-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Fiscal Stimulus Nears, With FOMC Ahead

HIGHLIGHTS:

- A US fiscal stimulus deal looks increasingly likely - buoying risk appetite across the board.

- The dollar is on the back foot (EURUSD above 1.22 for first time since 2018) as Eurozone flash PMIs beat expectations.

- In other 'deal' news, Brexit optimism has boosted GBPUSD (also post-2018 high) and weakened Gilts.

- Focus later turns to the Fed, which is expected by some (though not consensus) to make adjustments to its asset purchase program.

US TSYS SUMMARY: Weaker On Fiscal Deal Optimism; FOMC Eyed Later

Treasuries are off overnight highs, with a Washington fiscal stimulus deal finally appearing to be within reach, and the FOMC decision coming this afternoon.

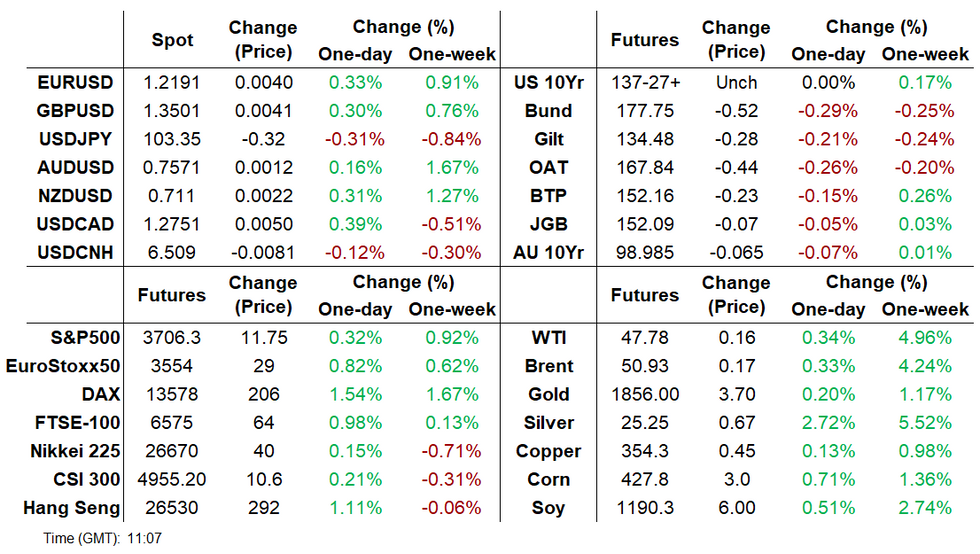

- TYs have traded basically within Tuesday's ranges, briefly going through yesterday's low but holding. Mar 10-Yr futures (TY) steady at at 137-27.5 (L: 137-25.5 / H: 138-00.5)

- Modest bear steepening in the curve: 2-Yr yield is up 0.6bps at 0.119%, 5-Yr is up 0.8bps at 0.3718%, 10-Yr is up 1.2bps at 0.9196%, and 30-Yr is up 1.8bps at 1.6682%.

- Dollar's been weakening and equities rallying pretty much the entire overnight session. Positive Brexit deal headlines and Eurozone PMI beats have boosted the tone.

- Politico's Jake Sherman tweeting at 0442ET that he is "pretty confident that there will be a stimulus deal reached in the next 24 hours". This comes after bipartisan meetings Tuesday after which Senate's McConnell said he was optimistic on completing "an understanding sometime soon".

