-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Banks Kick Off Earnings Season

EXECUTIVE SUMMARY

- U.S. FINANCIALS EARNINGS IN FOCUS

- EUROPEAN UNION UNVEILS PLAN TO RAISE E800BN IN DEBT FOR RECOVERY FUND

- E.C.B.'S DE GUINDOS WARNS ON EARLY SUPPORT WITHDRAWAL

- E.U. COMMISSION TO END ASTRAZENECA AND J&J CONTRACTS AT EXPIRY (RTRS/STAMPA)

- U.K. ASKS E.U. FOR MORE TIME FOR RESPONSE TO LEGAL ACTION ON N. IRELAND

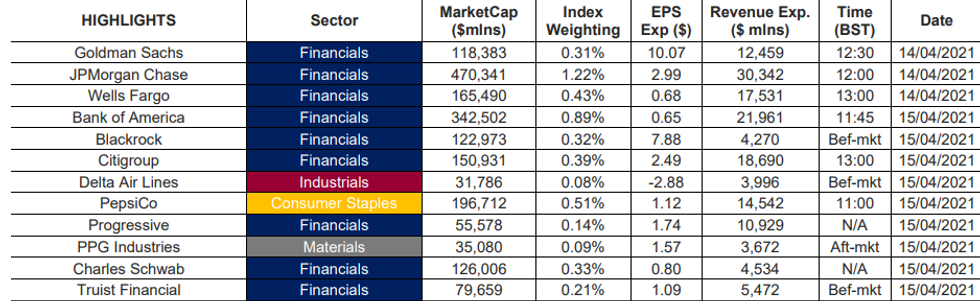

Fig. 1: US Earnings Calendar (S&P 500)

MNI

MNI

NEWS:

U.S. EQUITIES: Q2 earnings season kicks off with the largest US bank names, with reports from Goldman Sachs, JPMorgan, and Wells Fargo later Wednesday (and Morgan Stanley, Bank of America, Citi later in the week). This keeps the financials sector in focus, with the bulk of the larger reports due on Thursday. Full schedule here: https://roar-assets-auto.rbl.ms/documents/9444/MNI...

E.U. (BBG): The European Commission will use a diversified funding strategy to raise as much as about EU800 billion in current prices until 2026, Johannes Hahn, Commissioner in charge of Budget and Administration, says in statement. Summary: Borrowing to include green bonds, EU bills; average roughly EU150b a year. Will be repaid by 2058. Approach, which will be in line with the best practices of sovereign issuers, will enable the Commission to raise the needed volumes in a smooth and efficient way. Will also attract investors to Europe and strengthen the international role of the Euro.

E.U.: Full EU commission statement on NextGenerationEU here: https://ec.europa.eu/commission/presscorner/detail...

ECB: Monetary, fiscal and prudential authorities face a delicate balancing act, European Central Bank vice president Luis de Guindos said Wednesday, as any early withdrawal or scaling back of support measures was likely to trigger a wave of insolvencies that would have a big impact on banks' asset quality and the wider economy. Providing public support and low financing costs for too long may result in unviable corporates being kept alive to the detriment of banks' viability, economic productivity and, by extension, economic growth, de Guindos told the ECON committee at the European Parliament. But he stressed that the risks from early withdrawal of support are higher at present, echoing recent comments by President Christine Lagarde, rebuffing hawkish comments from a number of Governing Council members.

ECB: Privacy and security are the key concerns of both the public and professionals, the European Central Bank said Wednesday as it published the analysis of its public consultation on a digital euro. According to the survey, 43% of respondents put privacy as the most important 'want' from a digital currency, followed by security at 18%. "A digital euro can only be successful if it meets the needs of Europeans," ECB Executive Board member Fabio Panetta said.

E.U./COVID VACCINES (RTRS): The EU Commission has decided not to renew COVID-19 vaccine contracts next year with companies such as Astrazeneca and Johnson & Johnson (J&J), Italian daily La Stampa reported on Wednesday citing a source from the Italian Health Ministry. "The European Commission, in agreement with the leaders of many (EU) countries, has decided that the contracts with the companies that produce (viral vector) vaccines that are valid for the current year will not be renewed at their expiry," the newspaper reported.

OIL (BBG): Oil advanced for a third day after the IEA lifted its forecasts for demand and an industry report pointed to another decline in U.S. crude stockpiles. Futures rose 1.6% in New York and are heading for the longest run of gains in over a month. The International Energy Agency lifted its forecasts for oil consumption this year by 230,000 barrels a day amid a stronger outlook for the U.S. and China. It follows an upbeat outlook for demand from OPEC on Tuesday.

