-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Hunt Quick To Enact Further Fiscal U-turns

EXECUTIVE SUMMARY

- FED’S BULLARD LEAVES OPEN POSSIBILITY OF LARGER DECEMBER HIKE (BBG)

- JEREMY HUNT DELAYS 1P INCOME TAX CUT, LEAVING TRUSS MANIFESTO IN TATTERS (TIMES)

- CHANCELLOR WARNS OF TAX RISES AND SQUEEZE ON SPENDING (BBC)

- INTEREST RATE RISE WILL BE HIGHER THAN EXPECTED NEXT MONTH, BANK OF ENGLAND CHIEF SUGGESTS (SKY)

- TORIES HOLD SECRET TALKS ON CROWNING NEW LEADER (TIMES)

- ECB IS DELIBERATELY VAGUE ON TARGET FOR INTEREST RATE, LANE SAYS (BBG)

- XI’S OPENING CPC CONGRESS ADDRESS PROVIDES NO CURVEBALLS IN MAJOR POLICY AREAS

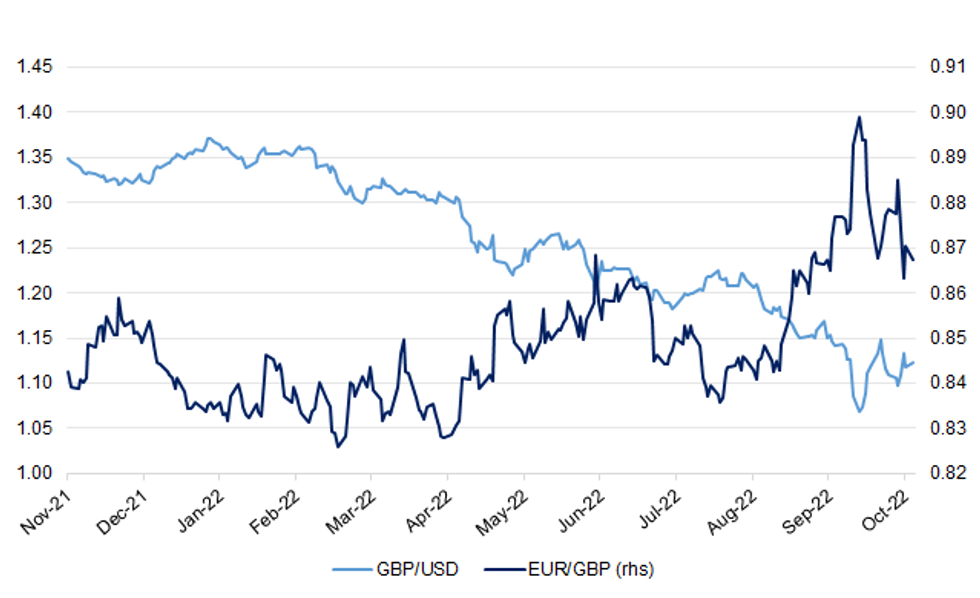

Fig. 1: GBP/USD Vs. EUR/GBP

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Interest rates will have to be raised higher than initially hoped in the face of inflationary pressures, the Bank of England (BoE) governor has suggested. (Sky)

FISCAL: Difficult decisions will be needed "across the board" on tax and spending, the new chancellor has said. Jeremy Hunt told the BBC that some taxes will go up, while government spending may need to fall. (BBC)

FISCAL: Liz Truss is preparing to sign off Jeremy Hunt’s plans to defer a 1p cut in income tax until 2024. The prime minister met her new chancellor yesterday for an hour and a half at Chequers, her countryside retreat, to discuss their new plans to stabilise the nation’s finances. They were joined by their advisers and families for lunch afterwards. (The Times)

POLITICS: Jamie Wallis became the third Conservative MP to break ranks by calling for Liz Truss to quit Downing Street on Sunday night. (Telegraph)

POLITICS: Rebel Tory MPs are reportedly sending letters of no confidence in Liz Truss to the 1922 Committee in a bid to get rid of her as prime minister. The number of letters already sent in is said to be “substantial”, according to Sky News. (Independent)

POLITICS: Senior Conservatives will this week hold talks on a “rescue mission” that would see the swift removal of Liz Truss as leader, after the new chancellor Jeremy Hunt dramatically tore up her economic package and signalled a new era of austerity. (Observer)

