-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Treasury Yields Continue To Climb

EXECUTIVE SUMMARY:

- U.S. 10-YR YIELDS HIT FRESH 14-MONTH HIGH

- MUFG WARNS OF POTENTIAL $300MN LOSS TIED TO U.S. CLIENT

- SPANISH, GERMAN INFLATION PICKS UP SHARPLY IN MARCH...

- ...WITH EUROZONE AND FRENCH SENTIMENT BETTER THAN EXPECTED

Fig. 1: Relentless Rise In Tsy Yields

BBG, MNI

BBG, MNI

NEWS:

MITSUBISHI UFJ (BBG): Mitsubishi UFJ Financial Group Inc.'s securities unit has warned of a potential loss stemming from an event last Friday concerning an unidentified U.S. client. The unit of Japan's biggest bank is evaluating the extent of the loss and estimates it at about $300 million, it said in a statement on Tuesday. It won't have a material impact on the firm's business capability or financial soundness, it said. It's unclear whether the issue relates to the massive unwinding of leveraged bets by Bill Hwang's Archegos Capital Management. Global banks including Credit Suisse Group AG and Nomura Holdings Inc. warned of "significant" losses in the wake of the matter.

TURKEY (BBG): Turkish President Recep Tayyip Erdogan appointed a Morgan Stanley executive to the central bank's interest-rate setting committee, as the shake-up at the monetary authority deepens. Mustafa Duman, formerly an executive director at Morgan Stanley in Turkey, was named a deputy governor early Tuesday, according to a decree published in the Official Gazette.

ECB (BBG): The European Central Bank must be cautious when it shifts away from its emergency stimulus even if the economy rebounds from the pandemic as predicted, according to outgoing policy maker Vitas Vasiliauskas. The Governing Council member and head of Lithuania's central bank, who steps down from those roles next month, said in an interview that the ECB should draw on its earlier experiences of tightening too soon. That means switching back to more-standard monetary tools only gradually.

GERMANY BOND ISSUANCE: Germany has updated its issuance plans for Q2 and will sell E59.5bln of nominal bonds, up from E57.0bln originally planned with increases for one auction each of Bobl, 7-year Bund and 30-year Bund. There are no updates to bubill sales, ILB sales or the May syndication of the 30y Green Bund.

GERMANY: German companies are planning to hire more staff, led especially by the strong industrial activity, with the labor market "starting to recover, despite the lockdown.", the Munich-based Ifo Institute said. The Ifo March German employment barometer increased markedly to 97.6, up from 94.5 in February, hitting the highest level since February 2020.

JAPAN: Credit costs could increase considerably, given the prolonged spread of Covid-19, the Bank of Japan warned in a report published Tuesday, although noting any increase will depend on the roll out of the vaccine and how the economy picks up.

DATA:

French Consumer Confidence At 3-Mo High

FRANCE MAR CONSUMER CONF IND 94; FEB 91

- Consumer sentiment edged up 3pt to 94 in Mar, with markets looking for a downtick (BBG: 90)

- The index is now at the highest level since Dec 2020.

- Mar's uptick was driven by a sharp 16-pt increase of consumer's assessment of the general economic situation in the 12 months, while their opinion on the past economic situation deteriorated by 4pt.

- Households expect their financial situation to improve in the next year, up 4pt, while they assess their past financial situation marginally better.

- The fear of unemployment in the next year eased by 8pt, but remains elevated compared to pre-pandemic levels.

- Savings intentions ticked up 3pt in Mar, but intentions to make major purchases recovered by 2pt.

- Consumer confidence improved despite the continuing severe covid-situation, which bodes well with household spending going forward.

EZ ESI Beats Expectations in March

Economic Sentiment Indicator (ESI): 101.0; Prev (Feb): 93.4

Consumer: -10.8(Feb: -14.8); Industry: +2.0 (Feb: -3.1); Services: -9.3 (Feb: -17.0); Retail: -12.2 (Feb: -19.1); Construction: -2.7 (Feb: -7.5)

- The EZ ESI jumped to 101.0 in Mar, surpassing market expectations looking for an uptick to 96.

- The index rose 7.6pt in Mar to its highest level since Feb 2020.

- Mar's increase was broad-based with every industry recording monthly gains, led by service sector sentiment which gained 7.7pt and registered at a 1-year high.

- Retail trade confidence rose 6.9pt to -12.2, while consumer confidence increased 4pt to -10.8, confirming the flash result.

- Industrial sentiment rebounded markedly in recent months, as business activity in the indstrial sector is less affected by the lockdowns.

