-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Kwarteng Returns To London Early With The BoE Set To Cease Gilt Purchases

EXECUTIVE SUMMARY

- KWARTENG TO RETURN TO LONDON FROM WASHINGTON EARLY AS MAJOR MINI-BUDGET U-TURN EXPECTED (SKY)

- ECB STAFF SEES LOWER RATE PEAK THAN MARKET (RTRS SOURCES)

- ECB’S HAWKS TARGET EARLY 2023 TO START UNWINDING BALANCE SHEET (BBG SOURCES)

- ECB MAY START BALANCE SHEET RUNDOWN IN SECOND QUARTER, SOURCES SAY (RTRS SOURCES)

- FISCAL EXPANSION RISKS FORCING ECB INTO MORE RATE HIKES, KAZAKS SAYS (RTRS)

- JAPAN KEEPS UP YEN WARNINGS, DECLINES TO SAY IF INTERVENED (BBG)

- CHINESE YUAN WON’T DEPRECIATE IN MID-TO-LONG TERM (SEC. NEWS)

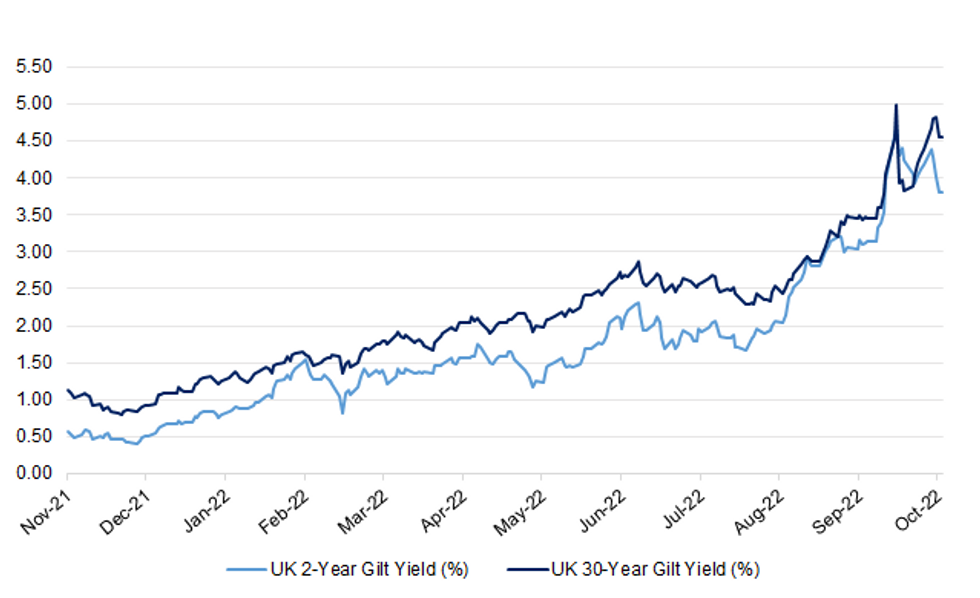

Fig. 1: UK 2- & 30-Year Gilt Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Kwasi Kwarteng will return to the UK from Washington earlier than planned, as another major mini-budget U-turn is expected. The chancellor was due to brief journalists on Friday morning after attending the International Monetary Fund's annual meeting in Washington, but held the briefing on Thursday night before announcing he will fly home in the next few hours. A source close to him dismissed suggestions that this represented a sign of panic and insisted that the chancellor's focus was the medium term fiscal plan. (Sky)

FISCAL: Kwasi Kwarteng said “let’s see” when asked about an imminent U-turn on his flagship cut to corporation tax, after weeks of turmoil on the markets. (Telegraph)

FISCAL: Kwasi Kwarteng has insisted he is “not going anywhere” as Number 10 prepared to reverse a tax cut at the heart of his mini-Budget. (Telegraph)

FISCAL: Liz Truss and Kwasi Kwarteng may be bounced into a U-turn on corporation tax by "market forces", Priti Patel suggested this evening. (Telegraph)

