-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/RUB Spikes +7.50% as Putin Orders Full-Scale Ukraine Invasion

- USD/RUB trades +6.99% higher at the open with the intraday high at 88.2670. Fighting is being conducted on four fronts with jets, tanks and missiles being used extensively in key cities of Kharkiv, Mariupol, Kyiv & Donetsk.

- As noted earlier in the week, Russia’s position from Belaurs is vital in terms of cutting off NATO support from the West. Additionally, Mariupol is a key strategic point in creating a land bridge and facilitating a sea landing.

- The initial wave sees a potential push towards the Dnieper river to control the East of the country before launching the remainder of the assault towards the West of Ukraine.

- Reactions from Western nations have been towards harsher sanctions, with Kuleba urging SWIFT – which will be the most critical decision for markets.

- The CBR has said it will conduct FX intervention to protect the RUB and provide OFZ liquidity. With $630bn in reserves and <20% of OFZs held by foreigners, this should help limit the damage on the currency, but uncertainty remains elevated and will be contingent on how far Russia pushes the conflict and whether the West implements SWIFT – which could create full extensive global financial instability.

- Putin’s resolve seems to have little consideration for economic consequences and more focused on ideological and legacy-based factors – making the scope for a full invasion of the country notably high.

- USD/RUB will likely focus on round numbers and midpoints in terms of support and resistance. 90 will be the first major obstacle if we push past the initial highs and equated to a 9.82% rise from yesterday’s close.

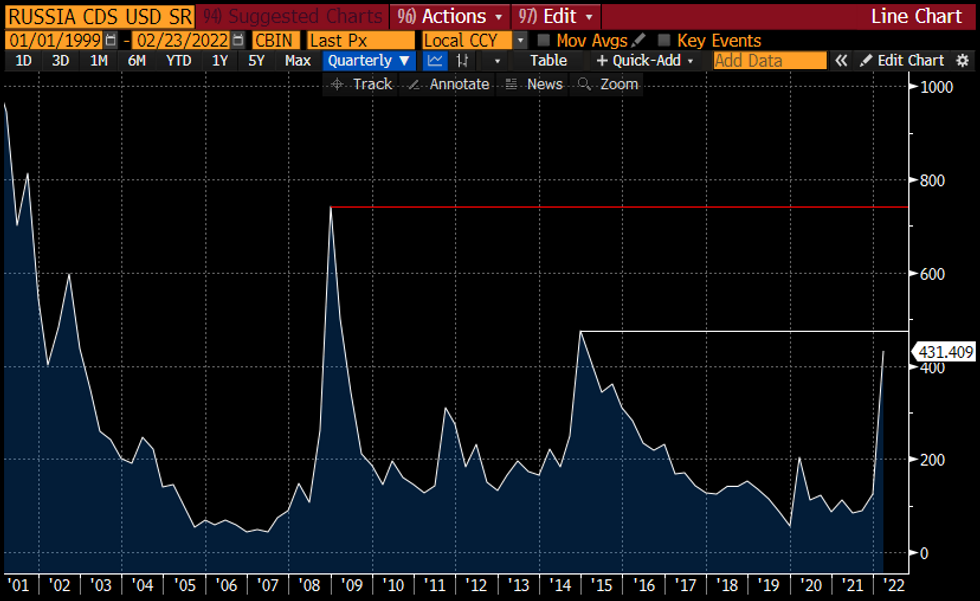

Russia 5Y CDS

Russia 5Y CDS

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.