-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Dollar Falls Out Of Bed

EXECUTIVE SUMMARY:

- EUROPEAN MANUFACTURING PMIS IMPRESS VS EXPECTATIONS; SERVICES LESS SO

- U.K. RETAIL SALES FALL SHARPLY IN JANUARY AMID LOCKDOWN

- CHINA MAY BAN RARE EARTH TECHNOLOGY EXPORTS ON SECURITY CONCERNS (BBG)

- RIKSBANK MINUTES SHOW RATE CUT STILL AN OPTION FOR SOME POLICYMAKERS

- BIDEN, VON DER LEYEN, JOHNSON AMONG LEADERS SPEAKING AT CONFERENCE TODAY

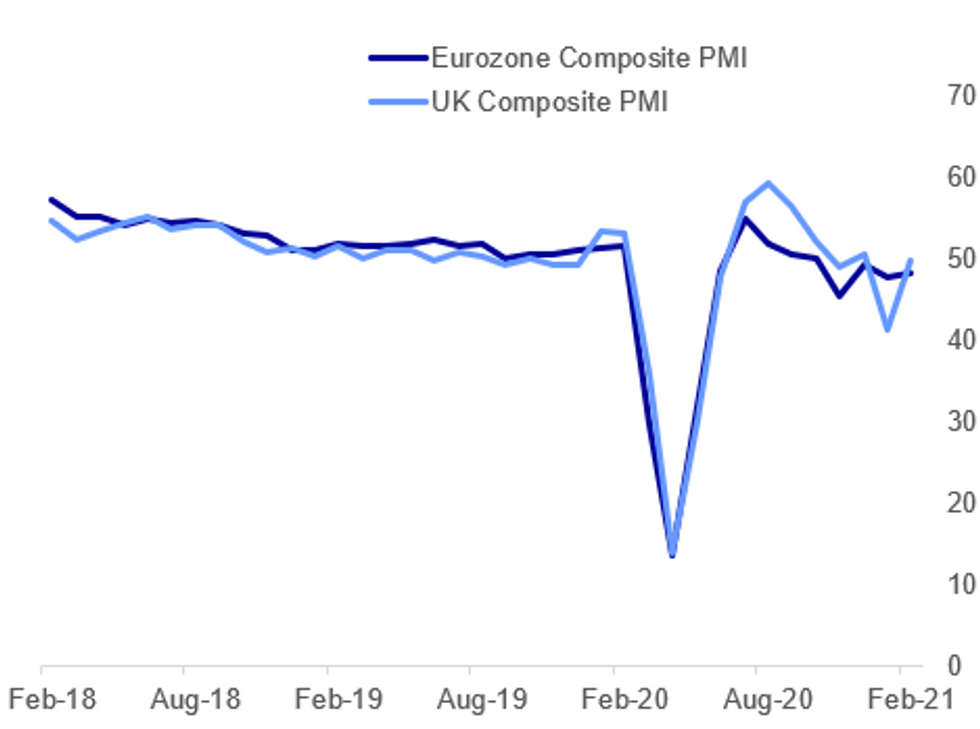

Fig. 1: European PMIs Better Than Expected

IHS MARKIT, MNI

IHS MARKIT, MNI

NEWS:

UK PMI DATA: The UK PMI press release emphasises stability. Most things not really changed since January (remember this is a diffusion index, so being close to 50 for services means things didn't worsen as much as though in Feb - but this is from a weak January baseline). Firms a bit more positive (as vaccine rollout continues) but there was a slight reduction in new work. In essence the way to read this is not that its "good" per se but that February wasn't any worse than a weak January for services.

EUROZONE PMI (IHS MARKIT): Eurozone business activity fell for a fourth successive month in February, driven lower by a further slump in the service sector as virus-related restrictions continued to affect many businesses. The service sector downturn was offset, however, by faster manufacturing growth, led by Germany. Business expectations also improved to the highest for nearly three years as companies looked ahead to vaccine roll-outs allowing an easing of restrictions. Rising price pressures were evident, however, as surging demand for raw materials led to nearrecord supply constraints, driving manufacturing input prices up at a rate not seen for almost ten years.

FRANCE / GERMANY PMI DATA: From the French PMI press release: "Looking forward, firms remained optimistic towards the 12-month business outlook. In fact, the degree of positivity was the strongest for just over two-and-a half years, with panellists signalling expectations for a recovery in demand later this year." For Germany, like France, manuf better than exp. But services broadly in line (unlike the miss in France).

CHINA (BBG): China may ban the export of rare-earths refining technology to countries or companies it deems as a threat on state security concerns, according to a person familiar with the matter. The Chinese government is currently conducting a review of its rare-earths policy. Officials view the technology needed to refine and purify the raw materials as a more powerful weapon in protecting state interests than the actual minerals, and is looking at banning sales of the technology to some countries or companies, according to the person, who asked not to be identified because the information isn't public. While China has no plans to restrict shipments of rare earths to the U.S., it is keeping the plan in its back pocket should a trade war break out again, the person said.