POLITICS: Liz Truss will appeal to moderate Tory MPs to save her premiership tonight after it emerged that powerbrokers had held secret discussions about ousting her and arranging a “coronation”. (The Times)

POLITICS: He was a surprise absentee from the leadership race in July, but the defence secretary, Ben Wallace, is now being touted as a replacement for Liz Truss. (Guardian)

POLITICS: Senior Conservative MPs have warned that voters could desert the party “in droves” if Liz Truss drops her plans for post-Brexit reforms. (Telegraph)

POLITICS: Around 10 cabinet ministers including Jacob Rees-Mogg, Thérèse Coffey, Jeremy Hunt and Simon Clarke would lose their seats in a general election, according to a poll for the Trades Union Congress (TUC), which also shows voters are opposed to the removal of workers’ rights. (Guardian)

ECONOMY: Analysts at Goldman Sachs Group Inc. have downgraded their growth outlook for the UK, according to a report released Sunday, after Prime Minister Liz Truss removed Kwasi Kwarteng as chancellor and rowed back on canceling an increase in corporation tax. (BBG)

PROPERTY: More than 5 million British families face an increase of £1,200 ($1,340) in their annual mortgage payments as a direct result of the market turmoil unleashed by Prime Minister Liz Truss and her former Chancellor of the Exchequer Kwasi Kwarteng. That’s according to the Resolution Foundation, which said mortgage costs are set to surge by £5,100 on average between now and the end of 2024. A quarter of that is due to the tax-cutting mini budget announced last month. (BBG)

ENERGY: Ministers are in talks with major US-based producers of liquefied natural gas (LNG) in a bid to bolster Britain's energy security. (Sky)

EUROPE

ECB: The European Central Bank is being purposefully vague on how far interest rates will have to rise to ensure inflation returns to the 2% goal, according to Chief Economist Philip Lane. (BBG)

ECB: The European Central Bank must press ahead with raising interest rates and reducing its balance sheet to ensure inflation expectations don’t unanchor and demand a more aggressive policy response, according to Governing Council member Joachim Nagel. (BBG)

ECB: Europe's energy subsidies may reduce the current rate of inflation but only at the expense of future higher readings, potentially complicating the task of monetary policy, European Central Bank (ECB) policymaker Francois Villeroy de Galhau said on Saturday. (RTRS)

ECB: The European Central Bank should consider starting to shrink its oversized stock of assets once interest rates rise to a level that neither stimulates nor slows economic growth, Dutch Central Bank chief Klaas Knot said on Saturday. (RTRS)

ECB: The European Central Bank is likely to begin the process of shrinking its balance sheet next year, once it’s raised borrowing costs to a point that they no longer stimulate the economy, according to Governing Council member Olli Rehn. (BBG)

ECB: Governments’ efforts to ease the energy crisis risk forcing the European Central Bank to raise interest rates more aggressively as it battles record inflation, according to Governing Council member Pierre Wunsch. (BBG)

ECB: European Central Bank Governing Council member Martins Kazaks said interest rates should be raised beyond year-end -- a time when economists increasingly expect the euro zone to be in the midst of a recession. (BBG)

ECONOMY: The euro-area economy is expected to shrink next year as it battles surging energy costs and the risk of shortages following Russia’s invasion of Ukraine. (BBG)

EU/FISCAL: Brussels is ready to freeze payments of regional aid to Poland because of threats to judicial independence, as the stand-off over rule of law violations hangs over funding lines worth tens of billions of euros to Warsaw. (FTT)

FRANCE: French Prime Minister Elisabeth Borne called on striking refinery workers to return to work as fuel shortages worsened and left-wing politicians led a protest march against increased cost-of-living expenses. (BBG)

NETHERLANDS: The Dutch government on Friday said it will spend up to 3.1 billion euros ($3.02 billion) to support small businesses such as bakeries and greenhouses that have been hit hard by surging energy prices. (RTRS)

RATINGS: Czech Republic Affirmed At S&P On Friday

Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed {CZ} the Czech Republic at AA-; Outlook Stable

BANKS: Credit Suisse is preparing to sell parts of its Swiss domestic bank as it attempts to close a capital hole of around SFr4.5bn, according to people briefed on the discussions. (FT)

U.S.

