-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Industrial Metals Stay Red-Hot

EXECUTIVE SUMMARY:

- E.C.B. CAN ADJUST PACE OF BOND BUYS AS NEEDED: CHIEF ECON LANE

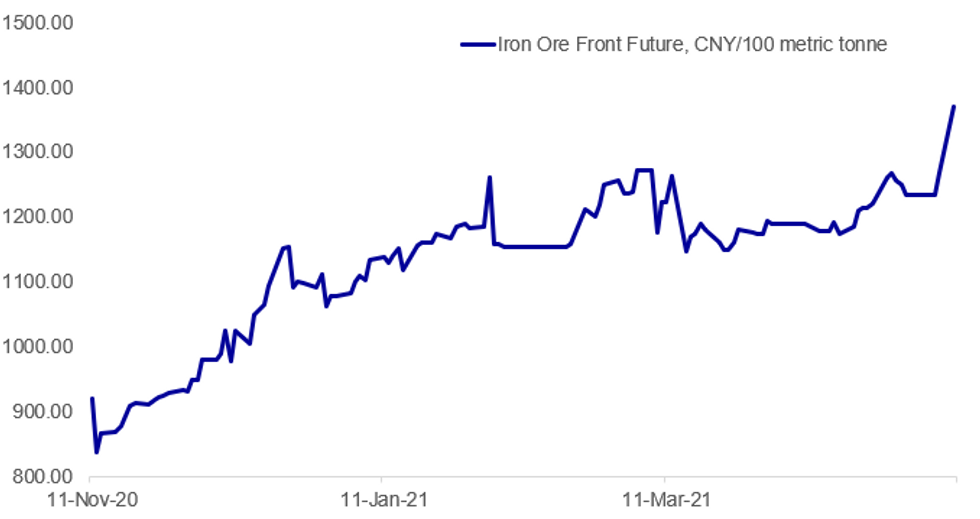

- COMMODITY PRICES SURGE AGAIN, IRON ORE GAINS 10%

- OIL GAINS AFTER CYBERATTACK FORCES SHUTDOWN OF U.S. FUEL PIPELINES

- JPM, DEUTSCHE ARE SAID TO BE AMONG FIRMS SUED BY 1MDB

- CHINA CPI HIGHER ON RISING SERVICES COSTS (MNI REALITY CHECK)

Fig.1: Iron Ore Prices Soar 10%

BBG, MNI

BBG, MNI

NEWS:

E.C.B.: The European Central Bank will look again in June at whether financing conditions remain favourable and can use the flexibility of the Pandemic Emergency Purchase Program to either increase of slow the pace of bond purchases as required, Chief Economist Philip Lane said in an interview with Le Monde published Monday. "Our overall commitment is to maintain favourable financing conditions," he said. Lane was sanguine about higher bond yields impacting bloated state finances in coming years, with repayment costs at a far lower level of tax take and national income that after the financial crisis. "Current levels of debt in today's environment are not a source of concern to global investors – but, of course, governments will have to rebuild fiscal capacity once the recovery firmly takes hold," he said.

COMMODITIES (BBG): Iron ore futures surged more than 10% and copper jumped to a record amid growing bets they'll be among the biggest winners from a commodities boom that's stoking concerns about inflation around the world. While market participants struggled to pinpoint a trigger for Monday's gains, they cited several ongoing trends including optimism that central banks will retain supportive policies even as the global economy recovers. Expectations China will tighten environmental rules have added to the bull case for copper -- seen as vital to the green energy transition -- and fueled speculation that steelmakers may front-load iron ore purchases before new curbs kick in.

COMMODITIES (RTRS): Oil rose on Monday after major U.S. fuel pipeline operator Colonial Pipeline had to shut fuel pipelines due to a cyberattack, raising concerns about supply disruption and pump price increases.Colonial Pipeline said on Sunday its main fuel lines remained offline after the attack that shut the system on Friday, but some smaller lines between terminals and delivery points were now operational."The Colonial Pipeline hack headlines over the weekend have lifted oil prices," said Jeffrey Halley, analyst at brokerage OANDA. "Colonial aside, oil may be vulnerable to some abrupt long-covering sell-offs as the week progresses."

