-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

Wunsch Reminds Wages (And Productivity) Not Aligning For ECB (1/2)

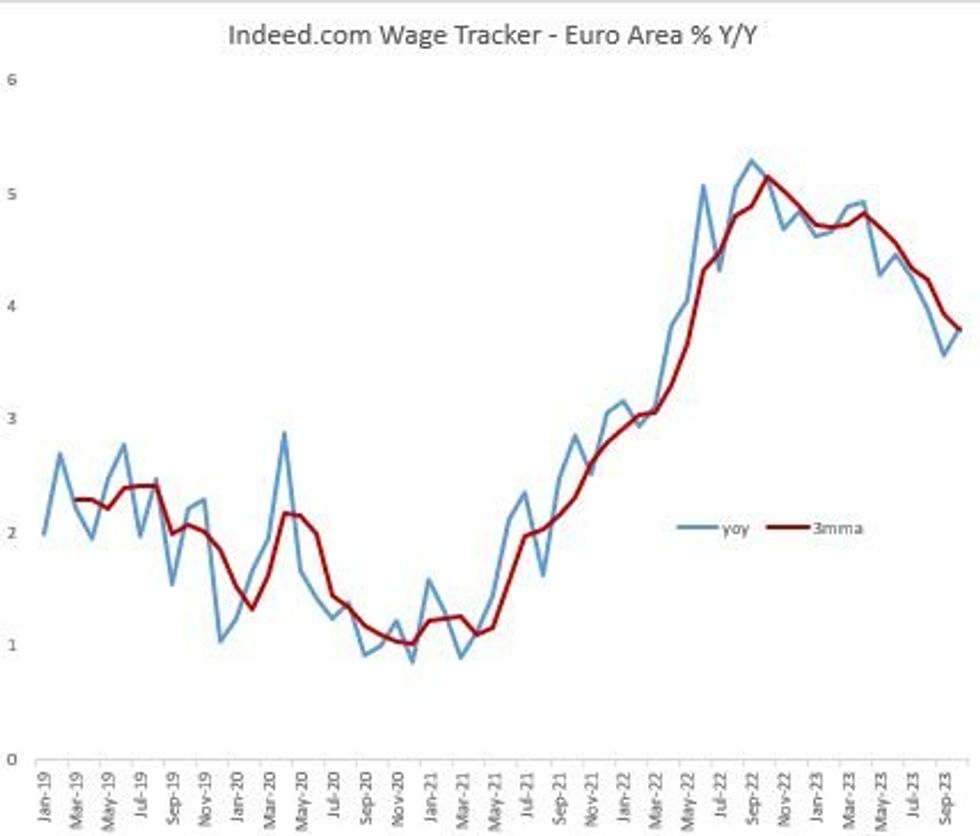

Recent data suggests that the Eurozone labour market - arguably the strongest element of the bloc's economy right now - has turned the corner in a softening direction, after an extended period of unexpectedly solid employment growth. Today's PMIs were a case in point, showing the first fall in the Eurozone employment subindex in almost three years.

- However, the deterioration in actual employment levels and unemployment rates has been slow-moving and it's unclear whether it will be fast enough to give the ECB confidence it is on track to hit its inflation target, until further evidence develops later in 2024.

- November PMIs for example showed stubbornly high input costs for services firms, which is primarily a wage issue, and the EC services surveys suggests more optimism on hiring going forward. And while wage growth is slowing, it is still well above levels consistent with 2% inflation.

- “If wage growth remains at a level that is not compatible with the 2.0%, there is unfortunately nothing we can do even if there is a recession... with wage growth of around 5%, we will not lower interest rates — even if the economy shrinks slightly,” Belgian central bank Governor Wunsch told Boersen-Zeitung in an interview published today, as cited by Bloomberg.

- ECB Chief Economist Philip Lane in May 2022 provided a rough guide to assessing wages vs productivity vs inflation: "under typical conditions and allowing for labour productivity growth at about one per cent, nominal wage growth at three per cent is consistent with the two per cent inflation target".

- Two problems in that formula for achieving the 2% target: nominal wage growth is well above that cited level, and productivity is well below that level.

- By all metrics, wage growth remains well above-average going into Q4 2023. The ECB's negotiated wages tracker showed 4.7% growth in Q3, with national central banks showing 5-6% growth in wages implied by agreements reached for 12 months ahead; the Indeed.com Wage Tracker based on job adverts, often cited by ECB economists as a more up-to-date measure, showed a 3.8% Y/Y rise in October.

Source: Indeed.com, MNI

Source: Indeed.com, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.