-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Inflation Trade Fades

EXECUTIVE SUMMARY:

- HIGH PRICES NO DRAG ON U.S. RETAIL SPENDING (MNI REALITY CHECK)

- ISRAELI ARTILLERY FIRES ON GAZA AS FEARS GROW OF GROUND ASSAULT

- CUTTING INFLATION TARGET "WRONG": EX-B.O.J. SEKINE (MNI INTERVIEW)

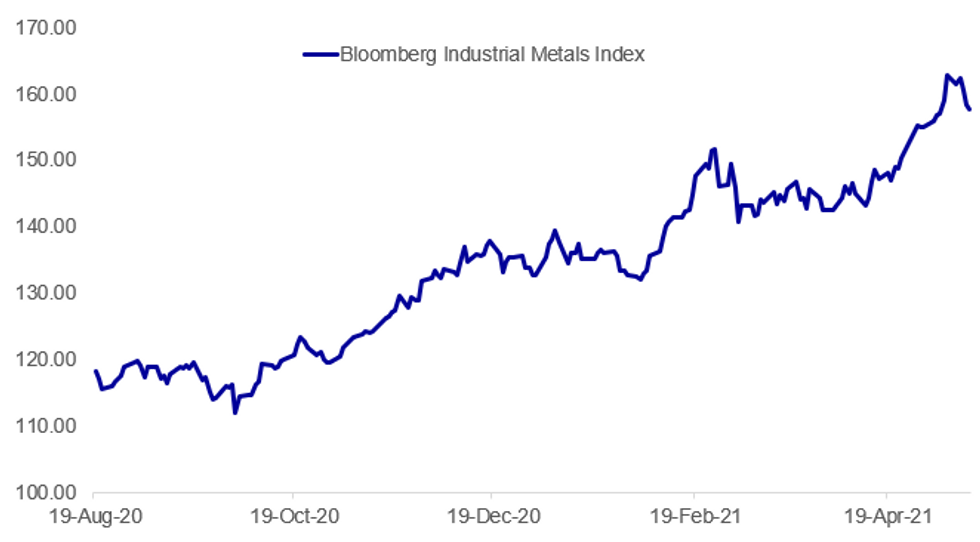

Fig. 1: Industrial Metals Continue To Struggle As Energy And Equities Bounce

BBG, MNI

BBG, MNI

NEWS:

U.S. (MNI REALITY CHECK - REPEAT FROM MAY 13): U.S. April retail sales growth likely slowed over March as reopenings and vaccinations tapered, industry experts told MNI, although more fiscal relief and tax refunds mean higher prices for goods won't be a drag on spending. "I'm expecting that we'll see another solid month" of spending, said Jack Kleinhenz, chief economist at the National Retail Federation, noting that the ability to spend improved through the month, with stimulus money in "full force" and tax refunds on the way, however delayed. For full article, please contact sales@marketnews.com

MIDDLE EAST (BBG): Israel's ground forces fired artillery into the Hamas-run Gaza Strip early Friday after a blistering four-day air assault failed to quell militant rocket attacks, sweeping aside international appeals for de-escalation and possibly preparing for an assault by troops. Prime Minister Benjamin Netanyahu has been warning that an extended campaign was in the offing. The decision to escalate with heavy aircraft, tank and artillery fire came at a uniquely sensitive time, as Israel grappled with the worst outbreak in years of violence between Arabs and Jews inside its borders. The military said it hadn't sent troops into Gaza.

INDUSTRIAL METALS (BBG): Iron ore's slump from a record accelerated as China ramps up efforts to control a dizzying surge in prices.Futures in Dalian dropped the daily limit, while prices in Singapore tumbled 11% as the world's biggest iron ore buyer rolled out more measures to temper recent gains. Tangshan city banned steelmakers from fabricating or spreading price-hike information, the latest in a list of measures targeting the hub, after Premier Li Keqiang earlier this week urged China to deal with surging prices.

BOJ (MNI EXCLUSIVE 1): The Bank of Japan should resist growing calls from some observers to lower the inflation target from 2% as that would confirm a drop in inflation expectations, a former chief economist at the central bank told MNI.

BOJ (MNI EXCLUSIVE 2): There is insufficient evidence that the Bank of Japan's latest policy decision to allow the ten-year JGB yield to fluctuate in a range 25 bps either side of zero percent has any material impact on boosting capital investment, a former chief economist at the central bank told MNI. For both exclusive interviews, please contact sales@marketnews.com

UK/COVID (BBG): U.K. ministers may bring forward second vaccine doses for millions of people and local restrictions could be imposed to curb the spread of a Covid-19 variant from India.Cases of the B.1.617.2 strain have risen to 1,313 from 520 over the past week, Public Health England said Thursday, assessing the strain to be "at least as transmissible" as the so-called Kent variant that took hold in December, precipitating the U.K.'s third lockdown in January.