POLITICS: Senior Conservatives are holding talks about replacing Liz Truss with a joint ticket of Rishi Sunak and Penny Mordaunt as part of a “coronation” by MPs. Truss and Kwasi Kwarteng, the chancellor, are expected within days to make a humiliating climbdown over corporation tax in an effort to calm the markets and see off a mounting revolt. However, the uncertainty has fuelled fears that Truss will not be able to salvage her premiership, especially in the wake of an acrimonious meeting with the 1922 Committee of backbenchers. (The Times)

POLITICS: Mutinous Conservative MPs have given Liz Truss 17 days to save her job. Tory whips warned she could face a leadership challenge if Kwasi Kwarteng’s economic statement on October 31 fails to end the turbulence in the financial markets. (Daily Mail)

POLITICS: Almost half of Conservative supporters believe that their party chose the wrong leader this summer. (The Times)

PENSIONS/FUNDS: A Bank of England fix to ease pension schemes' cash crunch by getting banks to assume the role of rescue lender is being shunned by some of the biggest banks, who say the returns on offer do not reward the risks involved, sources said. (RTRS)

GILTS/MMFS: Intensifying or persistent gilt market volatility could lead to “sudden large redemptions” of cash from sterling money market funds as liquidity pressure spreads beyond pension funds, according to Fitch Ratings. (BBG)

EUROPE

ECB: European Central Bank staff see the need for fewer rate hikes than markets now estimate to tame inflation, according to a new internal model that could serve as a key input in future deliberations, four sources close to the discussion said. (RTRS)

ECB: Hawkish European Central Bank officials aim to start unwinding the institution’s €5.1 trillion ($4.9 trillion) asset hoard by early 2023 while retaining interest rates as their primary monetary-policy tool, according to people familiar with the matter. (BBG)

ECB: European Central Bank policymakers discussed earlier this month a detailed timeline for running down a 3.3 billion euro bond portfolio and envisioned the start of quantitative tightening sometime in the second quarter of 2023, sources told Reuters. The ECB could already tweak its language on reinvestments at its October meeting and then could provide a detailed plan possibly in December but more likely in February, according to three sources who spoke on condition of anonymity. (RTRS)

ECB: The European Central Bank should keep raising interest rates quickly, and expansive fiscal policy around the 19-country euro zone is raising the risk the bank will have to tighten more, Latvian central bank chief Martins Kazaks said on Thursday. (RTRS)

GERMANY: Germany's natural gas storage facilities passed the 95% target for November three weeks ahead of schedule on Thursday, according to data released by the Aggregated Gas Storage Inventory (AGSI), a European energy data platform. (RTRS)

FRANCE: French energy major TotalEnergies on Thursday started talks with trade unions to break a deadlock over a third week of strikes in refineries and fuel depots which have sapped the country's petrol supplies. (RTRS)

RIKSBANK: Sweden's policy rate may need to stay at a high level for longer than the current forecast made by Sweden's central bank, Deputy Governor Anna Breman said on Thursday. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on the Czech Republic (current rating: AA-; Outlook Stable)

U.S.

FED: The surprisingly strong September U.S. CPI report reflects an environment in which high inflation has become entrenched, and it will take months if not another year for tighter monetary policy and supply-side relief to change those dynamics, Atlanta Fed economist Brent Meyer told MNI Thursday. (MNI)

ECONOMY: Treasury Secretary Janet Yellen, reacting to data showing another faster-than-anticipated increase in consumer prices, said the US has “more work to do” to restrain the worst burst of inflation since the 1980s. (BBG)

ECONOMY: The U.S. labor market is cooling in a way that opens up the possibility of an economic "soft landing," a White House economic adviser said on Thursday. (RTRS)

ECONOMY/MARKETS: President Joe Biden met with members of his economic team this morning as September's worse-than-expected inflation report poses new headaches for the White House. (Washington Examiner)

POLITICS: The House select committee investigating the Jan. 6 Capitol riot unanimously voted at its public hearing Thursday to subpoena former President Donald Trump about his actions surrounding the insurrection. (CNBC)

ENERGY: U.S. President Joe Biden said on Thursday that U.S. gasoline prices remain too high and that he will have more to say about lowering the cost next week. (RTRS)