FED: A "hotter-than-expected" September inflation report doesn't necessarily mean the Federal Reserve needs to raise interest rates higher than officials projected at their most recent policy meeting, St. Louis Fed President James Bullard said on Friday, though it does warrant continued "frontloading" through larger hikes of three-quarters of a percentage point. (RTRS)

FED: Federal Reserve Bank of St. Louis President James Bullard left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings in November and December, while saying it was too soon to make that call. (BBG)

FED: The Federal Reserve is looking into trades that Raphael Bostic, the head of the central bank’s Atlanta district, made during restricted periods. (CNBC)

ECONOMY: The U.S. will enter a recession in the coming 12 months as the Federal Reserve battles to bring down persistently high inflation, the economy contracts and employers cut jobs in response, according to The Wall Street Journal’s latest survey of economists. (WSJ)

ECONOMY/DOLLAR: President Joe Biden dismissed the risks of a strong US dollar and instead blamed anemic growth and policy missteps in other parts of the world for dragging down the global economy. “I’m not concerned about the strength of the dollar, I’m concerned about the rest of the world,” Biden told reporters on Saturday during a campaign stop in Portland, Oregon. “Our economy is strong as hell.” (BBG)

ECONOMY: Treasury Secretary Janet Yellen told an international audience in Washington that fighting inflation was the Biden administration’s top priority, a message that won’t comfort countries feeling the pain from a strong dollar. (BBG)

ECONOMY: The Federal Reserve’s interest-rate hikes to bring inflation under control are starting to work, while President Joe Biden is doing everything possible to support the US central bank, two administration economic advisers said. (BBG)

TSYS: The U.S. Treasury Department is asking primary dealers of U.S. Treasuries whether the government should buy back some U.S. government bonds to improve liquidity in the $24 trillion market. (RTRS)

BANKS: The U.S. Federal Reserve announced on Friday it was soliciting feedback on potentially imposing new requirements on how to resolve large regional banks should they falter, including requiring firms to hold more long-term debt. (RTRS)

OTHER

GLOBAL TRADE: The EU must toughen up its attitude towards China and see the country as an all-out competitor with limited areas of potential engagement, the bloc’s ministers have been advised ahead of talks on recalibrating Brussels’ strategy towards Beijing. (FT)

G20: Finance chiefs of the world’s biggest economies clashed in Washington over a variety of issues, including Russia’s invasion of Ukraine, complicating efforts to coordinate policies to cope with rising risks to global growth. (BBG)

U.S./CHINA: Chinese President Xi Jinping pledged his nation will prevail in its fight to develop strategically important tech, underscoring Beijing’s concern over a US campaign to separate it from cutting-edge chip capabilities. (BBG)

U.S./CHINA: Chinese government officials are stonewalling U.S. efforts to solidify a long-planned face-to-face meeting between President Joe Biden and Chinese President Xi Jinping on the sidelines of the G-20 meeting in Bali next month. (POLITICO)

TAIWAN: China will never renounce the right to use force over Taiwan, President Xi Jinping has declared at the opening of a major party meeting. (Sky)

TAIWAN: Taiwan will not back down on its sovereignty or compromise on freedom and democracy, and its people clearly oppose Beijing's idea of "one country, two systems" management for Taiwan, the self-ruled island's presidential office said on Sunday. (RTRS)

HONG KONG: China has achieved comprehensive control over Hong Kong, turning it from chaos to governance, Chinese President Xi Jinping said in a speech on Sunday at the opening of the once-in-five-year Communist Party congress in Beijing. (RTRS)

GEOPOLITICS: Western countries this week ratcheted up their criticism of China, the world's largest bilateral creditor, as the main obstacle to moving ahead with debt restructuring agreements for the growing number of countries unable to service their debts. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday that Japan’s core consumer price index will fall below a 2% year-on-year pace in fiscal 2023 and it’s appropriate for the bank to maintain easy policy to achieve its price stability target accompanied by wage hikes. (MNI)