RIKSBANK: A rate cut pushing the benchmark Repo Rate back into negative territory remains an option for some Riksbank policy makers, despite the economy performing better previously expected, the minutes of the February meeting showed. Deputy Governor Anna Breman said that "a rate cut may be an effective tool to contribute to a broad-based demand stimulus" while her colleague Martin Floden said a cut may be appropriate if there were any developments endangering the recovery. Per Jansson said that previous experience showed the harmful side-effects of negative rates were relatively minor.

UBER/UK (BBG): Uber Technologies Inc. lost a U.K. Supreme Court ruling over the rights of its drivers, in a landmark decision that threatens the company's business model in the country.The judges said that Uber drivers were "workers" entitled to rights like minimum wage, holiday pay and rest breaks. The court said the contact terms were set by Uber and working conditions were controlled by the company.

GLOBAL POLITICAL RISK: This afternoon a series of major global leaders will deliver foreign policy speeches to the virtual Munich Security Conference. Coming just hours after the first G7 leaders video meeting since April 2020, the conference rounds off a busy day for international relations and the outlining of major foreign policy visions.

- 1015ET, 1515GMT, 1615CET: Antonio Guterres, Secretary General of the United Nations - 'Priorities for Global Action'.

- 1035ET, 1535GMT, 1635CET: Bill Gates, Co-Chair Bill and Melinda Gates Foundation; Dr Tedros Adhanom Ghebreyesus, Director-General World Health Organisation - 'Spotlight: Fighting the Pandemic'.

- From 1115ET, 1615GMT, 1715CET: Joe Biden, President of the United States; Angela Merkel, Chancellor of Federal Republic of Germany; Emmanuel Macron, President of French Republic - 'A New Transatlantic Agenda Part 1'.

- From 1200ET, 1700GMT, 1800CET: Ursula von der Leyen, President of the European Commission; Charles Michel, President of the European Council; Jens Stoltenberg, NATO Secretary-General - 'A New Transatlantic Agenda Part 2'.

- 1245ET, 1745GMT, 1845CET: John Kerry, Special Presidential Envoy for Climate Change and former US Secretary of State - 'Spotlight: Tackling the Climate Crisis'

- 1300ET, 1800GMT, 1900CET: Boris Johnson, Prime Minister of the United Kingdom - 'A New Transatlantic Agenda Part 3'

GERMANY FLASH FEB MFG PMI 60.6; JAN 57.1

FRANCE FLASH FEB MFG PMI 55.0; JAN 51.6

EZ FLASH FEB MFG PMI 57.7; JAN 54.8

UK FLASH FEB MFG PMI 54.9; JAN 54.1

ITALY JAN FINAL HICP -0.9% M/M, +0.7% Y/Y; DEC -0.3% Y/Y

MNI: FRANCE JAN FINAL HICP +0.3% M/M, +0.8% Y/Y; DEC 0.0% YY

MNI: EZ DEC CURRENT ACCOUNT +EUR37 BN; NOV +EUR25 BN

UK Jan Retail Sales Dropped Amid Third Lockdown

UK JAN RETAIL SALES -8.2 % M/M; -5.9% Y/Y

UK JAN RETAIL SALES EX-FUEL -8.8% M/M; -3.8% Y/Y

UK DEC TOTAL SALES REVISED AT +0.4% M/M

UK JAN RETAIL SALES DEFLATOR -1.0% Y/Y; EX-FUEL -0.4% Y/Y

The national lockdown led to a sharp fall in UK retail sales which plunged by 8.2% in Jan. This month's decline was significantly stronger than expected (BBG: -3.0%), marking the sharpest decline since April. This is in line with MNI's Reality Check which suggested that Jan's decline was likely to be greater than expected as many firms adapted to the new circumstances. However, Jan's decrease was not as severe as in the first lockdown. While food sales rebounded and grew by 1.4%, non-food stores saw a sharp decline in sales with all categories registering monthly drops. Clothing and footwear recorded the largest drops in Jan, falling by 34.7% on the month. Online sales as a proportion of all retailing jumped to a record high level of 35.2% and accounted for over a third of total spending.

FIXED INCOME: Bund and gilt yields hit new multi-month highs

It has been a choppy morning session with Bunds and gilts falling to new recent lows around the open.

- 10-year Bund yields hit their highest levels since June while 10-year gilt yields the highest levels in 11-months (still some way off the spike seen ahead of the BoE's emergency QE decision. Treasuries have failed to break through (or even challenge) yesterday's low (which itself was higher than Wednesday's low).

