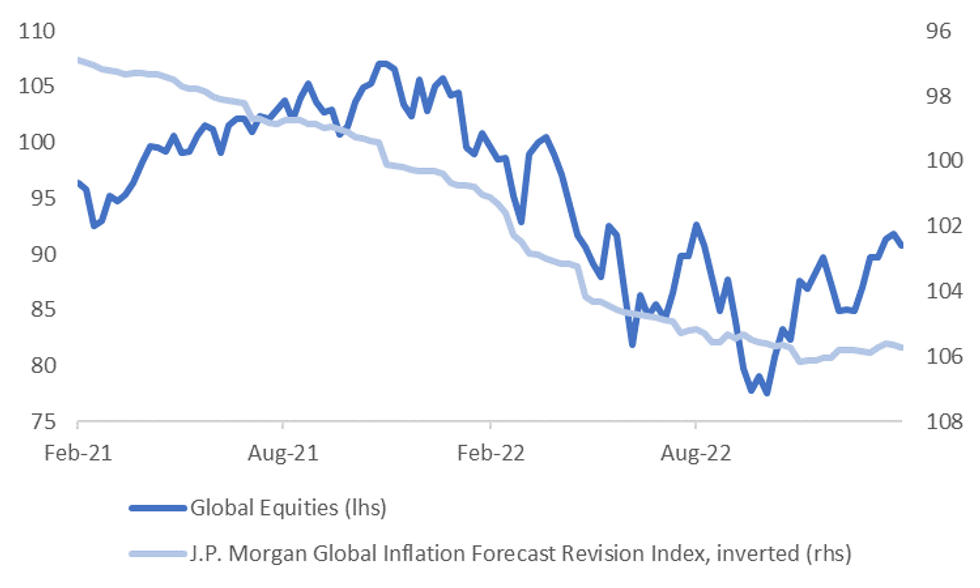

Fig. 1: Global Equities Vs. J.P.Morgan Global Inflation Forecast Revision Index

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England will make its final increase to borrowing costs in the current cycle next month to combat double-digit inflation, according to a Reuters poll which showed the British economy is almost certainly entering a recession. (RTRS)

FISCAL: Millions of households are facing an increase in their council tax from April, as local authorities try to balance their books. (BBC)

BREXIT: A new Brexit deal is expected to be announced in the next fortnight after the UK watered down its hardline resistance to European judges ruling on issues in Northern Ireland. (Telegraph)

U.S.

FED: WSJ Fed reporter Timiraos tweeted the following on Monday: “The Fed expects to see the economy slow. A growth reacceleration doesn't sound like officials' base case. John Williams last week on the "no landing" scenario: "It’s not just about where the economy is today [but] where is it likely going to be over the next couple years." (MNI)

ECONOMY/FED: President Joe Biden has decided to name Federal Reserve Vice Chair Lael Brainard as his top economic adviser, with an announcement coming as soon as Tuesday, people familiar with the matter said Monday night. (BBG)

OTHER

U.S./CHINA: Secretary of State Antony Blinken is considering a meeting with Wang Yi, China’s top diplomat, at a security conference later this week, people familiar with the matter said, in what would be their first face-to-face talks since an uproar over a Chinese balloon led to a new spike in tensions. (BBG)

U.S./CHINA: The White House on Monday defended its decision to shoot down three low-flying, aerial objects over U.S. and Canadian airspace in the past three days, but said it had not determined yet exactly what the objects were, who owned them or what they were doing. (CNBC)

U.S./CHINA: There are no U.S. surveillance aircraft in Chinese airspace, White House national security spokesman John Kirby said on Monday, repeating denials of China's claim that U.S. high altitude balloons had flown over its airspace without permission more than 10 times since the beginning of 2022. (RTRS)

U.S./CHINA: The White House said on Monday there is no change to an executive order on U.S. corporate investments in China, which is expected to be unveiled in the coming months. (RTRS)

GEOPOLITICS: Canadian Prime Minister Justin Trudeau said on Monday that the four aerial objects shot down in recent days, including one over Yukon territory on Saturday, are connected in some way, without elaborating. (RTRS)

GEOPOLITICS: Officials from China, India, Saudi Arabia and Group of Seven wealthy nations will participate in a first virtual meeting of a new sovereign debt roundtable on Friday, three sources familiar with the plans said on Monday. (RTRS)