BOJ: The yen's recent fluctuations were "clearly too rapid and too one-sided," Bank of Japan Deputy Gov. Masazumi Wakatabe said on Saturday, signaling caution over the potential economic damage from the currency's slump to 32-year lows against the dollar. (RTRS)

BOJ: The BOJ should continue its easy monetary policy stance to ensure the 2% inflation target can be achieved durably, but the Japanese government's intervention in the foreign exchange market is not likely to have a lasting effect in supporting the yen's level on currency markets, Sanjaya Panth, deputy director of the International Monetary Fund's Asia-Pacific Department, told Nikkei in an interview. (Nikkei)

BOJ: Japanese Prime Minister Fumio Kishida said on Monday he would pick the most appropriate person to take up the governorship of the central bank next April, suggesting the decision could wait until just before the current governor's term ends on April 8. (RTRS)

JAPAN: Japan's top currency diplomat Masato Kanda on Friday said authorities are ready to take decisive action in the currency market if excessive moves in the yen continue. (RTRS)

JAPAN: There are no changes to Japan's position that it will act resolutely in case of volatility in the currency market, the Kyodo news agency quoted Japan's Finance Minister Shunichi Suzuki as saying on Saturday. (RTRS)

JAPAN: Increasing Japan's corporate tax rate is an option to fund a defense budget that could double in the next few years, Yoichi Miyazawa, head of tax policy in the ruling Liberal Democratic Party, told Nikkei. (Nikkei)

AUSTRALIA: Increasingly dire forecasts for the global economy will see last-minute downgrades to Australia’s economic figures in next week’s federal budget, with the treasurer, Jim Chalmers, warning of “an increasingly perilous path” for world markets and key trading partners. (Guardian)

AUSTRALIA: Prime Minister Anthony Albanese has revealed $9.6 billion of infrastructure spending across Australia, with Victoria’s Labor government set to be the greatest beneficiary. (Sky)

BOK: South Korea's central bank governor said on Saturday that external factors, such as aggressive U.S. policy tightening buoying the dollar and driving the won currency sharply down, made providing forward guidance on policy difficult. (RTRS)

BOK: Bank of Korea Governor Rhee Chang-yong told reporters in Washington that there’s a board member who believes the central bank’s terminal rate should be higher than 3.5%, Edaily reports. (BBG)

BOK: Economists surveyed by Bloomberg see the Bank of Korea reaching the end of its hiking cycle early next year, a view that largely tallies with a central bank projection that the terminal interest rate may rise to around 3.5%. (BBG)

SOUTH KOREA: South Korea's finance minister said the government will scrap taxes on foreigners' income from investments in treasury bonds and monetary stabilization bonds from Monday. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem on Friday hammered home the message interest rates must keep rising to bring inflation back to target, saying there's still a narrow path to slowing down an overheated economy without a hard landing. (MNI)

BRAZIL: Brazil’s Luiz Inacio Lula da Silva and incumbent Jair Bolsonaro exchanged insults and corruption allegations during a tense televised debate as they sought to sway voters ahead of a runoff election on Oct. 30. (BBG)

BRAZIL: Brazil’s three consecutive months of falling consumer price indexes aren’t reason to celebrate yet, said central bank chief Roberto Campos Neto. (BBG)

RUSSIA: Russia should be finished calling up reservists in two weeks, President Vladimir Putin said on Friday, promising an end to a divisive mobilization that has seen hundreds of thousands of men summoned to fight in Ukraine and huge numbers flee the country. (RTRS)

RUSSIA: China is urging its citizens to evacuate from war-torn Ukraine. Beijing's Ministry of Foreign Affairs and the Chinese Embassy in Ukraine announced on Saturday that all Chinese citizens should evacuate the country, according to the Global Times, a Chinese state news agency. The embassy said it would assist its citizens in this capacity. (Washington Examiner)

RUSSIA: Chrystia Freeland is calling for Russia to be kicked out of the Group of 20 countries and the International Monetary Fund over its invasion of Ukraine, saying the war is to blame for current turbulence in the global economy. (RTRS)

SOUTH AFRICA: South Africa’s energy utility company says it will limit power cuts to the evenings as it seeks to manage emergency generation reserves to bolster capacity. (BBG)

SOUTH AFRICA: Workers from South Africa’s Transport and Allied Workers Union have rejected a compromise pay deal aimed at ending a days-long dispute that threatens to curb the nation’s exports, Johannesburg-based News24 reported. (BBG)

