-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Plenty of Data, Earnings to Digest

HIGHLIGHTS:

- CAD hits a new multi-year high, 2018 lows in USD/CAD beckon

- Commodity rally continues, Palladium tops $3,000/oz

- Heavy US data slate, with PCE, MNI Chicago Business Barometer due

US TSYS SUMMARY: Off Lows Ahead Of PCE/Income And MNI Chicago PMI

Treasuries have edged higher from Asia-Pac lows, but remain weaker and have stayed well within Weds/Tues' ranges on limited volumes.

- Jun 10-Yr futures (TY) down 2/32 at 131-29.5 (L: 131-26 / H: 132-00), ~240k traded. The 2-Yr yield is up 0.2bps at 0.1643%, 5-Yr is up 0.7bps at 0.8702%, 10-Yr is up 0.9bps at 1.6437%, and 30-Yr is up 0.5bps at 2.3036%.

- Bounce off lows came amid softer-than-expected Chinese PMI data, but not much to report since then, certainly not compared to the price action of the previous two sessions. Softness in equity futures/dollar strength probably helping support Tsys a bit.

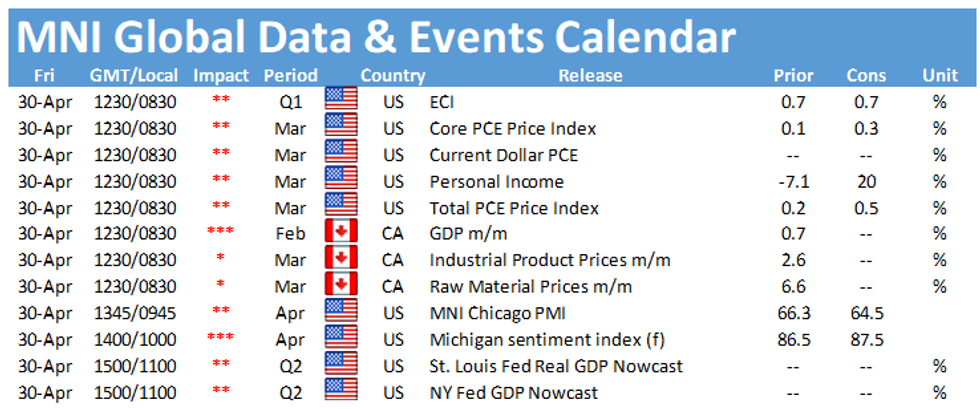

- Data is the focus to close out the week, with 0830ET seeing the release of March personal income/spending, incl the Fed's preferred PCE inflation metric.

- 0945ET sees MNI Chicago PMI, with final UMich Cons Sentiment at 1000ET.

- Dallas Fed's Kaplan speaks at 0945ET.

- No supply; NY Fed buys ~$12.825B 0Y-2.25Y Tsys.

- Month-end is here, but only small extensions seen for Tsys.

EGB/GILT SUMMARY - Holding Firm

European sovereign bonds have traded firmer this morning alongside losses for equities and broad USD strength against G10 FX.

- Gilts opened higher and, despite giving back some of the early gains, remain above yesterday's close.

- Bunds have rallied with yields 1-2bp lower and the curve marginally flatter.

- It is a similar story for BTPs where yields are 1bp lower on the day.

- Preliminary first quarter GDP estimates for the euro area were mixed. France came in significantly stronger, Italy was marginally above consensus, Spain was in line and Germany was worse than expected in Q/Q terms while the annualised estimate was a touch better. The eurozone as a whole was in recession during the first quarter.

- Elsewhere, the Nationwide Property Price index showed an acceleration in UK house price growth in April (7.1% Y/Y vs 5.0% expected).

- The UK DMO sold GBp3.5bn of 1-/3-/6-/month T-bills.

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXM1 169/167.5/166p fly, sold at 18 in 1k

RXM1 170/169ps 1x2, sold at 3 in 3k

RXN1 168.00p, was bought for 25 in 10k

RXU1 169.50/167.50ps vs 175.50c, bought the ps for 2 in 3k

RXU1 172/169.5ps 1x1.5, bought for 50.5 in 2k

2RU1 100.25/100.125 ps vs 100.50/100.625 cs, bought the ps for 1 in 5k

UK:

LZ1 100/100.12/100.25c ladder, sold at flat in 6k

LZ1 99.62p, bought 1.25 in 3k

0LZ1 993.62/99.87cs 1x2 with 99.75/99.87cs 1x2 as a strip, sole the 1s at 4.5 in 3k

2LU1 99.62/99.37ps vs 3LU1 99.12/98.87ps, sold the 2yr at 7 in 5k

2LU1 99.25p bought for 9.5 in 5k

FOREX: CAD Moves From Strength-to-Strength Ahead of GDP

- CAD strength has persisted, with USD/CAD edging lower for the sixth session in eight, helping pressure the pair to its lowest level today since 2018. 1.2251 undercuts as decent support headed into today's Canadian GDP number.