EQUITIES: Twitter has said Elon Musk is under investigation by US authorities for “his conduct in connection with the acquisition” of the social media group, according to a court filing. (FT)

OTHER

GLOBAL TRADE: U.S. Trade Representative Katherine Tai and her European counterpart, Valdis Dombrovskis, agreed to speed up talks on global steel issues, among other trade and economic topics raised at their meeting in Washington, Tai's office said on Thursday. (RTRS)

U.S./CHINA: The manager of a $184 billion public pension fund for Texas public education employees is halving its target allocation to Chinese stocks, potentially cutting billions of dollars of such holdings over months. (BBG)

G20: The Group of 20 major economies has "quite a lot of huge gaps" to bridge over geopolitical divisions, including the war in Ukraine, but remains in agreement over many financial issues, the group's chair said on Thursday. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Thursday raising interest rates now was inappropriate in light of the country's economic and price conditions. (RTRS)

JAPAN: Japan kept up its warnings over speculative currency moves following the yen’s slump to a three-decade low, as it tried to dissuade traders from testing its intervention strategy. (BBG)

JAPAN: Japan's currency intervention last month to stop a sharp slide in the yen was likely a "signaling action" to smooth volatility, though the impact of such moves tend to be short-lived, a senior International Monetary Fund official said on Thursday. (RTRS)

NEW ZEALAND: Governments need to tighten spending plans to help their central banks combat inflation, according to New Zealand Finance Minister Grant Robertson. (BBG)

NEW ZEALAND: New Zealand's Fonterra on Friday lowered its forecast for fiscal 2022/23 milk collection on poor weather conditions in parts of the country. (RTRS)

SOUTH KOREA: South Korea is not likely to face a financial crisis as it maintains solid fundamentals, the head of the International Monetary Fund (IMF) said Thursday (U.S. time), amid looming fears over the fallout of the strong U.S. dollar. (Yonhap)

SOUTH KOREA: South Korea's financial markets will likely see amplifying volatility affected by the U.S.' announcement of higher-than-anticipated inflation data in September that will strengthen the case for the Federal Reserve's sharp interest rate hikes in the coming months, Seoul's central bank said Friday. (Yonhap)

NORTH KOREA: North Korea fired a short-range ballistic missile into the sea off its east coast on Friday, South Korea's military said, the latest in a series of launches by the nuclear-armed country. (RTRS)

NORTH KOREA: South Korea has announced its own sanctions against North Korea for the first time in five years, placing 15 North Korean individuals and 16 institutions on its blacklist. (KBS)

HONG KONG: Hong Kong may report a fiscal deficit this year that’s triple the government’s original estimate, according to economists, as the city’s budget takes a beating from economic turmoil. (BBG)

SINGAPORE: Singapore's central bank on Friday tightened monetary policy for the fourth time this year to rein in inflation running near a 14-year high, and left the door open for further policy action amid upside risks to the price outlook and global uncertainty. (RTRS)

MEXICO: Most analysts understood the message from the central bank’s minutes with a consensus for a 75bp rise in November and 50bp rise in December, deputy governor Jonathan Heath said on Twitter. (BBG)

MEXICO: Mexico’s top trade negotiator, who was overseeing an ongoing dispute with the US over President Andres Manuel Lopez Obrador’s energy policy, was pushed out of her job by the country’s new economy chief, according to people familiar with the matter. (BBG)

BRAZIL: Brazil’s Luiz Inacio Lula da Silva and incumbent Jair Bolsonaro campaigned across the northeast of the country on Thursday, with both candidates trying to shore up support among the poor amid signs the presidential race is tightening ahead of the Oct. 30 runoff. (BBG)

RUSSIA: Russia's central bank on Thursday said the effect of the rouble's strengthening carrying over into prices was diminishing, a little over two weeks before it is next due to decide on rates. (RTRS)

SAUDI ARABIA: President Joe Biden feels that the US’ relationship with Saudi Arabia needs to be re-evaluated in the wake of the OPEC+ decision last week to decrease oil production, a National Security Council spokesman said. (CNN)