SAUDI ARABIA: President Joe Biden’s options for re-evaluating US-Saudi relations include “changes to our approach to security assistance to Saudi Arabia,” White House National Security Adviser Jake Sullivan said. (BBG)

OIL: Saudi King Salman said on Sunday the kingdom was working hard to support stability and balance in oil markets, including by establishing and maintaining the agreement of the OPEC+ alliance. (RTRS)

ENERGY: The European Union’s executive arm plans to propose a mechanism to curb price volatility on the bloc’s biggest gas marketplace and prevent extreme price spikes in derivatives trading to rein in the region’s energy crisis. (BBG)

ENERGY: The European Union’s planned package to curb surging natural-gas prices must avert an increase in the use of the fuel amid an unprecedented supply crunch, EU energy chief Kadri Simson said. (BBG)

ENERGY: Measures by European Union countries to shield households and companies from the energy price surge should be temporary and targeted but, crucially, encourage lower consumption by not distorting price signals, the International Monetary Fund said on Friday. (RTRS)

ENERGY: Sweden has rejected plans to set up a formal joint investigation team with Denmark and Germany to look into the recent ruptures of the Nord Stream 1 and 2 pipelines, a Swedish prosecutor investigating the leaks, said. (RTRS)

OIL: OPEC Secretary General Haitham al-Ghais said on Sunday that the group, alongside other producers that form the OPEC+ alliance, took purely technical decisions and that oil output cuts were a pre-emptive measure. (RTRS)

OIL: OPEC Secretary General Haitham Al Ghais said on Sunday that "oil markets are going through a stage of great fluctuations" during his two-day visit to Algiers. (RTRS)

OIL: Saudi King Salman said on Sunday the kingdom was working hard to support stability and balance in oil markets, including by establishing and maintaining the agreement of the OPEC+ alliance. (RTRS)

OIL: Polish pipeline operator PERN said on Saturday that the pumping of crude oil in the damaged Druzhba pipeline has been restored. (RTRS)

OIL: Gazprom CEO Alexei Miller on Sunday said plans to cap the price of Russian gas exports would cause supplies to be halted, echoing a similar threat from President Vladimir Putin. (RTRS)

FOREX: U.S. Treasury Secretary Janet Yellen said that she does not see another allocation of International Monetary Fund Special Drawing Rights reserves to member countries as appropriate at this time, when more existing reserves need to be channeled to poorer countries. (RTRS)

CHINA

CORONAVIRUS: China's President Xi Jinping signalled there would be no immediate loosening of his controversial zero-Covid strategy as a historic Communist Party congress opened in Beijing. (BBC)

ECONOMY: China will unwaveringly support the private economy and let the market play decisive role in resource allocation, President Xi Jinping said in a speech on Sunday at the opening of the once-in-five-year Communist Party Congress in Beijing. (RTRS)

ECONOMY: China will focus on smoothing the domestic cycle of supply and demand to boost economic growth, wrote Zhang Wenkui, researcher at the Development Research Center of the State Council in a commentary published by Caixin after President Xi Jinping's speech at the 20th CPC National Congress on Sunday. (MNI)

ECONOMY: The Chinese economy has posted a notable trend of recovery in the third quarter of this year, an official said Monday. (China Daily)

BANKS/ECONOMY: Six major state-owned banks all issued statements late Sunday pledging their support for the economy after President Xi Jinping’s speech at the 20th CPC National Congress, National Business Daily reported. (MNI)

YUAN: China's major state-owned banks were spotted swapping yuan for U.S. dollars in the forwards market and selling those dollars in the spot market on Monday morning, six banking sources said. (RTRS)

EQUITIES: The China Securities Regulatory Commission is working on a system to allow foreign investors to trade their positions within six months to facilitate investment in A shares, 21st Century Business Herald reported citing sources from regulatory departments. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY19 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos and CNY500 billion 1-year medium-term lending facilities with the rate unchanged at 2.00% and 2.75%, respectively, on Monday. The operation has led to a net drain of CNY19 billion after offsetting the maturity of CNY21 billion repos and CNY500 MLFs today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:25 am local time from the close of 1.4751% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 49 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1095 MON VS 7.1088 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1095 on Monday, compared with 7.1088 set on Friday.