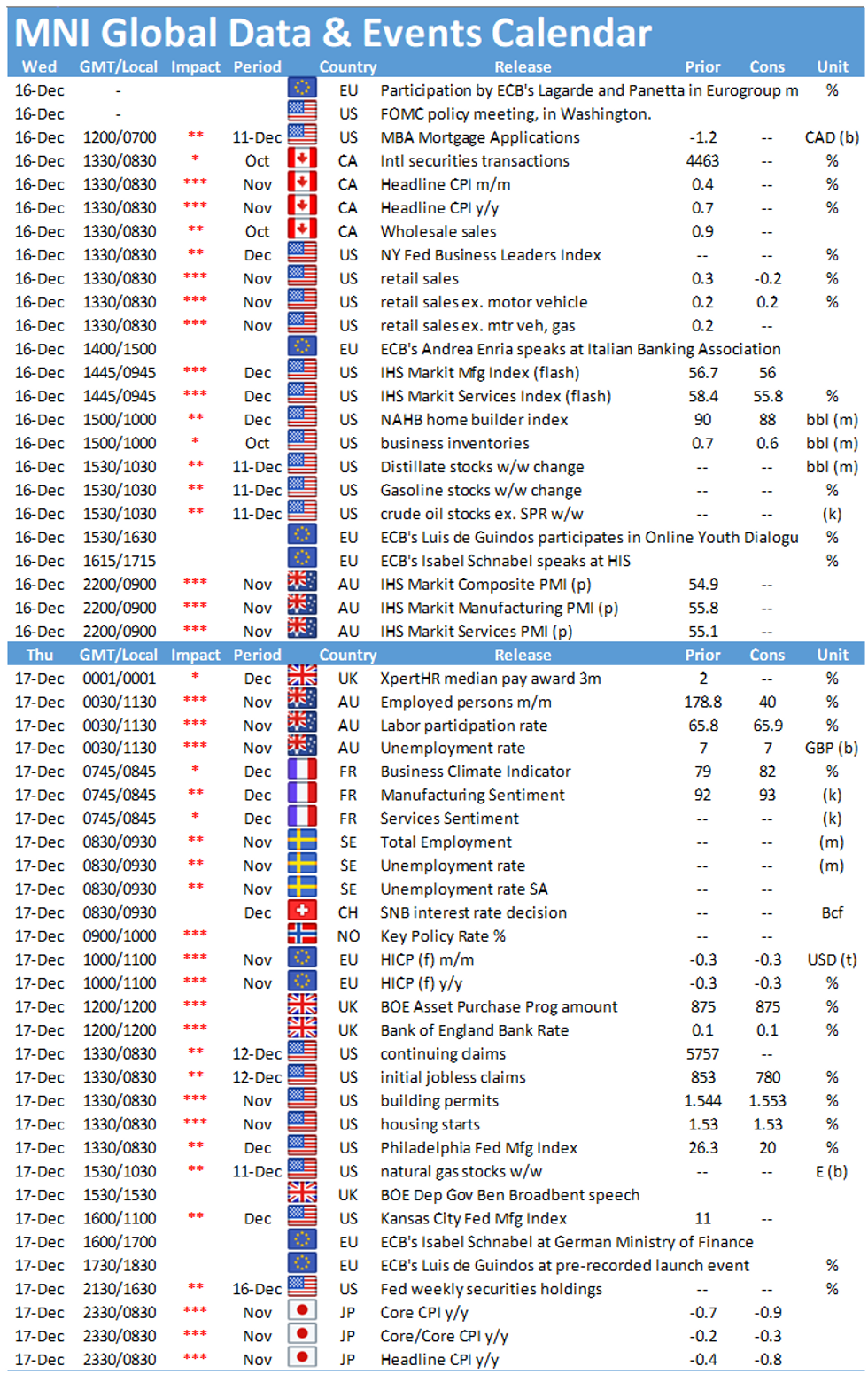

- Solid data slate, with Nov advance retail sales at 0830ET, and prelim Dec PMIs at 0945ET.

- Later of course is the Fed decision at 1400ET, with the Powell presser a half hour later.

- In supply, $55bn of 105-/154-day bills sell at 1130ET; no NY Fed operation (due to FOMC meeting today).

MNI FEDERAL RESERVE MARKETS PREVIEW

The FOMC is likely to adopt new guidance on asset purchases at the December FOMC, but will fall short of adjusting its purchase program in either scope or size, preferring to wait for further clarity over the outlook before taking such a step. While an increase in the weighted average maturity of the Fed's asset purchases is not the consensus outcome from this meeting, it is expected by some market participants – setting up the potential for a mildly hawkish disappointment on Wednesday. Full preview here.

EGB/GILTS SUMMARY

A busy morning session for EGBs, with the beat in EU PMIs beating expectations.

- France, Germany and EC PMIs saw decent release beat, which pushed Equities higher and EGB's lower.

- German curve is bear steepening and the Bund contract is down 64 ticks at the time of typing.

- Brexit hope has also been a playing factors, with hope that a deal could be reach, although some of the headlines still note that Fish and level playing remains.

- Gilts have traded in tandem with EGB and have taken their cues from Brexit hope, and trade 30 ticks down during the morning session.

- Looking ahead, US Retail sales and PMI are the notable data. Speakers sees ECB Guindos, de Cos, Schnabel and Weidmann.

- ALL EYES on Brexit, US stimulus and especially the Fed.

- Gilt futures are down -0.32 today at 134.44 with 10y yields up 2.7bp at 0.286% and 2y yields up 1.0bp at -0.53%.

- Bund futures are down -0.61 today at 177.66 with 10y Bund yields up 3.6bp at -0.576% and Schatz yields up 2.2bp at -0.744%

- BTP futures are down -0.26 today at 152.13 with 10y yields up 1.8bp at 0.536% and 2y yields up 0.8bp at -0.450%.

