-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Equity Gains Continue

EXECUTIVE SUMMARY:

- OPEC+ SET TO BOOST SUPPLY AGAIN

- S&P FUTURES POINT TO FRESH ALL-TIME HIGH

- ITALY PARLIAMENT TO BEGIN VOTING FOR NEW HEAD OF STATE ON JAN 24

- CHINA TO EXPAND CROSS-BORDER TRADE AND INVESTMENT IN PILOT ZONES

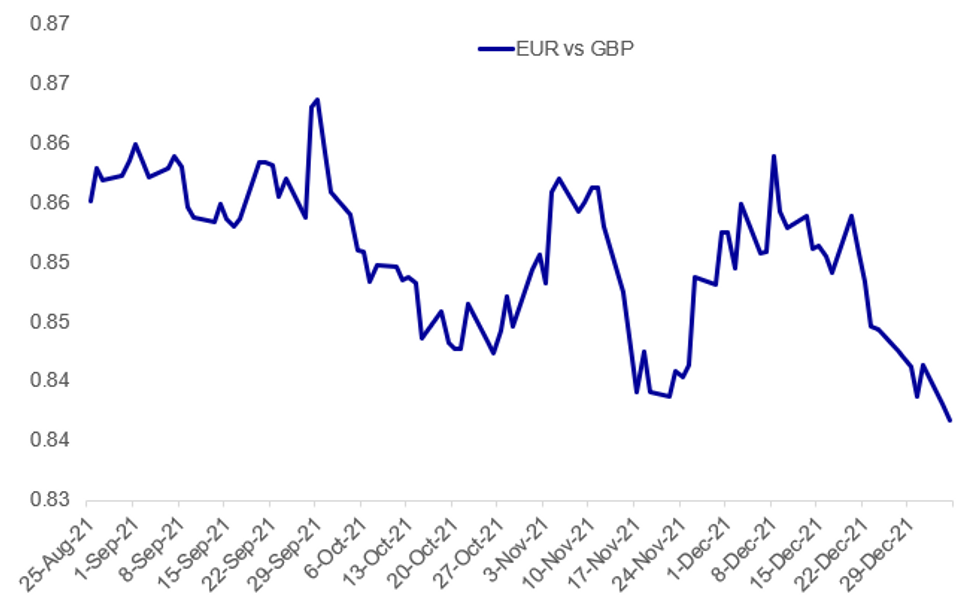

Fig. 1: Sterling Starts 2022 On The Front Foot

Source: BBG, MNI

Source: BBG, MNI

NEWS:

OIL / OPEC+ (BBG): OPEC and its allies are poised to revive more halted oil production when they meet on Tuesday after predicting a tighter outlook for global markets.The 23-nation alliance led by Saudi Arabia and Russia is on track to ratify another modest output revival of 400,000 barrels a day, restoring supplies shuttered during the pandemic, delegates said. At a preliminary meeting on Monday, the group’s analysts cut estimates for the surplus expected in the first quarter, predicting weaker supply growth from its rivals. The Organization of Petroleum Exporting Countries and its partners have restarted about two-thirds of the production they halted in 2020, and are seeking to drip-feed the remainder at a pace that will satisfy the recovery in fuel consumption.

ITALY POLITICS (RTRS): The Italian parliament will convene on Jan. 24 to begin voting for a new head of state to replace the outgoing Sergio Mattarella, the chief of the lower house of parliament ruled on Tuesday. The election of a new president of the republic may have major repercussions for the future of Prime Minister Mario Draghi's government, which is trying to contain a wave of COVID-19 infections. Draghi has made clear he would like to become president, bringing to an end his 11-month old government and leaving the country with the choice of either installing a new premier or holding fresh elections a year ahead of schedule. However, there is no guarantee the 74-year-old former European Central Bank chief will get the job. The first choice of Italy's centre-right parties is the 85-year-old four-times prime minister Silvio Berlusconi.

CHINA (RTRS): China's foreign exchange regulator said on Tuesday it will relax cross-border trade and investment rules in several domestic pilot zones, while stepping up risk control over capital flows. Companies in the pilot zones - in Shanghai, Guangdong, Hainan and Zhejiang - will get more freedom to borrow money from overseas, and to experiment with cross-border asset transfer businesses, the State Administration of Foreign Exchange (SAFE) said on its website.

EUROPE ENERGY (BBG): Natural gas surged for a second day in Europe as top supplier Russia cut flows further at the start of the year. Power prices advanced.Benchmark European gas jumped as much as 10%, extending Monday’s 14% rally. Russian supplies via Ukraine are set to remain constrained a second day after dropping to the lowest since February on Monday. The key Yamal-Europe pipeline is also operating in reverse with flows moving from Germany to Poland for a 15th day.

UKRAINE/RUSSIA (BBG): Russia reinforced front-line military positions in occupied areas of the Donetsk and Luhansk regions by adding personnel and weapons during the New Year holidays, the Ukrainian intelligence service said Tuesday in an e-mailed statement. Ukraine also said additional intelligence units and snipers were deployed along the contact line, and that artillery drills in occupied Donbas were being conducted under the command of Russian military officers.