- The index ticked up 5.1pt to 2.0 in Mar, the highest level since Dec 2018.

- Among the largest EZ economies, Germany surpassed its peers, showing the largest gain of its ESI (+7.9pt) and registering above the long-term average.

- Increases in other major countries were significant as well: Spain (+6.2pt), France (+5.4), Italy (+4.9), the Netherlands (+4.4).

- The employment expectations index increased to 97.7 in Mar, marking the highest level since the beginning of the pandemic.

MNI: SPAIN MAR FLASH HICP +1.9% M/M, +1.2% Y/Y; FEB -0.1% Y/Y

MNI: BADEN-W MAR CPI +0.6% M/M, +1.9% Y/Y; FEB +1.4% Y/Y

MNI: SAXONY MAR CPI +0.5% M/M, +1.7% Y/Y; FEB +1.3% Y/Y

MNI: BRANDENBURG MAR CPI +0.7% Y/Y, +2.0% M/M; FEB +1.4% Y/Y

HESSE MAR CPI +0.4% M/M, +1.7% Y/Y; FEB +1.0% Y/Y

MNI: BAVARIA MAR CPI +0.5% M/M, +1.8% Y/Y; FEB +1.3% Y/Y

MNI: SWISS MAR KOF ECON BAROMETER 117.8; FEB 102.6r

FIXED INCOME: Core 10y yields over 5bp higher

Risk-on sentiment continues to wave through the core fixed income market following the unblocking of the Suez Canal. Equities are higher across the board in Europe, but fixed income has seen larger moves. 10y Treasury, Bund and gilt yields are all over 5bp higher on the day. Eurozone semi-core spreads are all narrower but peripheral spreads are little changed.

- As well as the boost in sentiment from the Suez Canal, data across the Eurozone has also been encouraging. Spanish inflation came in higher than expected with HICP ticking up to 1.2% (0.9% exp) while German state inflation data has also pointed to upside risks for the national print which is due at 13:00GMT/ 8:00ET. Eurozone confidence data all came in better than expected, too.

- There is not too much on the calendar later outside of US housing and Conference Board consumer confidence data.

- TY1 futures are down -0-14 today at 130-29+ with 10y UST yields up 5.3bp at 1.763% and 2y yields up 1.2bp at 0.155%.

- Bund futures are down -0.80 today at 170.82 with 10y Bund yields up 5.4bp at -0.266% and Schatz yields up 1.6bp at -0.698%.

- Gilt futures are down -0.55 today at 127.55 with 10y yields up 5.3bp at 0.840% and 2y yields up 2.4bp at 0.085%.

FOREX: Busy Morning Session

A busy morning session across assets and FX.

- After being mixed overnight, USD is in the Green against all majors, although Kiwi is still holding onto small gains (up 0.09%) versus the USD.

- This was led by higher US yields, after the end of traffic jam at the Suez canal brought back a positive outlook for Global trade.

- US 10 yr yields trades above the 2021 high, which was at 1.7525%,

- USDJPY is now trending towards levels last seen since last year.

- Risk on and higher US yields as Global trade are set to re-open is seeing safe haven FX better offered.

- JPY and CHF are down 0.44% and 0.32% respectively on the Risk on tone.

- SEK is also underperforming going into Month End/Quarter End, down 0.37%.

- Next target in the USDJPY cross is seen further out towards 110.63 0.764 proj of Mar - Apr 2020 rally from Jan 6 low

- Also note, that 110.67 is the May 2019 high

- Looking ahead, German national CPI, and US Consumer Confidence are the notable data.

- Speakers, sees Fed Quarles, Williams,ECB Centeno and Riksbank Ingves

EQUITIES: Nasdaq Lags Broader Rally

- Asian stocks closed mixed, with Japan's NIKKEI up 48.18 pts or +0.16% at 29432.7 and the TOPIX down 15.48 pts or -0.78% at 1977.86. China's SHANGHAI closed up 21.381 pts or +0.62% at 3456.677 and the HANG SENG ended 239.2 pts higher or +0.84% at 28577.5.

- European equities are stronger, with the German Dax up 90.87 pts or +0.61% at 14924.29, FTSE 100 up 35.61 pts or +0.53% at 6781.72, CAC 40 up 37.29 pts or +0.62% at 6053.83 and Euro Stoxx 50 up 18.77 pts or +0.48% at 3908.59.

