-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Retail Sales Seen Dipping Again In June

EXECUTIVE SUMMARY:

- FINAL READING CONFIRMS EUROZONE INFLATION SLOWED IN JUNE

- U.S. RETAIL SALES SEEN DECLINING AGAIN IN JUNE

- KURODA DETAILS BOJ'S CLIMATE LENDING PLANS

- RBNZ TO HIKE TO 1.75% BY END-2022 (MNI INTERVIEW)

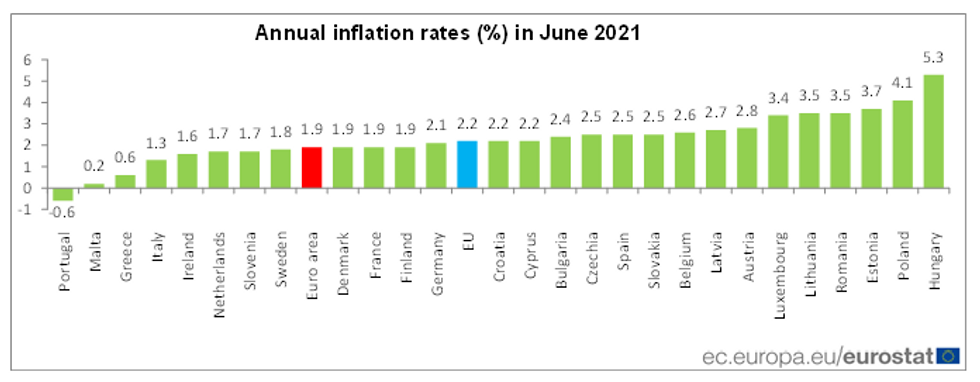

Fig. 1: June Eurozone Inflation Figures

NEWS:

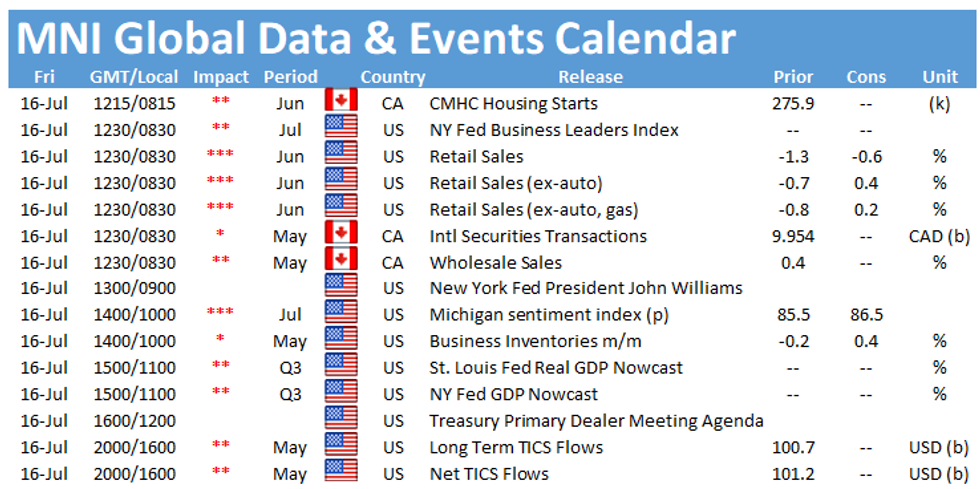

U.S. RETAIL SALES (MNI DATA): U.S. retail sales likely dipped again in June as spending slowed further after a stimulus-fueled surge in the spring. Total sales should fall 0.3% after dropping 1.3% in May, according to Bloomberg. That should mostly be driven by a decline in vehicle sales, analysts say. Excluding car sales, retail sales should increase 0.4%, according to the Bloomberg consensus. Excluding both vehicle and gas station sales, retail sales are expected to increase 0.5% following May's 0.8% decline.

U.K.: Just a quick note that the Lord Economic Affairs Committee's report on QE was published overnight with the title "Quantitative easing: a dangerous addiction?" - which gives away the punchline of the tone of the report. The EAC's inquiry states that there is not enough scrutiny of QE including in parliament and notes that credibility of the Bank could worsen and "harm its ability to control inflation and maintain financial stability" if "perceptions continue to grow that the Bank is using QE mainly to finance the Government's spending priorities". The full report is available here. Note that our policy team conducted an exclusive interview with Lord Bridges, which was also published overnight and is available here.

U.K. (BBG): U.K. Office for National Statistics releases data on adherence to coronavirus rules and about social attitudes to the virus and restrictions to contain it.89% of those who had contact with a Covid-19 positive person fully adhered to self isolation requirements in the week through July 364% of adults plan to continue wearing masks in shops and on public transport once restrictions lift on July 1957% of adults say they're worried about plans to ease Covid restrictions.

RBNZ (MNI EXCLUSIVE): The Reserve Bank of New Zealand is likely to hike rates in August and possibly in November as well, tightening by up to 50 basis points this year and to 1.75% by the end of 2022 after rising inflation expectations robbed it of the opportunity for a slow and steady tightening, former senior RBNZ economist Sharon Zollner told MNI. For more details please contact sales@marketnews.com

HONG KONG/CHINA (BBG): China plans to exempt companies going public in Hong Kong from first seeking the approval of the country's cybersecurity regulator, removing one hurdle for businesses that list in the Asian financial hub instead of the U.S., according to people familiar with the matter.The exemption was outlined by officials in recent meetings with bankers, after a government statement on Saturday announcing a new review process for foreign listings prompted questions over whether it would apply to Hong Kong, the people said, asking not to be identified as the discussions are private.