ITALY AUCTION RESULTS: BTP buyback results: E4.76bln purchased

- E630mln of 4.75% Sep-21 BTP, offer-to-cover 2.75x

- E497mln of 2.30% Oct-21 BTP, offer-to-cover 4.16x

- E1043mln of 0.35% Nov-21 BTP, offer-to-cover 1.98x

- E1403mln of Jun-21 CTZ, offer-to-cover 1.34x

- E1187mln of Nov-21 CTZ, offer-to-cover 1.77x

KEY US/EUROPE BOND/RATES OPTIONS FLOW

Overnight options flow included:

US:

- TYG1 137.50/136.50ps 2x3, bought for 19 in 2kx3k

- TYH1 132p, bought for '03 in 5k

- RXF1 177.50/177.00/176.50p fly, sold at 5 in 900

- RXF1 179c, bought for 7 in 1k

- RXF1 179.50c bought for 3 in 5k

- RXG1 177.00/175.5ps, trades 26 in 2k

- RXG1 176.5/175.5ps 1x2, bought for 9 in 1k

- LZ1 100^, bought for 18.5 in 2k

FOREX SUMMARY

FX took its cue from Risk, Brexit hope and the European PMIs release.

- The beat in the French, German and EC PMI saw Estoxx and the EUR rally.

- The push higher in risk spilled over into the USD, and the Greenback saw broad base selling.

- EURUSD rallied above 1.2200 and the pair is now at its highest since April 2018.

- EURUSD printed a 1.2212 high, just short of MNI tech next resistance at 1.2222 1.500 proj of the Nov 4 - 9 rally from the Nov 11 low.

- GBP is also trading on the front foot, on Brexit hopes, but the risk on tone and USD selling got Cable above the 1.3500 handle.

- Cable now targets the December high at 1.3539 (managed 1.3521 high this morning), which will also be the highest level since May 2018.

- Brexit comment this morning; VDL:" Governance issue largely resolved, but still Fisheries and level playing field left"

- USD trade in the red against all major, besides the CAD, up 0.23%.

- Looking ahead, US Retail sales and PMI are the notable data.

- We also get few more speakers including ECB Guindos, de Cos, Schnabel and Weidmann.

- Nonetheless, ALL EYES are on Brexit, US stimulus and especially the Fed.

FX OPTION EXPIRY

EURUSD; 1.2150 (450mln), 1.2175 (300mln), 1.2200 (420mln), 1.2250 (250mln)

GBPUSD: 1.3450 (283mln), 1.3600 (368mln)

USDJPY: 103.00 (352mln), 103.50 (300mln)

AUD 0.7500 (1.2bn), 0.7550 (253mln)

TECHS: Price Signal Summary - USD Under Pressure, EU FI Offered

- EURUSD resumed its uptrend this morning clearing 1.2178, Dec 4 high. Attention turns to 1.2222, 1.500 projection of the Nov 4 - 9 rally from the Nov 11 low. Cable is firmer too with the focus on key resistance at 1.3539, Dec 4 high. USDJPY is closing in on key support at 103.18, Nov 6 low. AUDUSD is probing recent highs just above 0.7570. Bulls target 0.7638 next, 38.2% of the 2013-2020 downtrend. USDCAD remains vulnerable too with scope for 1.2677 next, 76.4% of the 2017-20 uptrend.

- On the commodity front, Gold is firmer. Key resistance and the bull trigger is at $1875.4, Dec 8 high. Silver has cleared trendline resistance signaling an important reversal. This opens $26.008, Nov 9 high and a bull trigger. Brent (G1) targets $51.66, 0.764 projection of the Nov 16 - 25 rally from Dec 2 low. WTI (F1) bulls eye $48.07 next, 0.764 projection of Apr - Aug rally from the Nov 2 low.

- Bund and Gilts offered. Bund (H1) is down sharply this morning and approaching the next support at 177.70, 50.0% of the Dec 2 - 11 rally. Gilts (H1) weakness exposes 134.10 76.4% retracement of the Dec 2 - 11 rally.

EQUITIES: Most stock markets higher this morning

- Japan's NIKKEI up 69.56 pts or +0.26% at 26757.4 and the TOPIX up 4.78 pts or +0.27% at 1786.83

- China's SHANGHAI closed down 0.25 pts or -0.01% at 3366.983 and the HANG SENG ended 253 pts higher or +0.97% at 26460.29

- The German Dax up 216.32 pts or +1.62% at 13587.08, FTSE 100 up 61.13 pts or +0.94% at 6572.26, CAC 40 up 44.52 pts or +0.81% at 5573.07 and Euro Stoxx 50 up 33.87 pts or +0.96% at 3558.2.

- Dow Jones mini up 73 pts or +0.24% at 30279, S&P 500 mini up 10.5 pts or +0.28% at 3705.75, NASDAQ mini up 41.25 pts or +0.33% at 12637.

COMMODITIES: Weak dollar benefitting commodities; silver leading the way

- WTI Crude up $0.13 or +0.27% at $47.77

- Natural Gas down $0.04 or -1.31% at $2.647

- Gold spot up $8.82 or +0.48% at $1862.26

- Copper up $2.1 or +0.59% at $356.55

- Silver up $0.65 or +2.67% at $25.1466

- Platinum up $9.38 or +0.9% at $1050.01

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.