-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI Global Morning Briefing: BOC On Deck

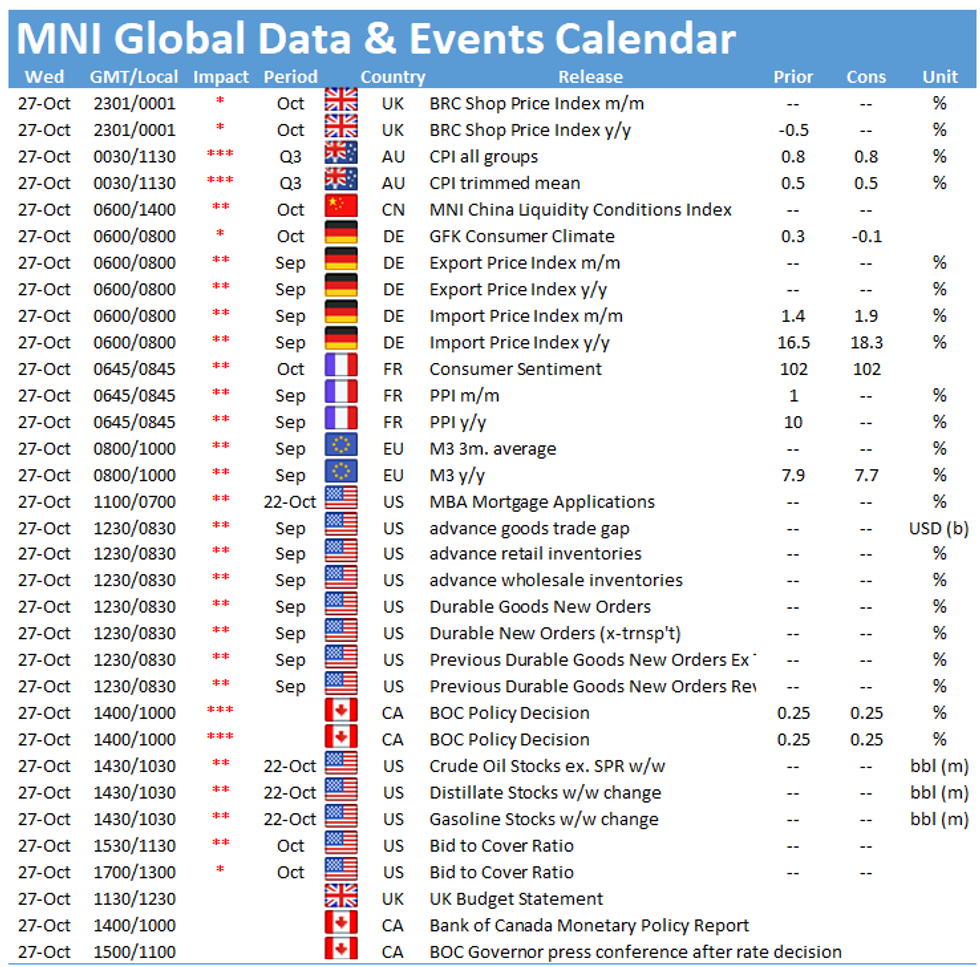

A full data calendar is scheduled for Wednesday, but the Bank of Canada policy decision will be the highlight of the day.

France PPI likely higher again (0745 BST)

French factory gate inflation is seen higher again in September, extending further the rise to 10% y/y seen in August, with analysts looking for an increase to10.3% y/y. However, with the surge in gas and other energy costs through the month, there certainly looks like an upside risk, particulalrly in the light of Spain data published Tuesday showing a sharp rise to 23.6% y/y.

UK Budget to see cut in borrowing forecasts(circa 1230 BST)

The UK government will likely get a boost from the latest Office for Budget Responsibility forecasts that ill revise lower estimates for borrowing in the current year by around GBP 25-30 billion (they will still be at the highest level since the end of WWII), but there will be the partial offset from a forecast of higher debt interest payments, largely from the sharp increase in payments to index-linked Gilt investors. Other good news from the OBR will be the likely revision lower of scarring on the economy from the pandemic to 2.5% of GDP from an earlier estimate of 3%.

Chancellor Rishi Sunak is unlikely to row back on planned tax rises or calls for departmental spending curbs, but he is likely to find plenty of spending projects to highlight - whether old or new money.

Bank of Canada to extend taper (1500 BST)

The Bank of Canada is universally expected to hold a record low 0.25% interest rate Wednesday, and most investors see QE being slimmed down from CAD2 billion a week to either CAD1 billion a week or CAD4 billion-CAD5 billion a month, a pace that would effectively mark the "reinvestment" phase that stabilizes the balance sheet, according to our Ottawa bureau.

Governor Tiff Macklem will also likely raise inflation forecasts and cut growth predictions, affirming his view conditions for a rate hike won't be in place until 2h 2022. The press conference will likely be stocked with questions about why he sees most price pressure as short-lived.

Set piece fiscal and monetary events will dominate Wednesday, as UK Chancellor of the Exchequer Rishi Sunak delivers the government's annual Budget statement and BOC Governor Tiff Macklem addresses the press.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.