-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: China Risk-Off Continues

EXECUTIVE SUMMARY:

- CHINA RISK-OFF BLEEDS INTO EUROPE

- HOLZMANN: HAD RESERVATIONS REGARDING NEW ECB GUIDANCE

- LOCKDOWNS COULD DELAY BUT NOT DERAIL REBOUND: RBA (MNI INSIGHT)

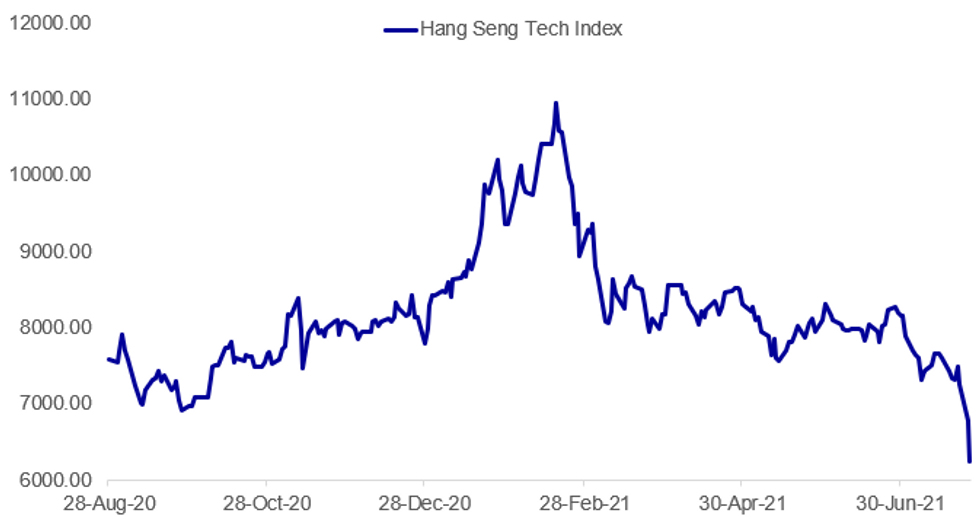

Fig. 1: Hang Seng Tech Index Drops Further On Regulatory Crackdown

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA / HONG KONG / GLOBAL EQUITIES: Weakness in Chinese/HK assets has persisted, with USD/CNH this morning touching levels not seen since mid-April while local equities suffer sharply. The Hang Seng Index closed lower by 4.4%, adding to yesterday's acute sell-off. The sell-off in China assets has fed into the European open, with core European equity markets off 1% or more early in the session, while US futures markets come well off the overnight highs. Beijing's decision to crack down on private tuition firms catalysed the sell-off late last week, with selling accelerating today and prompting speculation that offshore (namely US) funds are offloading positions and exiting the region. Moves follow report from Bloomberg late yesterday "Cathie Wood Keeps Dumping Chinese Stocks as Beijing Cracks Down" which may be adding weight to this morning's moves.

CHINA / HONG KONG / GLOBAL EQUITIES (BBG): A bellwether for China's listed tutoring firms suffered a credit rating downgrade, following a recent crackdown on the nation's private education firms.New Oriental Education & Technology Group Inc.'s score was cut to Baa3 from Baa1 by Moody's Investors Service on Tuesday. Baa3 is the lowest investment-grade rating, just one step away from junk territory at the credit assessor.

CHINA / HONG KONG / GLOBAL EQUITIES (BBG): Meituan has shed more than $60 billion of its market value over two frenetic trading sessions, after Beijing unveiled sweeping reforms against private-sector companies that darkened the outlook for the world's No 2 economy. China's top food delivery company slid a record 18% Tuesday in Hong Kong, on top of a 14% plummet the previous day. Spreads on Meituan's dollar bond due 2030 rose 16 basis points to 232 basis points, set for the widest on record, Bloomberg-compiled data showed.

CHINA / HONG KONG / GLOBAL EQUITIES (BBG): China Evergrande Group surprisingly decided against declaring a special dividend after investors were spooked by news that banks and ratings companies are growing wary of the debt-laden developer. The board chose to cancel the proposal less than two weeks after flagging it to investors. It took into consideration the current market environment, the rights of shareholders and creditors, and the long-term development of businesses, according to a statement to the Hong Kong stock exchange on Tuesday.

ECB (BBG/CNBC): The European Central Bank would have been more honest if it had told the market it will maintain accommodative policy but stands ready to change rates if necessary, Governing Council member Robert Holzmann says in CNBC interview. Holzmann says he would've preferred more specificity on underlying inflation metric, property prices in statement.

