-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSpeculation Mounts On Unlocking Delay As COVID-19 Cases Rise

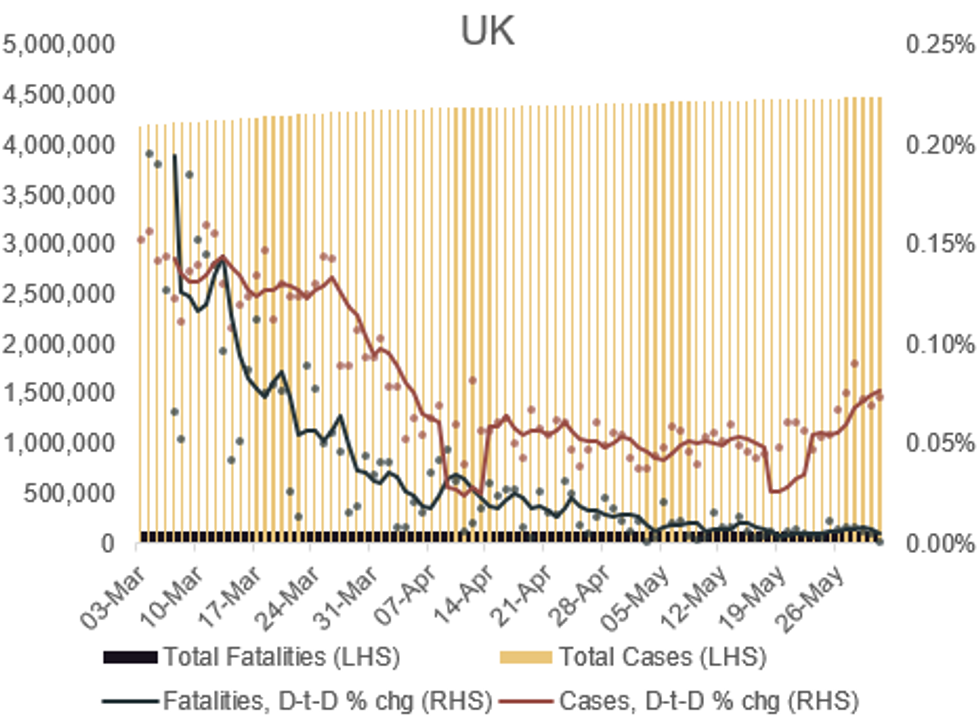

Media speculation is escalating that the final stage of unwinding COVID-19 restrictions in England could be delayed from the intended date of 21 June due to a rise in new infections and a very small uptick in hospitalisations from the virus.

- The 21 June 'Freedom day' has been seen as a full 'return to normalcy' after the pandemic in England, with the 'work from home' order revoked, capacity limits on hospitality removed, and a significant expansion in the size of mass events all expected to provide a notable boost to the UK economy.

- However, there have been calls from some scientists and politicians to push back the date of the full removal of restrictions due to a sustained rise in cases in recent days (see chart below), and a very small increase in hospitalisations. These individuals have argued that the small increase is the start of a potential exponential rise that could result in third-wave of infections from the Indian variant of the virus currently in evidence in the UK, and that a delay of a few weeks to the 21 June lifting of restrictions is a small price to pay to avoid this.

Chart 1. COVID-19 Cases and Fatalities in the UK, Nominal and % chg D-t-D (5dma)

Source: JHU, Gov.UK, MNI

Source: JHU, Gov.UK, MNI

- However, others - including many vocal Conservative MPs - have warned against pushing back the 21 June data, arguing that the UK's rapid vaccination programme offers significant protection to the section of the population accounting for 99% of COVID-19 fatalities, and that the virus is something to be lived with rather than being wholly eliminated.

- The gov't has so far tried to remain on the fence about the issue, having pushed back the date of notification on whether the 21 June unwinding will take place several times. Rising pressure from both sides of the argument are likely to force a decision in the coming days.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.