-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Not So Fast, Mester

EXECUTIVE SUMMARY

- MNI SOURCES: Italy Seeks EU Cover For Borrowing As Yields Rise

- CLEVELAND FED MESTER: WANT TO RAISE RATES TO NEUTRAL BY YEAR END, AROUND 2.5%, Bbg

- MESTER: MAY NEED ABOVE-NEUTRAL RATES IF PRICES DON’T EASE .. ASKED ABOUT 75 BPS, MESTER SAYS FED DOES NOT `NEED TO GO THERE', Bbg

US TSYS: Cleveland Fed Mester Pushes Back on 75Bp May Hike, Favors 50Bp

Rates trade modestly higher after the bell, recovering a portion of Thursday's sell-off. Bonds see-sawed +/- a few ticks around steady in early trade before making session highs around 1000ET, 30YY slipped to 2.8850% before climbing and holding a range from noon on around 2.9470%.- Short end rates were under pressure for much of the session recovered slightly after the bell as Cleveland Fed Mester pushed back on any need for 75bps hike at May 4 FOMC, in favor of 50bp moves.

- Curves bounced off flatter levels: After tapping 42.0 ahead Mon's open, 2s10s fell to 14.108 low in the first half as markets price in the off chance of 75bp hike at the May 4 FOMC. Bbg noted Fed Swaps priced in 250bp in hikes by year end.

- Nomura analysts anticipate the Fed to make two consecutive 75bp hikes (June and July) after a 50bp hike on May 4:

- "For some time, our view has been that if the Fed could hike 200bp at one meeting without significantly affecting market functioning, they would. So far, markets have been reluctant to price 75bp hikes, but stronger pricing for such a move would likely ease the path for the FOMC and participants could likely forge a consensus on such action quickly".

- Fed enters Policy blackout at midnight tonight.

EUROPE

ITALY: The Italian government hopes for signals from the European Union in favour of more stimulus before increasing its projected budget deficit in coming months in response to the economic impact of the war in Ukraine, in the hope that approval from Brussels will reduce the impact of additional spending on its borrowing costs, sources close to the matter told MNI.

- Italy, which favours an extension of the waiver on rules on public borrowing and debt in Europe’s Stability and Growth Pact and is already concerned by the recent rise in its bond yields, wants any additional spending to be perceived by investors as part of a joint European trend, said one of the sources. While the SGP is already suspended for 2022, extending that until 2023 would signal to markets that Italy is not alone in needing to spend more, they noted.

- “We don’t want to be seen as the sick man of Europe again,” the source said. For more see MNI Policy main wire at 0857ET.

OVERNIGHT DATA

- US FLASH APR SERVICES PMI 54.7 (FCST 58.0); MAR 58.0

- US FLASH APR MANUFACTURING PMI 59.7 (FCST 58.0); MAR 58.8

- US FLASH APR COMPOSITE PMI 55.1 (FCST 57.9); MAR 57.7

MARKETS SNAPSHOT

Key late session market levels:

