-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

Position Adjustment May Leave High Bar For BoJ To Boost Yen Tomorrow

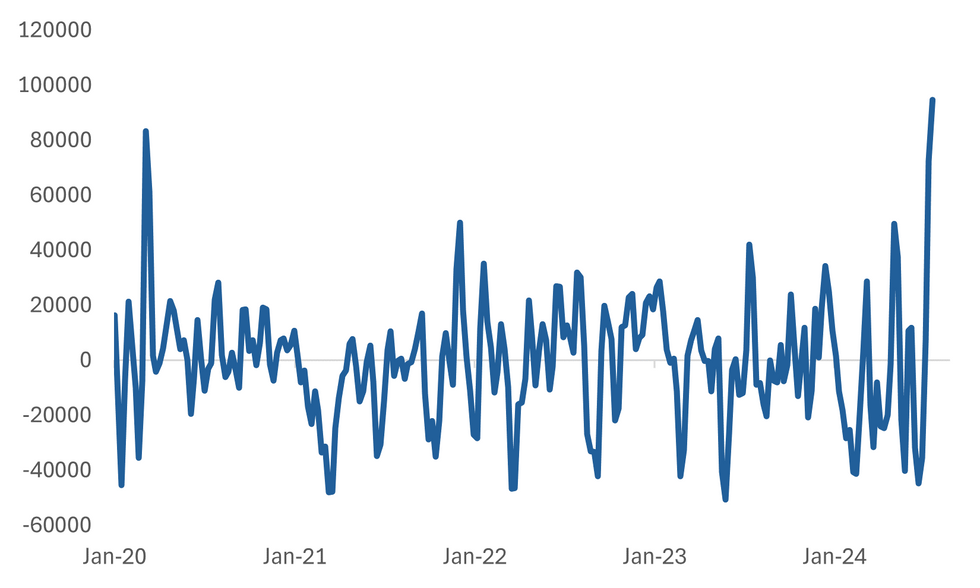

We have arguably seen a decent adjustment in terms of market positioning around yen shorts in recent weeks as tomorrow's BOJ outcome approaches. The first chart below plots the rolling 2 week change for leveraged funds and asset managers (per the CFTC report). It shows a very strong squeeze in short yen positions.

- This data is up to last Tuesday (July 23rd). Given yen continued to rally strongly through Wed/Thurs last week, the actual adjustment may have been larger than this.

- At face value it suggests there is a high bar for a hawkish BoJ surprise tomorrow, given how much positions have been adjusted (see our full preview here.)

- Of course, these position adjustments have reflected a number of factors and not necessarily view shifts around the BoJ outlook. Changing Fed views, risk off in the equity space, global growth concerns amid the metal price slump (which was a factor in AUD/JPY's decline last week) have all been in play as well.

- There are some other important caveats to be mindful as well. Firstly, outright positioning is still short and the JPY TWI is very low by historical standards. This may draw some selling interest on USD/JPY on any BOJ disappointment or as expected outcome (no rate change and BoJ bond buy taper as expected).

- We also have the FOMC outcome not long after the BoJ meeting. Here though with markets fully priced for a Fed cut in September, it may be difficult for the Fed to sound more dovish than what is already priced by the market.

- Levels wise for USD/JPY we have the 151.94 July 25 low, while the simple 200-day MA is at 151.57. On the topside, the July 24 high is at 155.99.

- In the FX option expiry space, note the following for NY on July 31 Y154.00 ($1.4bln), Y155.00 ($1.8bn), Y15650-65 ($1.2bln), then on Aug01 Y154.00-05 ($1.3bln), Aug02 Y151.41 ($2.0bln), Y155.00 ($1.7bln).

Fig 1: Rolling 2 Week Change In Leveraged Funds/Asset Management JPY Positioning

Source: CFTC: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.