-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Tech Stocks And USD Slip

EXECUTIVE SUMMARY:

- EUROZONE FINAL SERVICES PMIS COME IN BELOW EXPECTATIONS

- CHINA'S XI'AN HAS EFFECTIVELY CONTAINED VIRUS SPREAD: CCTV

- BOJ IS SAID TO DISCUSS CHANGING LONG-HELD VIEW ON PRICE RISKS

- U.K. OPPOSITION LEADER STARMER TESTS POSITIVE FOR COVID

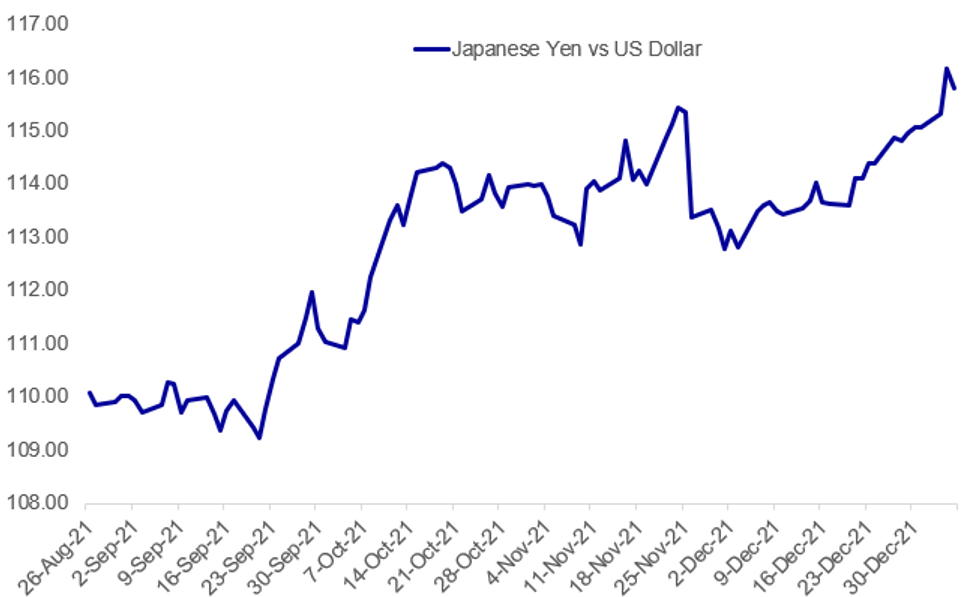

Fig. 1: USDJPY Fades Off Multiyear High

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROZONE DATA: Final readings for the Service PMIs for Spain, Italy, France and the Eurozone saw all but Germany coming in below both forecasts and flash readings. All readings remained above the break-even point of 50 except for German services which saw a contraction (albeit less extreme than expected) in December. Across the region, growth rates weakened and job creation slowed against a backdrop of persistent cost inflation. New business growth was seen easingdue to the surge in COVID-19 cases. In Germany in particular, service sector activity dipped due to COVID-19 restrictions affecting the unvaccinated, however growth expectations remained optimistic.

CHINA / COVID (BBG/CCTV): The total number of Covid cases has been trending down in the northwestern Chinese city where the country’s worst outbreak since Wuhan has been unfolding, state broadcaster CCTV reports, citing a local government briefing.

BOJ (BBG): Some Bank of Japan officials say it’s likely the central bank will discuss the possible ditching of a long-held view that price risks are mainly on the downward side at a policy meeting this month, according to people familiar with the matter. The officials are also likely to consider adjusting the bank’s growth outlook, the people said.The central bank meets on Jan. 17-18, with its quarterly report on prices and growth likely to be the focus of interest. Considering rising inflationary pressure, the BOJ board is likely to discuss if it’s still valid to say price risks are “skewed to the downside,” wording that has been used since October 2014, according to the people.

U.K. POLITICS (@TimesRadio on Twitter): Labour leader Sir Keir Starmer has tested positive for coronavirus and Angela Rayner will deputise for him at Prime Minister’s Questions, a party spokesman said.

TURKEY (BBG): Turkish authorities are keeping tabs on investors who are buying large amounts of foreign currency and asked banks to deter their clients from using the spot market for hedging-related trades as they struggle to contain the lira’s slide.The central bank has requested commercial lenders inform them of any big-ticket dollar purchases that may impact the market negatively, according to people familiar with the matter, who asked not to be named as the information isn’t public.

FRANCE / COVID (BBG): French President Emmanuel Macron took Europe’s aggressive stance against the unvaccinated up a notch, saying he wants to “p--- off” people who don’t get their Covid-19 shot.“We will continue to do this, to the end. This is the strategy,” he said in an interview with newspaper Le Parisien. He added that means “limiting as much as possible their access to activities in social life.”Targeted measures are already in action in a number of countries, where those who aren’t vaccinated are restricted when it comes to accessing bars, restaurants and other day-to-day activities. The drive to get more people inoculated has stepped up since the emergence of the omicron variant, which has sent cases surging at record rates across Europe.