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday that the scale of new climate change measures may be sizeable as major commercial banks are considering large scale projects. Kuroda told reporters that the BOJ "will decide on the scale of new measures after further examining requests by commercial banks." On Friday, the BOJ, announced the outline of new measures to support financial institutions efforts to address climate change issues, but there were no numbers yet available as to the scale of support.

DATA:

EUROZONE DATA: Inflation Slowed in June

EZ JUN FINAL HICP +0.3% M/M, +1.9% Y/Y; MAY +2.0% Y/Y

EZ JUN FINAL CORE HICP +0.3% M/M; +0.9% Y/Y; MAY +1.0% Y/Y

- Headline EZ inflation slipped 0.1pp in Jun to 1.9%, confirming the flash estimate and coming in line with market expectations.

- The headline inflation rate dipped below the ECB's target after recording the first reading above it since October 2018.

- Core inflation ticked down to 0.9% in Jun, after rising to 1.0% in May.

- Energy inflation was again the main driver of inflation, adding 1.16pp to CPI growth, despite a small deceleration to 12.6% in Jun.

- Food, alcohol and tobacco prices remained at May's level of 0.5% in Jun, while non-energy industrial accelerated to 1.2%.

- Prices for services slowed to 0.7% in Jun, after rising to 1.1% in the previous month.

- Among the member states, Portugal (-0.6%), Malta (0.2%) and Greece (0.6%) saw the lowest inflation rates, while Estonia (3.7%), Lithuania (+3.5%) and Luxembourg (+3.4%) recorded the highest annual rates.

Source: Eurostat

MNI: EZ MAY SA TRADE BALANCE +EUR9.4 BN; APR +EUR13.4 BN

FIXED INCOME: Unexplained minor divergence

Bunds and gilts are higher on the day, but Treasuries lower. All are within yesterday's trading range but there is little in the way of explanation for the divergences across the Atlantic.

- In Europe, there seems to be focus on the delta variant and increasing Covid-19 cases across the region, with peripheral spreads generally widening a bit too

- The main focus for the day ahead will be the release of US retail sales data for June while there will will also be attention paid to Michigan inflation expectations data.

- TY1 futures are down -0-7 today at 133-18+ with 10y UST yields up 3.0bp at 1.330% and 2y yields up 0.8bp at 0.233%.

- Bund futures are up 0.20 today at 174.78 with 10y Bund yields down -0.9bp at -0.344% and Schatz yields down -0.4bp at -0.686%.

- Gilt futures are up 0.24 today at 128.90 with 10y yields down -1.6bp at 0.647% and 2y yields down -1.2bp at 0.128%.

FX SUMMARY- Busy GBP

- USD stays mixed since the cash Govie open.

- The standout overnight has been the Kiwi, up now 0.50%, but just off its best levels, after the New Zealand second quarter inflation broke through the CB's range.

- This saw Westpac changing their calls, to a punchy three 25bps hikes this year (August, October, November).

- Initial upside resistance in NZDUSD is seen at 0.7045.

- Most of the morning action was in the Pound, with another round of selling hitting the Pound, and Cable traded below 1.3800, Tuesday's low.

- Delta variant spike and a mess with the NHS Covid app, is weighted on the British Pound, with the country set to fully re-open on the 19th.

- Desk reported some demand below 1.3800, and Cable faded all the early losses to trade at session high 1.3862.

- There was no clear catalyst, but market participants still favour fading the bid, and we now trade at 1.3831.

- Looking ahead, US Retail sales in the notable data. US Fed Williams (Voter, leaning Dove) is the scheduled speaker.

- At 12.30BST/07.30ET: The President participates in the Asia-Pacific Economic Cooperation Leaders' Virtual Retreat,

EQUITIES: US Futures Clawing Back Thursday's Losses

- Asian equities closed mostly lower, with Japan's NIKKEI down 276.01 pts or -0.98% at 28003.08 and the TOPIX down 7.42 pts or -0.38% at 1932.19. China's SHANGHAI closed down 25.286 pts or -0.71% at 3539.304 and the HANG SENG ended 8.41 pts higher or +0.03% at 28004.68.

- European equities are a little higher, with the German Dax up 64.35 pts or +0.41% at 15669.77, FTSE 100 up 34 pts or +0.48% at 7045.52, CAC 40 up 3.65 pts or +0.06% at 6520.45 and Euro Stoxx 50 up 8.85 pts or +0.22% at 4067.82.

- U.S. futures are up slightly as well, with the Dow Jones mini up 65 pts or +0.19% at 34929, S&P 500 mini up 6.75 pts or +0.16% at 4358.75, NASDAQ mini up 16.25 pts or +0.11% at 14803.75.

COMMODITIES: Oil Gains, But Still Headed For Weekly Losses

- WTI Crude up $0.42 or +0.59% at $71.57

- Natural Gas down $0.01 or -0.33% at $3.588

- Gold spot down $6.48 or -0.35% at $1822.35

- Copper up $0.8 or +0.19% at $431.3

- Silver down $0.15 or -0.59% at $26.1504

- Platinum down $5.29 or -0.46% at $1134.55

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.