-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI Global Morning Briefing: Eyes on UK Labour Report

Monday kicks off with the UK's labour report at 0700GMT, followed by the CBI industrial trends survey at 1100GMT. The main data release in the US is the publication of new home sales at 1400GMT.

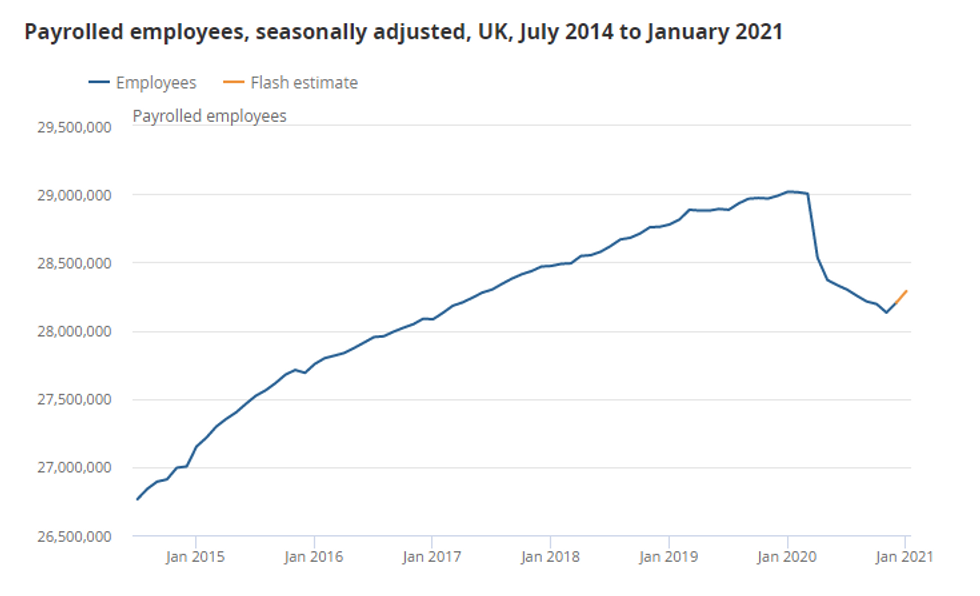

UK unemployment rate forecast to edge higher

The UK's jobless rate is forecast to tick up marginally to 5.2% in January, up from 5.1% seen in December. More timely PAYE data for January showed a decline in the number of payrolled employees by 726,000 since February 2020. Especially young people were among those who have lost their jobs, the ONS noted. While the unemployment rate increased modestly during the pandemic, the employment rate eased. Moreover, the number of people away from work receiving no pay edged slightly higher in November and December. The nationwide lockdown in January is likely to push this figure up a little further. Nevertheless, the extension of the job support scheme is likely to prevent a steeper rise in unemployment in the coming months. The planned reopening of non-essential shops and the hospitality sector should be beneficial for the labour market in the coming months.

Source: ONS; HM Revenue and Customs - Pay As You Earn Real Time Information

CBI total order books seen improving

The CBI industrial trends survey is forecast to show another increase in total orders in March to -20, up from -24 seen in February. This would mark the highest reading since February 2020, although it remains low for historical standards. February's report showed an improvement in total orders, but export orders deteriorated, likely driven by supply chain issues and new trade rules between EU and UK. Furthermore, firms expected output to be broadly flat in the next three months, which is a significant improvement compared to the downbeat outlook companies had in January.

US new home sales expected to slow

The sale of new single-family houses in the US increased by 4.3% in January to an annual rate of 923,000, up from 885,000 seen in December and supported by low interest rates and more people moving away from cities as a result of the pandemic. January's home sales were 19.3% higher than a year ago when they recorded 774,000. In February, markets expect new home sales to slow by 4.8% to an annual rate of 879,000.