EUROPE ENERGY (BBG): European gas prices extended gains, climbing for a third day, as shipments from top supplier Russia remain curbed.Dutch prices for next month gained as much as 9.1% after rallying more than 10% on both Monday and Tuesday. The U.K. equivalent advanced as much as 9.8% to 237.9 pence a therm.Prices are rebounding after a sharp slide at the end of last year as pipeline volumes of Russian gas to central Europe plummet to their lowest in at least seven years. Russian supplies via Ukraine remain curtailed, while the Yamal-Europe pipeline is flowing in reverse direction from Germany to Poland.

KAZAKHSTAN (BBG): Kazakh President Kassym-Jomart Tokayev accepted the government’s resignation Wednesday after increases in fuel prices led to clashes between protesters and police in central Asia’s largest energy producer.The unrest intensified Wednesday even after Tokayev declared a state of emergency in and around the country’s largest city, Almaty, and the oil-rich Mangystau region. The declaration allows him to impose a curfew, ban protests, and restrict internet access after a rare show of dissent in the tightly controlled nation.

U.K. / COVID / TRAVEL (BBG): The U.K. is considering scrapping its pre-departure Covid-19 test requirement for vaccinated travelers entering the country, according to a person familiar with the matter, after airlines hard-hit by the omicron variant lobbied for the rules to be eased.The government is likely to keep a mandate for inoculated arrivals to quarantine until they’ve done a so-called PCR test within two days of entering the country, said the person, who asked not to be identified before a decision was made. The cabinet is scheduled to consider its regular three-week review of travel rules on Wednesday.

DATA:

EUROZONE FINAL DEC SERVICES PMI

- EUROZONE Final Services PMI for December 53.1 (53.3 flash, previous 55.9 previous)

- GERMANY Final Services PMI for December 48.7 (48.4 flash, 52.7 previous)

- FRANCE Final Services PMI for December 57.0 (57.1 flash, 57.4 previous)

- ITALY Services PMI for December 53.0 (54.0 expected, 55.9 previous)

MNI: SPAIN DEC SERVICES PMI 55.8; NOV 59.8

MNI: FRANCE DEC CONSUMER CONF INDEX 100; NOV 98r

FIXED INCOME: Looking ahead to the FOMC Minutes

There has been some modest bull flattening of yield curves this morning as equities move a little higher but core fixed income is trading largely within yesterday's ranges, waiting for the FOMC Minutes later.

- European final services PMIs did little to move the market this morning with focus instead on large corporate supply as well as bond sales from Germany, Spain, Italy and Slovenia.

- The focus of the FOMC Minutes later today will be whether there will be any hints as to raising rates potentially as soon as March and any more detail about balance sheet normalization.

- TY1 futures are up 0-3+ today at 129-12+ with 10y UST yields down -0.8bp at 1.641% and 2y yields unch at 0.761%.

- Bund futures are unch today at 170.81 with 10y Bund yields down -1.0bp at -0.134% and Schatz yields down -0.3bp at -0.626%.

- Gilt futures are up 0.07 today at 124.01 with 10y yields down -1.6bp at 1.067% and 2y yields down -1.0bp at 0.743%.

FOREX: USDJPY Fades Off Multiyear High

- Markets are largely in consolidation mode Wednesday, with USD/JPY fading slightly off the multi-year high posted yesterday at 116.35, with prices now either side of the 116.00 handle. The pair has re-correlated with equity indices, following the e-mini S&P off the alltime high, with the index around 25 points off Tuesday's 4808 at typing.

- A modest souring in sentiment follows a generally risk-off session in Asia, with the Hang Seng Index retreating over 1.5% as further cases of omicron are found clustering across Hong Kong. Tighter activity restrictions have been rolled out, including restaurant capacity limits and forced closures for certain outlets this weekend.

- USDJPY's pullback has worked against the USD Index, with the greenback lower against most others in G10. JPY is firmest, with NOK and SEK both posting minor gains.

- Fed minutes take focus later today, with ADP Employment Change for December also on the docket.

EQUITIES: Europe Higher; Tech Weighs In Asia, US

- Asian markets closed mixed: Japan's NIKKEI closed up 30.37 pts or +0.1% at 29332.16 and the TOPIX ended 9.05 pts higher or +0.45% at 2039.27. China's SHANGHAI closed down 37.153 pts or -1.02% at 3595.176 and the HANG SENG ended 382.59 pts lower or -1.64% at 22907.25.

- European stocks are gaining again, with the German Dax up 94.14 pts or +0.58% at 16245.88, FTSE 100 up 15.61 pts or +0.21% at 7522.28, CAC 40 up 24.62 pts or +0.34% at 7342.69 and Euro Stoxx 50 up 22.21 pts or +0.51% at 4389.24.

- U.S. futures are flat/mixed, with the Dow Jones mini up 42 pts or +0.11% at 36717, S&P 500 mini up 1.5 pts or +0.03% at 4785.75, NASDAQ mini down 30.5 pts or -0.19% at 16245.75.

COMMODITIES: Precious Metals Edge Higher With Dollar Lower

- WTI Crude down $0.07 or -0.09% at $76.81

- Natural Gas up $0.06 or +1.53% at $3.774

- Gold spot up $4 or +0.22% at $1818.93

- Copper down $3.8 or -0.85% at $443.65

- Silver up $0.01 or +0.04% at $23.0717

- Platinum up $9.13 or +0.94% at $984.63

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 05/01/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/01/2022 | 1900/1400 | * |  | US | FOMC Minutes |

| 06/01/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 06/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 06/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/01/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | trade balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.