RBA (MNI INSIGHT): The Reserve Bank of Australia expects that lockdowns to contain the delta variant of Covid-19 could delay recovery and cause the economy to contract in the third quarter, before a rebound on the back of improving world demand, MNI understands. For full article contact sales@marketnews.com

ECB (BBG): European Central Bank policy makers have acknowledged that their new push to boost inflation expectations could take quite a while to kick in, according to officials familiar with the discussions.In its strategy review this month, when it raised its inflation goal and acknowledged that it might overshoot, the ECB's Governing Council discussed the experience of the U.S. Federal Reserve, the officials said.U.S. expectations -- a critical signal of future price gains -- were slow to move last August when the Fed adopted average inflation targeting and said it was willing to overshoot its 2% target. They only started to gather pace months later when the incoming Biden administration started to discuss a fiscal boost to the economy.

BITCOIN (BBG): Bitcoin fell after briefly rallying past $40,000, as Amazon.com Inc. pushed back against speculation it will accept the token for payments this year, offering investors another reminder of the coin's volatility.The largest digital currency dropped as much as 3.5% and was trading at about $37,100 as of 1:44 p.m. in Hong Kong, extending a late reversal in U.S. trading. Rival coins including Ether and Litecoin also retreated.

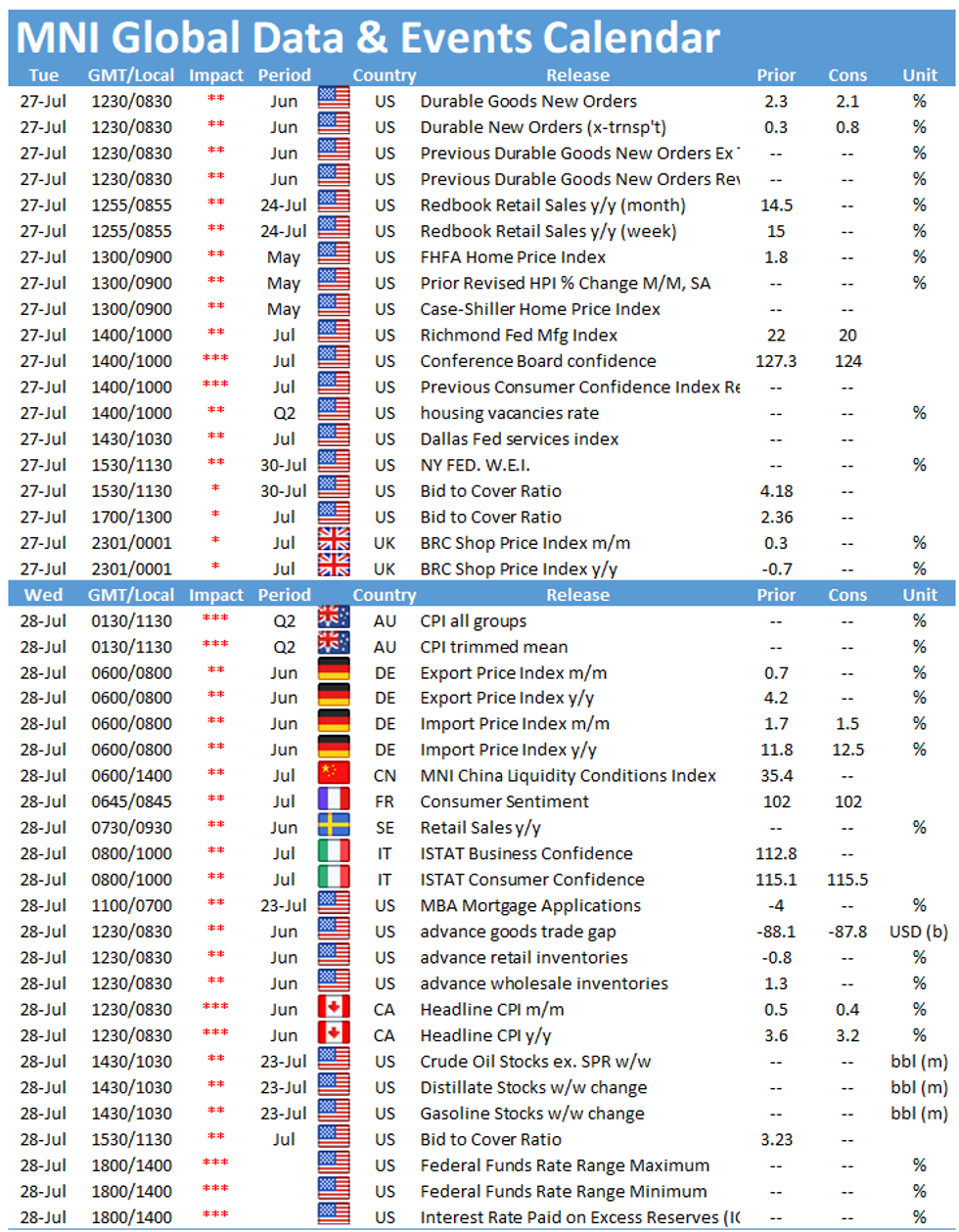

DATA:

FIXED INCOME: Govies are favoured as Asian Equities plummet

EGBs extended gains on FTQ (Flight to Quality) flows, after Asian Equities plummeted further during our morning European session.

- The move in Asia spilled over into EU and US Equities.

- Bund has once again tested the initial Yield support -0.442% which equated to 176.30 today.

- We did print a 176.32 high today, and yield was also tested yesterday, down to -0.449% (176.49 in futures).

- Peripherals are mostly wider, with Greece leading by 1bp.

- Gilts are trading inline with EGBs, and the curve traded bull flatter.

- UK 5/30s eye yesterday's low at 69.356, also the flattest level in a year (14/07/2020), now at 69.952.

- US Treasuries saw similar price action, with investors moving into safe haven, after US Equities move into the red.

- US 5/30s is flatter, but trade within yesterday's range.

