-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS Treasury Auction Calendar

BRIEF: ECB's Panetta-Time To Start Thinking Of NGEU Successor

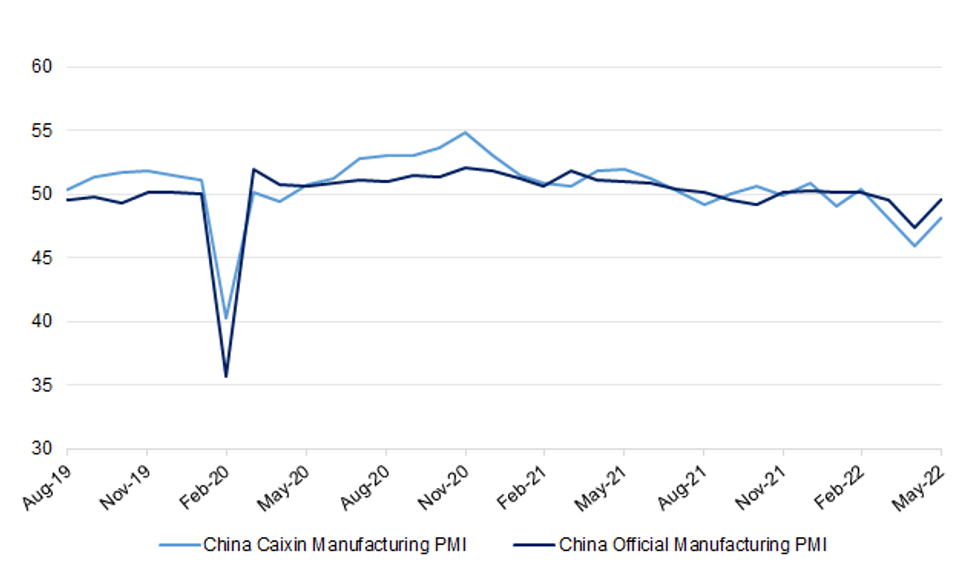

Offshore Yuan Consolidates Losses After Release Of Caixin PMI

Spot USD/CNH caught a bid in the lead-up to the release of Caixin M'fing PMI, consolidating these gains thereafter.

- Caixin M'fing PMI improved to 48.1 in May from 46.0 recorded in April, missing Bloomberg median estimate of 49.0. This means that contraction in the sector slowed, but not by as much as expected.

- The Caixin survey came out on the heels of official data published Tuesday. Official figures surprised on the upside for both m'fing and non-m'fing, even as both indices remained in contractionary territory.

- Note that the methodologies for Caixin and official surveys differ. Caixin PMI mainly captures small, private-owned businesses, while official data uses a larger sample of generally bigger, state-owned enterprises.

- Caixin M'fing PMI remaining in contractionary territory is testament to the headwinds faced by the SME sector on the back of local COVID-19 outbreaks and associated containment measures, a focus point for Chinese policy makers.

- Overall, the data lacked the kind of surprises that could either shake market confidence or provide a notable optimistic surprise.

- Spot USD/CNH trades at CNH6.6912, up 125 pips at typing. The key bullish target is provided by CNH6.7856, the high print of May 27. A break here would suggest that a double bottom pattern is crystallising. Conversely, bears need a sell-off past May 30/23 lows of CNH6.6552/6.6479 to regain the upper hand.

Fig. 1: China Caixin vs. Official Manufacturing PMI

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.