EMERGING MARKETS: Emerging markets that have coped well with the surge in global borrowing costs so far could find themselves in trouble if episodes such as the turbulence in the UK government bond market spread, a top IMF official has warned. (FT)

ENERGY: European Union country leaders may support plans to launch a new gas price benchmark at a meeting next week, as they seek to curb energy prices for consumers and industries, a draft document showed. (RTRS)

OIL: Saudi Arabia pushed other OPEC+ nations into an output cut last week, the White House claimed on Thursday, part of an escalating war of words between the two former allies. (RTRS)

OIL: OPEC Secretary General Haitham Al Ghais will visit Algiers from Oct. 15 to 17 to discuss global oil issues and medium and long term perspectives, according to a statement released by the energy ministry on Thursday. (RTRS)

CHINA

PBOC: The People’s Bank of China’s will push banks to increase loans to the infrastructure, manufacturing and property sectors to better support the economy, Governor Yi Gang said. (BBG)

PBOC: China may refrain from draining cash via medium term loans for the first time in three months as authorities seek to boost market confidence during the Communist Party’s twice-a-decade leadership congress next week. (BBG)

YUAN: There is no reason for the yuan to continue to depreciate against the U.S. dollar over the longer term given the steady recovery of the Chinese economy, the Securities Daily reported, citing analysts after both the onshore and offshore yuan breached 7.19 on Thursday. (MNI)

FISCAL: China is likely to front-load a portion of the quota of next year’s infrastructure-back local government special bonds in Q4 to boost investment and stabilise economic growth, the China Securities Journal reported citing analysts. (MNI)

CORONAVIRUS: China must insist on its dynamic “zero-Covid” policy as there is no way to completely eliminate the virus and no guarantee of zero cases, Caixin reported citing Liang Wannian, head of an expert panel on the Covid-19 response affiliated with the National Health Commission speaking at a Thursday press conference. (MNI)

CORONAVIRUS: China may not move away from its stringent Covid Zero policy until the second half of next year, according to the International Monetary Fund’s top official in the country, who also called for more monetary and fiscal stimulus to support the economy. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY56 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY56 billion after offsetting the maturity of CNY58 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7794% at 09:41 am local time from the close of 1.5651% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday, flat from the close of Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1088 FRI VS 7.1101 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1088 on Friday, compared with 7.1101 set on Thursday.

OVERNIGHT DATA

CHINA SEP CPI +2.8%; MEDIAN +2.9%; AUG +2.5%

CHINA SEP CPI +0.9%; MEDIAN +1.0%; AUG +2.3%

JAPAN SEP M2 MONEY STOCK +3.3% Y/Y; MEDIAN +3.4%; AUG +3.4%

JAPAN SEP M3 MONEY STOCK +2.9% Y/Y; MEDIAN +3.0%; AUG +3.0%

SOUTH KOREA SEP UNEMPLOYMENT RATE 2.8%; MEDIAN 2.7%; AUG 2.5%

SOUTH KOREA SEP EXPORT PRICE INDEX +15.2% Y/Y; AUG +13.0%

SOUTH KOREA SEP EXPORT PRICE INDEX +3.2% M/M; AUG -1.3%

SOUTH KOREA SEP IMPORT PRICE INDEX +24.1% Y/Y; AUG +22.9%

SOUTH KOREA SEP IMPORT PRICE INDEX +3.3% M/M; AUG -0.9%

NEW ZEALAND SEP BUSINESSNZ MANUFACTURING PMI 52.0; AUG 54.8

New Zealand's manufacturing sector saw an easing of expansion in September, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). (BusinessNZ)

MARKETS

SNAPSHOT: Kwarteng Returns To London Early With The BoE Set To Cease Gilt Purchases

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 867.28 points at 27104.7

- ASX 200 up 116.19 points at 6758.8

- Shanghai Comp. up 55.121 points at 3071.846

- JGB 10-Yr future up 5 ticks at 148.4, yield up 0.1bp at 0.251%

- Aussie 10-Yr future down 0.5 tick at 95.97, yield down 0bp at 4.003%

- U.S. 10-Yr future +0-02+ at 111-03, yield down 0.53bp at 3.938%

- WTI crude up $0.17 at $89.28, Gold up $0.56 at $1666.93

- USD/JPY up 32 pips at Y147.44

- KWARTENG TO RETURN TO LONDON FROM WASHINGTON EARLY AS MAJOR MINI-BUDGET U-TURN EXPECTED (SKY)

