-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Risk-On Start To The Year

MNI US MARKETS ANALYSIS - Risk-On Start To The Year

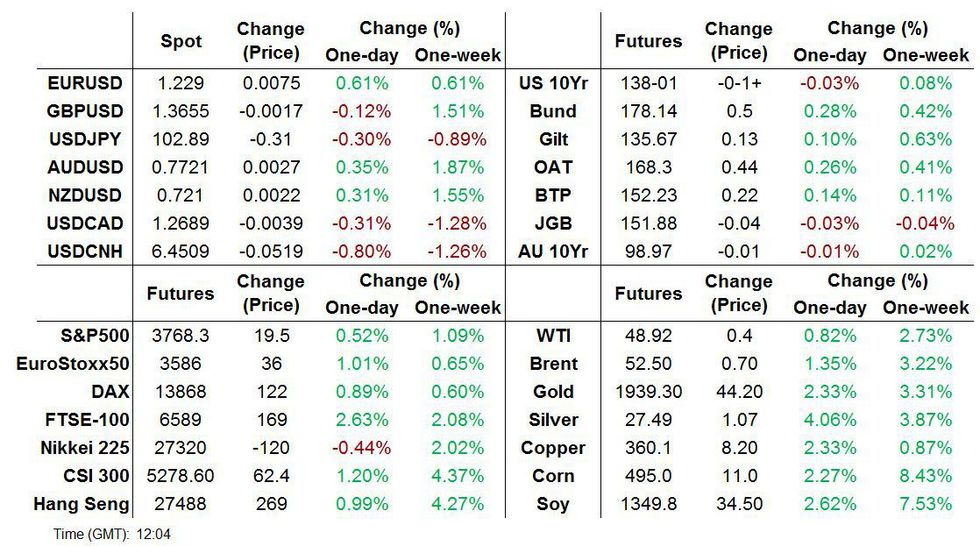

- It has been a broadly risk-on start to the year (equities and commodities higher, dollar weaker)

- The UK has become the first country to roll out the Oxford/AstraZeneca vaccine

- UK ministers continue to hint at the prospect of a further tightening of Covid restrictions

US TSYS SUMMARY: Mixed Start To A Busy Week

2021 trading has begun in mixed fashion, with weakness in Asia-Pac followed by a sharp rebound in the European morning. All in all, a little weaker, with bear steepening in the curve.

- The 2-Yr yield is unchanged at 0.1211%, 5-Yr is up 0.5bps at 0.3655%, 10-Yr is up 1.7bps at 0.9298%, and 30-Yr is up 1.8bps at 1.6629%.

- Mar 10-Yr futures (TY) down 3.5/32 at 137-31 (L: 137-26.5 / H: 138-02) on decent volume (275k).

- Not much rhyme or reason to price action, with Tsy rebound coming alongside rising stocks and a weaker dollar (DXY index hitting a fresh post-2018 low).

