-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US Open: Equities Remain Under Pressure

EXECUTIVE SUMMARY:

- UK RETAIL SALES DIP SHARPLY IN JULY

- CHINA DELAYS HONG KONG ANTI-SANCTIONS LAW AS MARKETS TUMBLE

- BANK OF JAPAN SEES PRODUCTION RECOVERY AFTER TOYOTA SETBACK (MNI INSIGHT)

Fig. 1: Hang Seng Enters Bear Market

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BANK OF JAPAN (MNI INSIGHT): Bank of Japan officials are concerned about near-term pressure on exports after Toyota Motor Corp this week outlined cuts to production because of parts shortages, but expects demand to remain solid, MNI understands. For full article contact sales@marketnews.com

UK: The governing Scottish National Party (SNP) have finalised a 'power-sharing partnership' with the environmentalist Green Party of Scotland to create a pro-independence majority in the Scottish Parliament. First Minister Nicola Sturgeon's Cabinet are set to approve the deal at a 0930BST Cabinet meeting. The deal between the two left-wing, pro-Scottish independence parties sees the Greens given several ministerial positions in the Scottish Cabinet in exchange for their support of the bulk of SNP-supported legislation. There will be no official coalition, but the partnership creates a coalition in all but name. The creation of a formalised pro-independence majority in Holyrood could see the SNP submit a bill that seeks to call another Scottish independence referendum (although it is unlikely that this would be legally binding under UK law).

CHINA / HONG KONG (BBG): China's top legislative body postponed a vote on a proposal to impose an anti-sanctions law on Hong Kong, delaying a move that could put global firms in the cross-hairs of a conflict between the world's two largest economies.The National People's Congress Standing Committee ended a closed-door session Friday in Beijing without announcing the passage of a resolution adding the legislation to Hong Kong's charter. Tam Yiu-chung, a local delegate to the body, later told reporters that the vote had been delayed pending further study, media outlets including Now TV said.

HONG KONG STOCKS (BBG): Hong Kong's benchmark stock index entered a technical bear market, amid a deepening rout triggered by investor concerns over China's regulatory crackdown across a swathe of industries. The Hang Seng Index fell 1.8% on Friday, taking losses from its recent Feb. 17 peak to more than 20%. That extended its weekly loss to 5.8%, the worst showing since March 2020, with Alibaba Group Holding Ltd. and Meituan weighting on the gauge Friday.

CHINA (MNI INTERVIEW): China is likely to be "highly flexible" in its macroeconomic policy in the face of a pandemic flare up, but authorities will be cautious about further major monetary or fiscal stimulus while growth remains at acceptable levels, a high-ranking advisor to the central government told MNI. For full article contact sales@marketnews.com

SWEDEN (BBG): The biggest lenders in Sweden will soon be able to resume shareholder payouts and stock buybacks after the country's financial watchdog said it won't extend restrictions beyond the end of September."The exceptional uncertainty from last spring has passed at the same time as the Swedish economy has entered into a clear recovery phase," Erik Thedeen, the chief of the Swedish Financial Supervisory Authority, said in a statement.

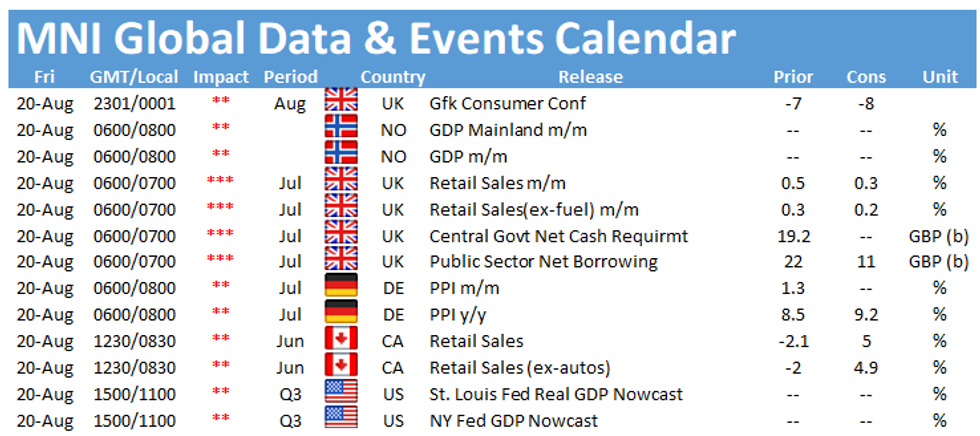

DATA:

UK retail sales dip sharply in July

JUL RETAIL SALES -2.5% M/M, +2.4% Y/Y (JUN +9.7% Y/Y)

JUL EX-FUEL RETAIL SALES -2.4% M/M; +1.8% Y/Y (JUN +7.4%YY)

----------------------------------------------------------------------------------------

- UK retail sales fell sharply in July, declining in nearly all sectors.