SINGAPORE/COVID (BBG): Singapore is returning to the lockdown-like conditions it last imposed a year ago, banning dining-in and limiting gatherings to two people, as a rising number of untraceable virus infections pressures one of the most successful places in the world at Covid containment.For four weeks from May 16 to June 13, gathering sizes as well as household visitors will be cut to a maximum of two people from five people now, working from home will be the default, and food places can only do takeaways and deliveries, the health ministry said in a statement on Friday. The resurgence is also putting a highly-anticipated travel bubblewith Hong Kong in doubt.

UK: The latest YouGov opinion poll shows Prime Minister Boris Johnson's centre-right Conservatives extending their lead over the main opposition centre-left Labour Party to 15%, the widest lead for the party since May 2020. Westminster voting intention: Conservative: 45% (+2), Labour: 30% (-3), Green: 8% (+2), Liberal Democrat: 7% (-), ReformUK: 2% (-1). via @YouGov. Chgs. w/ 05 May. Fieldwork: 11-12 May.

IRELAND (DPA): The Irish government's Health Service Executive (HSE) has shut down its information technology systems after being hit with what it described as "a significant ransomware attack" on Friday. HSE chief executive Paul Reid told public broadcaster RTE that the computer shutdown was necessary to protect patient data. "It's quite a very sophisticated attack," Reid said, and "is impacting all of our national and local systems.""We are at the very stages of fully undertanding the threat," Reid said.

DATA:

FIXED INCOME: UST and gilts reverse CPI-induced weakness; focus on US data later

- It has been a positive start for core fixed income this morning with gilts and Treasuries continuing to drift higher from yesterday's lows and almost close the gap gap lower seen following the higher than expected CPI print on Wednesday.

- Bunds are a little bit higher on the day with peripheral spreads wider by 1.5-2.0bp despite European equities being on the front foot this morning.

- US data remains in focus today with retail sales due at 13:30BST/8:30ET, IP at 14:15/9:15 and Michigan confidence at 15:00/10:00.

- Markets will also watch the Accounts of the ECB's last monetary policy meeting which are due for release at 12:30BST/7:30ET for any discussion over the pace of bond purchases.

- TY1 futures are up 0-8 today at 132-14 with 10y UST yields down -2.4bp at 1.634% and 2y yields down -0.3bp at 0.152%.

- Bund futures are up 0.21 today at 169.10 with 10y Bund yields down -1.2bp at -0.133% and Schatz yields unch at -0.662%.

- Gilt futures are up 0.36 today at 127.44 with 10y yields down -3.0bp at 0.867% and 2y yields down -1.7bp at 0.081%.

FOREX: Greenback Edging Lower as CPI Rally Unwinds

- Having staged a fierce rally mid-week, the greenback is G10's poorest performing currency ahead of NY hours, as markets unwind and take profit on the volatile post-CPI moves. The USD Index is still comfortably ahead of the week's multi-month lows printed at 89.987, with focus shifting to today's retail sales release.

- The USD's losses are working in favour of EUR/USD, which has crept well off yesterday's 1.2052 low to narrow the gap with Wednesday's high, and next resistance, at 1.2152.

- NOK and NZD are among the session's best performers after both currencies traded heavy on commodity weakness across the Wednesday/Thursday sessions. USD/NOK is edging off resistance that held yesterday at the 8.4160 50-dma.

- Today's retail sales numbers are expected to show a 1.0% gain, a marked slowdown from March's revised 9.7%. The prelim University of Michigan data also crosses, with forward-looking expectations seen rising to a new post-pandemic high.

EQUITIES: Bounce Continues

- Asian markets closed higher, with Japan's NIKKEI up 636.46 pts or +2.32% at 28084.47 and the TOPIX up 34.38 pts or +1.86% at 1883.42. China's SHANGHAI closed up 60.84 pts or +1.77% at 3490.376 and the HANG SENG ended 308.9 pts higher or +1.11% at 28027.57.

- European bourses are gaining, with the German Dax up 55.35 pts or +0.36% at 15235.57, FTSE 100 up 55.51 pts or +0.8% at 7018.39, CAC 40 up 36.04 pts or +0.57% at 6323.17 and Euro Stoxx 50 up 20.98 pts or +0.53% at 3966.93.

- U.S. futures continue to claw back recent losses, with the Dow Jones mini up 154 pts or +0.45% at 34092, S&P 500 mini up 24.75 pts or +0.6% at 4132, NASDAQ mini up 114 pts or +0.87% at 13214.25.

COMMODITIES: Industrial Metals Fall Again

- WTI Crude up $0.42 or +0.66% at $63.75

- Natural Gas up $0 or +0.07% at $2.974

- Gold spot up $8.46 or +0.46% at $1832.28

- Copper down $4.6 or -0.98% at $465.6

- Silver up $0.15 or +0.57% at $27.1945

- Platinum up $15.24 or +1.26% at $1225.12

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.