- U.S. futures are gaining, with the exception of tech: Dow Jones mini up 63 pts or +0.19% at 33095, S&P 500 mini down 1.75 pts or -0.04% at 3957.25, NASDAQ mini down 69.5 pts or -0.54% at 12875.

COMMODITIES: Weaker As Dollar Continues To Gain

- WTI Crude down $0.46 or -0.75% at $61.42

- Natural Gas up $0.02 or +0.83% at $2.646

- Gold spot down $14.05 or -0.82% at $1702.12

- Copper down $1.95 or -0.48% at $400.75

- Silver down $0.15 or -0.59% at $24.5073

- Platinum down $0.43 or -0.04% at $1179.57

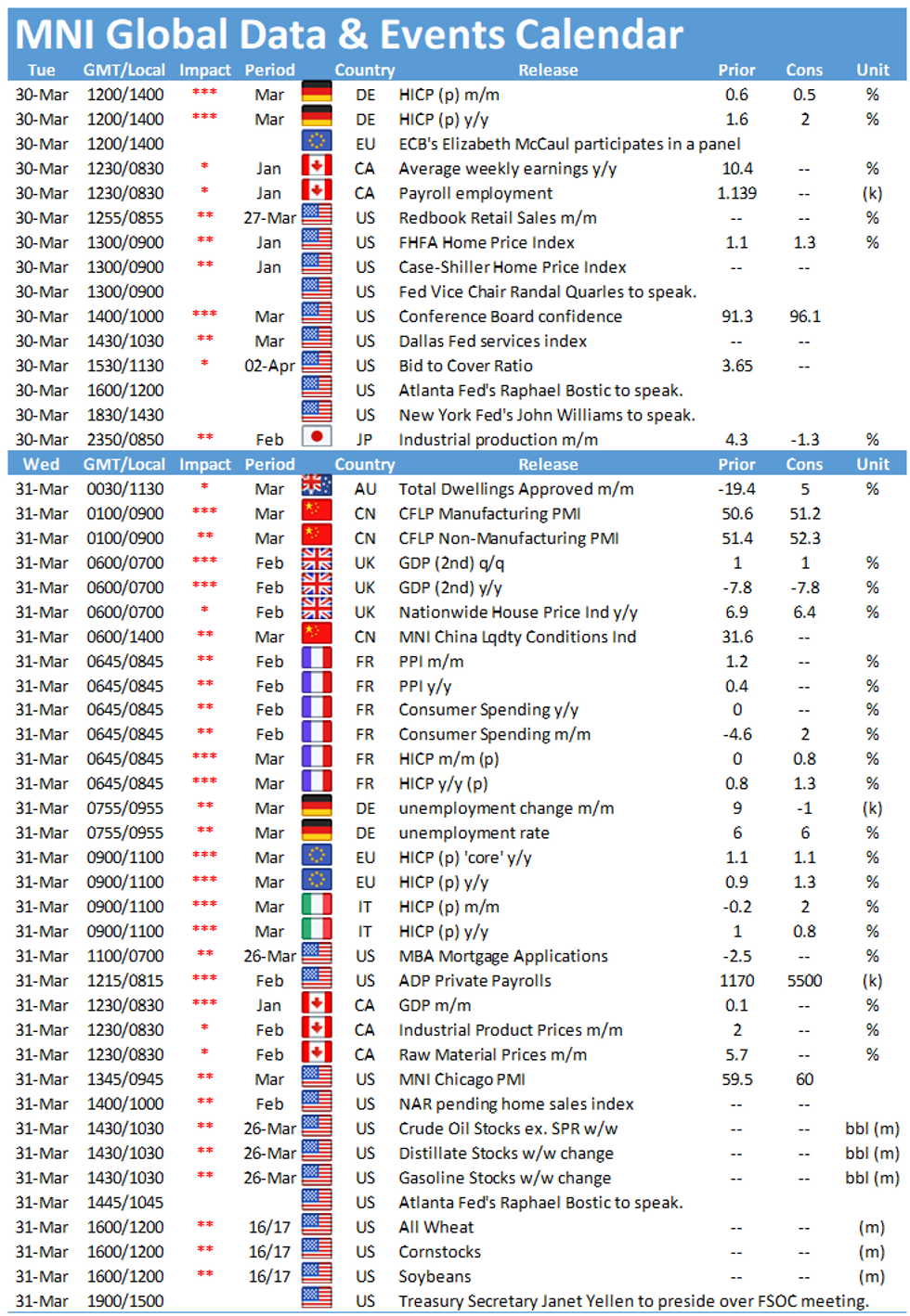

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.