-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Big Week Ahead For Fed, BoE, RBA

EXECUTIVE SUMMARY:

- EU GAS PRICES SURGE AS RUSSIAN FLOWS REVERSE

- JAPAN'S KISHIDA PLANS STIMULUS PACKAGE AFTER MAJORITY WIN

- MNI RBA PREVIEW: GUIDANCE ADJUSTMENTS INBOUND

- BARCLAYS CEO STALEY TO STEP DOWN AMID EPSTEIN PROBE

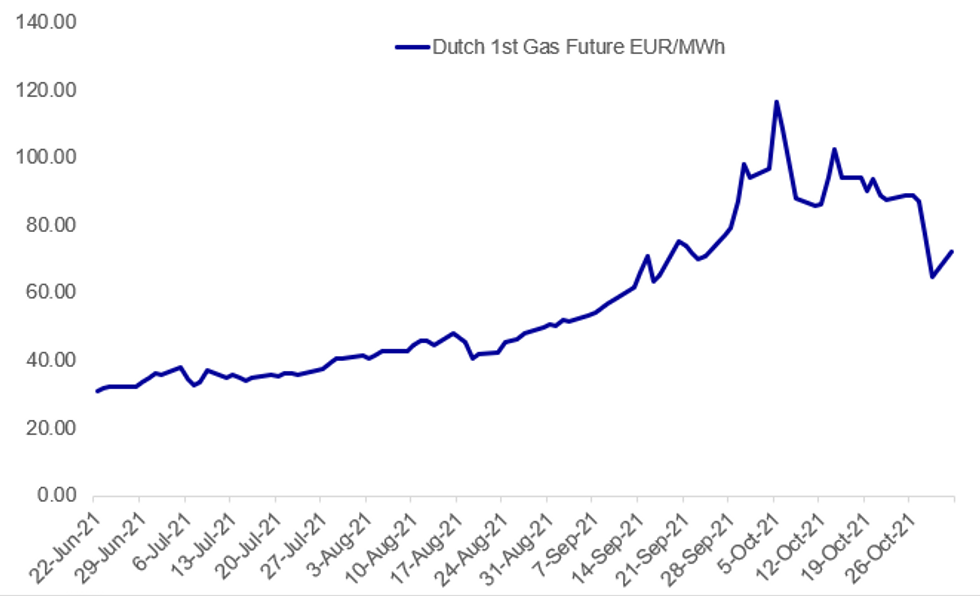

Fig. 1: European Gas Prices Rising Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE / ENERGY (BBG): European gas prices surged after Russian flows into Germany via a key pipeline dropped to zero and reversed direction over the weekend. Russian natural gas shipments entering Germany's Mallnow compressor station dropped to zero on Saturday, according to data from grid operator Gascade. The Yamal-Europe pipeline was instead sending gas eastward from Germany to Poland, which was still receiving some Russian gas, albeit at a lower rate. Shipments through Yamal-Europe pipeline, one of several routes Gazprom PJSC uses to deliver fuel to the region, were already expected to be capped this month after the Russian gas giant only booked 35% of the monthly capacity offered at Mallnow. The reverse flows, however, left traders scratching their heads as European countries are hungry for gas as the winter approaches.

JAPAN: Japan's Liberal Democratic Party headed by Fumio Kishida got 261 seats out of 465 seats by losing 12 seats at the Sunday's election but the LDP secured a sole majority in the lower house, local media reported on Monday. Prime Minister Kishida will rush to restart the economy with stimulus spending plans to be unveiled as early as this month while preparing for the next surge in COVID-19 infections. The prime minister is considering resumption of a domestic travel subsidy programme with some modifications and promised to compile a supplementary budget by the end of this year. The coalition including partner Komeito got 293 seats compared to 172 seats for the opposition, meaning that the ruling party (LDP and New Komeito) gained the two thirds majority needed to propose constitutional amendments.