U.S. / RUSSIA: White House says Putin-Biden in-person meeting may take place this summer at a neutral venue following a phone call held yesterday between leaders last night. Both sides expressed readiness to promote dialogue and de-escalate tensions. Biden called for Moscow to dial back the military build-up on Ukraine's border, while Putin outlined a number of approaches to political settlement in the Donbass rooted in the Minsk Agreements.

ITALY (BBG): Budget outline document, to be discussed by Premier Mario Draghi's cabinet Wednesday, points to a 2021 deficit of between 10% and 11%, financial daily Il Sole 24 Ore reports. New round of measures to shore up economy could total more than EU20b. Draghi is bringing forward plans for new borrowing as the cost of keeping the economy afloat drains state coffers, people familiar with the matter told Bloomberg last week.

B.O.J. (BBG): The Bank of Japan will persistently continue its easing policy until its 2% price goal is reached, Governor Haruhiko Kuroda says in a speech in Tokyo on Wednesday. Japan's economy is maintaining movement toward recovery, though downside risks remain including the possible impact of tighter virus measures.

SUEZ CANAL (RTRS): The technical manager of the container ship that became jammed across the Suez Canal last month said on Wednesday that the vessel was fit for onward passage but remained anchored pending an agreement could between the owner and the canal authority. The Ever Given ship was declared suitable for onward passage from the Great Bitter Lake to Port Said, where she would be assessed again before departing for Rotterdam, Bernhard Schulte Shipmanagement (BSM) said in a statement.

EZ Production At 10-Month Low in Feb

EZ FEB IND PROD -1.0% M/M, -1.6% Y/Y; JAN +0.8% M/M

EZ IP dropped in Feb, falling by 1.0%, but beating market expectations (BBG: -1.1%)

This marks the biggest and only second decline since Apr 2020.

Feb's downtick was broad-based with every major category posting a decrease.

Capital goods output registered the largest drop, down 1.9%, followed by energy production (-1.2%) and durable consumer goods (-1.1%).

Intermediate goods production eased 0.7% and non-durable consumer goods output ticked down 0.1%.

Annual industrial output fell by 1.6%, recording the lowest level since Oct.

Among the member states, France (-4.8%), Malta (-3.8%) and Greece (-2.5%) saw the largest declines, while Ireland (+4.2%), Lithuania (+2.4%) and Portugal (+1.2%) recorded the biggest gains.

