-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Nominees Face Capitol Hill Scrutiny

MNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI US OPEN: Treasury Curve Inversion Persists

EXECUTIVE SUMMARY:

- EU SAYS IT HOLDS RUSSIA RESPONSIBLE FOR ATROCITIES IN UKRAINE

- HUNGARY'S ORBAN WINS RE-ELECTION, RESULT SUPPORTS POLICY CONTINUITY (MNI POLITICAL RISK)

- GERMAN TRADE REBOUNDS ABOVE FORECASTS

- MNI RBA PREVIEW: PATIENCE TESTED, SET TO REMAIN

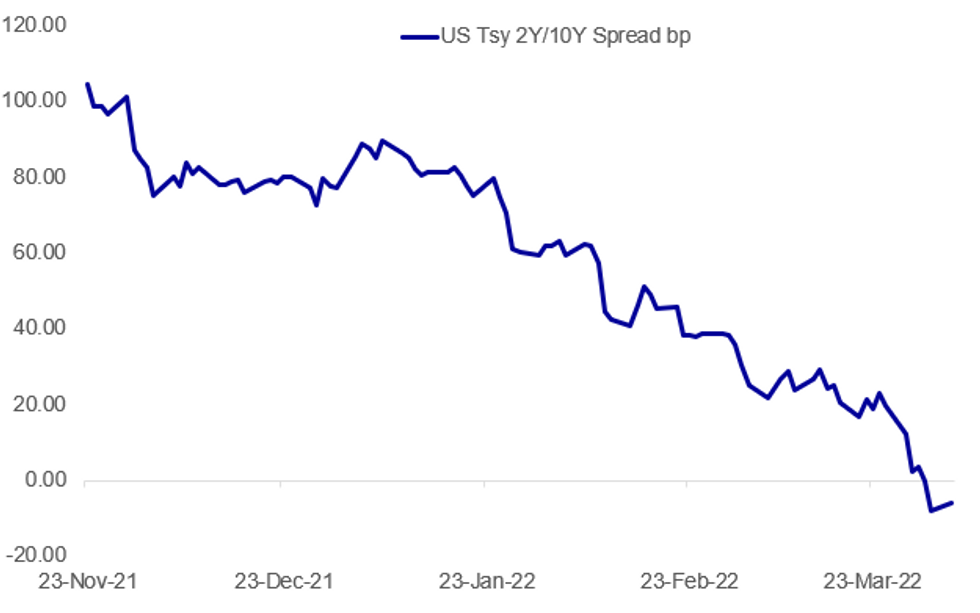

Fig. 1: Curve Flattening Reverses Slightly, But Inversion Still Prevalent

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EU-RUSSIA (BBG): The European Union condemned Russia for atrocities by its military in several Ukrainian towns, saying that the bloc will “as a matter of urgency” work on additional sanctions against Moscow. “The Russian authorities are responsible for these atrocities, committed while they had effective control of the area,” the bloc said Monday in a joint statement, adding that Brussels will assist Ukraine in collecting and preserving evidence of war crimes. “They are subject to the international law of occupation.”

HUNGARY ELECTION (MNI POLITICAL RISK): Prime Minister Viktor Orban and his right-wing populist Fidesz Party pulled off an electoral shock on 3 April, increasing the government's supermajority in parliament by two seats after 12 years in office. Taking 135 of 199 seats (up from 133 previously) points to the dominance Orban's party holds over Hungarian politics, the media landscape, and the nation's institutions. Full analysis available on the MNI website.

RBA (MNI PREVIEW): The RBA will leave its monetary policy settings unchanged at the end of its April meeting. Focus will quickly move to the Bank’s guidance paragraph, with the board likely to reaffirm that it is “prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve,” even as the strength of the labour market persistently outstrips its expectations. Full analysis available on the MNI website.Full analysis available on the MNI website.

UK-RUSSIA (BBG): The U.K.’s Foreign Secretary Liz Truss will travel to Poland on Monday to see Ukrainian and Polish foreign ministers ahead of G-7 and NATO talks in Brussels later this week, U.K. government says in an emailed statement. Truss will “call for tougher sanctions against Russia to cripple its war machine and to support Ukraine including in peace negotiations”

JPM/FED (BBG): JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon called for ratcheting up sanctions against Russia in response to its invasion of Ukraine and said the Federal Reserve may ultimately raise interest rates more than the market expects. The U.S. should increase sanctions “in whatever way national security experts recommend to maximize the right outcomes,” Dimon wrote Monday in his annual letter to shareholders. The war and the resulting sanctions “will slow the global economy -- and it could easily get worse.”

BOE/CRYPTO (BBG): Bank of England Governor Andrew Bailey said crypto-currencies are the “new front line” in criminal scams that regulators are trying to prevent. Underlying technology of crypto is contributing a good deal of innovation to financial services.