BARCLAYS (BBG): Barclays Plc Chief Executive Officer Jes Staley is stepping down amid a U.K. regulatory probe into how he characterized his ties to the financier and sex offender Jeffrey Epstein.Staley, 64, is leaving Monday, according to a statement. C.S. Venkatakrishnan, who was promoted last year to run the Barclays markets division and was previously chief risk officer, will replace him as CEO.C.S. Venkatakrishnan The bank was made aware on Friday night of the preliminary conclusions of regulators "into Mr. Staley's characterisation to Barclays of his relationship with the late Mr. Jeffrey Epstein and the subsequent description of that relationship in Barclays' response to the FCA," Barclays said in the statement. "In view of those conclusions, and Mr. Staley's intention to contest them, the board and Mr. Staley have agreed that he will step down from his role as group chief executive and as a director of Barclays."

CHINA MACRO (OVERNIGHT - BBG): China's economy showed signs of further weakness in October as power shortages and surging commodity prices weighed on manufacturing, while strict Covid controls put a brake on holiday spending.The official manufacturing purchasing managers' index fell to 49.2, the National Bureau of Statistics said Sunday, the second month it was below the key 50-mark that signals a contraction in production. The non-manufacturing gauge, which measures activity in the construction and services sectors, dropped to 52.4, below the consensus forecast.

COVID (BBG): More than 5 million people worldwide have died from Covid-19 less than two years after the novel pathogen was first documented, despite the arrival of vaccines that have slashed fatality rates across the globe.The latest 1 million recorded deaths came slower than the previous two. It took more than 110 days to go from 4 million deaths to 5 million, compared to less than 90 days each to reach the 3- and 4-million marks. The rate has returned to what was seen during the first year of the pandemic, when the virus was still taking hold.

CREDIT SUISSE (BBG): Credit Suisse Group AG said it will give investors a long-awaited update on strategy later this week, as the Swiss lender seeks to map out its future direction after the Archegos Capital Management and Greensill hits.The bank will hold an investor day alongside third-quarter results on Nov. 4, according to a statement on Monday. It will take place in London and be led by Chairman Antonio Horta-Osorio and Chief Executive Officer Thomas Gottstein, as well as other members of the executive board.

MNI RBA PREVIEW: The well-documented surge in front end ACGB yields over the last week, coupled with, and partially resulting from, the RBA's inaction when it came to enforcing its 0.10% yield target via purchases of ACGB Apr-24, means that consensus now looks for the RBA to remove its ACGB Apr-24 yield target at the end of Tuesday's monetary policy meeting, with the Bank set to drop yield targeting mechanisms all together. Full preview here

DATA:

UK DATA: Manufacturing PMI revised up 0.1 point

- Manufacturing PMI for October revised up 0.1 point to 57.8.

FIXED INCOME: Risk-on start to the week

- Risk-on start to the week with US/European equity futures moving higher while core government bonds move lower.

- There has been some divergence in STIR markets this morning with the short sterling and Eurodollar strips shifting lower but the Euribor strip shifting higher.

- With parts of Europe out this morning for All Saints Day, the focus is on the final print of the UK PMI and the US ISM manufacturing.

- It's a busy week for central banks with the Fed and the BoE headlining.

- TY1 futures are down -0-6+ today at 130-16 with 10y UST yields up 3.1bp at 1.586% and 2y yields up 1.3bp at 0.512%.

- Bund futures are down -0.09 today at 168.03 with 10y Bund yields up 1.8bp at -0.89% and Schatz yields down -0.9bp at -0.624%.

- Gilt futures are down -0.37 today at 124.55 with 10y yields up 5.2bp at 1.084% and 2y yields up 2.7bp at 0.728%.

FOREX: The Dollar pares some gains

- USD trades more mixed against G10, after the currency was outperforming across the board in the early European session, the dollar is now up 0.25% against the Yen, and down 0.22% versus the NOK.

- The bid in Equities has somewhat been the driver in the USD pullbacks.

- EUR is mostly on the front foot, up in G10s, albeit still struggling, a touch, trading in the red against the Scandis, NOK and SEK.

- Some pressure on the British Pound this morning, EURGBP is through initial resistance at 0.8476 High Oct 26, and next upside level is now seen at 0.8508 50-day EMA.

- EURCHF is off the lows, and market participants are keeping a close eye on the 2020 low at 1.05075, also the lowest level since July 2015.

- EURCHF is now at 1.05911.

- Looking ahead, UK OBR and Rishi Sunak testify.

