-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UK Inflation Insight: October 2024

MNI UK Inflation Insight: October 2024

MNI Global Morning Briefing

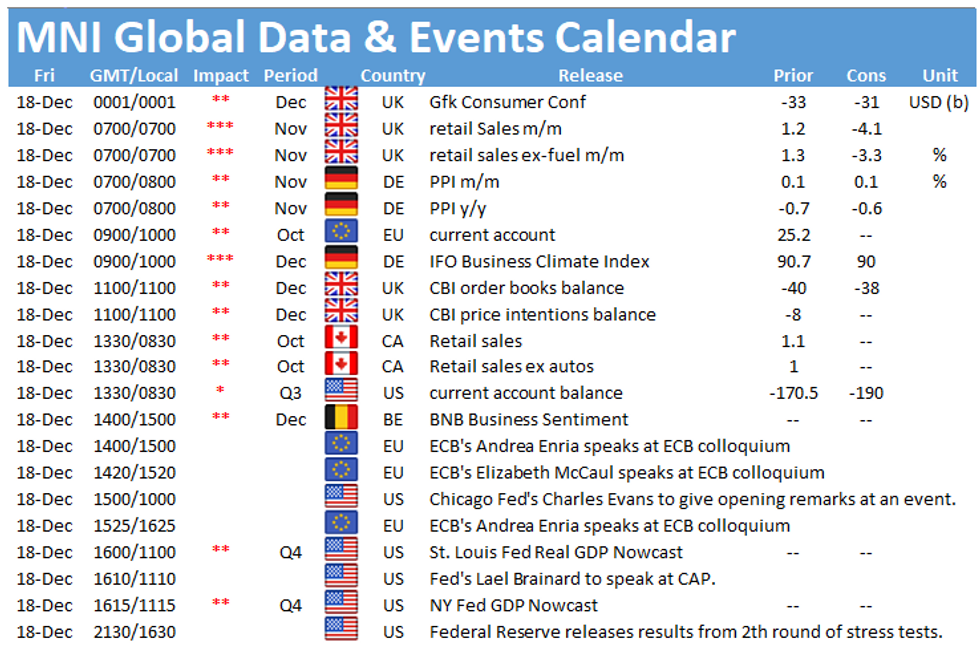

The week ends with several interesting data releases starting with UK retail sales at 0700GMT. At 0900GMT the publication of the Ifo business climate will be closely watched. In the North Americas, the highlight of the day is the release of Canadian retail sales at 1330GMT.

UK retail sales seen falling amid lockdown

UK November retail sales are expected to decline by 4.1% after rising by 1.2% in October. Tight restrictions came into place in November with non-essential shops being forced to shut their doors again, likely dampening sales in this month. However, MNI's Reality Check suggests an upside risk to analyst's forecasts as food and internet sales surged in November according to retailers. Consumers likely accelerated their Christmas shopping ahead of the second lockdown and Black Friday sales were stretched out this year which should also provide a boost to sales. According to the BRC some retailers were able to offset some of their losses due to the lockdown via improved online sales channels and services such as click and collect. Looking ahead, December sales are likely to see a solid increase in sales as shops opened again in most parts of the UK in early December.

German Ifo business climate forecast to edge slightly lower

The IFO business climate indicator is seen little changed in December. Markets expect the headline index to tick down 0.7pt to 90.0. This would mark the lowest reading since June and the third consecutive monthly decline. Germany entered a partial lockdown in November, but infection rates continue to rise at a fast pace in December and the country decided to tighten the rules from Wednesday onwards over Christmas, which is going to weigh on sentiment. The current conditions index is projected to ease to 89, its lowest level since August. On the other hand, the Expectations index is seen 1pt higher at 92.5 as the positive vaccine news are likely to have improved the outlook for the next six months.

Canadian retail sales projected to stagnate

Markets are looking for flat reading for monthly Canadian retail sales in October amid rising infection rates. Sales rose by 1.1% in September, showing the fifth consecutive increase since the record fall in April. On a quarterly basis, sales were up 22.6% in Q3 following Q2's sharp decline. Increasing Covid-19 cases led to tighter restrictions in many parts of the country which is likely to weigh on sales going forward. However, some of the losses will be offset by increase in online sales ahead of Christmas.

The events calendar holds enough speakers of note to carry us in to the pre-holiday weekend, including ECB's Andrea Enria and Elizabeth McCaul as well as Chicago Fed's Charles Evans and Fed's Lael Brainard.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.