- The USD Index has stabilised after hitting a new multi-month low yesterday, with 90.424 now seen as key support, while the 100-dma at 91.0394 the near-term target.

- Scandi FX is moderating, with NOK & SEK underperforming all others so far Friday. NOK is pulling off recent highs having traded solidly alongside commodities, while SEK has fallen out of favour after the Swedish health ministry pushed back their vaccination target for the country to September 5th from August 15th.

- A raft of US and Canadian data follows Friday, with personal income/spending and PCE numbers as well as the MNI Chicago Business Barometer from the US. Canadian GDP also crosses, with markets expecting a slight moderation in the pace of expansion across February. The speakers slate is very quiet, with just Fed's Kaplan on the docket.

FX OPTIONS: Expiries for Apr30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-60(E687mln), $1.2030(E734mln), $1.2050-65(E749mln), $1.2075(E676mln), $1.2100(E2.1bln-EUR puts), $1.2125(E605mln), $1.2150(E987mln)

- USD/JPY: Y108.50($837mln), Y109.25-30($785mln)

- GBP/USD: $1.3900(Gbp671mln), $1.4000(Gbp560mln-GBP puts), $1.4095-1.4100(Gbp411mln)

- EUR/GBP: Gbp0.8600(E776mln)

- AUD/USD: $0.7790-0.7800(A$553mln-AUD puts)

- USD/CAD: C$1.2400($990mln-USD puts)

- USD/MXN: Mxn19.50($1.46bln), Mxn19.95($500mln-USD calls), Mxn20.05($760mln-USD puts), Mxn20.40($500mln)

Price Signal Summary - Bunds And Gilts Appear Vulnerable

- In the equity space, S&P E-minis maintain a bullish tone. The focus is on 4239.26, 1.764 projection of the Feb 1 - Feb 16 - Mar 4 price swing. Key support is unchanged at 4110.50, Apr 21 low.

- In FX, EURUSD has this week cleared the bear channel resistance drawn off the Jan 6 high. This reinforces the current uptrend and paves the way for strength towards 1.2184 next, Feb 26 high. Initial support is at 1.2056, Apr 28 low. GBPUSD remains below 1.4009, Apr 20 high. A break is required to signal scope for stronger gains. Support to watch is at 1.3824, Apr 22 low. USDCAD resumed its underlying downtrend this week with fresh cycle lows. The focus is on 1.2239, 1.236 projection of Jan 28 - Feb 25 - Feb 26 price swing. The JPY remains vulnerable:

- USDJPY is holding above support at 107.48, Apr 23 low and trendline support drawn off the Jan 6 low remains intact. The focus is on 109.23, 50.0% of the Mar 31 - Apr 23 sell-off.

- EURJPY this week confirmed a resumption of the underlying uptrend. The move higher opens 133.19, the channel top.

- On the commodity front, Gold is consolidating. The outlook is bullish and the focus is on $1805.7, Feb 25 high. Watch support at $1756.2, Apr 29 low. Brent (M1) has traded higher this week. The key bull trigger is $69.73, Mar 8 high WTI (M1) key resistance and bull trigger is at $67.29 - Mar 8 high.

- In the FI space, Bunds (M1) have breached 170.05, 76.4% of the Feb 25 - Mar 25 rally. This opens 169.24, Feb 25 low. Gilts (M1) maintain a weaker tone. The next level to watch is 127.32, Apr 1 low.

EQUITIES: Mixed Earnings Lead Index Futures Lower

- Stocks are mixed across Europe, with the EuroStoxx50 flat. French and Italian stocks are in retreat, while German, Spanish and UK indices march higher.

- In Europe, materials and real estate names are trading softer, while healthcare and communication services trade more favourably.

- US futures are soft, taking profit on the late rally posted Tuesday off the 4,168 low. Index futures are shrugging off support from some solid after-market earnings Thursday, with Amazon higher by 2%. Contrasting with Facebook's solid performance this week, Twitter sank over 10% after their report yesterday.

- Price action so far Friday has seen the e-mini S&P hold inside Thursday's range, which keeps the directional parameters at 4,168 to the downside, while 4,211 - the all time high - remains the target.

COMMODITIES: Palladium Inches North of $3,000/oz For First Time

- The global commodity rally persists Friday, with industrial metals a key beneficiary this morning to boost the spot Palladium price north of $3,000/oz for the first time. This extends the rally to over 25% YTD, as the commodity tide continues to lift all boats.

- Cycle highs have been posted in copper, iron ore, soy, corn, lumber and others this week - with Biden's infrastructure plan, the long-awaited post-pandemic economic recovery and a resurgence in Chinese demand all being cited as behind the recent rally.

- The rally in soft commodities, precious and industrial metals has failed to buoy the oil price this morning, however, with both WTI and Brent crude futures in negative territory ahead of the NYMEX open. nonetheless, WTI holds above $64/bbl, while Brent is in a holding pattern just below the week's high of $68.95/bbl.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.