1MDB (BBG): Malaysia's 1MDB and a former unit have filed suits against entities including JPMorgan Chase & Co. and Deutsche Bank AG as the nation seeks to recover assets worth more than $23 billion linked to the scandal-plagued state-owned investment fund.1MDB, whose full name is 1Malaysia Development Bhd., filed six suits against nine unnamed entities, including two foreign financial institutions, and 25 individuals for various wrongdoings including fraud and conspiracy to defraud the fund, the Finance Ministry said on Monday. SRC International Sdn. filed additional suits. The global firms were JPMorgan and Deutsche Bank, according to a person familiar with the matter who declined to be identified discussing non-public information.

CHINA DATA (MNI REALITY CHECK): China's consumer price index is set to edge higher in April, accelerating the move back into positive territory started in March, as recovering services prices will largely offset declining food prices and base comparisons to the same period last year help lift the headline number, industry insiders and analysts told MNI. For full article contact sales@marketnews.com

FRANCE/E.U. (BBG): France would require investment partnerships with European countries if it decides to increase the size of its economic recovery program in September, Finance Minister Bruno Le Maire said.In comments that add to the drumbeat of calls for Europe to consider more stimulus, Le Maire said European involvement would come as part of France's review of its existing 100 billion euro ($122 billion) program.

U.K. DATA: UK house prices rose to a record high for a second consecutive month in April, the Halifax said Monday, rising 8.2% y/y. The average property value across the country is now GBP258,204, up 1.4% m/m. In cash terms, almost 20,000 has been added to the value of the average home since the market had essentially come to a standstill in April 2020, according to the Halifax managing director Russel Galley.

BOJ (MNI BRIEF): Bank of Japan officials are becoming increasing concerned that the continued weakness in the face-to-face service sector will spill over into demand for goods and clothes through Q2 as department stores in big cities remain closed, MNI understands.

NORWAY/INFLATION (BBG): Norway's underlying inflation slowed last month to the central bank's 2%-target for the first time since Dec. 2019, helped by the strengthening krone. Underlying CPI rose 2.0% y/y in April versus +2.7% in March, according to Statistics Norway. The median forecast in a Bloomberg survey of 11 economists was 2.1%, with estimates ranging between +2.0% and +2.5%; Norges Bank had also forecast a 2.1% increase.

NORWAY/COVID VACCINE (RTRS): Norway should exclude the COVID-19 vaccines made by AstraZeneca AZN.L and Johnson & Johnson JNJ.N in its inoculation program due to a risk of rare but harmful side-effects, a government-appointed commission said on Monday. Those who would volunteer to take either of the two vaccines should however be allowed to do so, the commission added.

DATA:

No key data released in the European morning.

FIXED INCOME: Bear steepeners favoured

A range bound start for EGBs, although we are trading in the red, on the back of higher Equities.

- Estoxx closed the small gap lower, keeping Bund just off its lows.

- Curve trade bear steeper, but within ranges, with very little of note on the calendar to start the week.

- Peripheral are a touch tighter, and we keep an eye on Italy and Greece 10yr yields as they trade near, albeit below 1%.

- Gilts have traded inline with EGBs, but are underperforming Europe,

- UK politics saw the Tories make further inroads into traditional Labour strongholds.

- US treasuries are better offered, especially in the longer end part of the curve.

- US 5/30s sees bear steepening continuation.

- Now highest since end of March.

- Next targets comes at 26/03 high at 154.343.

- Looking ahead, no tier 1 data, US Fed Evans (Voter, leaning Dove), will be discussing Economic outlook at a virtual event.

FX SUMMARY- All about the Pound

FX have mostly stayed range bound, but most of the action has been in GBP.

- Better buying continuation in GBP as Europe. joined the session.

- Overnight desk reported shorts bailing as we broke through the important 1.4000.

- Similar price action during the EU session with Cable making an attempt at 1.4100 (printed 1.4097 high).

- Contributing factors, UK politics saw the Tories make further inroads into traditional Labour strongholds.

- SNP failed by just 1 seat to get an outright majority. BUT, the party is expected to team up with pro-independence Greens to launch another bid for a referendum, but unlikely to be anytime soon.

- Boris also confirmed that the next stage of re-opening will go as planned on the 17th, and he will hold a presser later today.

- The Pound is bid across the board and versus all majors.