- Food sales fell, down 1.5% m/m, partly in response to high volumes in the previous month as the Euro football tournament got underway and partly as a result of the full reopening of the hospitality sector on July 19.

- Non-food sales also declined rapidly, down 4.4%, with all sectors showing negative outcomes.

- Auto fuel sales volumes fell 2.9%, with heavy rainfall seen impacting transport volumes.

- Online retail was one bright note, with sales proportion at 27.9% vs 27.1% in June

UK Government Borrowing Falls In July

JULY CGNCR GBP1.81 BLN; JUL PSNCR -GBP2.29 BLN

JUL PSNB GBP9.619 BN; JUL PSNB-X GBP10.353 BN

----------------------------------------------------------------------------------

- Public sector net borrowing (ex public sector banks) fell to GBP10.4 billion in July 2021; the second-highest July borrowing since monthly records began in 1993, but GBP10.1 billion less than in July 2020.

- Central government receipts in July 2021 were GBP70.0 billion, GBP9.5 billion more than in July 2020. central government bodies spent GBP79.8 billion in July 2021, GBP2.9 billion less than in July 2020.

- Self-assessed Income Tax receipts were GBP8.5 billion in July 2021, GBP3.7 billion more than in July 2020

- Debt interest payments totalled GBP3.9 billion, GBP1.1 billion higher than July 2020, with RPI over the period at 3.4%

FIXED INCOME: Core fixed income continues to drift higher

Core fixed income has drifted a little higher and is generally challenging the highs seen in yesterday's session at the time of writing.

- The main event of the morning has been some disappointing UK retail sales. The silver lining in the data seems to be that it wasn't purely due to a lack of consumer demand, but there were product availability constraints due to shipping issues. However, it does show how the pingdemic and shipping constraints are affecting growth.

- Later today the only notable event will be a speech by the Fed's Kaplan.

- European equity indices are generally a little lower (although there are some exceptions like the Ibex which are close to flat) and peripheral spreads are flat to a little wider on the day.

- TY1 futures are up 0-1+ today at 134-12 with 10y UST yields down -1.2bp at 1.232% and 2y yields down -0.6bp at 0.215%.

- Bund futures are up 0.12 today at 177.16 with 10y Bund yields down -0.5bp at -0.496% and Schatz yields down -0.4bp at -0.760%.

- Gilt futures are up 0.16 today at 130.24 with 10y yields down -1.1bp at 0.527% and 2y yields down -1.3bp at 0.098%.

FOREX: USD extend gains on Safe Haven flow

- Story in FX in early trading has been the upside continuation in USD, as investors look for safer haven Bond and USD, after Equities plummeted this week.

- USDCAD pushed higher to highest levels since December.

- USDCAD has gained 2.56% from Wednesday low, and next resistance comes at 1.2957 High Dec 21, 2020.

- The Canadian Dollar is the worst performer versus the USD in G10, down 0.84% on the session.

- Cable fell to the lowest level since the 21st of July, but 1.3600 has so far held, after the pair printed a 1.3609 low.

- Main downside target remains at the July low at 1.3572, which is also the lowest print seen since February.

- Only the Swiss Franc, Japanese Yen and Singapore Dollar are holding onto small gains against the Greenback

- Looking ahead, we have no tier 1 data of note.

- Some focus on the Canadian Retail Sales release.

- Fed's Kaplan speaks at Texas tech college of business, where he will take questions from the audience.

EQUITIES: Hang Seng Enters Bear Market (-20% From Feb High)

- Asian markets closed lower, with Japan's NIKKEI down 267.92 pts or -0.98% at 27013.25 and the TOPIX down 16.51 pts or -0.87% at 1880.68. China's SHANGHAI closed down 38.221 pts or -1.1% at 3427.334 and the HANG SENG ended 466.61 pts lower or -1.84% at 24849.72.

- European equities are weaker, with the German Dax down 64.62 pts or -0.41% at 15765.81, FTSE 100 down 19.62 pts or -0.28% at 7058.86, CAC 40 down 27.64 pts or -0.42% at 6605.89 and Euro Stoxx 50 down 4.85 pts or -0.12% at 4124.71.

- U.S. futures are also pointing downward, with the Dow Jones mini down 160 pts or -0.46% at 34658, S&P 500 mini down 20.5 pts or -0.47% at 4381, NASDAQ mini down 43.75 pts or -0.29% at 14884.25.

COMMODITIES: Oil Turns Lower After Early Recovery

- WTI Crude down $0.28 or -0.44% at $64.07

- Natural Gas up $0.08 or +2.19% at $3.874

- Gold spot up $1.79 or +0.1% at $1787.87

- Copper up $2.4 or +0.59% at $409.5

- Silver down $0.13 or -0.55% at $23.2832

- Platinum up $2.13 or +0.22% at $986.52

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.