- We are now a little off the lows of the day in Bunds and gilts but peripheral spreads remain tighter and the overarching sentiment of the market remain risk-positive.

- Flash PMI data has largely been ignored. It surprised to the upside for manufacturing across Germany, France, the Eurozone and UK but services data was a bit more mixed (with the UK surprising to the upside but remaining below 50).

- Later today we will hear from the Fed's Barkin and Rosengren and BOE's Vlieghe.

- TY1 futures are down -0-4+ today at 135-23 with 10y UST yields up 0.9bp at 1.305% and 2y yields up 0.3bp at 0.110%.

- Bund futures are down -0.26 today at 174.42 with 10y Bund yields up 1.9bp at -0.328% and Schatz yields up 0.3bp at -0.690%.

- Gilt futures are down -0.27 today at 130.58 with 10y yields up 2.1bp at 0.642% and 2y yields up 0.9bp at -0.37%.

FOREX: Dollar Downside Eyes Feb Lows for Greenback

The greenback's been sold throughout European morning hours, prompting the USD index to narrow the gap with February lows printed earlier this week at 90.118. A break through here opens key support at 90.05 and would provide some major impetus for EUR/USD, GBP/USD and USD/JPY rates.

USD weakness this morning has buoyed GBP/USD above the $1.40 handle for the first time since April 2018, a move that's also seen USD/JPY show below the Y105.50 mark. European prelim PMI data has been mixed, with manufacturing generally faring better, but services lagging.

CNH saw some minor volatility on the back of further headlines suggesting China could ban rare earth technology exports if it deems necessary on national security grounds. USD/CNH initially rallied, touching 6.4553, before fading as markets deemed the news had little new information.

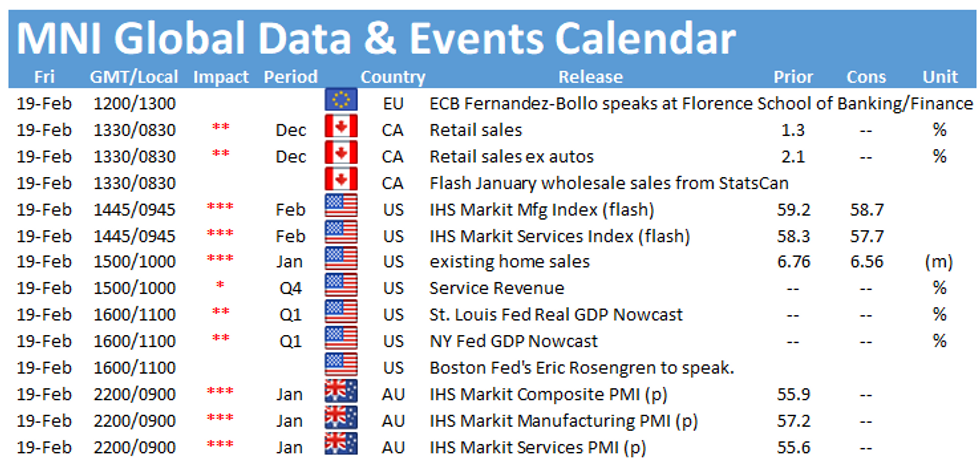

Focus Friday turns to Canadian retail sales and prelim February PMIs, existing home sales from the US. Central bank speakers include Fed's Barkin & Rosengren.

EQUITIES: Off Overnight Lows

- Asian stocks closed mixed, with Japan's NIKKEI down 218.17 pts or -0.72% at 30017.92 and the TOPIX down 12.96 pts or -0.67% at 1928.95. China's SHANGHAI closed up 20.811 pts or +0.57% at 3696.168 and the HANG SENG ended 49.46 pts higher or +0.16% at 30644.73

- European equities are higher, with the German Dax up 70.27 pts or +0.51% at 13932.4, FTSE 100 up 7.49 pts or +0.11% at 6617.15, CAC 40 up 30.36 pts or +0.53% at 5728.33 and Euro Stoxx 50 up 17.78 pts or +0.48% at 3690.89.

- U.S. futures have reversed overnight losses and are now in the green, with the Dow Jones mini up 66 pts or +0.21% at 31497, S&P 500 mini up 12 pts or +0.31% at 3921.5, NASDAQ mini up 46.75 pts or +0.34% at 13679.75.

COMMODITIES: Oil Retreating, Metals Mixed

- WTI Crude down $0.9 or -1.49% at $59.36

- Natural Gas up $0 or +0.13% at $3.076

- Gold spot down $5.7 or -0.32% at $1775.03

- Copper up $7.5 or +1.92% at $397.5

- Silver up $0.03 or +0.11% at $26.967

- Platinum down $6.44 or -0.5% at $1260.03

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.