-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US OPEN: Calmer But Still Unsettled

EXECUTIVE SUMMARY:

- KNOT: ECB RATES MUST RISE >0.25 PTS IN SEPT. IF CONDITIONS SAME

- UK UNEMPLOYMENT RATE EDGES HIGHER, REAL PAY FALLS

- GERMAN ZEW AGAIN SEES IMPROVEMENT IN EXPECTATIONS, OUTLOOKS STILL NEGATIVE

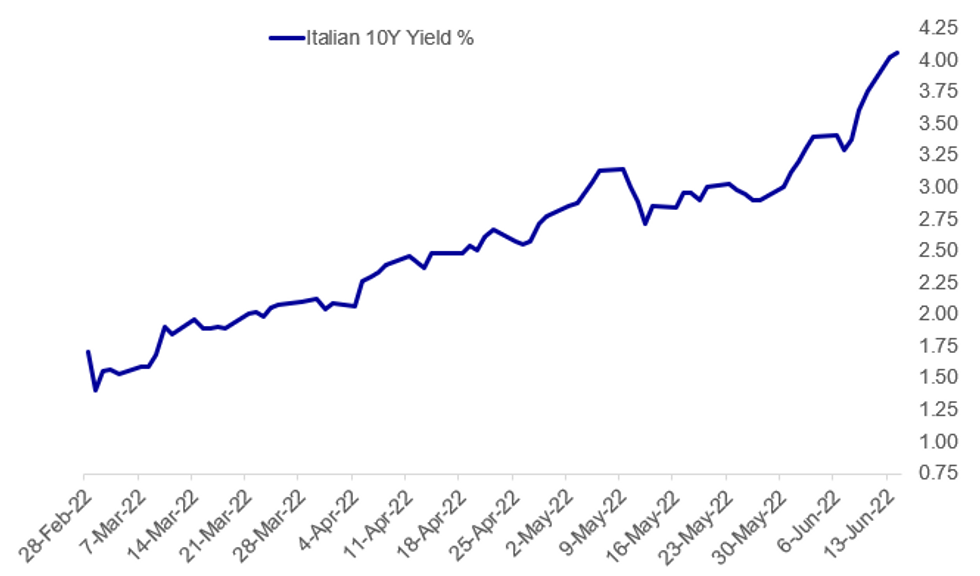

Fig. 1: BTP Yields Soar Through 4%

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): European Central Bank Governing Council member Klaas Knot said rates will need to rise by more than a quarter of a percentage point in September if conditions are unchanged. “If conditions remain the same as today, we will have to raise rates by more than 0.25 points,” Dutch central bank chief Knot said in an interview with Le Monde newspaper when asked what the ECB will do in September. “The next level is to raise 0.5 points, but our options are not necessarily limited to that” “All I can say is that it should be greater than 0.25 points”

BOE (MNI): The Bank of England is set to hike Bank Rate by another 25 basis points to 1.25% after its June meeting this week, but a Monetary Policy Committee split three ways is unlikely to provide further guidance on future policy ahead of the quarterly forecast round and new framework for gilt sales due in August. For full article contact sales@marketnews.com

HONG KONG / COVID (BBG): Hong Kong residents will have to show a negative Covid test result to enter the city’s bars and nightclubs starting on Thursday and running through the end of the month, Health Secretary Sophia Chan said. The decision comes as the city is seeing an increasing number of Covid infections, in many cases driven by transmission at nightlife venues that only recently were allowed to reopen. There have been six Covid clusters at the city’s bars since they reopened, involving 350 cases, officials said.

CRYPTOCURRENCIES (BBG): MicroStrategy Inc. may need to post additional collateral for a loan as Bitcoin tests a key price range flagged by the company last month.The software firm that invested heavily in Bitcoin said on a conference call in May that if the token’s price dropped enough, it would need to add to the digital asset originally pledged for the $205 million loan it took out in March. The initial value committed was around $820 million at the time but has since fallen to about half that.

DATA:

MNI BRIEF: UK Unemployment Rate Edges Higher, Real Pay Falls

The UK unemployment rate rose modestly to 3.8% in the 3 months to April, despite another rise in the overall real-time payrolls over the same period, the Office for National Statistics said Tuesday. Financial market economists had been looking for a further fall in the rate to 3.6%.