GEOPOLITICS: US says it supports the Philippines after China reportedly used laser devices against a Philippines coast guard ship on Feb. 6 in the South China Sea, according to an emailed statement from the State Department. (BBG)

BOJ: Japan's government named academic Kazuo Ueda as its pick to become next central bank governor, a surprise choice that could heighten the chance of an end to its unpopular yield control policy. (RTRS)

BOJ: Bank of Japan governor-elect Kazuo Ueda, who is set to take office on April 9, will likely keep interest rates at low levels but may quicken the scrapping of yield curve control to restore functioning in financial markets, MNI understands. (MNI)

BOJ: Bank of Japan officials remain vigilant against the risk of weaker exports and production in the first quarter due to a slowing global economy, as well as the threat of weaker private consumption amid ongoing high prices, MNI understands. (MNI)

JAPAN: Japan’s economy rebounded in the fourth quarter from a contraction in the third quarter due to stronger private consumption, but the government must pay attention to downward pressure from high prices on spending in the first quarter, a senior official at the Cabinet Office said on Tuesday. (MNI)

RBA: As Australian central bank governor Philip Lowe prepares for his first public appearance of the year on Wednesday for his first public appearance of the year on Wednesday, speculation is mounting that he won’t be offered an extension in the role, prompting local media to begin looking at possible successors. (BBG)

HONG KONG: Hong Kong’s leader defended the inclusion of a national security clause into the city’s land sales, saying it was the duty of the whole city to protect the country’s interests. (BBG)

HONG KONG: Hong Kong bought local dollars to defend its peg to the greenback for the first time since November, as a slump in bank borrowing costs made shorting the city’s currency a popular trade. (BBG)

TURKEY: Turkey’s Treasury and Finance Minister Nureddin Nebati decided to offer listed companies tax incentives to boost share buybacks after the nation’s main stock exchange resumes trading following a halt over last week’s massive earthquakes, according to a Turkish official with direct knowledge of the matter. (BBG)

TURKEY: Turkey is seeking more information on trades made by an unknown investor or investors, referred to locally as “the Dude,” during a selloff the day after devastating earthquakes last week. (BBG)

USMCA: Mexico issued a decree against GMO corn flour and tortillas on Monday, but says it will not affect its USMCA trade agreement, according to an Economy Ministry statement. (BBG)

BRAZIL: Brazil’s central bank chief pledged to work with Luiz Inacio Lula da Silva’s administration in an effort to make peace with a president who has been escalating his criticism of high interest rates. (BBG)

BRAZIL: Brazil’s top economists told the central bank that boosting inflation targets now would only raise questions about the government’s commitment to sound fiscal and monetary policies, according to seven participants of a meeting with the monetary authority on Monday. (BBG)

BRAZIL: Despite an uptick in risk aversion, Brazilian corporates are facing manageable refinancing risks with USD65 billion in debt maturing in the next two years, according to a new report in the Fitch Ratings LATAM Spotlight series. (Fitch)

SOUTH AFRICA: Top South African politicians including President Cyril Ramaphosa and Finance Minister Enoch Godongwana must act decisively to shutdown the governing African National Congress’s “ill-advised” proposal to change the central bank’s mandate and manage risk perceptions in the lead up to next year’s elections, the Bureau for Economic Research said. (BBG)

SOUTH AFRICA: South Africa declared a state of disaster so the government can accelerate its response to widespread floods and free up funds for assisting with reconstruction. (BBG)

ENERGY: U.S. crude oil and natural gas production from the seven biggest shale basins is expected to rise to record highs in March, the U.S. Energy Information Administration (EIA) said in its monthly Drilling Productivity Report on Monday. (RTRS)

ENERGY: Freeport LNG sought approval from the U.S. energy regulator for authorization to progress to full, commercial operations of the first phase of its fire-idled export plant in Texas, according to a filing made available on Monday. (RTRS)

OIL: The Biden administration plans to sell more crude oil from the Strategic Petroleum Reserve, fulfilling budget directives mandated years ago that it had sought to stop as oil prices have stabilized. (BBG)

CHINA

PBOC: The PBOC is expected to increase the quota of its Medium-term Lending Facility in February as it looks to ensure a stable economic rebound, according to China Securities News. (MNI)

CREDIT: China is pushing financial institutions to offer more loans in the areas of rural developments, the country’s agriculture minister Tang Renjian says in a briefing. (BBG)

