-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US MARKETS ANALYSIS - USD Close to Week's Lows Pre-CPI

Highlights:

- Core CPI seen remaining stubborn while headline inflation ebbs

- JPY backtracks amid positive equity mood

- Fed minutes eyed for FOMC's thoughts on banking instability

US TSYS: Cheaper Ahead Of CPI, FOMC Minutes, Fedspeak and 10Y Supply

- Cash Tsys see a modest bear flattening ahead of a heavy docket with focus on CPI (preview here) before the FOMC minutes plus also 10Y issuance and Fedspeak from ’24 voters landing in between. Despite the sell-off, yields have for the most part remained within yesterday's range.

- 2YY +3.2bp at 4.054%, 5YY +2.8bp at 3.556%, 10YY +2.1bp at 3.447% and 30YY +1.6bp at 3.635%.

- TYM3 trades 2+ ticks lower on the day at 115-09+, close to yesterday’s low of 115-06+ and support at 115-03 (20-day EMA) after which lies 114-18 (Apr 3 low). To the upside lies resistance at 115-31+ (Apr 10 high).

- Data: CPI for March dominates (0830ET) but we also see real average earnings at the same time plus weekly MBA mortgage data (0700ET) and the monthly budget statement for Mar (1400ET).

- Fed: FOMC minutes (1400ET) with Richmond Fed’s Barkin (0900ET) and SF Fed’s Daly (1200ET) landing after CPI earlier in the day.

- Note/bond issuance: US Tsy $32B 10Y Note auction reopen (91282CGM7) – 1300ET

- Bill issuance: US Tsy $36B 17W bill auctions – 1130ET

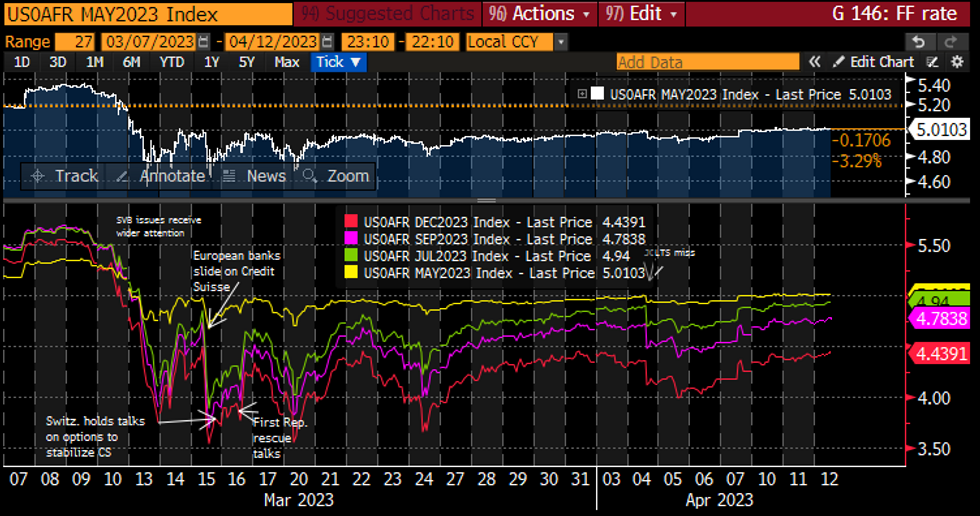

STIR FUTURES: Fed Rate Path Pushing Higher Pre-CPI

- Fed Funds implied rates are little changed for the May 3 FOMC (18bp hike) but have pushed higher further out.

- The peak spills over into June with 21bp of hikes to 5.04% (+2bp), with 22bp of cuts from current levels to 4.61% Nov (+5bp) and 40bp of cuts to 4.43% Dec (+5bp).

- ’24 voters Barkin and Daly speak today ahead of the FOMC minutes. ’23 voters from late yesterday: Harker repeats getting rates above 5% and holding whilst watching data to see if more action needed on inflation, banking strains seem to have calmed down; Kashkari hopeful signs calm is being restored in the bank sector and less optimistic than bond market on inflation outlook.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE

GERMAN AUCTION RESULTS: 30-year Bunds

- Allots E819mln 1.25% Aug-48 Bund, Avg yield 2.33% (Prev. 2.30%), Bid-to-cover 1.92x (Prev. 2.84x)

- Allots E1.228bln 0% Aug-52 Bund, Avg yield 2.31% (Prev. 2.26%), Bid-to-cover 1.09x (Prev. 1.13x)

The 1.25% Aug-48 Bund results were decent with the lowest accepted price above the pre-auction mid-price although the bid-to-offer and bid-to-cover were both lower than seen in February. The 0% Aug-52 Bund auction was technically uncovered again (as in February). The lowest accepted price was also lower than the prevailing mid-price (also as in February). The price of both Bunds on offer today has moved to the lows of the day post-auction and below the lowest accepted price in the auction.