OVERNIGHT DATA

JAPAN AUG, F INDUSTRIAL PRODUCTION +3.4% M/M; PRELIM +2.7%

JAPAN AUG, F INDUSTRIAL PRODUCTION +5.8% Y/Y; PRELIM +5.1%

JAPAN AUG CAPACITY UTILISATION +1.2% M/M; JUL +2.4%

JAPAN AUG TERTIARY INDUSTRY INDEX +0.7% M/M; MEDIAN +0.3%; JUL -0.6%

NEW ZEALAND SEP BNZ-BUSINESSNZ PERFORMANCE SERVICES INDEX 55.8; AUG 58.6

Expansion levels for New Zealand's services sector eased off in September, according to the BNZ - BusinessNZ Performance of Services Index (PSI). (BNZ)

UK OCT RIGHTMOVE HOUSE PRICE INDEX +0.9% M/M; SEP +0.7%

UK OCT RIGHTMOVE HOUSE PRICE INDEX +7.8% Y/Y; SEP +8.7%

MARKETS

SNAPSHOT: Hunt Quick To Enact Further Fiscal U-turns

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 342.53 points at 26748.23

- ASX 200 down 94.43 points at 6664.4

- Shanghai Comp. up 0.652 points at 3072.639

- JGB 10-Yr future down 13 ticks at 148.20, down 0bp at 0.251%

- Aussie 10-Yr future down 1.5 ticks at 95.955, yield up 1.7bp at 4.025%

- U.S. 10-Yr future up 0-05+ at 110-24+, yield down 2.86bp at 3.9898%

- WTI crude up $0.73 at $86.34, Gold up $7.02 at $1651.49

- USD/JPY up 7 pips at Y148.74

- FED’S BULLARD LEAVES OPEN POSSIBILITY OF LARGER DECEMBER HIKE (BBG)

- JEREMY HUNT DELAYS 1P INCOME TAX CUT, LEAVING TRUSS MANIFESTO IN TATTERS (TIMES)

- CHANCELLOR WARNS OF TAX RISES AND SQUEEZE ON SPENDING (BBC)

- INTEREST RATE RISE WILL BE HIGHER THAN EXPECTED NEXT MONTH, BANK OF ENGLAND CHIEF SUGGESTS (SKY)

- TORIES HOLD SECRET TALKS ON CROWNING NEW LEADER (TIMES)

- ECB IS DELIBERATELY VAGUE ON TARGET FOR INTEREST RATE, LANE SAYS (BBG)

- XI’S OPENING CPC CONGRESS ADDRESS PROVIDES NO CURVEBALLS IN MAJOR POLICY AREAS

US TSYS: A Touch Firmer On UK Fiscal Hopes

Tsys are a touch richer on the back of the weekend rhetoric from the new UK C’llr & UK press reports pointing to a more viable/responsible fiscal approach after the “mini” Budget disaster, with the major cash benchmarks printing 2.0-3.5bp firmer, as 5s lead the bid.

- Still, a block sale in TY futures has helped cap the space, while a lack of meaningful headline flow since the re-open has limited wider activity after the initial richening impulse.

- TYZ2 last prints +0-05 at 110-24, 0-01+ off the peak of its 0-07+ Asia range, with volume limited to ~57K lots.

- Outside of the UK news, the weekend saw St. Louis Fed President Bullard fail to rule out the idea of back-to-back 75bp hikes across the two remaining Fed meetings of ’22, although he flagged that ’23 could be a more data-dependent year for the central bank, maybe entailing more two-way risk to rates vs. what we have seen in ’22.

- Chinese President Xi’s opening round of remarks at the CPC congress provided nothing in the way of curveballs re: the major policy areas.

- A thin NY docket, with the Empire m’fing survey headlining, will leave headline flow front and centre as we move through the day, with UK Gilt market gyrations likely to set the tone in European hours (once again).

JGBS: Bear Steepening Extends Through Afternoon Post-Rinban

JGB futures held lower on Monday, looking through a modest uptick in U.S. Tsys linked to UK fiscal matters., last -14, respecting the base of their overnight session range thus far.