The overall jobs data showed a 'mixed pictures,' according to Sam Beckett, the ONS head of economic statistics, who noted that employment was up, but still below pre-pandemic levels. But Beckett also pointed to falling redundancies and vacancies at record highs -- standing at half a million more than pre-Covid.

Wages remain a black spot. Although total average earnings rose 6.8% y/y, they were boosted by bonus payments and, adjusted against CPI, fell 0.5% in the three months against a year ago, On the month, total real earnings fell 3.7% m/m, while regular real pay (ex-bonus) fell 4.5% m/m. Ahead of the BOE meeting, the wages data will remain a concern for policymakers, showing how rampant inflation could weigh on consumer's discretionary spending.

GERMANY JUN ZEW CURRENT CONDITIONS -27.6

MNI: GERMANY JUN ECONOMIC SENTIMENT INDEX -28

GERMANY: ZEW Again Sees Improvement in Expectations, Outlooks Still Negative

- Improvement was again seen in the German ZEW survey for June. The expectations index improved by 6.3 points to -28.0, remaining 1.2 points lower than consensus expectations.

- Perceptions regarding the current German business climate improved more than anticipated, up 8.9 points (vs expected +5.5 points) at -27.6 in June. Concerns surrounding supply bottlenecks worsened by lockdowns in China again came to light, as manufacturing industries continue to struggle to stabilise following the Ukraine war disruptions.

- The key takeaway is less pessimistic outlooks for financial market experts, despite remaining in very negative territory.

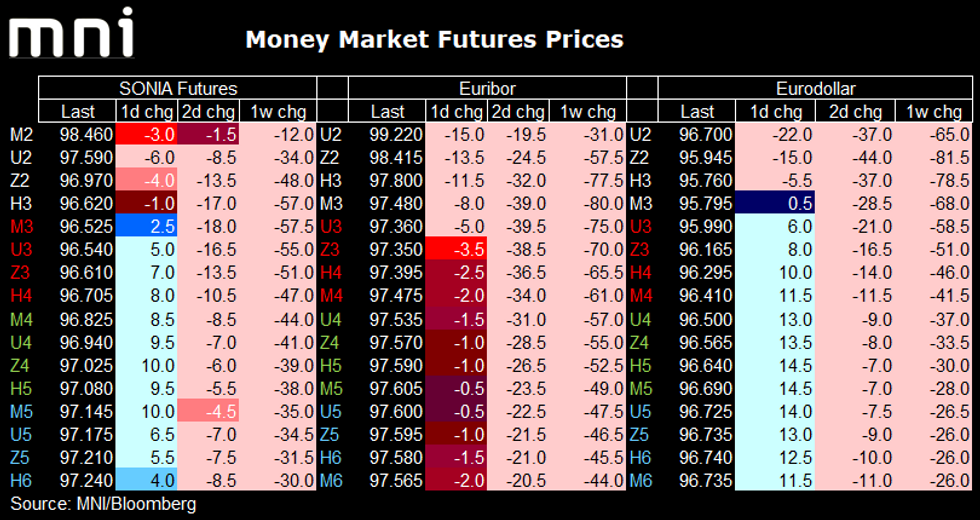

FIXED INCOME: Huge moves

There are continued huge moves in STIR markets as the market moves to pricing in around 74bp for tomorrow's FOMC meeting following yesterday's WSJ article by Nick Timiraos and the CNBC report from Steve Liesman.

- Eurodollar Whites are the biggest movers with the Sep-22 contract down 22.0 ticks since the close, Dec-22 down 15.0 ticks and Mar-23 down 5.5 ticks. The strip is inverted thereafter, with the rest of the strip having moved hither today. Reds are up 6.0-11.5 ticks and Greens/Blues up 11.5-14.5 ticks. Over the last week the Dec-22 contract has moved over 80 ticks lower and there is now a 75 tick spread between the Sep-22 and Dec-22 contracts.

