-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI ASIA OPEN: The Disinflation Process Has Begun

EXECUTIVE SUMMARY

US

FED: The Federal Reserve raised interest rates by a quarter percentage point as expected Wednesday, repeating that it anticipates "ongoing increases" will be needed and offering little hint on the timing of a pause in tightening.

- The move took the fed funds rate to a range of 4.5% to 4.75%, the highest level in 16 years. This was the second straight meeting where the Fed slowed the pace of rate increases, down from 50 basis points in December and 75 basis points for four meetings in a row preceding that.

- "The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time," the Committee said, reaffirming its guidance from December.

- The Fed made minor tweaks to its statement, acknowledging a recent easing of inflation. They also replaced the word "pace" of hikes with "extent," suggesting they are set to keep moving in 25bp increments.

- On that note, his comment toward the end didn't sound like a dogmatic hawkish Volckeresque Fed Chair, conceding that the data could change the FOMC's plans: "our forecast is that [bringing inflation down to target] will take some time and patience, and we will need to keep rates higher for longer, but we will see."

- Looking ahead to the coming meetings, it will be a story of data dependence.

- It seemed clear despite his nascent inflation optimism that he saw at least some two-way risk to the 5.1% terminal rate in the December Dot Plot: "We will be looking at the incoming data between the March meeting and May meeting. I don't feel a lot of certainty about where that will be. It could be higher than where we are writing down right now. If we come to the need to move rates up beyond what we said in December, we would certainly do that."

- Overall the path seems clearly paved to 25bp hikes in March and May, but there may be even more heightened sensitivity than usual to incoming data over the next few months.

UK

BOE: The Bank of England’s Monetary Policy Committee is set to announce another split decision on Thursday, as it hikes rates by either 25 or 50 basis points.

- While external members Silvana Tenreyro and Swati Dhingra are likely to repeat the calls for no change in Bank Rate they made in December, when the Committee split three ways, Catherine Mann may downscale, arguing for 50 rather than the 75 she advocated at the last meeting. Six members backed December’s 50bps rise to the current 3.5%, and some of these may now shift to arguing for 25bps.

- The MPC, having made clear in November that then market expectations for a 5.25% peak in the policy rate were overblown, with Governor Andrew Bailey pointing to an anticipated peak around 4%, looks unlikely to try to “talk to the curve” in February. It made no such attempt in December, when market expectations had moderated to around 4.6%, returning to its policy of eschewing explicit forward guidance other than when expectations become very misaligned with its intentions. For more see MNI Policy main wire at 0448ET.

US TSYS: Market Reacts as if Rate Hikes Wont Last Much Longer

Tsys experienced a whip-saw session even before the after FOMC policy pivot, 25bp hike to 4.5%. Rates (and stocks: ESH3 taps 4160.75 high) gapped higher after initial two way flow, markets essentially saying any further hikes from the Fed will not run out the calendar very far. As Chairman Powell said himself: the "disinflation process has begun".

- Fed funds implied hike for Mar'23 at 20.4bp, May'23 cumulative 29.8bp to 4.882%, Jun'23 30.7bp to 4.890%, terminal at 4.89% in Jun'23.

- Early data reacts: Tsys extended early highs after ADP jobs data climbed +106k, much less than estimated 180k jobs.

- Fast two-way trade between Mfg PMI and ISM saw bonds sell-off/extend lows (30YY tapped 3.6429% high) as ISM mfg index comes out lower than est at 47.4 (48.0 est), mfg orders, production weakest since mid 2020. JOLTS job openings rise to 11.01M vs. 10.3 est..

- A sharp bond-lead sell-off likely driven by two large steepener Blocks: total +20,000 TYH3 at 114-29 to -28.5 vs. -8,700 USH initially from 130-19 down to 130-12. Tsy 30Y futures fell to 129-31 low by midmorning before staging a rebounding in the lead up to the FOMC.

- Focus now turns to Friday's employment report for January (+175k est vs. +223k prior).

OVERNIGHT DATA

US DATA: ADP Employment Misses With Weather Impact. ADP employment was softer than expected in January at 106k vs consensus of 180k or 190k for Friday's private payrolls.

