-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Down 0.49% In Week of Feb 14

MNI: PBOC Net Drains CNY38.5 Bln via OMO Monday

MNI: PBOC Sets Yuan Parity Lower At 7.1702 Mon; -1.06% Y/Y

MNI: Japan Govt Vigilant Against Weaker Consumption

Recent Upside US CPI Surprises Haven't Seen Much USD Follow Through

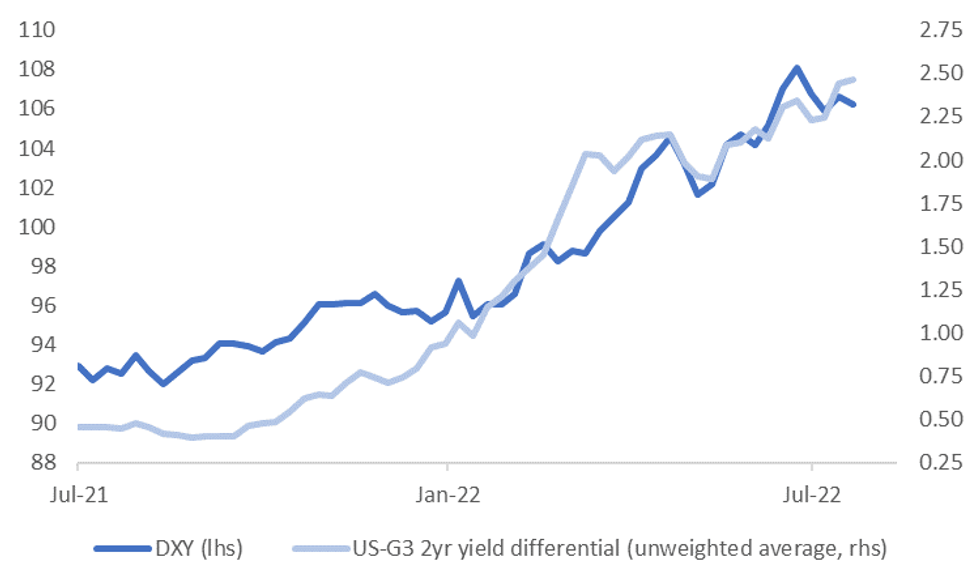

The DXY has drifted lower since the start of the week. We sit a little below 106.30 currently, which is slightly weaker than what 2yr yield differentials with the rest of the G3 imply, see the first chart below. To be sure though, the yield differential has only nudged up a touch over this period after last week's strong gains (+20bps). The market is clearly awaiting this week's key event risk in terms of tonight's US CPI print.

Fig 1: DXY Versus The 2yr Yield Differential

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

- Whilst this may leave the risks skewed to the upside for the USD, particularly if the CPI surprises on the upside, in recent months there hasn't been a great deal of follow through USD strength post inflation outcomes.

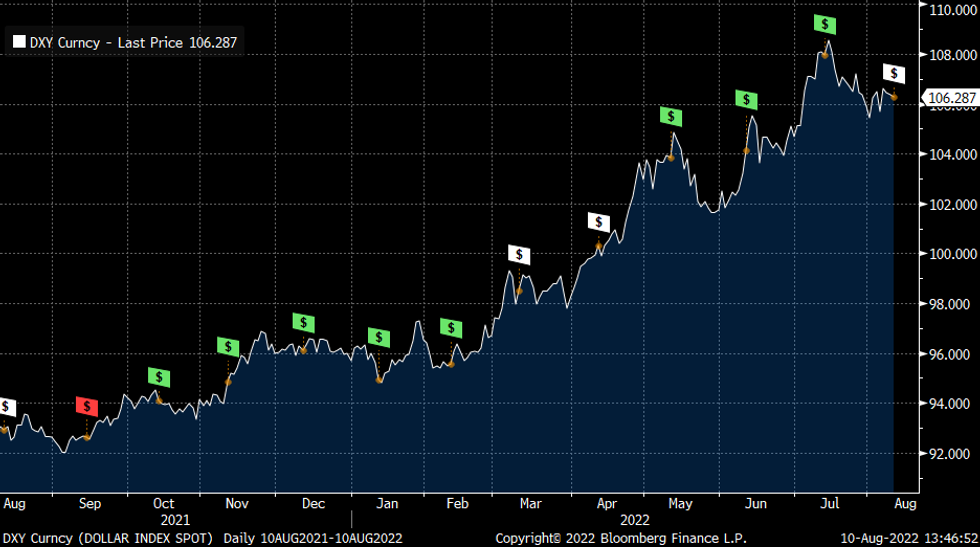

- The second chart below plots the DXY against US CPI release dates (the $ symbols on the chart). Green symbols represent upside surprises, while white symbols are as expected outcomes, red symbols are downside surprises relative to expectations.

- The last 3 CPI prints have been upside surprises for the CPI, but the DXY peaked shortly after each print. Part of this no doubt reflected profit taking to a degree, as the USD typically rallied ahead of these releases. The market may have also felt we were getting closer to peak inflation pressures in the US.

- The set-up is different this time around, with the USD broadly range bound to slightly lower in recent weeks and not rallying like has been the case in recent months. This is a caveat to keep in mind in terms of expecting a repeat outcome following tonight's US CPI release.

Fig 2: DXY Has Peaked Shortly After Recent US Inflation Beats

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

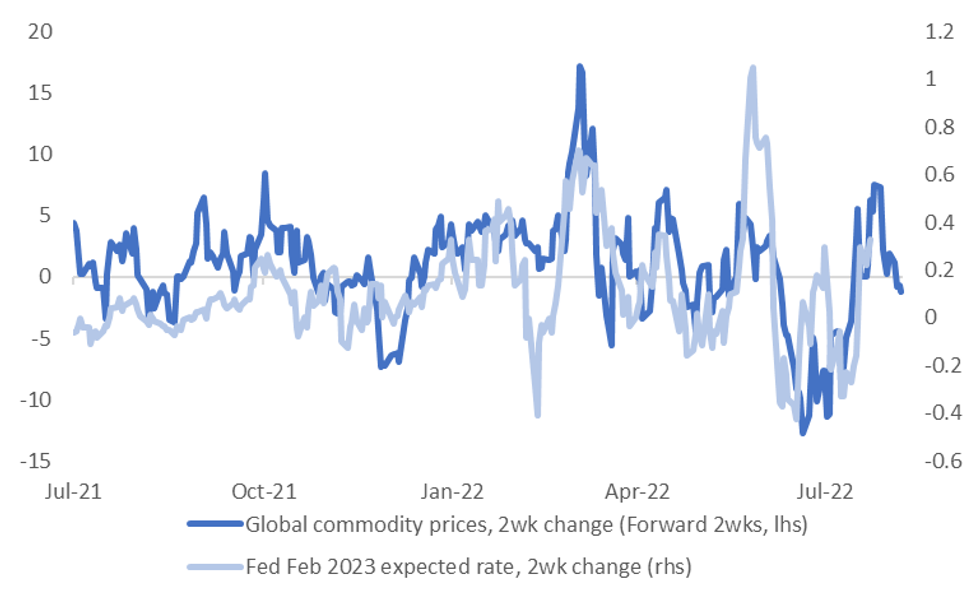

- There can still be other influences on the Fed hiking outlook, although we would note pricing for early 2023 Fed fund levels has caught up with the recent rebound in commodity prices, see the final chart below.

Fig 3: US Fed Expectations & Commodity Price Changes

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.