- ECB STAFF SEES LOWER RATE PEAK THAN MARKET (RTRS SOURCES)

- ECB’S HAWKS TARGET EARLY 2023 TO START UNWINDING BALANCE SHEET (BBG SOURCES)

- ECB MAY START BALANCE SHEET RUNDOWN IN SECOND QUARTER, SOURCES SAY (RTRS SOURCES)

- FISCAL EXPANSION RISKS FORCING ECB INTO MORE RATE HIKES, KAZAKS SAYS (RTRS)

- JAPAN KEEPS UP YEN WARNINGS, DECLINES TO SAY IF INTERVENED (BBG)

- CHINESE YUAN WON’T DEPRECIATE IN MID-TO-LONG TERM (SEC. NEWS)

US TSYS: Off Best Levels As Early Bid Fades

Cash Tsys run flat to 1bp richer into London hours, with TYZ2 +0-01 at 111-01+ operating around the middle of its 0-14 Asia range, on volume of ~95K.

- Tsys have moved away from best levels after leaning on the latest headlines surrounding the potential for another fiscal U-turn in the UK for support during the first half of the overnight session.

- ECB source reports from both BBG & RTRS flagged an apparent ease amongst hawks re: organic balance sheet run off getting underway at some point in H123, with their focus being on interest rates when it comes to the main monetary policy tool.

- Headline flow was relatively limited elsewhere, with the PBoC Governor reaffirming the Bank’s well-known support for the continued deployment of prudent monetary policy, Meanwhile, Chinese CPI & PPI data provided very modest downside surprises.

- Block sales were seen in FV (-2.0K) & TY (-2.9K) futures, with mixed blocked flow in TYX2 109.50 puts (+5K) and TYZ2 110.50 puts (-5K).

- Looking ahead, Gilt market gyrations will be eyed, with the BoE’s temporary purchases set to conclude today and continued fiscal/political rumours doing the rounds in London.

- Friday’s NY docket includes retail sales and the UoM sentiment survey (watch the inflation components in the latter). We will also get Fedspeak from Waller, Cook & George ahead of the weekend.

JGBS: Flatter Into The Weekend

JGBs have generally followed the lead of the wider cross-asset gyrations, with futures operating around the middle of their Tokyo range as we move towards the bell, last +3, while cash JGBs sit flat to 2bp richer across the curve, flattening as super-long paper leads the bid.

- The latest round of 5-Year JGB supply passed smoothly with the low price just about topping wider expectations, tail holding tight and cover ratio moving to the highest level observed at a 5-Year auction since November ’21. It would seem that outright and relative value appeal, coupled with carry & roll considerations, outweighed the impact of any worry surrounding ongoing wider market vol., facilitating a solid auction.

- Comments from BoJ Governor Kuroda & Japanese Finance Minister Suzuki failed to move the needle on BoJ policy & JPY intervention, respectively.

- Elsewhere, an MoF official provided no comment when questioned on potential JPY intervention on Thursday.

- CPI data (due Friday) headlines next week domestic docket.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0310tn 5-Year JGBS:

- Average Yield: 0.081% (prev. 0.040%)

- Average Price: 100.09 (prev. 99.83)

- High Yield: 0.083% (prev. 0.042%)

- Low Price: 100.08 (prev. 99.82)

- % Allotted At High Yield: 21.5292% (prev. 36.2922%)

- Bid/Cover: 3.993x (prev. 3.787x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.86407tn 3-Month Bills:

- Average Yield: -0.1511% (prev. -0.1899%)

- Average Price: 100.0406 (prev. 100.0505)

- High Yield: -0.1358% (prev. -0.1598%)

- Low Price: 100.0365 (prev. 100.0425)

- % Allotted At High Yield: 34.0350% (prev. 5.6319%)

- Bid/Cover: 3.042x (prev. 2.460x)

AUSSIE BONDS: Flattening Impulse Maintained

Aussie bonds flattened in sympathy with the overnight session move in futures/Thursday’s move in U.S. Tsys, albeit following the wider gyrations observed in core global FI markets during Sydney dealing, leaving YM -9.0 and XM -0.5 into the bell, off of worst levels of the session, with cross-market gyrations and UK fiscal matters at the fore.