FISCAL: Advanced approval for special bonds in 2023 by the Ministry of Finance has exceeded CNY2 trillion for the first time, as the government looks to promote investment and expand domestic demand, according to Yicai.com. (MNI)

PROPERTY: CITIC Bank Nanning will offer mortgages to buyers who’s age plus duration of the mortgage does not exceed 80 years, however the maximum age limit of 70 years will still apply, according to China Securities News. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY302 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY91 billion via 7 day reverse repos with the rates unchanged at 2.00% on Tuesday. The operation has led to a net drain of CNY302 billion after offsetting the maturity of CNY393 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:29 am local time from the close of 1.8994% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday, compared with the close of 41 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8136 TUES VS 6.8151 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8136 on Tuesday, compared with 6.8151 set on Monday.

OVERNIGHT DATA

JAPAN Q4, P GDP +0.2% Q/Q; MEDIAN +0.5%; Q3 -0.3%

JAPAN Q4, P GDP ANNUALISED +0.6% Q/Q; MEDIAN +2.0%; Q3 -1.0%

JAPAN Q4, P NOMINAL GDP +1.3% Q/Q; MEDIAN +1.5%; Q3 -0.8%

JAPAN Q4, P GDP DEFLATOR +1.1% Y/Y; MEDIAN +1.1%; Q3 -0.4%

JAPAN Q4, P GDP PRIVATE CONSUMPTION +0.5%; MEDIAN +0.5%; Q3 0.0%

JAPAN Q4, P GDP BUSINESS SPENDING -0.5% Q/Q; MEDIAN -0.3%; Q3 +1.5%

JAPAN Q4, P INVENTORY CONTRIBUTION TO GDP -0.5% Q/Q; MEDIAN -0.1%; Q3 +0.1%

JAPAN Q4, P NET EXPORTS CONTRIBUTION TO GDP +0.3% Q/Q; MEDIAN +0.4%; Q3 -0.6%

JAPAN DEC, F INDUSTRIAL PRODUCTION +0.3% M/M; PRELIM -0.1%; NOV +0.2%

JAPAN DEC, F INDUSTRIAL PRODUCTION -2.4% Y/Y; PRELIM -2.8%; NOV -0.9%

JAPAN DEC CAPACITY UTILISATION -1.1% M/M; NOV -1.4%

AUSTRALIA JAN NAB BUSINESS CONFIDENCE +6; DEC 0

AUSTRALIA JAN NAB BUSINESS CONDITIONS +18; DEC +13

Business conditions picked back up in January after three months of easing in late 2022 - returning to a very high level at +18 index points. The rise was led by very strong trading conditions in the month, but both profitability and employment are also well above average. Interestingly, it was ‘upstream’ sectors such as wholesale, construction and manufacturing that led the improvement, though conditions also remain strong in consumer-facing retail and personal services sectors. (NAB)

AUSTRALIA FEB WESTPAC CONSUMER CONFIDENCE INDEX 78.5; JAN 84.3

After a modest rally through the Christmas-New Year period, consumer confidence has fallen sharply to be back near the historic lows seen last November. Cost of living pressures and interest rate rises continue to weigh heavily. Hopes of some easing in both have been dashed by the strong December quarter CPI and the RBA’s resumption of its interest rate tightening cycle. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 78.1; PREV 83.6

Consumer confidence fell after the RBA raised interest rates by 25bp. This was the sharpest weekly drop in confidence since the June 2022 RBA meeting, which delivered the first 50bp cash rate hike of the current interest rate cycle. The average confidence among people paying off their mortgages fell sharper than other housing cohorts last week, by 10pts to its lowest since early April 2020. Confidence among homeowners and renters also fell, by5.2pts and 2.9pts respectively. The subindex for whether ‘it is a good time’ to buy a major household item dropped to its lowest since April 2020. (ANZ)

NEW ZEALAND Q4 2-YEAR INFLATION EXPECTATIONS +3.30% Y/Y; Q3 +3.62%

NEW ZEALAND JAN REINZ HOUSE PRICES -13.3% Y/Y; DEC -12.2%

NEW ZEALAND JAN REINZ HOUSE SALES -27.0% Y/Y; DEC -39.0%

The Real Estate Institute of New Zealand’s (REINZ) January 2023 figures show house prices have declined but at a slower rate than seen previously. (REINZ)

NEW ZEALAND JAN FOOD PRICES +1.7% M/M; DEC +1.1%

SOUTH KOREA DEC L MONEY SUPPLY -0.9% M/M NOV +0.4%

SOUTH KOREA DEC M2 MONEY SUPPLY -0.2% M/M NOV +0.7%

MARKETS

US TSYS: Marginally Richer in Asia, CPI In View

TYH3 deals at 112-30, +0-05, a touch off the top of a narrow 0-04+ range on volume of ~73K.

