-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI US Open: ECB Mulls Its December Options

EXECUTIVE SUMMARY:

- ECB TO DISCUSS "INTENSITY" OF ASSET PURCHASES: SCHNABEL

- KEY ECB DECISION IS WHICH STIMULUS TOOLS TO USE: REHN

- ECB'S MULLER EYES TLTRO BOOST FOR ECONOMY

- CHINA OFFERS BIDEN CONGRATULATIONS ON VOTE OUTCOME

- ITALY TO RELEASE GREEN BOND FRAMEWORK IN COMING WEEKS: PUBLIC DEBT CHIEF IACOVONI

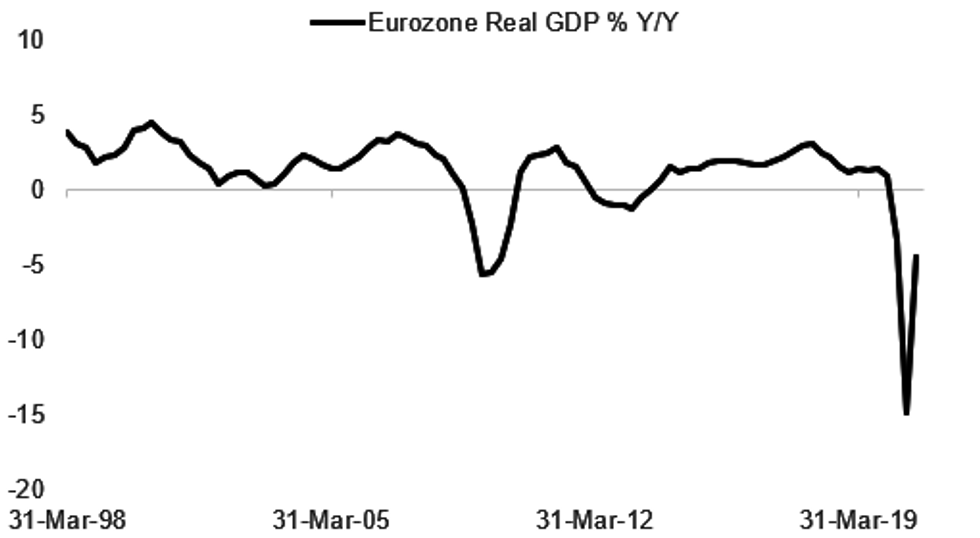

Fig.1: Eurozone Flash Q3 GDP Slightly Weaker Than Expected

Eurostat, BBG, MNI

Eurostat, BBG, MNI

NEWS:

ECB (BBG/CNBC): "We have to ask what is the intensity of purchases needed to preserve these historically low financial conditions," European Central Bank Executive Board member Isabel Schnabel says in interview with CNBC. "We have to look at the effectiveness of the measures in the current circumstances and we have to look at the side effects" "There are reasons why we haven't reduced interest rates in the past and now we have to check whether these reasons are still valid"

ECB (BBG): "For me the context for the forthcoming decision in December is not whether we will decide on further additional accommodation in monetary policy, it is rather which instruments, in which scale and duration, will best serve the purpose of supporting the European economy though the second wave, which we are now suffering from," ECB Governing Council member Olli Rehn says at a press conference in Helsinki. Asked about some countries' hesitance to take loans under EU recovery fund: "It is a matter for the member states and the European Union to see which kind of mechanisms best serve the purpose of fiscal policy".

ECB: TLTROs should be at the heart of the European Central Bank's next stimulus round to try and ensure lending gets through to the private sector, Estonian central bank governor Madis Muller told Bloomberg. Muller said the ECB's PEPP program was the right tool for the crisis back in March, when market dislocation was an issue but any announcement in December probably needed a combination of different measures, including an enhanced lending scheme.

CHINA/US: China has congratulated Joe Biden and Kamala Harris on the outcome of the U.S. presidential election, although understanding the result must be confirmed by due process, said Wang Wenbin, spokesman of the Ministry of Foreign Affairs at a regular press briefing on Friday. "We have been following the reaction of the U.S. and the international community to the U.S. presidential elections, and we respect the choice of the American people," said Wang, when asked to comment that many foreign leaders and heads of international organization had congratulated Biden on his victory.

BOJ (MNI INTERVIEW): The Bank of Japan should reduce its purchases of Exchange Traded Funds to near zero, as it has no impact on helping hit the 2% price target and there is no need to stabilize financial markets at the current time, a former BOJ executive director told MNI this week. For full article contact sales@marketnews.com

ITALY/EUROZONE ISSUANCE (BBG): Italy will release a green bond framework in a few weeks, and "I am confident that we will be in this market very soon," Davide Iacovoni, Head of Public Debt for Italy's Finance Ministry, says in an interview with Bloomberg Television. Italy's dollar borrowing costs is 15-20bps when looking at the dollar bonds in euro terms. Italy can't exclude issuance in other currencies, although it isn't planning a yuan issuance for time being.

EU COMMISSION: Commission President Ursula von der Leyen addressing the Riga Conference speaks of the future of EU-US relations. "Trustful EU-US cooperation must be the backbone of a new global alliance. EUhas a lot to contribute. But we need to develop more strength in security. Weshould invest in our capabilities & in cooperation with NATO."* The win for Joe Biden in the US presidential election is likely to seeWashington mend relations with Brussels after four years of deteriorationunder President Trump. However, if Brussels believes the relationship will be reset to that ofpre-Trump administrations it may be mistaken. Trump's hardline stance on EU nations paying their expected proportion of national GDP on defence spending remains a popular position in the US, as was the incumbent's 'America first' policies on trade relations, which saw an escalating trade spat over aeroplane tariffs between the US and the EU. There is no guarantee that the incoming Biden administration will immediately change tack on either of these issues.

