-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI US Open: Bonds Rise As Central Bankers Urge Patience

EXECUTIVE SUMMARY:

- ECB'S VISCO: DON'T EXPECT POLICY TO BE TIGHTENED FOR A LONG TIME

- BOE'S BAILEY SAYS HE WON'T RUSH TO JUDGMENT ABOUT INFLATION

- UK SEES RECORD JOBS GROWTH IN JUNE AS VACANCIES SOAR

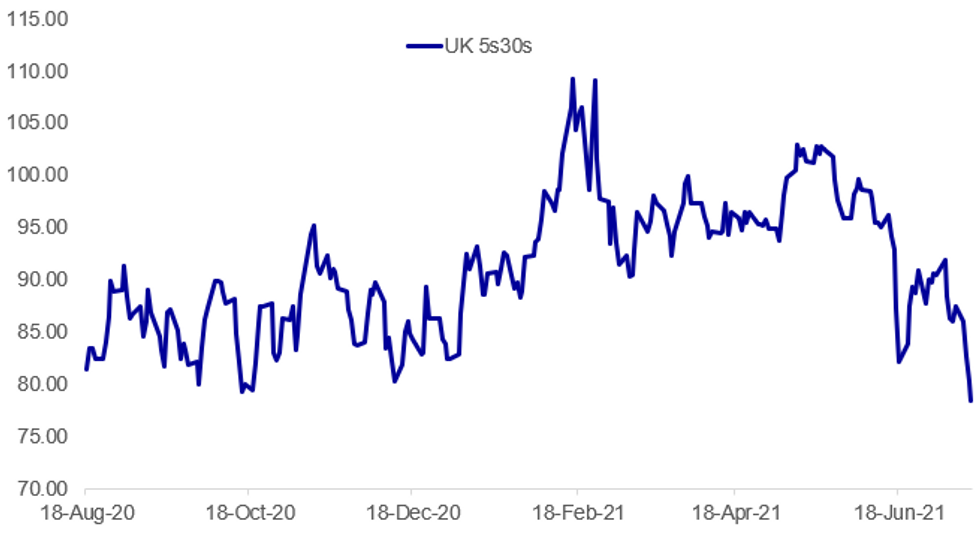

FIG. 1: UK Yield Curve Continues To Flatten

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): The European Central Bank must be careful not to reduce monetary stimulus too soon to convince investors that it's serious about meeting its inflation goal, according to Governing Council member Ignazio Visco."We have to avoid tapering before the time comes that we're really confident we're back where we should," Visco, who also heads the Bank of Italy, said in a Bloomberg Television interview on Thursday. "We really have to show to be determined." "I don't expect monetary policy to be tightened for a long period," Visco said, pointing to "substantial slack" in the euro-area economy and risks related to another wave of coronavirus infections.

BOE (BBG): Bank of England Governor Andrew Bailey said he won't rush to make judgments about inflation even after consumer prices leaped more than expected in June.The remarks, in an interview with the Business Live website yesterday and published on Thursday, were a reaction to inflation rising 2.5%, more than the BOE's 2% target. "Today's number -- yes, it was higher than we thought it would be," Bailey said, according to Business Live. "It's higher than pretty much most observers thought would be in that sense. What we will have to do, again, is go through all the evidence and assess to what extent we think the sorts of things that underlie that are likely to be transitory."

U.S.-GERMANY: German Chancellor Angela Merkel arrives at the White House today for a state visit, her last to the United States after 16 years in office. Andrew Feinberg in The Independent outlines the comments made last night by a White House official indicating the topics the two leaders would discuss. Post-talks presser due at 1615ET (2115BST, 2215CET).

- "The leaders…will discussshared ways to respond to regional challenges, including addressing Russian cyberattacks and territorial aggression, countering China's rising influence, non-market economic practices and human rights abuses, including forced labor, support for Ukraine's sovereignty and territorial integrity, and … bolstering the Euro Atlantic aspirations of the Western Balkan countries," as well as "their commitment to shoring up democracy at home, and defending human rights, democratic institutions and the rule of law around the world".

U.K.: UK Prime Minister Boris Johnson is due to make what is being billed as a major speech on his gov'ts strategic vision for 'levelling up' deprived areas of the country amidst concern from backbench Conservative MPs based in the wealthy south that the gov'ts plans could risk their seats.

- Speech due to take place at around 1115BST (0615ET, 1215CET).

- The speech is not due to be a detailed plan of how the gov't intends to level up, so no figures or spending plans included. These are set to come later in the year as part of a white paper due later in the year.

- Nevertheless, some real substance will be expected after a bruising week for the PM. Johnson will take questions from the media after the event, which could shed more light on his plans.

U.K. (BBG) :Decline in proportion on full or partial furlough leave reflects restrictions being relaxed across the U.K., the Office for National Statistics said Thursday. Figure suggests between 1.1 million and 1.6 million people were furloughed late last month: ONS

ECB / FRANCE (BBG): The main threat to the French economic outlook comes from hiring difficulties and not a resurgence of the Covid-19 pandemic, Bank of France Governor Francois Villeroy de Galhau says on France Info radio. The delta variant is "not the main threat" to the French economy as restrictions have a decreasing impact on output"The main threat for the recovery seems to be hiring difficulties for firms"

EUROPEAN EQUITIES (BBG): Siemens Gamesa shares drop 17%, the most since March 2020. The company's profit warning is likely to drive some investor concern about the impact of raw material inflation on the wind-turbine maker, Citi writes in a note.

