-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - GBP Nears 2020 High as Deal Within Reach

HIGHLIGHTS:

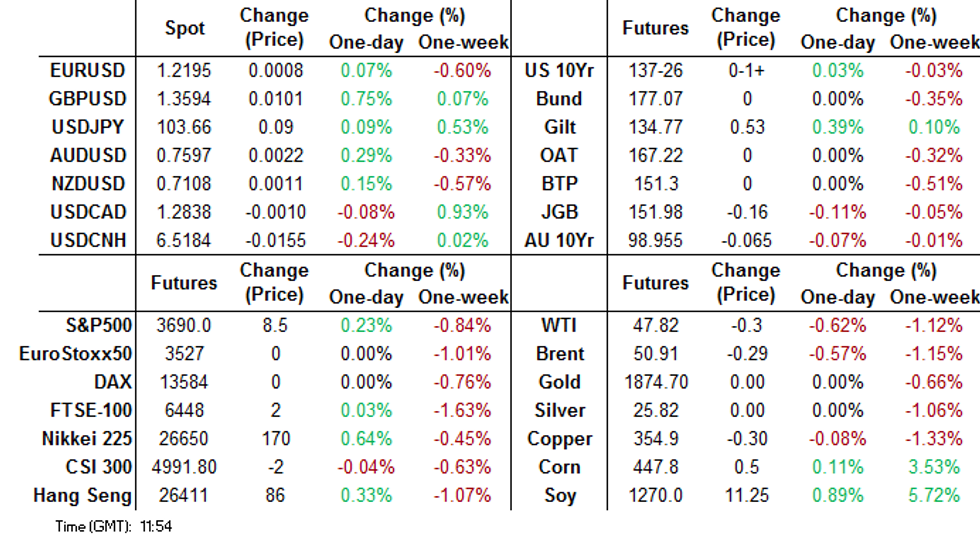

- GBP/USD nearing 2020 high as Brexit deal within reach - although obstacles remain

- European equities on the front foot ahead of NY

- Typically quiet calendar with early closes for Christmas Eve

BOND SUMMARY: Gilts Strengthen With Brexit Deal Nigh

Treasuries and Gilts are stronger Thursday, with EGB trade closed and amid holiday-thinned volumes.

- Gilts have strengthened since the open, as a press conference with an official announcement on the apparent Brexit deal eagerly awaited (though latest reports suggest this could happen at/close to the early market close).

- UK curve has bull flattened, giving back some of the bearish move Wednesday afternoon when it began looking like a deal was nigh.

- Early close for Tsys too - Mar21 TYs trading with minimal volume (<70k) and within a 3 tick range, with a couple of bill sales today ($65B 4-/8-week auctions at 1000ET) the scheduled "highlight".

- Some attention on House Democrats' attempt to push through legislation raising payments to individuals to $2k via unanimous consent (can be derailed by a single 'no' vote, and that looks likely, setting up a new bill to be put on the floor Monday).

- For those eyeing the exits already: CME floor closes at 1200ET, Globex closes at 1215ET.

- Mar Gilt futures (G) up 54 ticks at 134.78 (L: 134.01 / H: 134.83)

- Mar US 10-Yr futures (TY) up 1.5/32 at 137-26 (L: 137-23.5 / H: 137-26.5)

FOREX: GBP Continues Grind Higher as EU Trade Deal Nears

Cable the notable performer as the Christmas break approaches up 0.8% at 1.3600 with EURGBP down 0.74% at 0.8964. The markets are in wait-and-see mode as details are being finalised. Reports of an imminent press conference have not been confirmed by newswires. Some betting markets are now pricing a 2020 Trade Deal at 97% with this sentiment being echoed in GBP price action.

Elsewhere G10 ranges remain subdued with the USD index down 0.2%. Aussie and Kiwi are slightly better bid amid broad optimism for an EU-UK deal to be finalised.

Canada Building Permits will be released at 1330GMT but no other major data on the docket.

Expiries for Dec24 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2100(E536mln), $1.2200-20(E1.4bln)

USD/JPY: Y100.20($1.3bln-USD puts), Y102.50($600mln), Y103.75-85($674mln)

GBP/USD: $1.3150(Gbp640mln)

USD/CNY: Cny6.5750($600mln)

EQUITIES: European Stocks See Some Support as Brexit Deal Nears Finish Line

Stocks are mixed on the continent, with German, Italian markets gaining as a Brexit deal nears. UK equities are underperforming as strong pound weighs on the FTSE-100 - which has edged lower by around 0.1%. Financials and real estate trade well, while consumer staples and materials are flat-to-lower.

US stock futures trade with uniform gains - the e-mini S&P is higher by just under 10 points and indicates a higher open on Wall Street this Christmas eve.

COMMODITIES: Precious Metals Lead In Holiday-Thinned Session

- WTI Crude down $0.07 or -0.15% at $48.04

- Natural Gas down $0.05 or -2.03% at $2.556

- Gold spot up $5.09 or +0.27% at $1879.66

- Copper down $0.3 or -0.08% at $355.25

- Silver up $0.28 or +1.08% at $25.8102

- Platinum up $5.28 or +0.52% at $1024.68

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.