- Cash ACGB trade sees 9bp of cheapening to 1.5bp richening across the major banchmarks, with a pivot around 10s.

- A solid round of ACGB Apr-27 supply was noted, while next week’s AOFM issuance slate is somewhat vanilla.

- EFPs are incrementally wider on the session, with the 3-/10-Year box marginally flatter.

- Bills print 7-13bp cheaper through the reds, IRH3 through IRH4 leading the cheapening there.

- RBA dated OIS indicated a terminal rate of just over 4.05, ~!0bp or so higher on the day.

- Looking ahead, next week’s local docket is headlined by the monthly labour market reading (Thursday), with the minutes from the RBA’s most recent monetary policy decision (Tuesday) also due.

AUSSIE BONDS: ACGB Apr-27 Auction Results

The Australian Office of Financial Management (AOFM) sells A$700mn of the 4.75% 21 April 2027 Bond, issue #TB136:

- Average Yield: 3.6747% (prev. 2.8527%)

- High Yield: 3.6800% (prev. 2.8550%)

- Bid/Cover: 3.2500x (prev. 3.1400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 12.5% (prev. 89.8%)

- Bidders 45 (prev. 46), successful 18 (prev. 12), allocated in full 12 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 19 October it plans to sell A$800mn of the 3.25% 21 April 2029 Bond.

- On Thursday 20 October it plans to sell A$500mn of the 27 January 2023 Note, A$1.0bn of the 10 February 2023 Note and A$500mn of the 24 March 2023 Note.

- On Friday 21 October it plans to sell A$700mn of the 3.25% 21 April 2025 Bond.

NZGBS: NZGBs Off Lows, Lack Of Idiosyncratic Drivers Leaves Wider Themes At The Fore

The latest round of speculation surrounding the potential for another meaningful fiscal U-turn in the UK allowed the NZGB space to unwind the bulk of its early session losses, with the major benchmarks running 0.5bp cheaper to 1.0bp richer at the close, as the curve twist flattened, pivoting around 5s.

- A slowing of the headline rate of expansion in the latest domestic m’fing PMI survey had little impact, with all of the major sub-metrics outside of finished stocks exhibiting a slower rate of expansion or moving into contractionary territory.

- Elsewhere, comments from NZ FinMin Robertson re: the need to slow spending to head off inflation (in a global context) received little attention, as you would expect given the well-developed inflationary narratives.

- RBNZ dated OIS indicates a terminal OCR of just under 5.00%, marginally higher on the day.

- Looking ahead, Q3 CPI data headlines next week’s NZ docket, with a slight moderation expected in both the Y/Y & Q/Q headline metrics (although the BBG median consensus looks for +6.5% Y/Y, well above the RNZ’s 1-3% target band).

EQUITIES: Strong Rebound As US Equity Recovery Extends

Strong gains are evident across Asia Pac equities, following the sharp turn around in US markets overnight. After a mixed start US futures are tracking higher today, up a further 0.65-0.75% across the 3 main indices. Within Asia, gains have been led by tech sensitive sectors/countries.

- The HSI is up +3.4% at this stage, the tech sub index +4%, on track for its first gain since the middle of last week. Property stocks are up further, +2.7%, following yesterday's report of a possible property tax cut. Bank names have also continued to rally.

- China's Shanghai Composite is up +1.57%, lagging somewhat broader trends. The Texas Pension Fund, which has $184bn AUM, is cutting its China weight to 1.5% from 3%. While not a large sum, it is indicative of the trend around more cautious financial ties between the two economies.

- China inflation data also hinted that easier financial conditions are required for the economy.

- The Nikkei 225 is up 3.5%, the Kospi +2.6% and the Taiex nearly 3%, as tech related sectors do well. We are coming from depressed levels though, with the Kospi struggling to get positive traction above 2200 this month (last is 2218).