TURKEY INFLATION (RTRS): Turkey's annual consumer inflation leapt to a 20-year high of 61.14% in March, data showed on Monday, fuelled by rising energy and commodity prices following the Russia-Ukraine conflict which is compounding the impact of a lira crash late last year. Inflation has been surging since last autumn, when the lira slumped after the central bank (CBRT) launched a 500 basis-point easing cycle long sought by President Tayyip Erdogan. On a month-on-month basis consumer prices rose 5.46%, the Turkish Statistical Institute said, compared with a Reuters poll forecast of 5.7%. Annually, consumer price inflation was forecast to be 61.5%.

HONG KONG (BBG): Hong Kong Chief Executive Carrie Lam said she wouldn’t seek a second term, ending a tumultuous five-year tenure that saw the financial hub become more isolated due to its twin crackdowns on Covid-19 and the democratic opposition. Lam announced her plans at a regular news briefing Monday, saying that she informed authorities in Beijing of her plan at a National People’s Congress session more than a year ago. Hong Kong’s benchmark Hang Seng Index climbed as much as 2% after her announcement.

DATA:

MNI: GERMANY FEB IMPORTS +6.4% M/M, JAN -4.0% M/M

FEB TRADE BALANCE SA 11.5BLN, JAN 8.9BLNr

FIXED INCOME: US curves most inverted for over a decade

Divergence between USTs, Bunds and gilts in the Asian session saw the UST curve sell-off with 2s10s which overnight reached a low of-9.5bp, the most inverted level since 2006. US 5s30s went even further, themost inverted since September 2000, hitting a low of 15.2bp overnight. Through the European session we have seen Bunds, Treauries and gilts all drift higher.

- Treasuries remain below Friday's close but gilts and Bunds have both surpassed this.

- The main event of the day will be a speech from BOE MPC member Cunliffe, in what are expected to be his first public remarks on monpol since voting to keep rates on hold at the March meeting.

- We also have US factory orders and the final print of durable goods.

- TY1 futures are down -0-5 today at 122-02+ with 10y UST yields up 0.8bp at 2.393% and 2y yields down -0.6bp at 2.453%.

- Bund futures are up 1.06 today at 159.41 with 10y Bund yields down -5.6bp at 0.497% and Schatz yields down -3.3bp at -0.109%.

- Gilt futures are up 0.73 today at 121.92 with 10y yields down -4.8bp at 1.559% and 2y yields unch at 1.365%.

German Trade Rebounds Above Forecasts

GERMANY FEB IMPORTS +6.4% M/M, JAN -4.0% M/M

GERMANY FEB EXPORTS +4.5% M/M, JAN -3.0% M/M

FEB TRADE BALANCE SA 11.5BLN

- Germany's trade data saw an upside surprise in February following a January slump caused by associated slowdown effects of the Omicron wave.

- Both export/import and trade balance prints beat consensus forecasts.

- Exports grew +6.4% m/m (+1.5% expected), almost 5pp above expectations and a solid 9.4pp rebound from January.

- Imports expanded by +4.5% m/m in February (+1.0% expected), which is up 8.5pp from January.

- The total trade balance for February came in at 11.5bln EUR, 1.5bln above the forecast.

- February saw substantial reductions in trade with Russia due to sanctions imposed at the end of the month, although the March print will highlight the total extent of sanctions on trade between the countries.

FOREX: EUR Extends Pullback From Important Resistance

- EUR is underperforming so far Monday, with EUR/USD extending the pullback off last week's highs at 1.1185. An important S/T resistance has now been defined here, marking the Mar 31 high.

- Newsflow surrounding Ukraine remains a key focus, with reports suggesting a further pullback of Russian forces from cities and territories in the west and northern parts of the country - most notably the areas surrounding Kyiv. Despite the de-escalation of military tensions in these areas, accusations of uncovered evidence of war crimes will add additional pressure on western leaders to tighten the sanctions grip on Russia. This keeps energy prices underpinned on the continent and is helping CAD and NOK holding close to recent highs.

- SEK, EUR and JPY are among the poorest performers so far today, while AUD< CAD and NOK trade well.

- Data focus turns to February US factory orders and the final read for durable goods orders. The speaker slate is similarly light, with just BoE's Cunliffe on the docket.

EQUITIES: Hang Seng Closes Higher; Cyclical Stocks Lag In Europe

- Asian markets closed higher: Japan's NIKKEI closed up 70.49 pts or +0.25% at 27736.47 and the TOPIX ended 9.36 pts higher or +0.48% at 1953.63. The HANG SENG ended 462.76 pts higher or +2.1% at 22502.31T

- European equities are mixed, with healthcare/consumer stocks leading and financials/industrials lagging: the German Dax down 25.06 pts or -0.17% at 14422.3, FTSE 100 up 2.34 pts or +0.03% at 7539.32, CAC 40 down 9.45 pts or -0.14% at 6674.27 and Euro Stoxx 50 up 0.66 pts or +0.02% at 3918.53.

