-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS Open

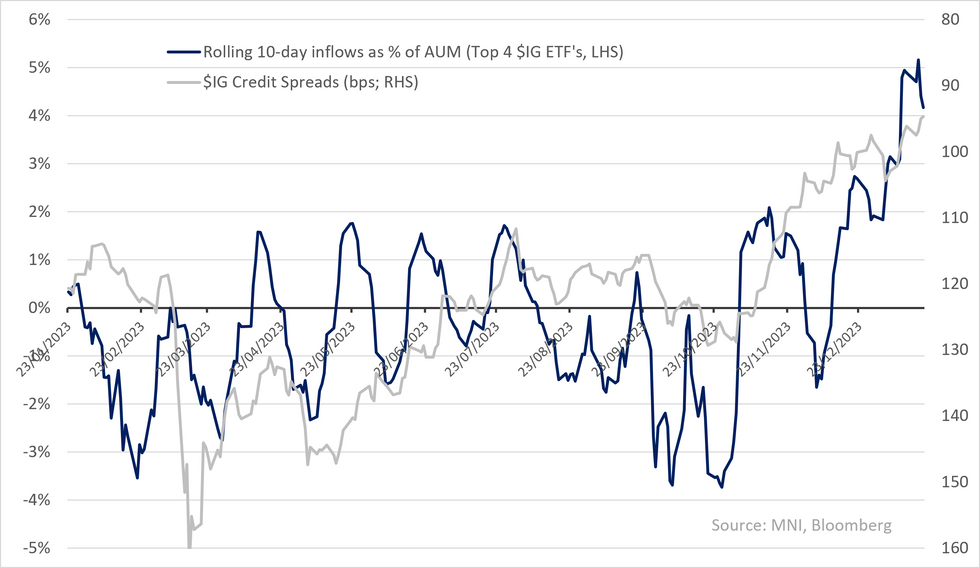

Rates are slightly bid this morning (-2bps), S&P futures flat, Active primary in €IG, spreads still looked skewed slightly tighter (RE curves main underperformer). Friday's session ended with $IG/HY -0.4/-4bps tighter, bringing the week's moves to -2/+1. $ spread curve continued to flatten (in contrast to steepening in €IG) - long-end spreads rallying on yield buying (primary books showed strong skews). Interestingly it came in the face of rates curve (& in turn index yield) bear flattening - continuation in re-steepening seems relative consensus (e.g. 5s30s) & if it does may be another tailwind for long-end spreads. 2-things we wanted to mention ahead of the open;

1. US ETF fund flows (which have been the bulk of recent inflows) show a turn/easing (particularly in $HY) - for $IG It'll be met with a slow down in supply (c$25b this week) perhaps muting any net impact. Part of the demand for $ was reportedly driven by overseas & in particular Euro area investors where there's been a sharp fall in hedging costs (-30bps since Oct in annualised 3m hedging costs) - still spreads in $ are not cheap (historical percentiles vs. €) & it may be duration/yield views that are driving flows across.

2. Swap spreads held onto their Friday morning widening - as we mentioned last week sell-side rates strat's we've seen seem skewed to continue seeing swap spread widening - QT tapering talks may be a tailwind for the moves. Adding onto this forward roll for shorts/payers is very attractive here - 6m5y has 17bps and that increases for those hedging shorter duration (6m2y roll is at 46bps). Both potential upsides for investors hedging in swaps.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.