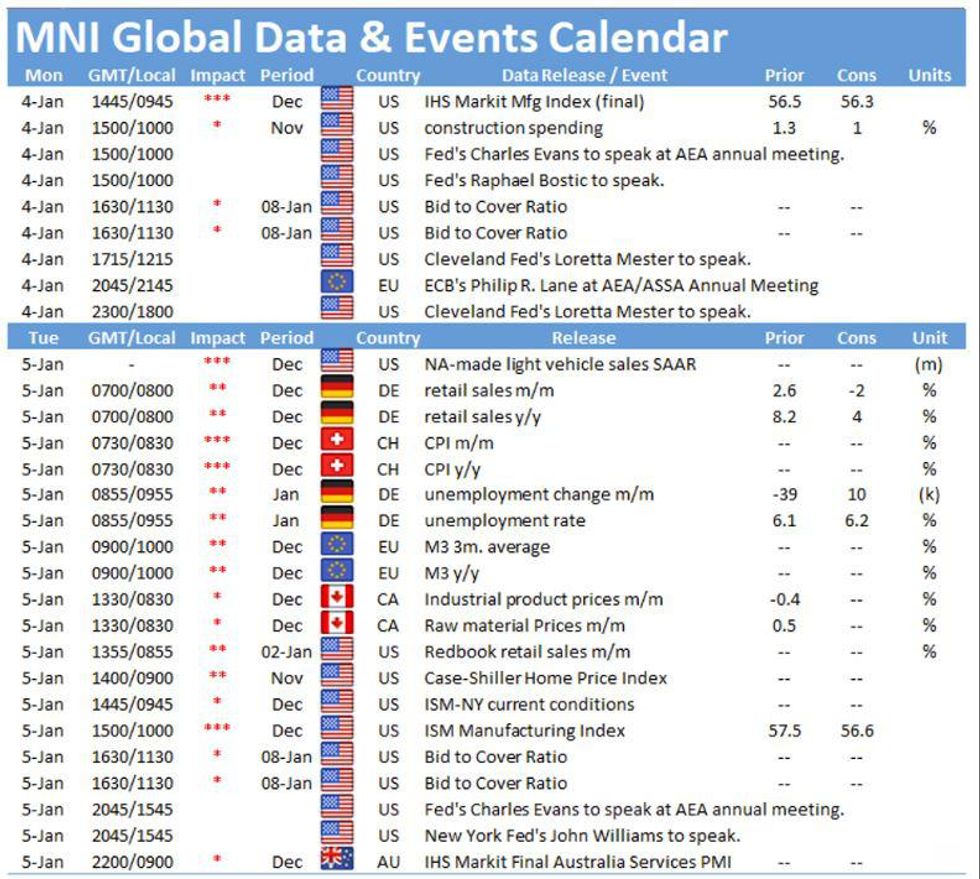

- Fairly limited schedule to start what is going to be a busy week, with Georgia Senate elections Tuesday, and Fed minutes Wednesday among the areas of interest.

- Of note are apparently increasing expectations that the Democrats could win both seats, a scenario whose odds are now even per bookmakers.

- Fed speakers today include Chicago's Evans (1000ET), Atlanta's Bostic (separately also at 1000ET), and Cleveland's Mester (1215ET and 1800ET).

- Final Dec Manuf PMI at 0945ET, Nov Construction spending at 1000ET are the only data points.

- Supply: $105B of 13-/26-week bill sale at 1130ET. NY Fed buys ~$8.825B of 2.25Y-4.5Y Tsys.

EGB/Gilt SUMMARY: Further Lockdown Talk

European govies have broadly rallied this morning alongside a strong start to the year for equities.

- The gilt curve has flattened with the 2s10s spread 5bp narrower on the day.

- Bunds have similarly rallied at the longer end with yields broadly 2-4bp lower across much of the curve.

- The OAT curve has steepened sharply with the 2s30s spread trading down 8bp on the back of the short-end sell off and the longer end firming.

- BTPs have underperformed core EGBs with cash yields ~1bp lower.

- Final UK manufacturing PMI estimate for December was a touch better than the initial reading )57.5 vs 57.3) and slightly weaker for the Eurozone aggregate (55.2 vs 55.5). UK mortgage approvals for November came in above expectations (105.0k vs 83.5k survey).

- UK PM Boris Johnson and Health Secretary Matt Hancock continue to hint at the possibility of tougher social restrictions and potentially another full national lockdown following a surge in coronavirus infections.

FOREX SUMMARY: USD On The Backfoot

USD saw selling continuation throughout the European morning session, on the back of risk on flow, after vaccine hope roll-outs.

- Despite the Spanish PMI miss, which triggered some safe haven buying in Bonds,

- EURUSD tested through intraday high, mainly on the USD weakness.

- EURUSD printed a 1.2301 high.

- Cable tested the figure at 1.3700 (printed 1.3703 high), ahead of next resistance at 1.3712 Low Mar 1, 2018.

- But seeing better selling interest at these levels, and Cable trades circa 1.3680 at the time of typing.

- PM Boris and his ministers are set to announce this week whether the country could be put into another national lockdown.

- Boris noted on Sunday that further measures will be enforced.

- USDJPY lowest since March and testing immediate support at 102.75 1.00 proj of Oct 7 - Nov 6 downleg from Nov 11 high. Did print a 102.71 low.

- While NOK is the best performing currency in G10 versus the Greenback.

- USDNOK trades at the lowest level since June 2019, with support coming at 8.4687 (24/06/19 low)

- Looking ahead, US Mfg PMI is the notable data, but final reading, Speaker front, Fed Evans, Bostic and Mester are scheduled, and for Europe, ECB Lane

- All eyes on US Georgia elections

Expiries for Jan04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100-15(E958mln-EUR puts), $1.2220(E729mln-EUR puts),

$1.2275(E561mln-EUR puts), $1.2430-40(E589mln)

EQUITIES: New Year Starts Happy In U.S., Europe

A strong start in the first day of trading in 2021 in Europe and the U.S., with all sectors in the green. Energy leading, with financials lagging in Europe.

- Asian stock markets closed mixed, with Japan's NIKKEI down 185.79 pts or -0.68% at 27258.38 and the TOPIX down 10.09 pts or -0.56% at 1794.59. China's SHANGHAI closed up 29.889 pts or +0.86% at 3502.958 and the HANG SENG ended 241.68 pts higher or +0.89% at 27472.81.

- European equities are higher, with the German Dax up 166.95 pts or +1.22% at 13827.06, FTSE 100 up 199.42 pts or +3.09% at 6569.82, CAC 40 up 103.15 pts or +1.86% at 5626.03 and Euro Stoxx 50 up 52.32 pts or +1.47% at 3589.65.

- U.S. futures are higher, with the Dow Jones mini up 175 pts or +0.57% at 30671, S&P 500 mini up 22 pts or +0.59% at 3770.75, NASDAQ mini up 63.5 pts or +0.49% at 12948.75.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.