- Out of the US, Manufacturing PMI will be final reading, we also get ISM manufacturing and price paid.

- Attention is squarely on the Fed and the BoE for G7 this week, with both Central Banks expected to stay unchanged.

EQUITIES: French Stocks Leading Early Gains

- Asian markets closed mixed, with Japan's NIKKEI up 754.39 pts or +2.61% at 29647.08 and the TOPIX up 43.54 pts or +2.18% at 2044.72. China's SHANGHAI closed down 2.857 pts or -0.08% at 3544.479 and the HANG SENG ended 222.92 pts lower or -0.88% at 25154.32

- European equities are higher, with the German Dax up 131.52 pts or +0.84% at 15821.3, FTSE 100 up 31.98 pts or +0.44% at 7269.9, CAC 40 up 61.18 pts or +0.9% at 6892 and Euro Stoxx 50 up 35.04 pts or +0.82% at 4285.78.

- U.S. futures are up a little, with the Dow Jones mini up 134 pts or +0.38% at 35838, S&P 500 mini up 16.5 pts or +0.36% at 4613.75, NASDAQ mini up 58.25 pts or +0.37% at 15896.75.

COMMODITIES: Copper Underperforming

- WTI Crude down $0.11 or -0.13% at $83.47

- Natural Gas down $0 or -0.02% at $5.425

- Gold spot unch at $1783.51

- Copper down $2.3 or -0.53% at $434.5

- Silver down $0.1 or -0.41% at $23.8107

- Platinum up $10.14 or +0.99% at $1032.57

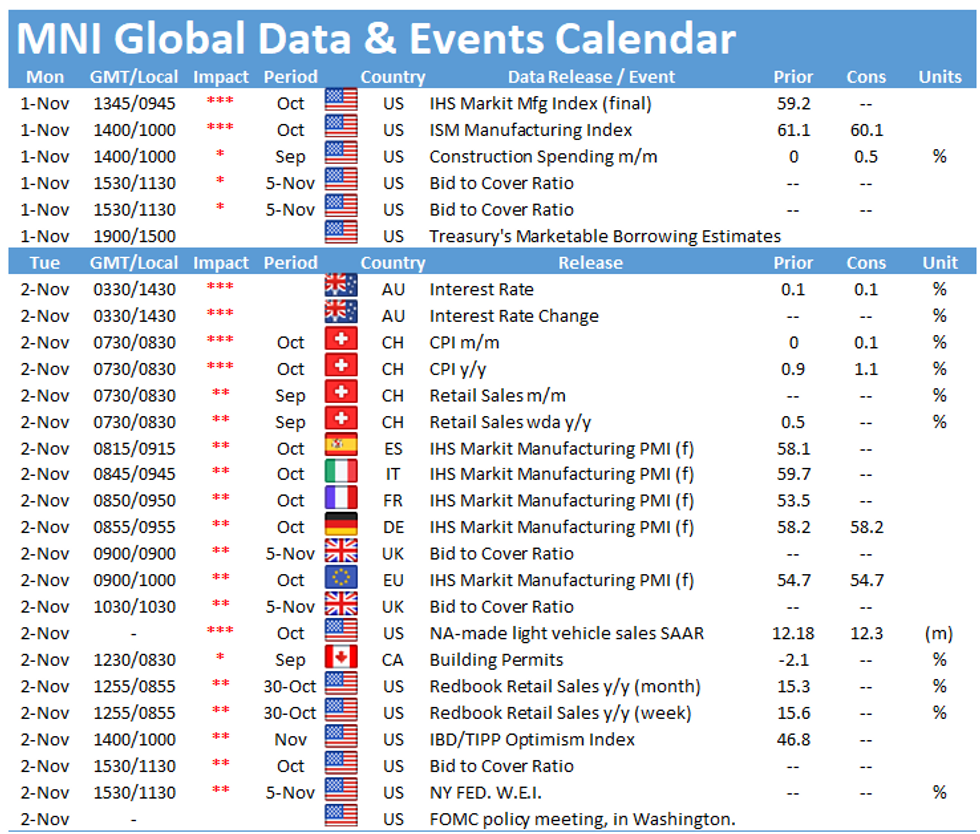

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.