May 14, 2024 09:36 GMT

Services Drive Core HICP Disinflation In April

SPAIN DATA

Spanish April final HICP confirmed flash estimates at 3.4% Y/Y and 0.6% M/M. HICP excluding unprocessed food and energy decelerated to 3.0% Y/Y (vs 3.4% prior), the lowest since January 2022.

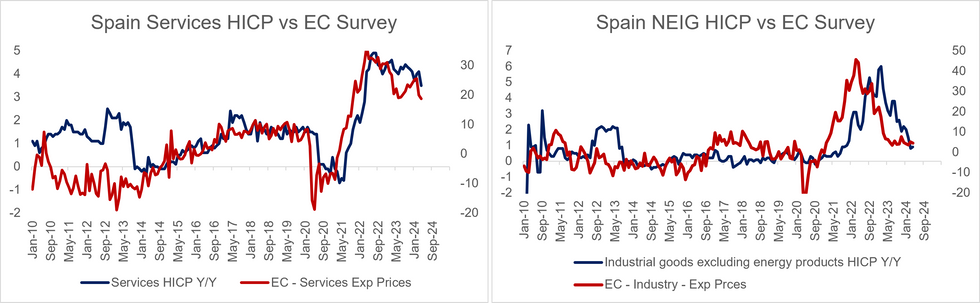

- Component level details, which are not available in the flash release, indicate that a moderation in services inflation led this disinflation, with services HICP falling to 3.5% Y/Y (vs 4.1% prior).

- This follows a moderation in services expected prices (from the EC business survey) over the past few months, with the April reading of 18.7 below March’s 20.0 and February’s 25.6.

- Non-energy industrial goods HICP was 0.9% Y/Y (vs 0.8% prior). We note that industry expected prices from the EC survey have stabilised in recent months, suggesting that further meaningful disinflation is unlikely.

- Of the non-core components, energy HICP rising to 5.0% Y/Y (vs 1.6% prior), following various electricity tax changes. Unprocessed food inflation rose to 5.0% Y/Y (vs 3.0% prior) while processed food inflation was 4.4% Y/Y (vs 4.7% prior).

- MNI’s inflation breadth metric showed a small improvement in April, with the proportion of sub-categories with inflation rates above 2% Y/Y falling below 50% for the first time since December 2021 (at 49% vs 52% prior).

208 words