- Cash JGBs run flat to 6bp cheaper across the curve, bear steepening. 10s are limited by their proximity to the upper end of the range permitted by the BoJ’s YCC settings and 7s sold off more than surrounding lines on the weakness in futures.

- A steady to slightly higher round of cover ratios in today’s BoJ Rinban operations has added the steepening, particularly given the recent upsizing of the super-long end purchases from the Bank (i.e. more super-long sellers were seen this time out in nominal terms).

- The idea of higher business tax rates was flagged by the ruling LDP Party tax chief over the weekend, but that did little to support the space.

- BoJ Governor Kuroda reiterated his previous musings re: the need for continued monetary easing, while Finance Minister Suzuki and top FX diplomate Kanda reiterated their own recent rhetoric re: FX matters.

- Japanese PM Kishida once again pointed to the need for continued government-BoJ cooperation, which will factor into his choice for Kuroda’s successor.

- 20-Year JGB supply headlines domestic matters on Tuesday.

AUSSIE BONDS: Rebounding From Lows

Aussie bond futures initially showed through their overnight session lows shortly after the Sydney re-open, as the impulse from Friday’s Gilt-driven cheapening, alongside an expected uptick in food price inflation owing to notable floods in food producing areas of Australia and PM Albanese outlining a A$9.6bn round of infrastructure spending, generated fresh pressure.

- That was before some hope surrounding a firmer fiscal footing in the UK provided a bit of a bid for the space, leaving the major cash ACGB benchmarks flat to 2bp cheaper across the curve ahead of the bell, as the 10- to 12-Year zone leads the weakness, while YM is unch. and XM is -2.0.

- A word of caution from Treasurer Chalmers re: the broader economic situation probably aided the rebound at the margin.

- Swaps have lagged the move in bonds, with the early narrowing of EFPs reverting to widening, led by 10s, as the 3-/10-Year EFP box steepens.

- Bills run 1-3bp cheaper across the curve, with RBA dated OIS pointing to a terminal rate of ~4.05%, little changed on the day.

- Tomorrow’s domestic docket is headlined by the minutes covering the latest RBA decision and an appearance RBA Deputy Governor Bullock, with her address on in front of the AFIA annual conference to be on the topic of “Policymaking at the Reserve Bank.”

NZGBS: Swap Spread Payside Activity Seemingly Aids NZGBs Cheapening

NZGBS cheapened on Monday, with the major benchmarks seeing yields move 4-5bp higher.

- This came after Friday’s weakness in UK Gilts & U.S. Tsys, with a relief bounce in the latter on the back of weekend news flow out of the UK which triggered hope re: the adoption of a more realistic fiscal footing in London doing little for NZGBs.

- Payside swap flows probably helped this dynamic, with swap spreads wider on the day, as outright 2-Year swaps registered fresh cycle highs above the 5.00% mark.

- Q3 CPI data headlines Tuesday’s docket, with moderations in headline readings expected (BBG median points to +6.6% Y/Y & +1.5% Q/Q vs. respective priors of +7.3% & +1.7%), although non-tradable inflation is expected to accelerate (BBG median of +1.8% Q/Q vs. the +1.4% seen in Q3). Such a dynamic would justify continued tightening from the RBNZ with domestic inflationary pressures remaining evident, while headline inflation is set to remain comfortably above the RBNZ’s 1-3% target band.

- RBNZ dated OIS shows terminal OCR pricing just above 5.00%.

- Non-resident bond holding data for Sep is also due.

- Elsewhere, any trans-Tasman impulse from the minutes covering the most recent RBA monetary policy decision and an address from RBA Deputy Governor Bullock will be eyed.

EQUITIES: Asia Pac Follows Wall St Lower, Kospi Outperforms

Most Asia Pac markets are following the negative lead from US markets on Friday night and are weaker for Monday’s. Losses aren't large, at least by recent standards, with higher US futures helping at the margin. Of the major indices, the Kospi is the main outperformer, around flat for the session.

- US futures are higher across the 3 main indices. Eminis back above 3600, close to +0.50% for the session. Some positive spill-over from UK fiscal developments has aided sentiment at the margin today. US yields are lower as well (2yr back to 4.46%, -3bp for the session).