UK (BBG): Transport Secretary Grant Shapps says arrangements are in place to ensure coronavirus vaccines aren't held up at the border after the U.K. leaves the EU single market at the end of the year. Shapps tells BBC in interview work has been done to ensure supply is not interrupted. Comments come after Business Secretary Alok Sharma declined three times to answer questions about the supply of vaccine being manufactured in Belgium and Germany.

CHINA: The space for fiscal and monetary policy in China is shrinking due to the high debt level, Lou Jiwei, former finance minister, told the 11th Caixin Summit Friday adding that the concern is that the global economy is far from recovery while asset prices are already high. China's central bank should consider withdrawing its easy policy at a gradual pace now, but fiscal policy will still be supportive next year, Lou added.

USD: It would be good to find a wider and more solidified method of providing dollar support to an extended list of global central banks in the times of market stress, Agustin Carstens, the General Manager at the Bank for International Settlements said Friday. However, noting that the Federal Reserve were the back stop for such facilities, he accepted there were political restrictions on such a move.

DATA:

MNI: EZ Q3 FLASH GDP +12.6% Q/Q SA, -4.4% Y/Y WDA

EZ SEP SA TRADE BALANCE +EUR24.0 BN; AUG +EUR21.0 BN

FIXED INCOME: Comments from Italian Debt Director Drive the Euro

Early bull flattening seen in core fixed income markets has reversed in Treasuries and Bunds and to a lesser extent in gilts.

- Director General at the MEF Iacovoni said in a Bloomberg interview that it is currently 15-20bp cheaper to fund in dollars than euros in a move that has helped EURUSD move to its highs of the day (effectively pointing out how undervalued the euro is versus the dollar on this basis).

- There have been some interesting comments from speakers this morning. ECB Executive Board member Schnabel said earlier today that the ECB is facing a more difficult situation in March and that the ECB would need to "discuss the intensity of asset purchases". Muller, Governor of the Estonian Central Bank said that the second wave of the virus was probably stronger than expected while Spain's de Cos has said that it is important to maintain flexibility in the purchase programmes.

- There are a number of other BOE and ECB speakers scheduled today as well as Bullard. Focus will remain on these and ongoing Brexit negotiations.

- TY1 futures are down -0-0+ today at 138-03+ with 10y UST yields up 0.9bp at 0.891% and 2y yields down -0.2bp at 0.176%.

- Bund futures are up 0.09 today at 174.83 with 10y Bund yields down -0.3bp at -0.540% and Schatz yields down -0.1bp at -0.730%.

- Gilt futures are up 0.17 today at 134.71 with 10y yields down -0.5bp at 0.342% and 2y yields up 1.1bp at -0.32%.

FOREX: Sterling Staging Tepid Bounce So Far

Comments from the Italian finance ministry drew some attention in early European hours, after the Director General signalled that it's currently 15-20bps cheaper to fund in USD vs. EUR, which helped buoy EUR/USD through yesterday's highs of 1.1823 (effectively pointing out how undervalued the euro is versus the dollar on this basis).

- There's been plenty more EUR-centric commentary, with ECB's Schnabel indicating that December's 'recalibration' of policy will likely include a discussion surrounding "the intensity of asset purchases". EUR is outperforming slightly, rising against most others in G10.

- After several sessions of underperformance, GBP is bouncing in early trade off the weekly low printed late yesterday at 1.3106. Markets may be taking the view that the departure of key Johnson aide Cummings could smooth the path to a free trade deal in the ongoing Brexit negotiations.

- US PPI and Uni. of Michigan releases are the data highlights Friday. Speaker slate includes ECB's Rehn, Fed's Williams & Bullard and BoE's Tenreyro, Cunliffe & Bailey.

EQUITIES: Bouncing Off Overnight Lows

Global equities have bounced from overnight lows, with most European and US indices/futures higher (and unlike Thursday, not as much of an outperformance by tech stocks though that sector is outperforming).

- Asian stocks closed weaker, with Japan's NIKKEI down 135.01 pts or -0.53% at 25385.87 and the TOPIX down 23.01 pts or -1.33% at 1703.22. China's SHANGHAI closed down 28.575 pts or -0.86% at 3310.104 and the HANG SENG ended 12.52 pts lower or -0.05% at 26156.86.

- European equities are mixed, with the German Dax up 55.14 pts or +0.42% at 13035.17, FTSE 100 down 5.38 pts or -0.08% at 6301.11, CAC 40 up 26.03 pts or +0.49% at 5362.75 and Euro Stoxx 50 up 16.92 pts or +0.49% at 3429.33.

- U.S. futures are up, with the Dow Jones mini up 242 pts or +0.83% at 29234, S&P 500 mini up 31.5 pts or +0.89% at 3564, NASDAQ mini up 101.5 pts or +0.86% at 11921.5.

COMMODITIES: Oil Continues To Slide

Oil continues to fade after Thursday's surprise build of DoE inventories, but WTI still above $40.00/bbl (support at $39.41).

- WTI Crude down $0.35 or -0.85% at $40.69

- Natural Gas up $0 or +1.02% at $2.973

- Gold spot up $2.08 or +0.11% at $1878.9

- Copper up $1.7 or +0.54% at $315.5

- Silver up $0.03 or +0.14% at $24.2732

- Platinum up $8.6 or +0.97% at $888.83

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.