-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS: Return Of The Dollar Wrecking Ball

Highlights:

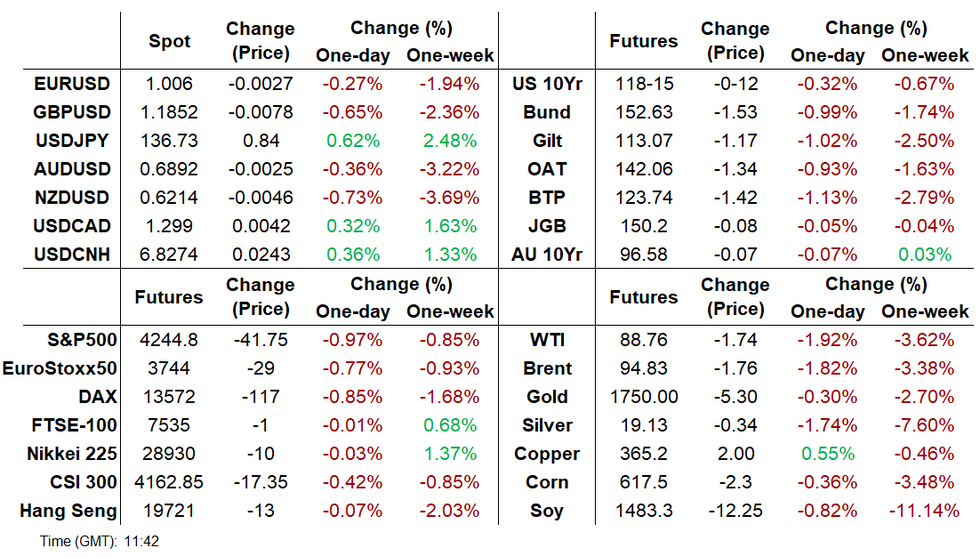

- Dollar strength has weighed on equities and commodities in overnight trade

- UK retail sales exceeded expectations, pushing BoE hike pricing even higher

- Light schedule to end the week, with Canada retail sales release and Fed's Barkin to speak

Source: BBG, MNI

Source: BBG, MNI

US TSYS: Lagging European Cheapening Ahead Of Light Docket

- Cash Tsys have sold off overnight, starting with light cheapening on news that Xi & Putin will be attending the G20 summit in Indonesia in November (with prior expectation of Biden and Xi speaking in South East Asia also in November) before being dragged lower by UK and Eurozone sovereigns on a huge beat for German PPI and less so UK retail sales.

- The moves make for a mild flattening which consolidates yesterday’s 6bp steepening, -0.5bps at -32bps and off lows of almost -50bps prior to the US CPI miss.

- 2YY +5.5bps at 3.253%, 5YY +4.9bps at 3.076%, 10YY +4.9bps at 2.932% and 30YY +3.8bps at 3.175%.

- TYU2 trades 12 ticks lower at 118-15+, just off session and week lows of 118-11 on above average volumes. It moves closer to support at 118-05 (50% retrace of Jun 14 – Aug 2 bull cycle) with a key near-term support at 117-14+ (Jul 21 low) underneath that.

- No data or issuance with only Barkin (’24 voter) due to speak at 0900ET with media Q&A expected to follow.

Source: Bloomberg

Source: Bloomberg

STIR FUTURES: Fed Hikes Retracing Yesterday's Decline

- Fed Funds implied hikes sit above yesterday’s high with 64bp for Sept, but beyond remain off highs with a cumulative 120bps over the three meetings to 3.53% year-end and 135bps to a terminal 3.68% in Mar’23 despite firming overnight.

- Fedspeak: Of the two ’22 voters from yesterday’s quartet, Bullard supports a third 75bp hike in Sept as part of his well-known 3.75-4% end’22 goal whilst George was more guarded, noting any easing in financial conditions based on optimism that Fed would slow down is not how the Fed is thinking about policy but also that the Fed has done a lot and must be wary of lags.