- China and HK equities have lost ground. Xi's speech from the party congress over the weekend didn't give any major indications of a turnaround in policies related to Covid, housing etc. The HSI is down 1.2% at this stage, with tech off by 3%. In China, the CSI 300 is down -0.44%. Note Q3 GDP and September monthly activity figures are due tomorrow.

- The Nikkei 225 is off by over 1.20%, the Taiwan Taiex by 1.5%, in line tech weakness in US markets on Friday. The Kospi has outperformed, flat for the session and back above 2200. We were sub 2180 in early trading. Foreign buying has reportedly returned for tech names like Samsung.

- The ASX 200 is off by 1.40%, dragged lower by mining names for the most part. Lower commodity prices will be weighing.

OIL: Futures Suggest That Oil Market May Be Easing

Oil prices are higher on the day, as the USD weakened. WTI is up about 0.7% to $86.17 and Brent 0.8% to $92.35 while DXY is down 0.2%.

- The upside to oil prices has been limited after Chinese President Xi Jinping signalled no change in the country’s Zero-Covid Policy, which is weighing on growth.

- Brent’s prompt spread was in backwardation today and is signalling a tentative easing in the oil market.

- The market is still very nervous regarding global growth prospects and the subsequent impact on energy demand. Last week’s IEA warning that OPEC+ production cuts could push the world economy into recession has added to fears.

- WTI is still below its 50-day moving average but hasn’t broken the 20-day MA yet on the downside or the 5-day on the upside.

GOLD: Stabilizes On USD Weakness

Gold is around 0.35% higher so far today, putting the precious metal back close to $1650. We closed last week just under $1645, dropping nearly 3% for the week.

- In terms of levels, late last week we saw a low close to $1640, beyond that is just under $1620 from September 28th, a cyclical low. On the topside, rallies last week rain out of momentum above $1680.

- Broader risks still appear skewed to the downside for gold, as it continues to be closely aligned with USD sentiment. Today's rebound has coincided with the DXY down by around -0.25%, with the index sitting back close to the 113.00 level.

- Gold ETF holdings continue to track lower, now back to April 2020 levels. Holdings are down around 10% from their April peak of this year.

FOREX: Potential For More Prudent Fiscal Policy Supports GBP, Risk-On Flows Take Hold

The GBP appreciated at the start to the week after PM Truss sacked Chancellor Kwarteng and appointed Jeremy Hunt to succeed him. The new Chancellor flagged potential for further U-turns on the fiscal plans that had roiled UK financial markets. BoE Gov Bailey spoke with Hunt over the weekend, noting that there was a "meeting of minds" on the importance of sustainable fiscal policy.

- Cable added ~50 pips before stabilising, while EUR/GBP is down ~270 pips as we type. GBP/USD implied volatilities edged higher, with one-month tenor last at 18.8%.

- UK news helped support broader risk appetite, with safe-haven currencies trading on the back foot. The greenback paced losses, with a slip in the BBDXY index facilitated by lower U.S. Tsy yields.

- Participants were on the lookout for signs of Japanese officials intervening in FX markets as FinMin Suzuki & top FX diplomat Kanda reiterated that they stand ready to step in. It had earlier been flagged that the option of a stealth intervention remains on the table.

- Spot USD/JPY oscillated near neutral levels after printing 32-year highs last Friday. It last sits at Y148.71 and the psychologically significant Y145.00 figure is firmly in sight, with BoJ Gov Kuroda adamant to keep powerful monetary easing in place.

- As spot USD/CNY was testing the CNY7.2 threshold, RTRS reported that major Chinese state-owned banks were swapping yuan for dollars in forwards market and selling USD in spot market to stabilise the redback.

- U.S. Empire State Manufacturing Survey headlines the global data docket today. ECB members dominate the central bank speaker slate, with Lane, de Guindos, de Cos and Nagel set to take the floor.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/10/2022 | 0800/1000 |  | EU | ECB de Guindos Speaks on Euro Anniversary | |

| 17/10/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/10/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/10/2022 | 1500/1700 |  | EU | ECB Lane at Bocconi Uni & Deutsche Bank Roundtable | |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/10/2022 | 2000/1600 |  | CA | BOC Deputy Rogers panel talk at Toronto Centre |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.