GLOBAL TAX / IRELAND (BBG): Ireland's finance minister reiterated his commitment to retaining the nation's long held corporate 12.5% tax rate, amid reports the government may accept an increase as part of a international agreement brokered by the Organization for Economic Co-operation and Development.Ireland has not signed up to a plan for a minimum tax rate of at least 15% backed by 130 countries for corporations along with rules to share the spoils from multinational firms like Facebook Inc. and Alphabet Inc.'s Google. The government may give up its long held 12.5% tax rate and sign up to the OECD plan in October, the Irish Examiner newspaper reported on Wednesday.

FRANCE (BBG): France's public deficit will be below 9% this year, AFP reports, citing French Finance Minister Bruno Le Maire.

DATA:

UK Employment Up in May; Vacancies Rose Sharply

MAR-MAY LFS JOBLESS RATE 4.8% VS 4.8% PRIOR

MAR-MAY AVG TOTAL EARNINGS +7.3% VS +5.7% PRIOR

MAR-MAY AVG EARNINGS EX-BONUS +6.6% VS +5.7% PRIOR

JUN CLAIMANT COUNT DOWN 114,800 to 2,322,200

- The UK unemployment rate was 4.8% in May, in contrast to markets looking for the jobless rate to register at 4.7%, although the ONS noted that the data was reweighted for the May survey.

- While the employment rate edged slightly up by 0.1pp to 74.8% in May, the inactivity rate was up 0.1pp as well and rose to 21.3%.

- More up-to-date PAYE data showed a m/m increase of 356,000 in the number of payrolled employees in Jun, indicating that the labour market continues to recover. However, compared to Feb 2020, there were still 206,000 fewer people in payrolled employment, but for the first time some regions were above pre-pandemic levels.

- There were 862,000 vacancies in Apr 2021 to Jun 2021, 241,000 more than in the previous quarter and 77,500 more than before the crisis. All but one sector recorded a gain with the hospitality sector being the main driver.

- Redundancies fell to 3.8 people per 1000 employees, while hours worked rose 0.7 hours to 30.5 hours.

- Wages grew strongly in the three months to May with total nominal pay rising by 7.3%, the highest on record. However, the ONS noted that pay growth is affected by compositional effects and base effects and the underlying picture suggests a more modest pay rise.

FIXED INCOME: Moving to the week's highs

Core fixed income has been marching higher today, with TY1, gilt and Bund futures all at their highs of the week.

- Bunds have seen the smallest moves, but have moved to the most significant levels. At the time of writing the July 8 high of 174.77 was within a couple of ticks, a level that marks the highest level for futures since February. Peripheral spreads are generally a little wider on the day too.

- Looking ahead the highlights are a speech from the BOE's Saunders at 11:00BST/6:00ET entitled "The Inflation Outlook". Powell testifies in front of the Senate Banking Committee while we are also due to hear from Evans.