- Cash Tsys sit flat ~1bp richer across the major benchmarks.

- Tsys firmed in early trade, the bid was facilitated by screen flow in TY futures and light pressure in e-minis, with the latter ticking away from yesterday's late NY levels.

- Kazuo Ueda was formally nominated for the BOJ position by the Japanese government however there was little reaction in Tsys.

- Macro headline flow remained light through the session, with January CPI print in view activity was limited and the early richening held.

- UK Labour Market Report and Eurozone GDP cross in Europe. However the aforementioned CPI print provides the highlight today. Fedpeak from Richmond Fed President Barkin, Dallas President Logan, Philadelphia Fed President Harker and NY Fed President Williams is also on the wires.

JGBS: BoJ Board Nominations Made Official

There wasn’t any meaningful market reaction to the Japanese government’s formal nominations for the BoJ’s leadership positions in the post-Kuroda era, given that the names (Ueda, Himino & Uchida) were telegraphed in Friday’s Nikkei article. JGB futures saw a modest extension through their morning high and print +20 into the close. Cash JGBs are little changed to 3bp richer across the curve, a touch shy of best levels with a similar dynamic seen in swaps.

- As flagged earlier, this leadership mix is generally seen as more of a centrist platform, as opposed to an outright hawkish or dovish setup, with many suggesting such appointments will cement expectations for a gradual normalisation of monetary policy. Still, we note that the most recent insight piece from our policy team fleshed out their understanding the Ueda will “likely keep interest rates at low levels but may quicken the scrapping of yield curve control to restore functioning in financial markets.”

- Locally, prelim Q4 GDP data was softer than expected, with inventories the major headwind for the headline print.

- Looking ahead, the latest round of BoJ Rinban operations headline on Wednesday.

AUSSIE BONDS: Post-RBA Rise in Rate Hike Expectations Eases

Aussie bond futures traded in a relatively tight range ahead of U.S CPI data. After spending much of the day in negative territory YM and XM eked out gains of +1.0 and +2.0, respectively. Cash bonds were 2-3bp richer with the 3/10 cash curve flat on the day. The AU/U.S. 10-year yield differential was unchanged ~5bp.

- AU swaps rates were 1-3bp lower with the curve a tad steeper.

- Bills were flat to 3bp firmer along the strip.

- After a small push higher in morning trade RBA-dated OIS terminal rate expectations (Sep/Oct-23) reversed course mid-session to close at 4.12%, down 3bp on the day and down 10bp from yesterday’s intraday high of 4.22%.

- Local data delivered divergent paths for consumer and business confidence in January with Westpac’s measure of consumer sentiment declining 6.9% m/m and NAB business confidence rising for the second consecutive month to +6. The market took the data in its stride, instead focusing on U.S. CPI data, slated for NY hours.

- Looking ahead, Wednesday's local docket will be headlined by the appearance of Governor Lowe given the scrutiny surrounding his future in the press, along with speculation re: potential successors if his term is not extended.

AUSSIE BONDS: Sep-30 Index Linked Auction Results

The Australian Office of Financial Management (AOFM) sells A$150mn of the 2.50% 20 September 2030 index linked bond, issue #CAIN408:

- Average Yield: 1.0120% (prev. 1.1742%)

- High Yield: 1.0325% (prev. 1.1875%)

- Bid/Cover: 2.1067x (prev. 2.4533x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 93.3% (prev. 50.0%)

- Bidders 37 (prev. 35), successful 23 (prev. 18 ), allocated in full 22 (prev. 16)

NZGBS: Moderating 2-Year Inflation Expectations Deliver A Mid-Session Reversal

NZGBS were a little weaker in morning trade before reversing sharply as the RBNZ's survey of inflation expectations at the 2-year point moderated to 3.30%, declining from the cycle high of 3.62% seen in Q4.

- Short-end benchmark yields swung from being 3bp higher pre-data to being down 6bp at the close. 2-year swaps followed a similar path but outperformed, closing down 9bp.