UK DATA (BBG): British consumers took on the most debt since July 2020 in the runup to Christmas, with a surge in borrowing on credit cards.Consumers added 1.2 billion pounds ($1.6 billion) to their unsecured debts in November, up from 828 million pounds in the previous month, Bank of Englanddata published on Tuesday show. Economists had expected a gain of about 800 million pounds. The figures are consistent with evidence that consumers brought forward their Christmas shopping this year because of concerns that supply shortages and the rapid spread of the omicron variant of Covid-19. Almost three quarters of the increase came from credit cards.

U.S. / EQUITIES (BBG - FROM OVERNIGHT): Elizabeth Holmes was found guilty of criminal fraud for her role building the blood-testing startup Theranos Inc. into a $9 billion company that collapsed in scandal.A jury in San Jose, California, returned the verdict after hearing three months of testimony that was often technical, heavily contested and, from Holmes herself, shocking. The 37-year-old faces a maximum sentence of 20 years in prison, although she’ll probably get far less than that. Holmes will also likely appeal her conviction and any sentence she gets.

DATA:

- Harmonised inflation estimate for December unchanged from November reading at 3.4% y/y.

- This was the strongest rate since September 2008.

- Marginally lower than consensus expectation of 3.5% y/y.

- Headline inflation came in lower at 2.8% y/y, also plateauing at November rate and slightly below estimate of 2.9% y/y

- Substantial acceleration in prices of manufactured goods and food, whilst energy prices ease up.

UK DEC MFG PMI 57.9r; NOV 58.1

UK Manufacturing PMI above forecast

- Final UK manufacturing PMI came in at 57.9 for December, up from the flash estimate of 57.6 and remaining above the break-even of 50 for the 19th consecutive month.

- This is a slight decline from 58.1in November.

- Manufacturing production grew on the back of increased new work and employment, whilst input prices increased further and inflationary pressures remained strong.

- Supply chain disruptions and dampened demand due to COVID-19 and Brexit complications continued to apply downward pressure.

FIXED INCOME: Looking to the ISM later

Gilts have been the big movers of the day, catching up with the large moves seen across fixed income yesterday when UK markets were closed. Bunds and to a lesser extent USTs have retraced some of yesterday's moves.

- This morning's data has not really moved the docket with focus instead on the US ISM manufacturing later today.

- TY1 futures are up 0-2 today at 129-16 with 10y UST yields down -0.1bp at 1.629% and 2y yields up 0.5bp at 0.775%.

- Bund futures are up 0.13 today at 170.87 with 10y Bund yields down -1.8bp at -0.140% and Schatz yields down -0.2bp at -0.651%.

- Gilt futures are down -0.66 today at 124.24 with 10y yields up 7.9bp at 1.047% and 2y yields up 5.7bp at 0.721%.

FOREX: JPY Drops to New Multi-Year Lows as Equities Crest at Fresh Highs

- JPY underperforms headed into Tuesday's NY crossover, slipping against all others and boosting USDJPY to closer to 116.00 and the best levels since early 2017. EURJPY is running higher in sympathy, with the cross approaching resistance layered between 131.00-04. JPY is lower as equities globally continue to improve (at the expense of bonds), evident in the e-mini S&P rallying through 4800 and hitting a fresh alltime high.

- The strongest currencies so far today include AUD and NOK, with commodity-tied and growth proxy FX at the top of the pile.

- Elsewhere, the greenback is a touch softer, but holds close to the highs printed yesterday as the USD Index rebounded off the 50-dma at 95.628.

- December's ISM Manufacturing data takes focus going forward, with activity seen slowing to 60.0 from 61.1. Particular focus will likely be paid to the employment sub component ahead of Friday's NFP release - with US jobs growth seen accelerating to 424k across December.

EQUITIES: Broad Gains With Energy And Financials Leading

- Asian markets closed mixed: Japan's NIKKEI closed up 510.08 pts or +1.77% at 29301.79 and the TOPIX ended 37.89 pts higher or +1.9% at 2030.22. China's SHANGHAI closed down 7.446 pts or -0.2% at 3632.329 and the HANG SENG ended 15.09 pts higher or +0.06% at 23289.84.

- European stocks are higher, with the German Dax up 55.21 pts or +0.34% at 16060.11, FTSE 100 up 87.67 pts or +1.19% at 7384.54, CAC 40 up 64.1 pts or +0.89% at 7217.22 and Euro Stoxx 50 up 27.05 pts or +0.62% at 4348.76.

- U.S. futures are gaining, with the Dow Jones mini up 82 pts or +0.22% at 36537, S&P 500 mini up 11.25 pts or +0.24% at 4797.25, NASDAQ mini up 39.25 pts or +0.24% at 16524.25.

COMMODITIES: Oil Rises Ahead Of OPEC+ Gathering

- WTI Crude up $0.32 or +0.42% at $75.93

- Natural Gas up $0.01 or +0.29% at $3.837

- Gold spot up $4.26 or +0.24% at $1805.29

- Copper down $2.35 or -0.53% at $438.7

- Silver down $0.08 or -0.36% at $22.8411

- Platinum up $5.2 or +0.54% at $955.6

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2022 | - | *** |  | US | domestic made vehicle sales |

| 04/01/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 04/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 04/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 04/01/2022 | 1630/1130 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 05/01/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/01/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/01/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/01/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/01/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 05/01/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/01/2022 | 1900/1400 | * |  | US | FOMC Minutes |

| 06/01/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.