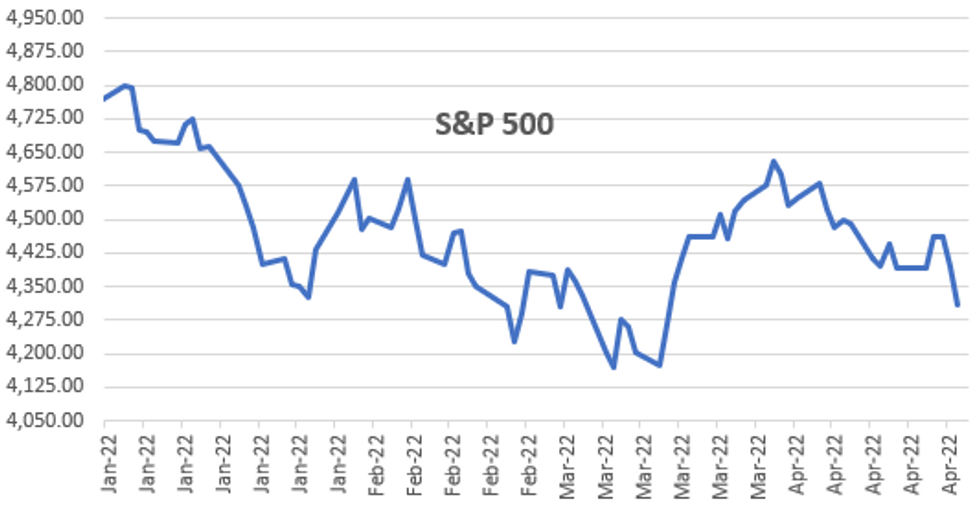

- DJIA down 981.36 points (-2.82%) at 33811.4

- S&P E-Mini Future down 139.5 points (-3.18%) at 4251

- Nasdaq down 335.4 points (-2.5%) at 12839.29

- US 10-Yr yield is down 1.1 bps at 2.8987%

- US Jun 10Y are up 8.5/32 at 119-0.5

- EURUSD down 0.0035 (-0.32%) at 1.0798

- USDJPY up 0.16 (0.12%) at 128.54

- Gold is down $16.24 (-0.83%) at $1935.36

- EuroStoxx 50 down 88.02 points (-2.24%) at 3840.01

- FTSE 100 down 106.27 points (-1.39%) at 7521.68

- German DAX down 360.32 points (-2.48%) at 14142.09

- French CAC 40 down 133.68 points (-1.99%) at 6581.42

US TSY FUTURES CLOSE

- 3M10Y -2.157, 207.012 (L: 200.791 / H: 212.65)

- 2Y10Y -1.906, 20.406 (L: 14.108 / H: 22.556)

- 2Y30Y +0.904, 25.049 (L: 14.885 / H: 25.591)

- 5Y30Y +5.837, 0.867 (L: -8.851 / H: 1.301)

- Current futures levels:

- Jun 2Y up 0.625/32 at 105-10.25 (L: 105-04.375 / H: 105-11.625)

- Jun 5Y up 6.5/32 at 112-16.25 (L: 111-31.5 / H: 112-18.5)

- Jun 10Y up 8/32 at 119-0 (L: 118-08 / H: 119-04.5)

- Jun 30Y up 2/32 at 140-4 (L: 139-10 / H: 140-30)

- Jun Ultra 30Y down 16/32 at 160-26 (L: 160-06 / H: 162-21)

US 10Y FUTURES TECH: (M2) Southbound

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 121-31/09 20-day EMA / High Apr 14 and a key resistance

- RES 1: 120-00+ High Apr 18

- PRICE: 118-17 @ 11:18 BST Apr 22

- SUP 1: 118-08 Intraday low

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries have edged lower again today to reinforce the underlying bearish condition. Fresh cycle lows confirm the resumption of the primary downtrend and an extension of the price sequence of lower lows and lower highs. Moving average studies continue to point south. The focus is on 118-02+ next, a Fibonacci projection. Initial firm resistance is unchanged at 121-09, the Apr 14 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.065 at 98.110

- Sep 22 -0.090 at 97.290

- Dec 22 -0.060 at 96.805

- Mar 23 steady at 96.555

- Red Pack (Jun 23-Mar 24) +0.030 to +0.055

- Green Pack (Jun 24-Mar 25) +0.065 to +0.085

- Blue Pack (Jun 25-Mar 26) +0.090 to +0.095

- Gold Pack (Jun 26-Mar 27) +0.060 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.0000 to 0.32643% (-0.00343/wk)

- 1M +0.03557 to 0.70343% (+0.10900/wk)

- 3M +0.02971 to 1.21371% (+0.15100/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.10214 to 1.82371% (+0.26700/wk)

- 12M +0.16628 to 2.60671% (+0.38514/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $70B

- Daily Overnight Bank Funding Rate: 0.32% volume: $264B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.26%, $906B

- Broad General Collateral Rate (BGCR): 0.30%, $339B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $328B

- (rate, volume levels reflect prior session)