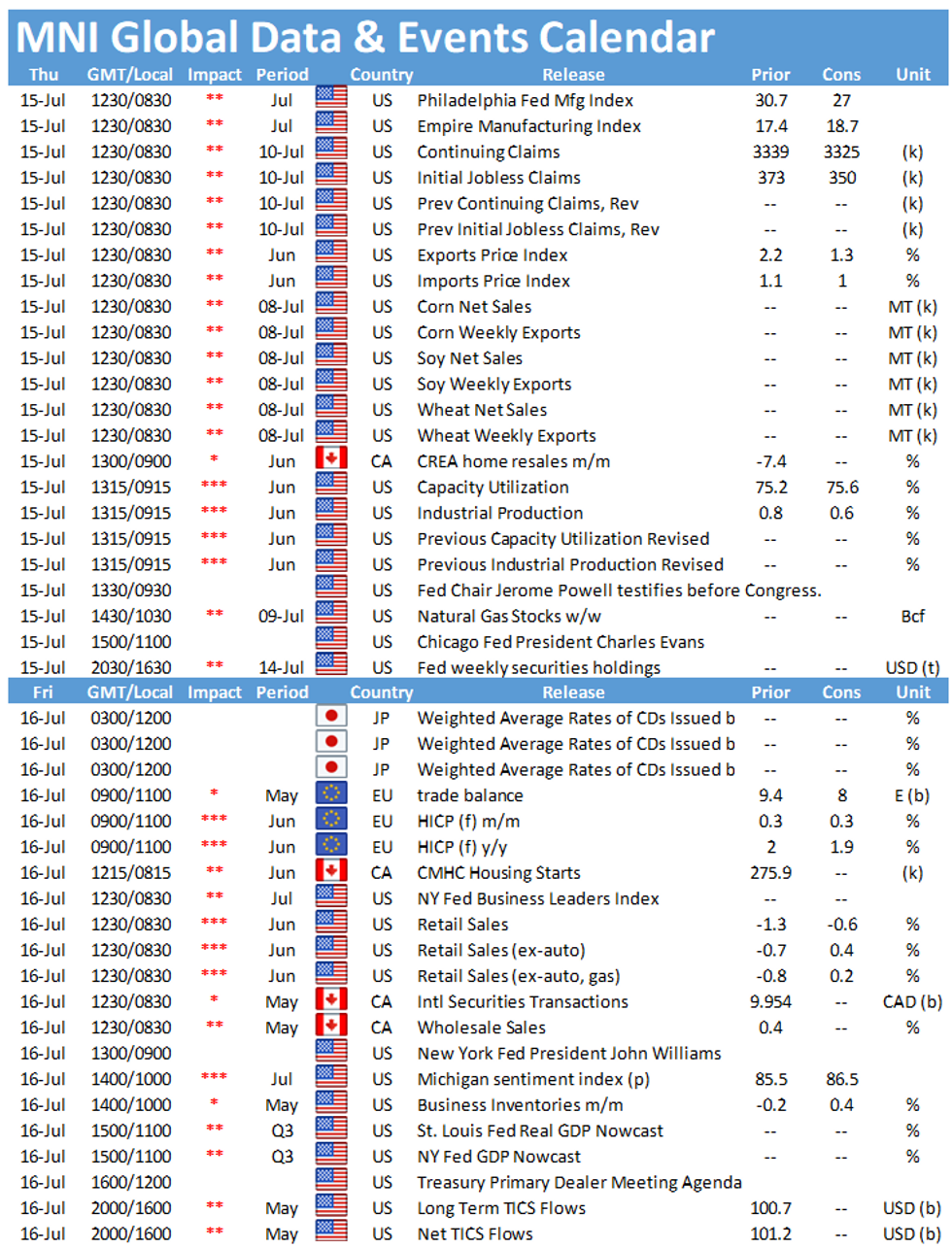

- In terms of data, we saw some mixed UK labour market data earlier this morning and the final print of Italian HICP was in line with the flash. Later today we have US weekly claims data, industrial production, Philly Fed and Empire manufacturing.

- TY1 futures are up 0-10 today at 133-24+ with 10y UST yields down -3.5bp at 1.313% and 2y yields down -0.6bp at 0.218%.

- Bund futures are up 0.40 today at 174.74 with 10y Bund yields down -2.1bp at -0.341% and Schatz yields down -0.2bp at -0.684%.

- Gilt futures are up 0.40 today at 129.46 with 10y yields down -3.4bp at 0.592% and 2y yields down -0.7bp at 0.069%.

FX SUMMARY- Dollar stays offered

USD trade in negative territory in G10, albeit still flat against NZD, AUD and SEK.

- US yields have drifted lower, providing some better selling interest in the Greenback.

- It has been a mixed early session for the Pound, initially went bid on the Govie open, but fully reversed during the cash Equity open on Asos falling over 10% on profit warnings, hurting sentiment.

- The pound has since, once again reversed its price action, with Cable back in the Green on the broader base offered Dollar.

- Safe haven FX, CHF and JPY are leading against the USD in G10s, up 0.47% and 0.33% respectively.

- Big selling in the German Dax, dragged Equities lower, following Siemens Gamesa falling some 15% on profit warning.

- Equities have since recovered some ground.

- Looking ahead, US, IJC, Phili Fedf and IP are the notable data.

- Speakers include, ECB Lagarde and Yellen releasing podcast conversation, BoE Saunders, Fed Evans, and Powell this time before Senate,

EQUITIES: Nasdaq Leading Gains Again

- Asian stocks closed mixed, with Japan's NIKKEI down 329.4 pts or -1.15% at 28279.09 and the TOPIX down 23.55 pts or -1.2% at 1939.61. China's SHANGHAI closed up 36.089 pts or +1.02% at 3564.59 and the HANG SENG ended 208.81 pts higher or +0.75% at 27996.27.

- European equities are mixed (industrials / energy are dragging, with a major drop in Siemens Gamesa, a wind turbine maker), with the German Dax down 90.78 pts or -0.58% at 15788.98, FTSE 100 up 9.16 pts or +0.13% at 7091.19, CAC 40 down 13.25 pts or -0.2% at 6558.38 and Euro Stoxx 50 down 13.91 pts or -0.34% at 4099.5.

- U.S. futures are mixed, with tech leading higher again: Dow Jones mini down 68 pts or -0.2% at 34748, S&P 500 mini up 0.5 pts or +0.01% at 4368.25, NASDAQ mini up 66 pts or +0.44% at 14957.25.

COMMODITIES: Oil Extends Losses On Wed's EIA Supply Numbers

- WTI Crude down $0.61 or -0.83% at $71.82

- Natural Gas up $0.01 or +0.3% at $3.667

- Gold spot up $4.41 or +0.24% at $1831.61

- Copper up $5 or +1.17% at $431.1

- Silver up $0.07 or +0.27% at $26.3731

- Platinum up $12.78 or +1.13% at $1142.97

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.