- Looking ahead, ECB de Cos is the notable speaker.

- On the data front, sees US prelim Durable Goods.

- Earning season continues, today includes, 3M, GE, Alphabet, Visa, Microsoft, Apple and Starbucks.

- Finally, we get US 5yr notes later

FOREX: China Rout Accelerates, Bleeding Into European Trade

- Weakness in Chinese/HK assets has persisted, with USD/CNH this morning rallying to touch levels not seen since mid-April while local equities suffer sharply. The Hang Seng Index closed lower by 4.4%, adding to yesterday's acute sell-off.

- This has prompted a broad risk-off theme across G10 currencies, with JPY and USD outperforming at the expense of AUD, NZD and NOK.

- Weakness in AUD/USD puts the pair just above the week's lowest levels at 0.7331 which provides first support ahead of the more major 0.7290 level. The formation of a death cross (50-dma < 200-dma) may continue to exert pressure on the pair.

- Prelim durable goods orders and July consumer confidence data make up the US data slate on Tuesday, but markets will also be watching for any comments from RBA's Debelle and ECB's de Cos. Corporate earnings releases worth watching include 3M, Apple, General Electric , Alphabet, Microsoft and Visa.

EQUITIES: China/HK Tech Stocks Lead Global Eqs Lower

China / Hong Kong tech stocks have led global equities lower.

- Asian markets actually closed mixed though, with Japan's NIKKEI up 136.93 pts or +0.49% at 27970.22 and the TOPIX up 12.42 pts or +0.65% at 1938.04. China's SHANGHAI closed down 86.258 pts or -2.49% at 3381.183 and the HANG SENG ended 1105.89 pts lower or -4.22% at 25086.43.

- European stocks are lower, with the German Dax down 131.82 pts or -0.84% at 15432.71, FTSE 100 down 58.67 pts or -0.84% at 6942.22, CAC 40 down 44.79 pts or -0.68% at 6533.84 and Euro Stoxx 50 down 32.35 pts or -0.79% at 4058.88.

- U.S. futures are a little lower too, with the Dow Jones mini down 201 pts or -0.57% at 34833, S&P 500 mini down 20 pts or -0.45% at 4394.25, NASDAQ mini down 36.75 pts or -0.24% at 15081.

COMMODITIES: Copper Drops, Oil And Gold Hang On

- WTI Crude down $0.07 or -0.1% at $71.62

- Natural Gas up $0.01 or +0.2% at $4.087

- Gold spot down $0.2 or -0.01% at $1799.31

- Copper down $4.95 or -1.08% at $453.45

- Silver down $0.06 or -0.24% at $25.1791

- Platinum down $12.73 or -1.19% at $1056.66

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.