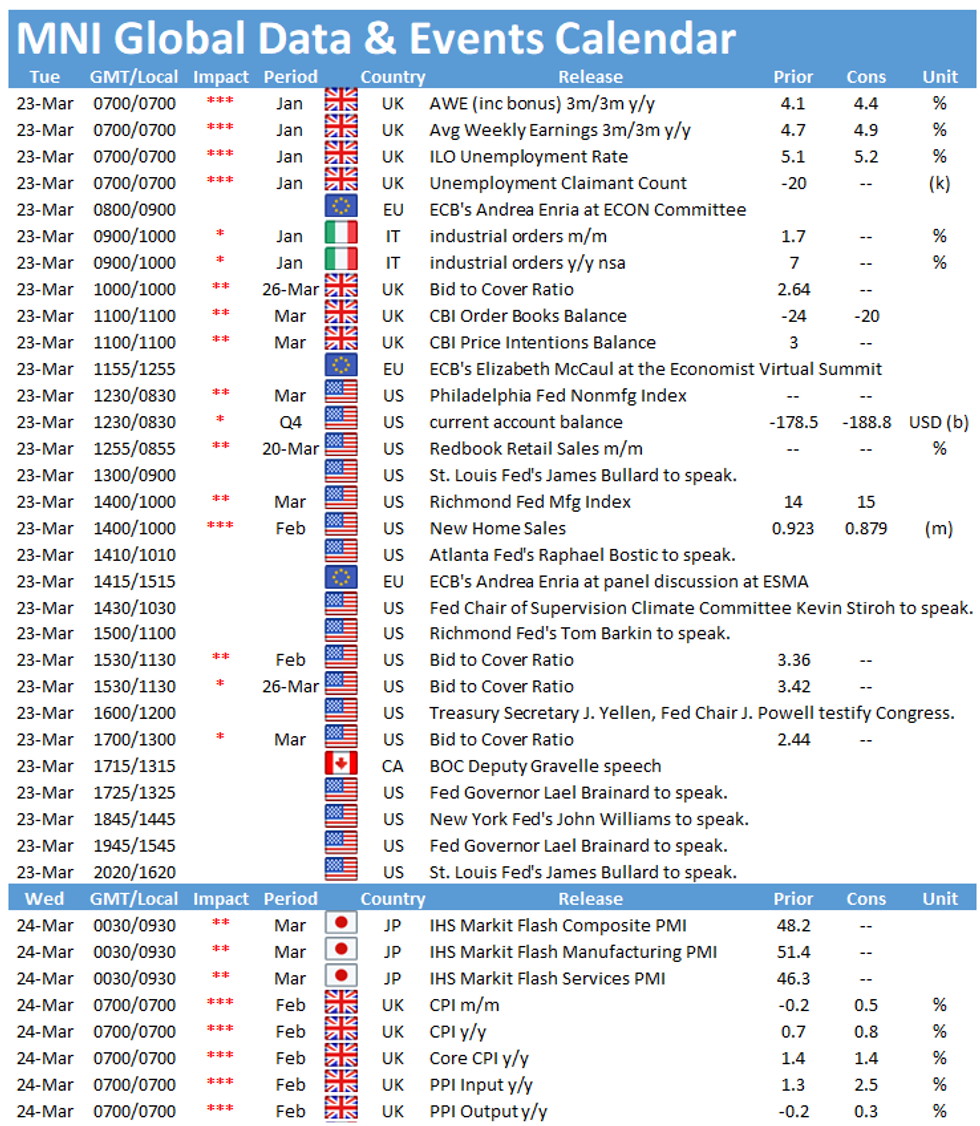

The events calendar throws up a busy schedule on Tuesday. The highlights are speeches by ECB's Andrea Enria and Elizabeth McCaul as well as St. Louis Fed's James Bullard, Atlanta Fed's Raphael Bostic, Richmond Fed's Tom Barkin, New York Fed's John Williams and BOC's Toni Gravelle.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.