-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI INTERVIEW: Americans Fear Recession, Weaker Jobs-UMich

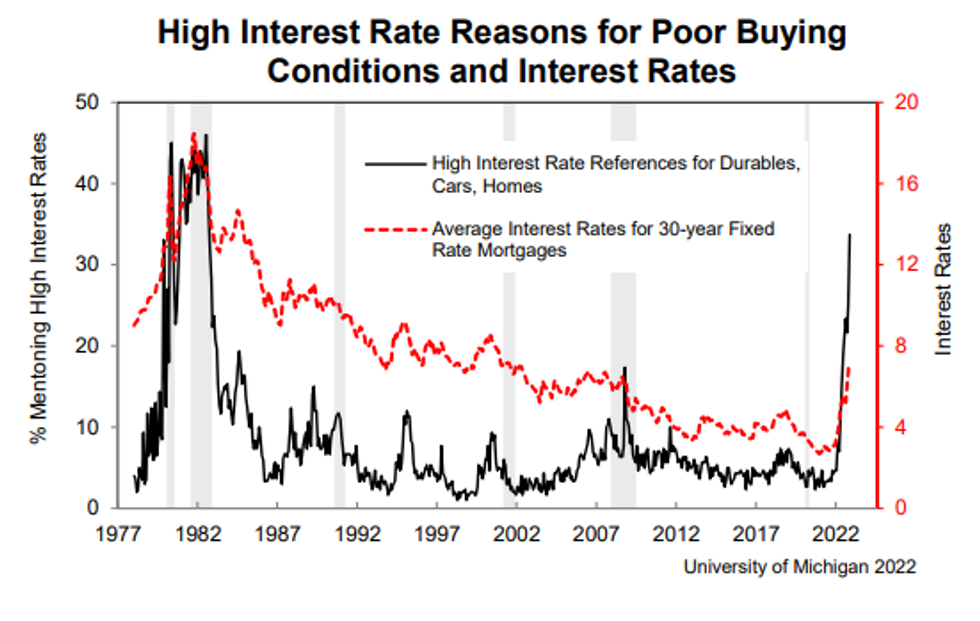

Higher interest rates and mounting fears of a downturn next year are biting into the morale of consumers, who are now expecting a worsening labor market, the head of the University of Michigan's Survey of Consumers, Joanne Hsu, told MNI.

"It is pretty unambiguous that consumers expect a downturn going ahead and do by and large expect a recession," she said. "What's actually kind of interesting about this month is that labor market expectations have worsened in spite of the fact that labor markets continue to be very strong."

"We have the highest share of consumers expecting unemployment to rise in the year ahead, since the very beginning of the pandemic, and is comparable to what we were seeing in the middle of the Great Recession. Consumers are absolutely expecting labor markets to worsen," Hsu said.

The University of Michigan survey's drop in the consumer sentiment index to a five-month low of 54.7 in November, from 59.9 and below expectations, reflected the damage that higher interest rates are doing, particularly to the demand for durable goods, she said. The one-year economic outlook sank to the lowest level since July, falling 3.5 points to 52.7.

"What that tells us is that the improvements we have seen the last few months were really tentative," she said. "We're going to have a bumpy ride ahead." The survey's interviews were conducted predominantly before the elections and a just over a third of responses for the month's final report will be after the election, Hsu said.

The Fed last week raised interest rates by 75 basis points for a fourth consecutive meeting, bringing this year's cumulative tightening to 375 basis points and the federal funds target range to 3.75% to 4%.

HIGHER RATES BITE

The decline in consumer sentiment is "very much attributable to people feeling the pain of higher interest rates. We're seeing that throughout the survey. People are complaining about higher interest rates not just for buying conditions for durables, which is going into the sentiment index, but also for cars and houses," she said

Earlier this week inflation showed hints of cooling as the headline CPI rose 0.4% in the month of October and headline inflation eased to 7.7% over the year. An Atlanta Fed economist told MNI the report for October paints a rosier picture of moderating inflation than is likely the case. (See: MNI INTERVIEW: Cooldown in Oct CPI Overstated -Fed's Meyer)

The Michigan survey's inflation expectation measures increased in the preliminary November report with the median expected year-ahead inflation rate rising to 5.1% and median long-run expectations increasing to 3.0%.

Hsu cautioned the CPI report would not necessarily translate quickly to improvements in consumer expectations.

"Consumers are waiting for something sustained and not a single month of decreased prices before they update their expectations," Hsu said.

"We have quite a bit of news kind of unfolding this month separate from the CPI report," she said. Consumers "are not really going to be reacting to the report. They're going to be reacting to the prices that they're actually experiencing and observing in the wild."

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.