- Barkin (’24) is the sole Fed speaker today at 0900ET with separate media Q&A after. He last noted after the US CPI miss that he wants to see short-term rates in restrictive territory with more to come to get there, watching data with a lot of time before the Sept FOMC.

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

FOMC-dated Fed Funds futures implied rateSource: Bloomberg

EGB/Gilt: UK Consumer Confidence Reaches New Depths

European sovereign debt has sold off sharply alongside losses for equities and gains for the US dollar.

- Following on the heels of another inflation surprise earlier in the week, UK consumer confidence has plumbed new depths with the GfK series sliding to -44 in August vs -42 consensus. UK retail sales data for July only narrowly missed expectations although continued to show a drop in spending (Inc Auto Fuel -3.4% Y/Y)

- Gilts opened lower and, following some temporary respite early in the session, selling pressure resumed into late morning. Cash yields are now up 7-12bp with the curve bear steepening.

- Bund yields are up 7-10bp with the 2s30s spread widening 3bp.

- OAT yields are up 4-11bp on the day with the belly of the curve underperforming.

- BTPs have underperformed core EGBs with teh curve bear flattening. Yields are up 8-13bp now while the 2s30s spread has traded down 5bp.

- Supply this morning came from the UK (UKTBs, GBP3.5bn).

FEDSPEAK PODCAST: EX-KC Fed President Hoenig's Jackson Hole Preview

Former KC Fed President Thomas Hoenig tells MNI he expects wide-ranging discussion of macroeconomic and policy constraints at next week's Annual Jackson Hole Symposium.

- Hoenig doesn't think Powell will show his cards on whether the Fed will hike 50 bps or 75 bps in September.

- He sees a high probability of recession next year if the Fed tightens policy enough to bring down inflation.

- The ex-FDIC vice chair says banks are not as well capitalized as regulators claim, and asset price declines linked to Fed tightening could accelerate losses.

EUROPE RATE / BOND OPTIONS SUMMARY

- RXV2 154.5/157cs vs 149p, bought the ps for 126 in 3.6k (short cover)

- OEV2 123.5/122ps, bought for 29 in 3k

- DUU2 110.00/109.30/108.60p fly sold at 41.5 and 41 in 5k

- DUU2 110.0/109.30/108.60p fly sold at 41 in 3k

- DUU2 109.70/109.40ps, sold at 20.5 in 1.5k

- DUV2 109.00/108.50ps sold at 20.5 down to 19.5 in 7.5k

- ERZ3 96.50/96.00ps vs 98.00c, bought the put spread for flat in 10k x 1k

FOREX: The Dollar remains favoured

- The USD remains king overnight and in early trade, as Equity are once again trading heavy.

- Hawkish comments from Fed speakers, and investors looking for more aggressive hikes, has also been supportive.

- The Dollar is still in the green against all G10, but has moved off its best levels at the time of typing.

- The pound is still under considerable pressure, with Cable testing the next area of interest at 1.1850, printed 1.1845 low so far. GBPUSD has now lost 235 pips from yesterday's high and a whopping 431 pips from the UK CPI peak.

- EURUSD broke out of its early tight range, to trade through the initial support seen at 1.0064 Low Jul 18. Further downside traction, will open to parity.

- NZDUSD is now through the August low on the Dollar bid.Next support comes at 0.6185

- The Yen has been under renewed pressure across the board in early trade but is off the lows at the time of typing.

- USDJPY printed a 136.86 high, just short of the next psychological target at 137.00.

- The SEK is still heading south since the Swedish CPI last week.

- USDSEK has now over 5.42% from the August low, and around 4.66% post CPI. Next immediate resistance is at 10.5568, the short term 76.4% retrace of the July/August fall.

- EURSEK is up 2.93% from the August low and 2.44% post CPI. Next resistance is seen at 10.66.

- Looking ahead there's no data of note, and the only speaker will be Fed Barkin.

FX OPTION EXPIRY

- EURUSD: 1.0070 (216mln), 1.0100 (715mln)1.0125 (367mln).

- GBPUSD: 1.2100 (578mln).

