-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Canada Unemployment Down For 2nd Month On 76K Job Gain

MNI BRIEF: StatsCan Reviews Factory Jobs and U.S. Demand

MNI POLITICAL RISK - House GOP Closes Gap On Budget Resolution

USD/CNH Holding Above 7.2500, LPRs Seen Unchanged Today

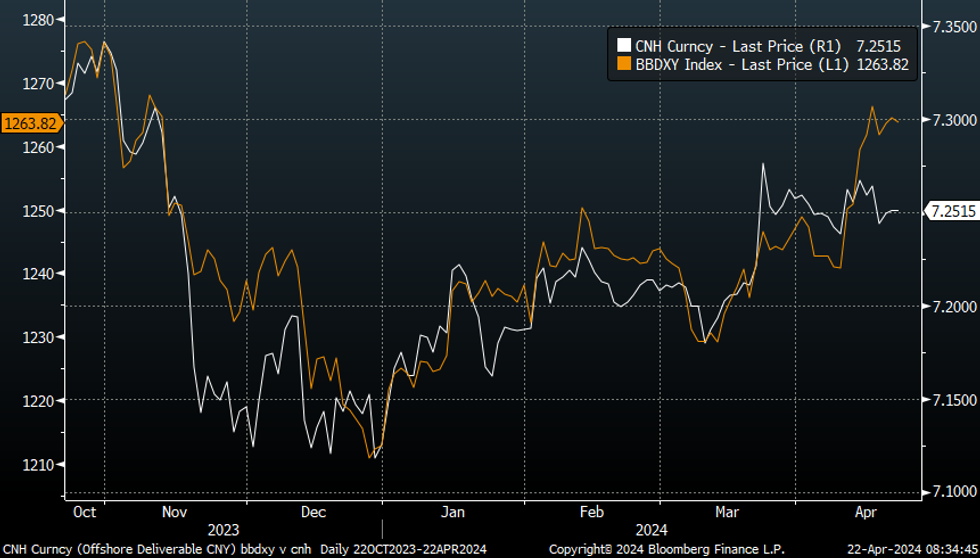

USD/CNH support emerged ahead of 7.2450 on Friday, comfortably off earlier risk aversion induced highs near 7.2630. We track near 7.2510 in early Monday trade, after finishing Friday's session close to unchanged. USD/CNY ended just under 7.2400. CNH made up some ground against the USD last week, while onshore spot lost a touch of ground, albeit amid tight ranges, with moves above 7.2400 in onshore spot unable to be sustained.

- Tighter CNH liquidity was a support point last week, the overnight CNH deposit rate in Hong Kong up to 6.13% on Friday, just shy of recent highs. The 1 week implied CNH rate was near 5.40%, also close to cyclical highs back to August last year. This is helping keep USD/CNH well behaved despite the recent spike up in the broader USD index (see the chart below)

- Still, the USD/CNY fixing crept higher and at 7.1046 is at highs back to the start of March. Early focus this week may be on whether USD/CNY spot can push above 7.2400 and hold above this level.

- On the data front today we have the 5yr and 1yr LPR's No change is expected, with the 5yr currently at 3.95%, the 1yr at 3.45%. PBoC commentary from last week cautioned against excessively low interest rates.

- US Secretary of State Blinken visits China this week, where China-Russia links could reportedly be a focus point.

- US-China relations are likely to remain in focus, particularly in the lead up to the US Presidential election later this year. Last week US President Biden proposed tariffs on certain China steel and aluminium products.

Fig 1: USD/CNH Versus BBDXY Index Trend

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.