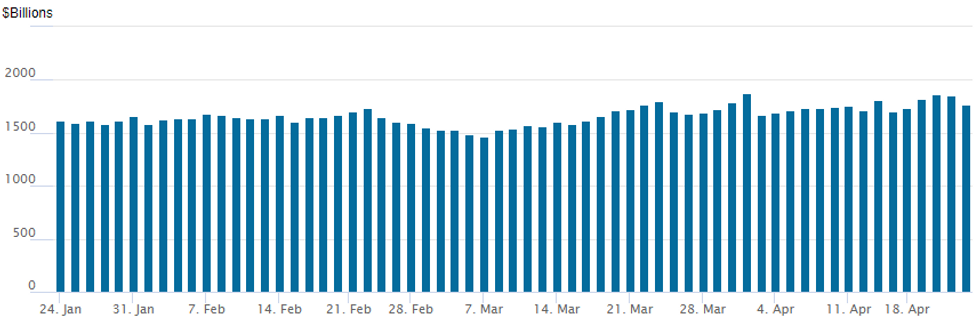

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage receded to 1,765.031B w/ 81 counterparties from prior session 1,854.700B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: APRIL High-Grade Issuance Near $165B

Domestic and some foreign bank US$ high-grade debt issuance surged this week, helping push running total for the month just under $165B. Expect issuance to remain strong ahead the May 4 FOMC where 50bp is widely expected (while 75bp hike is not ruled out by markets). No new issuance Friday.

- Date $MM Issuer (Priced *, Launch #)

- $18.05B Priced Thursday, $68.65B total for the week

- 04/21 $8.75B *Bank of America 4pt $2B 3NC2 +115, $500M 3NC2 SOFR+110, $2.25B 6NC5 +140, $4B 11NC10 +165

- 04/21 $5B *KFW 5Y SOFR+31

- 04/21 $2.3B *Lockheed Martin $800M 10Y +100, $850M 31Y +125, $650M 40Y +140

- 04/21 $1B *Development Bank of Japan 5Y SOFR+57

- 04/21 $1B *PNC Financial perpNC5 6%

FX: Equity Declines See Antipodean FX Plummet, GBPUSD Lowest Since Oct ‘20

- The extended selloff across major equity benchmarks, coupled with the upward pressure on core yields has continued to filter through to currency markets on Friday.

- Weakness in the Chinese Yuan has been persistent throughout the week as concerns over the Chinese growth outlook weighed on the local currency. USDCNY has broken some key technical resistance lines (200DMA, LT downward trending line) and looking at the WoW change (>2%), it represents the biggest move since the August 2015 ‘devaluation’, which generated a market shock with the SP500 falling by over 10%.

- Increased hawkishness towards the FED and the weakening Yuan have added significant headwinds for risk-tied currencies, including the emerging market basket, while continuing to support a bullish outlook for the US Dollar.

- AUD and NZD have been the hardest hit on Friday, both down over 1.5%, as weaker commodity prices contributed towards the perfect bearish storm for Antipodean FX.

- In similar vein, GBPUSD retreated close to 1.5% as sterling also fell victim to the risk-off sentiment. Cable extended aggressively through support and the bear trigger at 1.2974, Apr 13 low, in early European trade and was unable to recover. The break of this level confirms a resumption of bearish activity and an extension of the primary downtrend. Moving average studies also point south, highlighting current market sentiment which saw the pair trade as low as 1.2829 – lowest since October 2020.

- USDJPY remains close to unchanged on Friday, however, headlines continue to spark volatility in the Yen. USDJPY briefly traded back above the 129 handle, narrowing the gap with cycle highs at 129.40, however the pair retraced to around 128.50 approaching the close.

- The Bank of Japan meet next Thursday, a meeting that is garnering a bit more attention given the significant JPY weakening in recent weeks. Immediate focus in the Euro area will be on the French Presidential election results. The last opinion polls to be carried out ahead of the 24 April run-off election between Macron and Marine Le Pen continue to show the incumbent widening the gap in the last stages of the campaign.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2022 | 0900/1100 |  | FR | Presidential Election 2nd Round | |

| 25/04/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/04/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 25/04/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/04/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/04/2022 | 1500/1100 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/04/2022 | 1700/1900 |  | EU | ECB Panetta Speech at Columbia University |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.