- It was however impacted by adverse weather: "Employment was soft during our Jan. 12 reference week as the U.S. was hit with extreme weather. California was coping with record floods and back-to-back storms delivered ice and snow to the central and eastern U.S."

- US MBA: REFIS -7% SA; PURCH INDEX -10% SA THRU JAN 27 WK

- US MBA: UNADJ PURCHASE INDEX -41% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.19% VS 6.20% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 6.92 points (0.02%) at 34092.96

- S&P E-Mini Future up 52.5 points (1.28%) at 4140.75

- Nasdaq up 231.8 points (2%) at 11816.32

- US 10-Yr yield is down 10.3 bps at 3.4038%

- US Mar 10-Yr futures are up 31/32 at 115-15.5

- EURUSD up 0.0125 (1.15%) at 1.0987

- USDJPY down 1.17 (-0.9%) at 128.91

- WTI Crude Oil (front-month) down $2 (-2.54%) at $76.80

- Gold is up $23.38 (1.21%) at $1951.29

- EuroStoxx 50 up 7.99 points (0.19%) at 4171.44

- FTSE 100 down 10.59 points (-0.14%) at 7761.11

- German DAX up 52.47 points (0.35%) at 15180.74

- French CAC 40 down 5.31 points (-0.08%) at 7077.11

US TSY FUTURES CLOSE

- 3M10Y -7.647, -125.784 (L: -130.31 / H: -118.091)

- 2Y10Y +1.032, -68.809 (L: -76.226 / H: -68.809)

- 2Y30Y +4.455, -52.854 (L: -65.486 / H: -52.773)

- 5Y30Y +6.215, 7.545 (L: -3.814 / H: 7.617)

- Current futures levels:

- Mar 2-Yr futures up 7.625/32 at 103-2 (L: 102-23 / H: 103-02.375)

- Mar 5-Yr futures up 21.75/32 at 109-29.5 (L: 109-05 / H: 109-31)

- Mar 10-Yr futures up 31.5/32 at 115-16 (L: 114-17.5 / H: 115-19)

- Mar 30-Yr futures up 1-19/32 at 131-15 (L: 129-31 / H: 131-28)

- Mar Ultra futures up 2-19/32 at 144-11 (L: 142-09 / H: 145-03)

US 10YR FUTURE TECHS: (H3) Watching Support At The 50-Day EMA

- RES 4: 117-00 High Sep 8 2022

- RES 3: 116-08 High Jan 19 and the bull trigger

- RES 2: 115-21 High Jan 20

- RES 1: 115-00/115-13 High Feb 1 / Jan 25

- PRICE: 114-24+ @ 16:18 GMT Feb 1

- SUP 1: 114-05+ Low Jan 30

- SUP 2: 114-00+ 50-day EMA

- SUP 3: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

- SUP 4: 112-29 76.4% retracement of the Dec 30 - Jan 19 bull leg

Treasury futures have recovered from recent lows. A bearish threat remains present following the recent move lower. The contract has breached the Jan 17 low of 114-09+. This undermines the recent bull theme and signals scope for a deeper retracement. Next support undercuts at the 50-day EMA, at 114-00+ - a key support. On the upside a key short-term resistance is at 115-13, the Jan 25 high. A break would ease any developing bearish threat.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.030 at 95.045

- Jun 23 +0.055 at 94.970

- Sep 23 +0.065 at 95.065

- Dec 23 +0.105 at 95.430

- Red Pack (Mar 24-Dec 24) +0.155 to +0.180

- Green Pack (Mar 25-Dec 25) +0.150 to +0.160

- Blue Pack (Mar 26-Dec 26) +0.125 to +0.145

- Gold Pack (Mar 27-Dec 27) +0.105 to +0.120

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00157 to 4.29686% (-0.00785/wk)

- 1M +0.00071 to 4.57500% (-0.00387/wk)

- 3M -0.01728 to 4.79629% (-0.02900/wk)*/**

- 6M -0.01257 to 5.08786% (-0.01443/wk)

- 12M -0.02228 to 5.31529% (-0.00085/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $98B

- Daily Overnight Bank Funding Rate: 4.32% volume: $251B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.281T

