-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

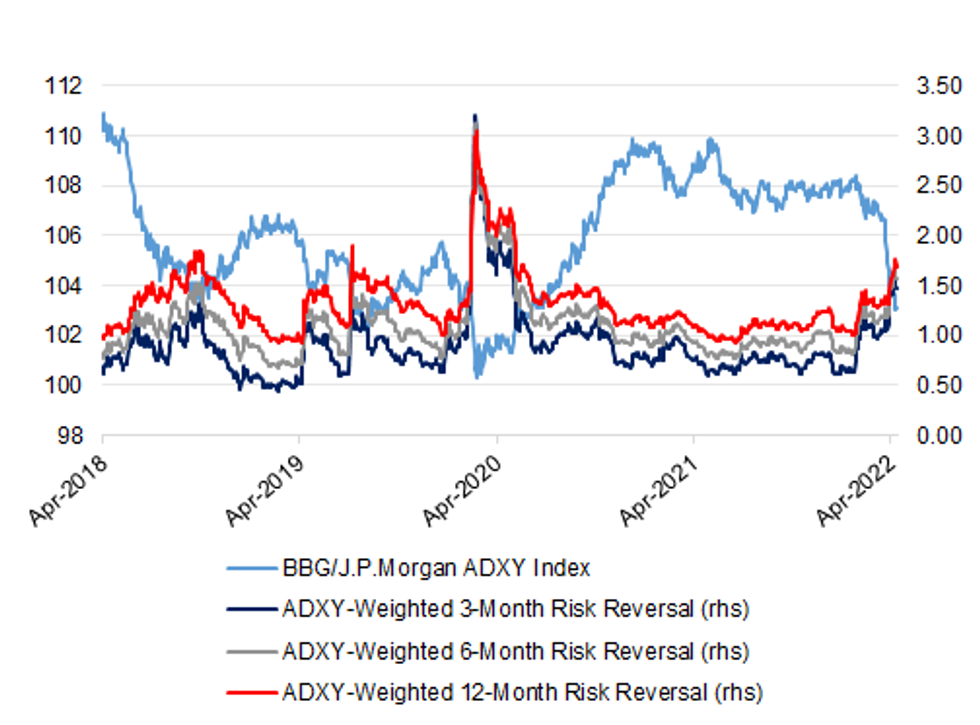

Free AccessRisk Reversals Move Higher, But Not Beyond U.S./China Trade-War Levels

A quick look at the wider USD/Asia risk reversal space in recent months reveals that upside hedging demand has dominated when it comes to the major USD/Asia crosses. Our 3-, 6- & 12-month ADXY-weighted risk reversal measures have pushed higher during ’22, which is understandable given the spot market moves (the BBG-J.P.Morgan ADXY currently sits at the lowest level observed since July ’20) and wider fundamental dynamics observed at present.

- Those moves come against the wider backdrop of USD strength, while the recent run weaker in the Chinese yuan has drawn most of the focus from a USD/Asia perspective.

- Even though risk reversals are elevated on a short-term horizon, we note that the 3 measures that we monitor operate well shy of their respective COVID outbreak peaks and haven’t really been able to push through their U.S.-China trade war highs.

- Nonetheless, regional authorities will be on the lookout for excessive one-way market positioning targeting further currency weakness, with the well-documented global inflationary pressures adding further focus on this front.

- Some notable regional intervention headline flow observed in recent days includes: the RBI seemingly stepping in to intervene against further INR weakness (after USD/INR touched a fresh record high earlier this week); Bank Indonesia reiterating that it will stabilise the IDR if necessary; Korean officials remaining wary of the potential need to stabilise markets/KRW; the PBoC deploying a modest bias against further CNY weakness via its USD/CNY mid-point fixing over the last 7 days, as well as touted state-owned bank activity in the FX forwards space.

- We also reiterate that all of the notable USD/Asia FX pairs are comfortably above their respective 200-DMAs.

Fig. 1: ADXY-Weighted 3- 6- & 12-Month Risk Reversals

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.