-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI Global Morning Briefing: French, German Inflation In Focus

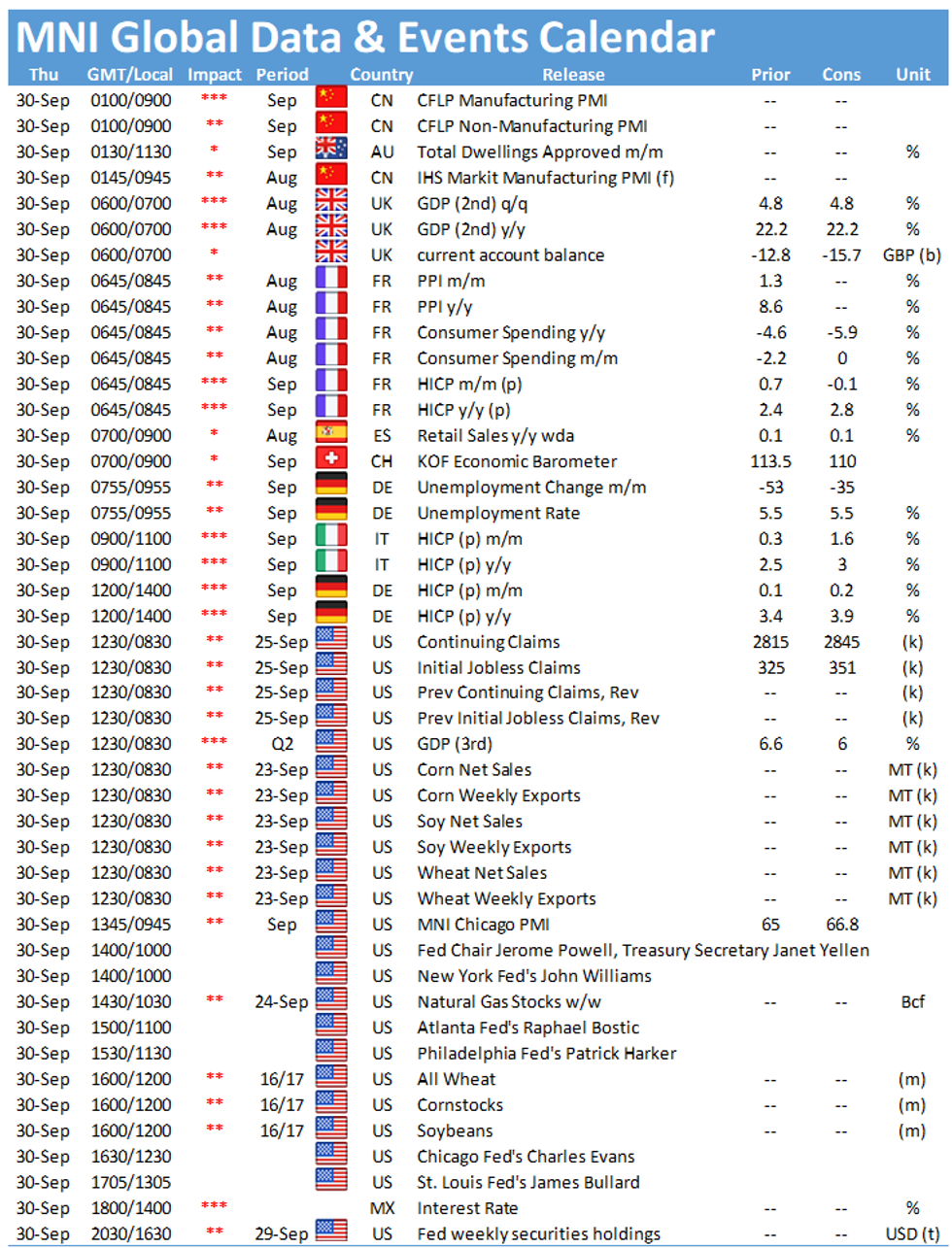

Thursday throws up a full data calendar, with UK final Q2 GDP, French German and Italian inflation all set for release. In the US, the third read of Q2 GDP and the latest initial jobless claims data will be the highlights.

UK Q2 GDP Seen Higher (0700 BST)

UK GDP likely increased by 4.8% in the second quarter, confirming the preliminary estimate released last month, data released Friday will show, with an unchanged annual growth rate of 22.2%. However, the risks to that forecast may lie to the downside, after negative revisions to April and May growth in the wake of initial releases. GDP grew by 2.2% between March and April, according to data released in August, down from the originally-reported 2.3%, while output expanded by just 0.6% in May, below the initial estimate of a 0.8% gain. Growth of 1.0% in June was unrevised in the latest GDP data.

Downward revisions to second quarter retail sales may imply slightly less exuberant consumer spending than the initially-reported 7.3% increase. Retail comprises just under 6% of GDP, but may provide a clue as to the consumer attitudes. Sales volumes rose by 11.7% in the second quarter, according to data released earlier this month, below the 12.2% gain reported in June.

Even if growth is revised lower, the UK would still register as the strongest-performing G7 economy over Q2. Eurozone output rose by 2.2% between April and June, while the U.S. expanded by 1.6%. Nonetheless, U.S. output was 0.8% above pre-pandemic levels at the end of the second quarter. If analysts' forecast of a 4.8% gain are confirmed, UK output would remain some 4.4% below the final quarter of 2019.

The current account deficit is forecast to have widened to GBP15.7 billion in the second quarter from GBP12.828 billion — or 2.4% of GDP — in the opening months of the year.

Germany Inflation seen higher again (1300 BST)

Inflation will continue to be a dominant theme in Germany in coming days, with annual rates expected to push even higher. Preliminary harmonized readings are expected to see German inflation rise to 3.9% y/y in September, up sharply from the already elevated 3.4% seen in August.

From a communications perspective, the rise in domestic prices to 4.1% y/y will create problems for the ECB, with a notoriously inflation-resistant German public growing increasingly antsy about higher prices.

Speakers on deck Thursday include Fed Chair Jerome Powell and New York Fed President John Williams. Also due up are St Louis Fed President James Bullard, Philly Fed's Patrick Harker and Chicago Fed's Charles Evans.

Mexico's central bank will announce their latest interest rate decision at 1900BST.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.