- Broad General Collateral Rate (BGCR): 4.28%, $482B

- Tri-Party General Collateral Rate (TGCR): 4.28%, $468B

- (rate, volume levels reflect prior session)

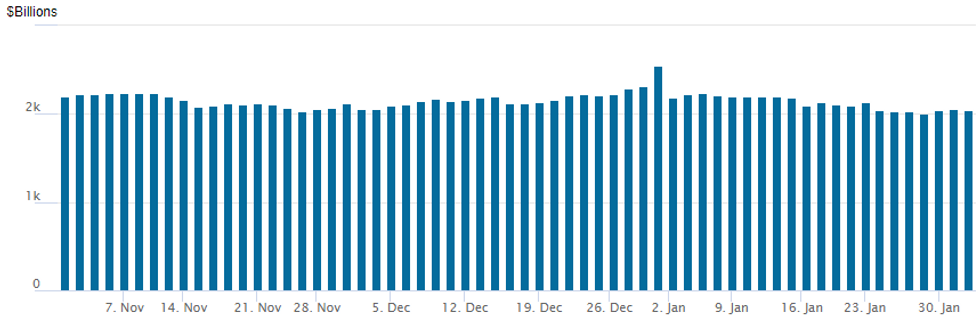

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slipped to $2,038.262B w/ 100 counterparties vs. prior session's $2,061.572B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: Euro CPI Data Fails To Convince Ahead Of ECB, BoE

The German curve twist flattened modestly, underperforming its bull steepening UK While Italian and eurozone core flash CPI prints came in stronger than expected, the eurozone headline print was very soft, helping boost Bunds to session highs.

- However, MNI analysis pointed to the possibility that Eurostat used a low estimate for Germany's as yet unreleased inflation figure, which both obscures the signal from today's readings and heightens potential volatility for the delayed German release as well as the Eurozone final number.

- Markets faded the headline CPI-related jump, with strong US job openings and ISM prices data helping keep a lid on global core FI in the afternoon.

- All eyes after the cash close are on the Federal Reserve decision, with attention swiftly turning to ECB and BoE meetings (our previews are, respectively, here and here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.1bps at 2.672%, 5-Yr is up 0.8bps at 2.318%, 10-Yr is down 0.2bps at 2.284%, and 30-Yr is up 0.3bps at 2.227%.

- UK: The 2-Yr yield is down 2.9bps at 3.439%, 5-Yr is down 3.6bps at 3.179%, 10-Yr is down 2.5bps at 3.307%, and 30-Yr is down 0.1bps at 3.712%.

- Spanish bond spread up 0.1bps at 99.7bps / Greek up 0.4bps at 202.1bps

FOREX: USD Weakness Extends As Powell Confirms Disinflation Process Started

- Despite a moderate pop higher for the greenback on the Fed’s guidance on rates remaining close to unchanged, markets quickly faded the moves. As Chair Powell confirmed the easing of price pressures and the fact the disinflation process has started, substantial greenback weakness has ensued.

- The USD index sits just over 1% weaker on the session and has extended on multi-month lows on Wednesday, continuing to press on session lows approaching the APAC crossover.

- The best performers are the Euro and the Japanese yen, along with the Australian dollar which is benefitting from the renewed optimism in equity markets.

- For EURUSD, technical bulls remain in the driver’s seat and the bull trigger at 1.0929, the Jan 26 high, has been breached. The break resumes the uptrend and initially targets 1.1022, 3.00 proj of the Sep 28 - Oct 4 - Oct 13 price swing.

- In USDJPY, the trend direction is down with price holding below resistance at 131.58, the Jan 18 high and below the 20-day EMA, at 130.57. The resumption of weakness now opens 126.81, a Fibonacci projection – with the bear trigger situated at 127.23, Jan 16 low.

- The focus quickly turns to the next major central bank meetings on Thursday with both the BOE and ECB decisions scheduled.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 02/02/2023 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/02/2023 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/02/2023 | 1345/1445 |  | EU | ECB Press Conference following Rate Decision | |

| 02/02/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/02/2023 | 1830/1930 |  | EU | ECB Lagarde Speech at Franco-German Business Awards | |

| 03/02/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.