- The ASX 200 is up nearly 2%.

OIL: Steady, But On Track For Weekly Drop

Brent crude is basically unchanged for the session, last at $94.55/bbl. We have consolidated following the overnight +2% gain. WTI was last just above $89.10/bbl. For Brent, this past week has seen support on dips below the 50-day MA, which comes in at $93.85/bbl, so this could be a level to watch on the downside. Early highs from this week/late last week above $98/bbl remain intact. Both crude benchmarks are headed for a weekly loss if current levels hold.

- The surge in US oil inventories, reported overnight has done little to dent sentiment. There is speculation this partly reflects the US SPR release from earlier in the year. There is also still concern around supply, particularly as we head into the northern hemisphere winter months.

- Reflecting this, Brent's prompt spread is down from highs seen last week, but isn't showing a clear downward trend either.

- US-Saudi tensions are elevated, with the US unhappy in terms of the country's role in last week’s OPEC+ supply cut decision. US President Biden said further relief on domestic gasoline prices is coming next week (although didn't spell out specifics).

- Elsewhere, the IEA cut its demand forecast for 2023 by 470k bpd. Weaker economic conditions/tighter policy settings prompted the 20% forecast drop.

GOLD: Rebounds As USD Falters

Gold is sitting slightly higher compared to NY closing levels, last around $1670 (+0.20-0.25% for the session so far). Earlier in the session we dipped to just under $1660, but rebounded amidst broad based USD weakness.

- Gold continues to follow broader USD sentiment, albeit with a lower beta compared to some other asset classes. The DXY is only down slightly from NY closing levels at this stage.

- Higher beta assets like equities and AUD, NZD and NOK are all enjoying firmer gains at this stage.

- From a level’s standpoint, dips sub $1645 were supported overnight (post the CPI print), while we couldn't sustain a move above the $1680 level.

- Longer term we still have late September lows just under $1620, while the 50-day MA (currently $1711.63) has provided resistance on the topside in recent months.

FOREX: UK Fiscal Headlines, PBOC Comments Prop Up Risk Sentiment

Sterling was volatile amid reports surrounding UK Cll'r Kwarteng's early departure from the annual IMF meetings and suggestions that the government may rip up parts of its controversial fiscal plans. There was talk of officials drafting options for the Truss/Kwarteng tandem, with many flagging the potential for a U-turn on the pledge to cancel a scheduled corporation tax hike.

- GBP/USD showed a delayed reaction to those headlines, posting a ~60 pip spike at one point to print session highs at $1.1366. The leap higher in cable sapped strength from the broader USD, with the BBDXY still lower on the day, even as GBP/USD gradually erased gains. Reminder that the BoE's emergency bond-buying scheme is set to expire on Friday.

- Comments from PBOC Gov Yi lent further support to risk sentiment, as the official vowed to promote increased lending to critical sectors. China's inflation data were marginally weaker than expected, causing no material perturbations in the FX markets.

- The yen was subject to renewed selling pressure as participants shied away from safe havens. USD/JPY rejected intraday resistance from Y147.45/46 on two approaches, failing to re-test yesterday's 30-year high of Y147.67.

- Japanese officials chose to keep the market in the dark about their potential intervention on Thursday. FinMin Suzuki stuck to his usual script, noting that officials are monitoring markets with a high sense of urgency and stand ready to take appropriate responses.

- The Antipodeans led high-betas higher amid better risk appetite. The Aussie dollar led gains, with AUD/NZD now poised to snap a four-day losing streak. Oil-tied NOK an CAD were also firmer.

- Focus will turn to U.S. retail sales & preliminary results of Uni. of Mich. survey. Central bank speaker slate features Fed's George, Cook and Waller, ECB's Holzmann, BoC's Macklem & Riksbank's Ohlsson.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/10/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/10/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/10/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/10/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 14/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 14/10/2022 | - | *** |  | CN | Trade |

| 14/10/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/10/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/10/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/10/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/10/2022 | 1400/1000 |  | US | Kansas City Fed's Esther George | |

| 14/10/2022 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 14/10/2022 | 1615/1215 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.