GILT AUCTION RESULTS: 0.125% Mar-39 linker

- UK sells GBP900mln 0.125% Mar-39 linker, Avg yield 0.334% (Prev. 0.070%), Bid-to-cover 2.65x (Prev. 2.46x)

That was a relatively strong linker auction with a solid bid-to-cover of 2.65x and an average price above that seen on the secondary market for the 12 minutes prior to the auction closing time. The price of the 0.125% Mar-39 linker moved higher following the release of the results but has remained lower than the average price achieved at auction.

FOREX: JPY Backtracks Amid Positive Equity Picture

- The JPY is backtracking early Wednesday, taking the place as the weakest currency in G10. Equities are furtively higher, with strength in French stocks tipping the CAC-40 to a fresh alltime high. USD/JPY hit the week's best levels of Y134.05 in Asia-Pac trade and is holding in positive territory ahead of the NY crossover.

- Elsewhere, markets are more muted, with the EUR and USD putting in a mixed performance and largely treading water ahead of the key US inflation release.

- SEK trades firmer against most others in G10, absent any macro drivers, to keep NOK/SEK within range of key support at 0.9823 ahead of the YTD low and bear trigger of 0.9725.

- Focus rests on the US CPI release due at 1330BST/0730ET, with markets on watch for any confirmation that a May 25bps rate hike could be the last of the cycle. Consensus looks for Y/Y CPI to slow to 5.1% from 6.0%, although core is expected to tick higher to 5.6% from 5.5%.

- FOMC minutes are also on the docket, at which markets will look to gauge the impacts of recent banking instability on the potential Fed policy path.

FX OPTIONS: Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900-10(E2.7bln), $1.0940-50(E640mln)

- USD/JPY: Y132.00($732mln), Y132.15-25($863mln), Y134.10-15($1.1bln)

- GBP/USD: $1.2300(Gbp692mln)

- EUR/GBP: Gbp0.8755-70(E480mln), Gbp0.8795-10(E595mln)

- AUD/USD: $0.6700(A$545mln), $0.6750(A$1.2bln)

- USD/CAD: C$1.3800($582mln)

EQUITIES: Eurostoxx Futures Eye Gains Above 4300.00 Level After Trading to Fresh Trend High Tuesday

- Eurostoxx 50 futures maintained a firmer tone Tuesday and the contract traded to a fresh trend high of 4299.00. Price has recently breached resistance at 4268.00, the Mar 6 high and a key hurdle for bulls. The break of this level strengthens bullish conditions with sights on gains above 4300.00. Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4190.60, the 20-day EMA.

- S&P E-minis remain in an uptrend and the contract is trading closer to its early April highs. Price has recently breached resistance at 4119.50, Mar 6 high, reinforcing a bullish theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4053.89, the 50-day EMA.

COMMODITIES: WTI Futures Briefly Test Above April Highs

- WTI futures remain in a bull cycle and last week’s gain strengthened this current condition. The contract touched a high of $81.81 on Apr 4, above key resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and a gap low on the daily chart. A pullback, if seen, would be considered corrective.

- Trend conditions in Gold remain bullish and last week’s resumption of the uptrend reinforces current conditions - the yellow metal cleared former resistance at 2009.7, the Mar 20 high, to post fresh YTD highs and signal scope for a climb towards $2034.0 next, a Fibonacci projection. On the downside, key support has been defined at $1934.3, the Mar 22 low - a break would highlight a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 12/04/2023 | 1230/0830 | *** |  | US | CPI |

| 12/04/2023 | 1230/1430 |  | EU | ECB de Guindos at Asociacion para el Progreso de Direccion Event | |

| 12/04/2023 | 1300/1400 |  | UK | BOE Bailey Remarks at Institute of International Finance | |

| 12/04/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 12/04/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/04/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/04/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/04/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 12/04/2023 | 1915/2015 |  | UK | BOE Bailey Speaks at IMF Governor Talks | |

| 13/04/2023 | 0130/1130 | *** |  | AU | Labor force survey |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.