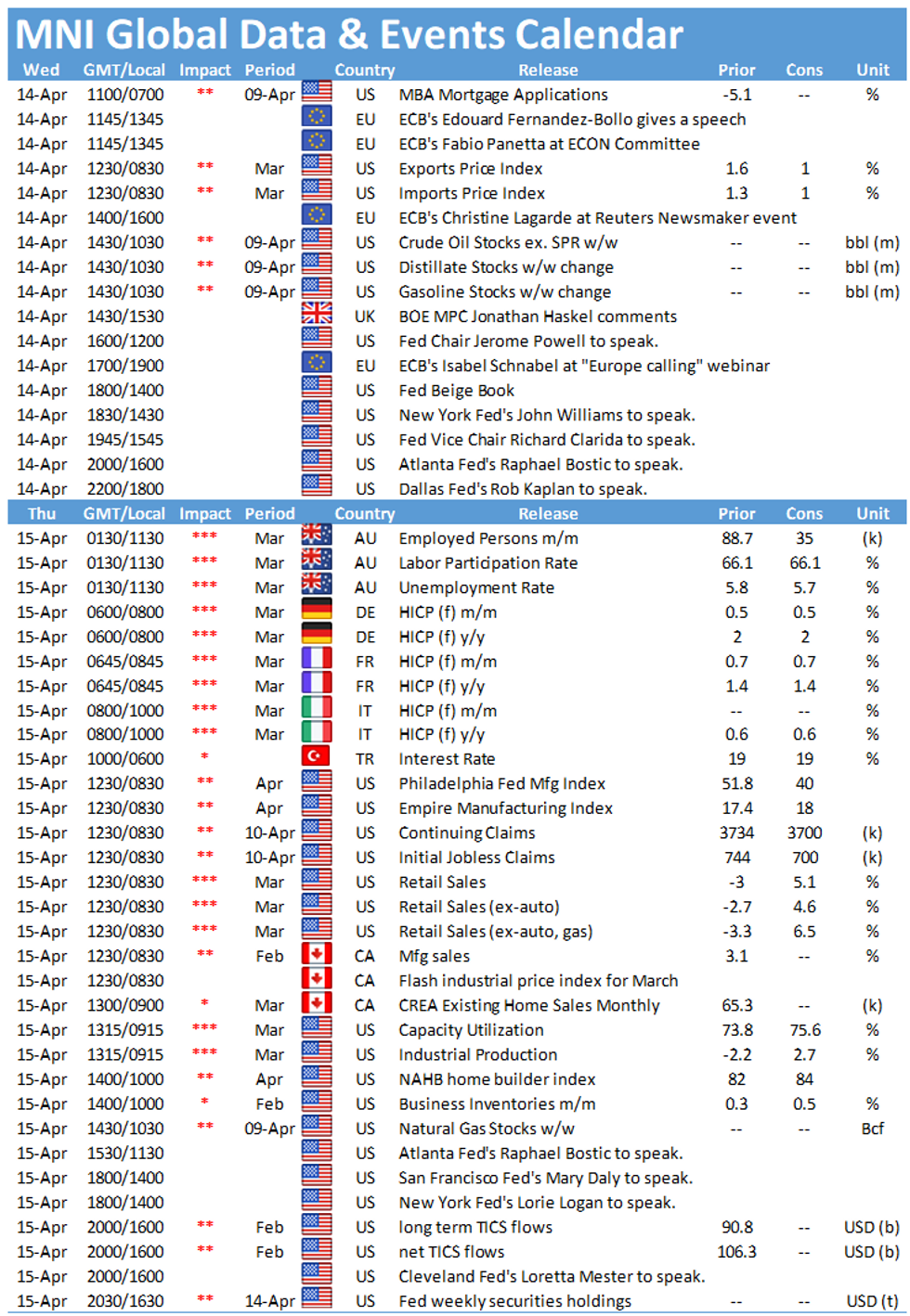

FIXED INCOME: Focus on CB speakers

- Core fixed income is a bit lower with equities mixed this morning.

- Markets showed no real adverse reaction to yesterday's huge day of supply (with the US, Spain, Italy, Netherlands, Austria, UK all issuing). Focus is instead on central bank speakers today.

- The highlights are Powell at the Economic Club of Washington and Lagarde in a fireside chat at a Reuters event. Elsewhere we also have ECB's Panetta and Schnabel, the Fed's Williams, Clarida and Bostic and the BOE's Haskel.

- TY1 futures are down -0-5 today at 131-29+ with 10y UST yields up 2.3bp at 1.639% and 2y yields up 0.4bp at 0.164%.

- Bund futures are up 0.09 today at 171.35 with 10y Bund yields down -0.3bp at -0.296% and Schatz yields unch at -0.707%.

- Gilt futures are down -0.03 today at 128.18 with 10y yields up 1.0bp at 0.787% and 2y yields up 0.8bp at 0.051%.

FOREX: USD Softer Pre-Powell, Clarida Speeches

- The greenback trades lower across the board, with the USD index hitting new April lows this morning and eyeing the key support at the 91.578 50-dma. Antipodean currencies are the main beneficiaries, with AUD and NZD outperforming ahead of NY hours.

- The RBNZ rate decision overnight saw rates unchanged, but some sell-side outfits eyed less dovish language in the policy statement, as the bank no longer stressed the possibility of negative interest rates going forward. The subsequent NZD strength is erasing the late-March weakness, with NZD/USD nearing the 100-dma at 0.7148 which becomes the first target.

- Risk sentiment is positive, with the e-mini S&P holding just below the late Tuesday highs which marked a new record. Futures are universally positive in the US, with tech-led NASDAQ futures outperforming relative to both the S&P and Dow.

- Focus turns to central bank speak, with key missives due from both Fed's Powell and Clarida later today. The data schedule is lighter, with just US import/export price indices on the docket.

EQUITIES: US Futures Edging Higher Ahead Of Financials Earnings

- Asian markets closed mixed, with Japan's NIKKEI down 130.62 pts or -0.44% at 29620.99 and the TOPIX down 6.37 pts or -0.33% at 1952.18. China's SHANGHAI closed up 20.251 pts or +0.6% at 3416.721 and the HANG SENG ended 403.58 pts higher or +1.42% at 28900.83.

- European equities are a little stronger, with the German Dax up 10.97 pts or +0.07% at 15234.36, FTSE 100 up 10.29 pts or +0.15% at 6890.49, CAC 40 up 27.77 pts or +0.45% at 6184.1 and Euro Stoxx 50 up 10.61 pts or +0.27% at 3966.99.

- U.S. futures are slightly higher, with the Dow Jones mini up 17 pts or +0.05% at 33587, S&P 500 mini up 6 pts or +0.15% at 4138.75, NASDAQ mini up 28.25 pts or +0.2% at 14004.

COMMODITIES: Oil Gains On IEA Demand Outlook Upgrade

- WTI Crude up $0.97 or +1.61% at $61.19

- Natural Gas up $0.01 or +0.31% at $2.629

- Gold spot up $0.95 or +0.05% at $1747.01

- Copper up $5.25 or +1.3% at $408.85

- Silver up $0.13 or +0.53% at $25.4894

- Platinum up $20.29 or +1.75% at $1180.76

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.