-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

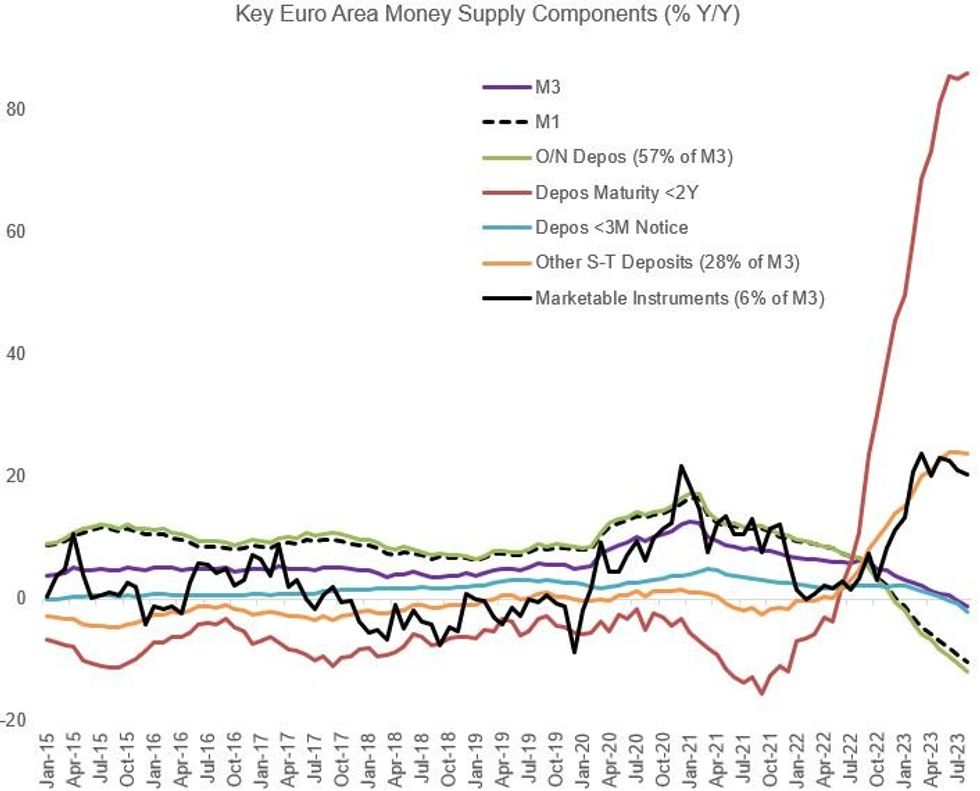

Free AccessMonetary Aggregates Show Deposit Rebalancing Amid Higher Rate Regime

Today's release of August monetary aggregates showed an accelerating pullback in overall money supply growth, including a continued pullback in bank deposits.

- The 1.3% Y/Y M drop in M3 was greater than the -0.4% in July (and a little below the consensus median of -1.0% expected) with M1 at -10.4% (-9.2% Jul). Both were the biggest falls in euro area history.

- The M3 drop was largely on the back of falling overnight deposits, which make up the majority of money supply. Looking bigger picture, M1 money supply (currency in circulation + overnight deposits) has been falling Y/Y since the end of 2021 and is likely to continue so long as interest rates remain elevated vs recent history.

- As the chart shows, sub-3 month notice deposits have started to decline, contrasted with strong growth in deposits maturing in <2Y.

- ECB's Schnabel addressed money market developments in a speech this week, pointing out that M1 rose to 73% of M3 at its peak during the pandemic vs a historical proportion of 40% seen prior to the global financial crisis, due to the low opportunity cost of holding highly liquid deposits over most of the past decade (ie, interest rates were low).

- But that's begun reversing since rates have been rising. Schnabel: "Households and firms are actively and rapidly rebalancing their portfolios towards time deposits and other instruments with higher rates of remuneration, contributing to the sharp fall in M1....Portfolio rebalancing has also resulted in 'money destruction', in the sense that depositors are using bank deposits to purchase instruments outside the scope of M3 from non-money-holding institutions" including government bonds.

- In this regard Schnabel says "considerable further declines in M1 can be expected", potentially on the order of E2trn (vs E10.5trn currently).

- Her conclusion is that rebalancing "will not in itself affect consumption and saving decisions", and the decline in M1 growth "says relatively little about the extent of the slowdown in economic activity in the euro area and the future evolution of inflation."

Source: ECB, MNI Calculations

Source: ECB, MNI Calculations

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.