- USDJPY: 135 (390mln), 136 (805mln).

- EURGBP: 0.8460 (491mln).

- AUDUSD: 0.6950 (302mln).

- USDCNY: 6.79 (300mln).

Price Signal Summary - EURUSD Bear Leg Extends

- In the equity space, the trend condition in S&P E-Minis remains up and short-term pullbacks are considered corrective. A deeper pullback though would allow an overbought condition to unwind. The support to watch is at the 20-day EMA which intersects at 4157.93. A resumption of gains would open 4345.75 next, 2.00 projection of the Jun 17 - 28 - Jul 14 price swing. The short-term uptrend in EUROSTOXX 50 futures remains intact and the current pullback is considered corrective. Attention is on resistance at 3840.00, the Jun 6 high. A break of this hurdle would strengthen bullish conditions. On the downside, initial firm support to watch is seen at the 20-day EMA which intersects at 3708.00.

- In FX, EURUSD remains below last week’s 1.0368 high (Aug 10), and continues to trade lower. The recent move down means that the pair has failed to clear channel resistance. The bear channel is drawn from the Feb 10 high and intersects at 1.0290. Attention is on 1.0007, the Jul 15 low. Initial resistance is at 1.0205, the 20-day EMA. GBPUSD is weaker, having breached support at 1.2004, the Aug 5 low. The break lower signals scope for an extension and has opened 1.1760, the Jul 14 low and bear trigger. USDJPY continues to appreciate. The pair has traded above resistance at 135.58, the Aug 8 high. This strengthens a short-term bullish condition and signals scope for a climb towards 137.27, 76.4% retracement of the Jul 14 - Aug 2 downleg.

- On the commodity front, Gold is trading lower, extending the pullback from last week’s high of $1807.9 (Aug 10). The yellow metal has failed to confirm a clear break of the 5-month downtrend and the break of support at $1754.4 Aug 3 low, signals scope for a deeper pullback towards $1711.7 next. Key resistance is $1807.9.In the Oil space, WTI futures remain vulnerable. This week’s move down has resulted in a print below support at $87.01, the Aug 5 low. This reinforces bearish conditions and a clear break of $87.01 would confirm a resumption of the downtrend. Attention is on $85.37, the Mar 15 low.

- In the FI space, Bund futures continue to weaken and a bearish theme suggests scope for a continuation lower. The focus is on 152.43 next, 38.2% retracement of the Jun 16 - Aug 2 rally. Gilts remain vulnerable and have gapped lower today. The next objective is 112.24, 76.4% retracement of the Jun 16 - Aug 2 upleg.

SNAPSHOT: Dollar Strength Weighs On Stocks And Commodities

Equities:

- Asia Closing Levels: Japan's NIKKEI closed down 11.81 pts or -0.04% at 28930.33 and the TOPIX ended 4.02 pts higher or +0.2% at 1994.52. China's SHANGHAI closed down 19.466 pts or -0.59% at 3258.078 and the HANG SENG ended 9.12 pts higher or +0.05% at 19773.03.

- Europe: German Dax down 131.42 pts or -0.96% at 13847.56, FTSE 100 up 5.61 pts or +0.07% at 7521.73, CAC 40 down 24.02 pts or -0.37% at 6573.53 and Euro Stoxx 50 down 34.21 pts or -0.91% at 3795.33.

- U.S. Futures: Dow Jones mini down 270 pts or -0.79% at 33711, S&P 500 mini down 43.25 pts or -1.01% at 4243.25, NASDAQ mini down 155.75 pts or -1.15% at 13367.5.

Commodities:

- WTI Crude down $1.56 or -1.72% at $88.94

- Natural Gas down $0.15 or -1.65% at $9.036

- Gold spot down $8.03 or -0.46% at $1774.56

- Copper up $1.85 or +0.51% at $365.45

- Silver down $0.31 or -1.61% at $19.225

- Platinum down $11.6 or -1.27% at $902.96

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 22/08/2022 | 0115/0915 |  | CN | PBOC LPR announcement | |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.