- While a more mixed session for the USD, as noted down 0.75% against GBP, but trade marginally in positive territory vs JPY, SEK and EUR.

- Looking at the rest of the day, US fed Evans Voter, leaning Dove), will be discussing Economic outlook at a virtual event.

EQUITIES: Natural Resources Stocks Lead Gains

- Asian stocks closed higher, with Japan's NIKKEI up 160.52 pts or +0.55% at 29518.34 and the TOPIX up 19.22 pts or +0.99% at 1952.27. China's SHANGHAI closed up 9.117 pts or +0.27% at 3427.991 and the HANG SENG ended 14.99 pts lower or -0.05% at 28595.66.

- European equities are mixed, with the German Dax down 36.46 pts or -0.24% at 15393.67, FTSE 100 up 12.11 pts or +0.17% at 7136.32, CAC 40 down 7.78 pts or -0.12% at 6372.73 and Euro Stoxx 50 down 15.88 pts or -0.39% at 4025.84.

- U.S. futures are mixed too, with the Dow Jones mini up 66 pts or +0.19% at 34752, S&P 500 mini down 0.75 pts or -0.02% at 4224.5, NASDAQ mini down 51 pts or -0.37% at 13658.75.

COMMODITIES: Industrial Metals Rally Continues

- WTI Crude up $0.52 or +0.8% at $65.35

- Natural Gas down $0.02 or -0.68% at $2.936

- Gold spot up $5.08 or +0.28% at $1834.71

- Copper up $11.3 or +2.38% at $486.35

- Silver up $0.24 or +0.88% at $27.6643

- Platinum up $9.76 or +0.78% at $1261.32

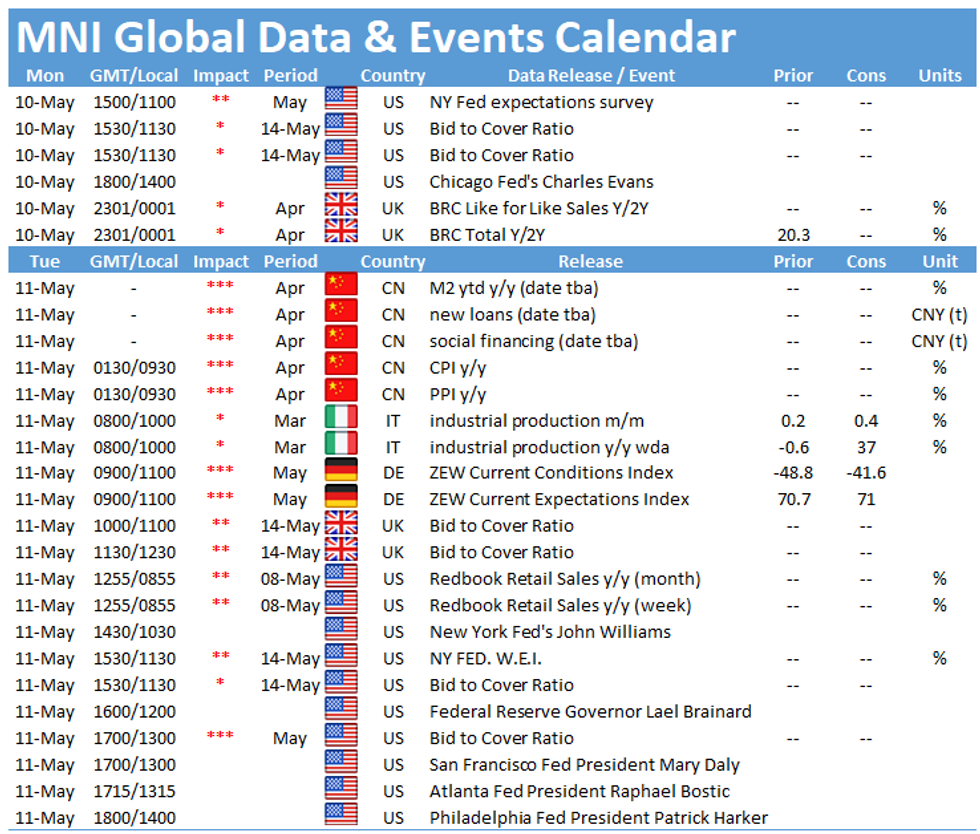

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.