- In the 10-year zone, bond yields and swap rates were unable to hold their post-data dips, both closing higher on the day, delivering an 8bp and 10bp steepening of their respective curves (vs. 2s).

- RBNZ-dated OIS also responded to the data by reducing the amount of tightening priced for this month’s meeting to less than 60bp for the first time in around a week. The largest mover on the day was pricing for the July meeting, with terminal OCR pricing moderating to just under 5.40% after threatening to break 5.50% yesterday.

- Other economic data of note included the REINZ House Price Index which delivered its fourteenth consecutive monthly decline, albeit with the m/m move moderating. National house prices were down 13.9% y/y in January.

- Tomorrow’s local docket is non-existent, which will leave reaction to the U.S. CPI print at the fore.

GOLD: Bullion Higher As USD Eases, Watch US CPI Later

Gold prices have been trending higher today and are up 0.3% to $1858.15/oz as the USD DXY is 0.2% lower. Bullion fell 0.65% on Monday despite dollar weakness but analysts expect a rise in the monthly change of headline US inflation in January published later today which may have weighed on the precious metal.

- Gold is currently trading close to its intraday high of $1858.58 and also its 50-day simple moving average. The low earlier was $1853.49. Near-term key support lies at $1855.5, the January 5 low. Given the USD is expected to weaken over the year, bullion should see upward pressure.

- Later US CPI data for January print and the annual rates are expected to ease further but headline could see a pick up in the monthly change to 0.5% m/m from 0.1% the previous month.

OIL: Crude Down But Fundamentals Remain Supportive

Oil prices have been trading in a narrow range during APAC trading but are down on the NY close. Brent is down 0.7% to around $86/bbl close and WTI is down 1.1% to $79.25, both are close to their intraday highs. The USD DXY is down 0.2%.

- Brent is trading above both the 50- and 100-day simple moving averages. The bull trigger is at $89 while support is $83.05, the February 9 low. WTI faces support at $76.52, the February 9 low, and initial resistance of $80.33, the February 10 low.

- Oil had rallied on news of Russia cutting output in response to sanctions but has now dropped again after the US DOE announced that it would sell 26mn barrels from its strategic petroleum reserve to offset the Russian cut. But going forward the market should be supported by improving Chinese demand, improved outlook for OECD growth and the cut to Russian output.

- Later US CPI data for January print and the annual rates are expected to ease further but headline could see a pick up in the monthly change to 0.5% m/m from 0.1% the previous month. The API also releases weekly inventory data and OPEC publishes its monthly market overview.

FOREX: Yen Firms, NZD Pressured In Asia

Yen is the strongest performer in the G-10 space at the margins, firming after Ueda was confirmed as the government's nomination for BOJ Governor.

- USD/JPY sits ~0.4% softer, extending a touch in recent trade, last printing at ¥131.80/90. In early trading the Yen had seen some moderate pressure as Q4 GDP printed below expectations. Final print of Industrial Production rose in Dec, the MoM measure was up 0.3% from -0.1% prior, however, in YoY terms it fell 2.4%.

- NZD is the weakest performer in G-10, NZD/USD is down ~0.2%. Kiwi was pressured as 2-year inflation expectations moderated from cycle highs to 3.3%. NZD/USD found support below its 50-day EMA and last prints at $0.6345/50.

- AUD/USD is marginally firmer, up ~0.1%. The pair was pressured in early trade before finding support at $0.6950, paring losses to last print at $0.6970/75.

- EUR and GBP are both up ~0.1%.

- Cross asset flows are mixed. E-minis are down ~0.1%, and DDXY is also down ~0.1%. 10 Year US Treasury Yields sit ~1bps lower.

- U.S. Jan CPI provides today's highlight, prior to that UK Labour Market Survey and Eurozone GDP are on the wires. There is also a slew of Fed speakers and the ECB's de Guindos will also cross.

FX OPTIONS: Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E608mln), $1.1480(E1.1bln)

- USD/JPY: Y116.00($533mln)

- AUD/USD: $0.6900(A$1.0bln), $0.7100-10(A$1.6bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/02/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2023 | 1000/1100 | * |  | EU | Employment |

| 14/02/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/02/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/02/2023 | 1330/0830 | *** |  | US | CPI |

| 14/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/02/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 14/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/02/2023 | 1800/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/02/2023 | 1905/1405 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.