-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI MARKETS ANALYSIS: Bias in Oil And Equities Remains Higher

The equity space and oil markets are trending higher and despite concerns that these trends may be mature, technical signals suggest the path of higher highs and higher lows is likely to continue near-term.

The S&P and the 50-day EMA

S&P E-minis traded lower between Jun 15 - 21. Price has however recovered from 4126.75, the Jun 21 low. The 50-day EMA is proving to be a reliable trend indicator and continues to successfully identify where demand interest in this contract lies, once a corrective cycle is underway.

- This year, the 50-day EMA has provided support on a number of occasions; in early February, early March, March 25, twice in mid-May and most recently on June 18 and 21.

- Importantly the slope of the EMA is positive. This is an important condition as it reflects and reinforces a bullish trend condition.

- Furthermore, the set-up between the 20- and 50-day EMAs is bullish and while this holds, the indicators suggest that the uptrend is likely to extend.

The recovery this week from just below the 50-EMA, once again highlights the potential end of a recent correction - this time at 4126.75. Attention is on the recent high of 4258.25 where a break would open:

- RES 1: 4264.41 1.618 proj of Mar 25 - May 10 - 13 price swing

- RES 2: 4300.00 Round Number Resistance

- RES 3: 4322.15 1.764 proj of Mar 25 - May 10 - 13 price swing

Key short-term support has been defined at 4126.75. A break would signal scope for a deeper decline. Price would need to remain below the 50-day EMA though and a change in the EMA set-up to bear mode is required to suggest a more significant reversal has occurred. Until then, the path of least resistance remains up.

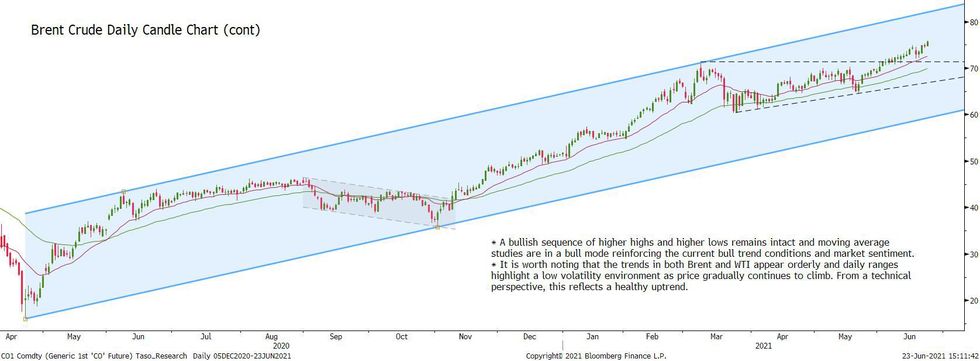

A note on the oil trend

Oil markets continue to trend higher and both Brent and WTI appearing comfortable above $70.00.

- A bullish sequence of higher highs and higher lows remains intact and moving average studies are in a bull mode reinforcing the current bull trend conditions and market sentiment.

- It is worth noting that the trends in both Brent and WTI appear orderly and daily ranges highlight a low volatility environment as price gradually continues to climb. From a technical perspective, this reflects a healthy uptrend.

- Key short-term support levels to watch are:

- Brent (Q1) - $72.01, June 17 low and $69.26, the 50-day EMA.

- WTI (Q1) - $69.54, Jun 17 low and $66.51, the 50-day EMA.

Sell-side, options markets increasingly positive on oil

Significantly, sell-side analysts have endorsed the recent upward trend in oil markets. Bank of America this week flagged that global oil consumption will continue to exceed supply. The Bank's analysts see pent-up demand for travel meeting inadequate supply of mass transit, resulting in increasing private car use and fuel consumption.

Similarly, Citi upgraded their Brent oil forecasts to reflect a high probability of touching $85/bbl before the end of 2021.

Reflecting the renewed bullish posture of oil markets, the cost of hedging against price rises before year-end has increased markedly. $100/bbl call options expiring in December have more than doubled in price since the beginning of the year.

This shifts focus to the upcoming OPEC+ meeting in Vienna next week. The group's delegates meet on July 1st, with recent reports suggesting the group could up daily output by a further 500,000bpd - still a relatively small move given the IEA's forecast that Q4 oil demand will hit multi-year highs of 100mln bpd in Q4.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.