- U.S. futures are flat, with the Dow Jones mini down 30 pts or -0.09% at 34688, S&P 500 mini up 1.25 pts or +0.03% at 4540.5, NASDAQ mini up 26.75 pts or +0.18% at 14890.5.

COMMODITIES: WTI Crude Recovers Early Losses To Trade Back At $100

- WTI Crude up $0.84 or +0.85% at $100.2

- Natural Gas up $0.02 or +0.28% at $5.736

- Gold spot up $4.44 or +0.23% at $1930.28

- Copper up $2.95 or +0.63% at $471.9

- Silver up $0.16 or +0.65% at $24.7895

- Platinum up $5.05 or +0.51% at $994.63

LOOK AHEAD:

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 04/04/2022 | 1230/0830 | * | Feb |  | CA | Building Permits | -- | -- | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory New Orders | 1.4 | -0.6 | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory Orders ex-transport | 1.0 | 0.3 | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | BOC Business Outlook Indicator | 6.0 | -- | |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Future sales (bal. of opinion) | 3.0 | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Investment (bal. of opinion) | -- | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Respondents seeing CPI 2%/less | -- | -- | % |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- | |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- | |

| 05/04/2022 | 2300/0900 | * | Mar |  | AU | IHS Markit Final Australia Services PMI | 57.9 | -- | |

| 05/04/2022 | 0030/0930 | ** | Mar |  | JP | IHS Markit Services PMI (f) | -- | -- | |

| 05/04/2022 | 0430/1430 | *** |  | AU | Interest Rate | 0.1 | -- | % | |

| 05/04/2022 | 0430/1430 | *** |  | AU | Interest Rate Change | 0.0 | -- | % | |

| 05/04/2022 | 0630/0830 | ** | Mar |  | SE | Services PMI | 68.0 | -- | |

| 05/04/2022 | 0645/0845 | * | Feb |  | FR | Industrial Production m/m | 1.6 | -0.5 | % |

| 05/04/2022 | 0645/0845 | * | Feb |  | FR | Industrial Production y/y | -1.5 | 2.5 | % |

| 05/04/2022 | 0645/0845 | * | Feb |  | FR | Manufacturing Prod m/m | 1.8 | -- | % |

| 05/04/2022 | 0645/0845 | * | Feb |  | FR | Manufacturing Prod y/y | -1.1 | -- | % |

| 05/04/2022 | 0715/0915 | ** | Mar |  | ES | IHS Markit Services PMI (f) | 56.6 | 54.3 | |

| 05/04/2022 | 0745/0945 | ** | Mar |  | IT | IHS Markit Services PMI (f) | 52.8 | 51.4 | |

| 05/04/2022 | 0750/0950 | ** | Mar |  | FR | IHS Markit Services PMI (f) | 57.4 | -- | |

| 05/04/2022 | 0755/0955 | ** | Mar |  | DE | IHS Markit Services PMI (f) | 55.0 | 55.0 | |

| 05/04/2022 | 0800/1000 | ** | Mar |  | EU | IHS Markit Services PMI (f) | 54.8 | 54.8 | |

| 05/04/2022 | 0830/0930 | ** | Mar |  | UK | IHS Markit/CIPS Services PMI (Final) | 61.0 | 61.0 | |

| 05/04/2022 | 1230/0830 | ** | Feb |  | CA | Prev Trade Balance, Rev | -1.582 | -- | CAD (b) |

| 05/04/2022 | 1230/0830 | ** | Feb |  | CA | Trade Balance | 2.618 | -- | CAD (b) |

| 05/04/2022 | 1230/0830 | ** | Feb |  | US | Previous Trade Deficit Revised | -82.0 | -- | USD (b) |

| 05/04/2022 | 1230/0830 | ** | Feb |  | US | Trade Balance | -89.7 | -88.5 | USD (b) |

| 05/04/2022 | 1255/0855 | ** | 02-Apr |  | US | Redbook Retail Sales y/y (month) | 12.9 | -- | % |

| 05/04/2022 | 1255/0855 | ** | 02-Apr |  | US | Redbook Retail Sales y/y (week) | 12.9 | -- | % |

| 05/04/2022 | 1345/0945 | *** | Mar |  | US | IHS Markit Services Index (final) | 58.9 | 58.9 | |

| 05/04/2022 | 1400/1000 | *** | Mar |  | US | ISM Non-manufacturing Index | 56.5 | 58.6 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.