- In terms of Fed pricing, 143bp is priced by July (almost two 75bp hikes priced), 197bp by September (another 50bp), 241bp by November (another 50bp) and then 278bp by year-end.

- The entire Euribor strip is lower on the day, with Whites seeing the biggest move - down 8-15 ticks. Reds are down 2-5 ticks and the rest of the strip down 1-2 ticks. For ECB pricing, 36bp is priced for July, 91bp by September, 127bp by October and 176bp by year-end.

- The SONIA strip has seen the smallest moves with Whites down up to 6 ticks but moves higher in Reds, Greens and Blues (up to 10 ticks higher). Markets now price 35bp for this week's MPC meeting, a cumulative 81bp by August, 125bp by September, 194bp by year-end and 247bp by May 2023.

- Bund underperforms against the Gilt, as the street re-price a more aggressive rate path for Europe.

- Gilt/Bund spread sits 7.6bps tighter on the session.

- Next support comes at the May's and the 2022 low, 79.03bps.

- Below the latter, opens to the 2021 low at 75.69bps.

- Tnotes/Bund spread is 6.1bps tighter, and support will be seen at the June and 2022 low 161.14, now at 166.7bps.

- BTP 10yr yield printed a 4.041% high yesterday and the highest print since03/01/14.

FOREX: Prices Settle, But Underlying Sentiment Still Fragile

- Following the dollar's fierce Monday rally, the USD Index is fading slightly ahead of Tuesday's NY crossover, allowing EUR/USD, GBP/USD and others to recover off the lows. This puts EUR/USD closer to 1.05 headed into US hours, after trading as low as 1.0397 overnight.

- A stabilisation of sentiment is also evident in equity markets, with futures uniformly higher, albeit still well short of the week's best levels - solidifying the scale of the risk sell-off on Monday. Despite the more stable outlook for spot prices today, markets remain fragile, with implied volatility across G10 FX still well elevated. Today, 1m USD/JPY implied vols cleared 14 points, the highest since the depths of the COVID-19 crisis.

- CAD is the sole currency underperforming the greenback at this stage, putting USD/CAD north of 1.29 for the first time since mid-May, cementing the recent short-term reversal. The extension higher has resulted in a test of resistance at 1.2896, the May 19 high. Sights are on a Fibonacci retracement at 1.2945, where a break would open key resistance at 1.3077.

- US PPI takes focus going forward, with markets continuing to look for any further clues on burgeoning inflationary pressure in the US. PPI is seen decelerating slightly on a Y/Y basis across both the core and non-core readings. ECB's Schnabel is also slated to speak, although a policy focus is unlikely today.

EQUITIES: Steadying After Rout

- Asian equity markets closed off overnight lows: Japan's NIKKEI closed down 357.58 pts or -1.33% at 26629.86 and the TOPIX ended 22.61 pts lower or -1.19% at 1878.45. China's SHANGHAI closed up 33.355 pts or +1.02% at 3288.906 and the HANG SENG ended 0.41 pts higher or +0% at 21067.99.

- European equities are trading mixed, with the German Dax down 18.8 pts or -0.14% at 13427.03, FTSE 100 up 13.89 pts or +0.19% at 7205.81, CAC 40 down 17.64 pts or -0.29% at 6022.32 and Euro Stoxx 50 down 5.76 pts or -0.16% at 3535.15.

- U.S. futures are up slightly, with the Dow Jones mini up 109 pts or +0.36% at 30641, S&P 500 mini up 19.5 pts or +0.52% at 3770.25, NASDAQ mini up 85.25 pts or +0.75% at 11384.25.

COMMODITIES: Oil Continues To Hold Up

- WTI Crude up $0.8 or +0.66% at $121.68

- Natural Gas up $0.06 or +0.65% at $8.564

- Gold spot up $3.53 or +0.19% at $1830

- Copper up $0.4 or +0.09% at $426.35

- Silver up $0.05 or +0.23% at $21.3336

- Platinum up $0.32 or +0.03% at $946.98

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/06/2022 | 1230/0830 | *** |  | US | PPI |

| 14/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/06/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 14/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 14/06/2022 | 1700/1900 |  | EU | ECB Schnabel Commencement Speech at Universite Paris |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.