-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing

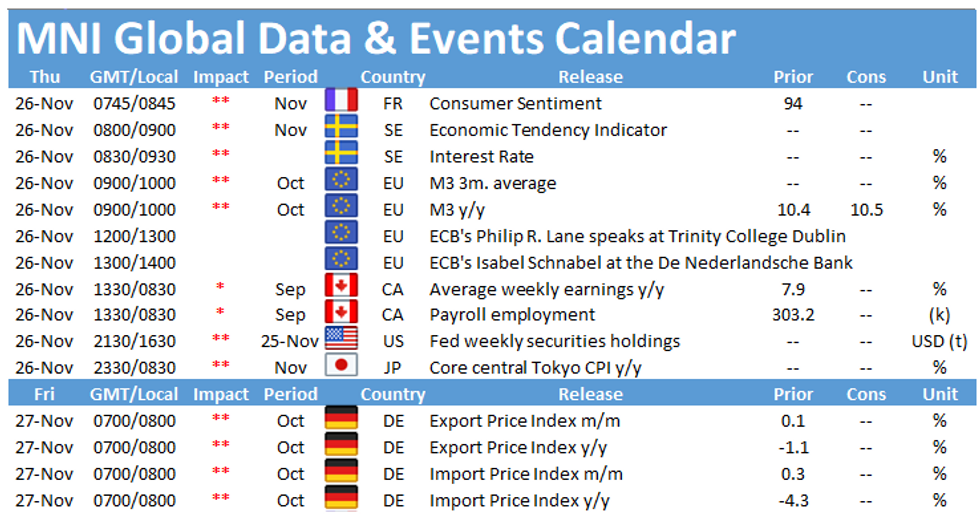

Thursday throws up a quiet data schedule as the US celebrates Thanksgiving. The highlights in Europe in terms data events are the release of French consumer confidence at 0745GMT, followed by the Swedish Economic Tendency Indicator at 0800GMT. The Riksbank interest rate decision will be closely watched at 0830GMT.

French consumer sentiment seen falling

Consumer confidence in France remained broadly unchanged in recent months, moving between 94 and 95 which is still far below the pre-pandemic level. France saw infection rates rise sharply at the end of October and in November which is likely to take its toll on consumer sentiment. Markets expect the index to fall to 92 in November which would be the lowest reading since May. The recently released flash consumer sentiment for the Eurozone also declined in November amid the second wave of Covid-19.

Swedish Economic Tendency Indicator likely to ease

The Economic Tendency Indicator rose to 96.3 in October, marking the sixth consecutive increase. All business sectors and consumers saw improvements in October. However, markets are looking for a downtick of consumer sentiment in November. The indicator rose to 90.0 in October and markets expect a drop to 88 amid rising infection rates and new social distancing rules. Manufacturing confidence is also forecast to ease slightly from 106.8 recorded to in October to 106 in November.

Riksbank likely to focus on QE

The Riksbank faces a dilemma at its meeting this week. Asset purchases are already confirmed until the middle of 2021 but other major central banks across Europe are going to end up with easier policies unless the Riksbank acts at this meeting. The MNI Markets team thinks that with economic scarring expected to be greater than anticipated back in September, with the ECB likely to act more aggressively (and hence the krona appreciating more than had been expected) and with concerns about the credibility of the inflation target, the Riksbank will be pushed towards a QE extension of SEK100bln until the end of 2021, but acknowledge that the call is likely to be very close.

The highlights of the events calendar on Thursday are speeches by ECB Executive Board members Philip Lane and Isabel Schnabel.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.