-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGLOBAL WEEK AHEAD: Gloomy Sentiment Outlooks for Europe

Monday:

Germany IFO Survey: The German IFO business climate index is anticipated to slow by another 1.5 points to 87.0 in September. This would be a fresh low since the pandemic onset with IFO seeing a -0.5% Q3 contraction. Acute concerns regarding both economic outlooks and gas/energy supply shortages remain key issues headed into year-end. Friday’s flash September PMI reiterated these issues and noted that easing supply chains are the only positive factor at present.

Tuesday:

US Consumer Confidence, US Durable Goods, New Home Sales: A 1.1-point improvement to 104.3 is projected for US consumer confidence in September. This would be the second month of improvement as inflationary concerns ease in the US. Also on the schedule for Tuesday will be durable goods orders, with the advance print anticipated to see a modest -0.1% contraction as demand slows. US mortgage rates are currently at a 14-year high, squeezing the new home housing market. New home sales will likely slow for the third consecutive month, to 500 (down 11k from July and back around late 2015 levels).

Wednesday:

Germany GfK Consumer Confidence: Consumer sentiment in Germany will likely fall another two points to a fresh record low of -38.5 for October due to relentless energy costs and recessionary fears.

France Consumer Confidence: September French should follow suit, edging another two points lower to 80 and giving back the modest improvement of August. An index of 80 is around euro-debt crisis lows.

Italy Consumer Confidence: Italian confidence completes the Wednesday round, forecast to slip 2.7 points to 95.0. The uncertain political environment will have added downwards pressure again in August.

Thursday:

Eurozone Economic Sentiment: Completing the round of pessimistic outlooks, the euro area aggregate consumer confidence index should be confirmed at a record low of -28.8. Economic sentiment is seen following suit, falling 2.4 points to 95.0 as recessionary fears loom.

Spain Flash Inflation: Spanish flash inflation is likely to ease in September, by 0.4pp to 10.1% whilst month-on-month prices pick up to +0.6% in the harmonised print.

Germany Flash Inflation: Following a slew of state CPIs, German headline inflation is set to soar further in the August flash estimate, quickening by 1.1pp to +1.5% m/m and by 1.4pp to +10.2% y/y, generating considerable concern for the ECB ahead of Friday’s aggregate print. A couple hours prior to release time of 1300 BST, MNI will calculate an estimate based on close to 90% of state CPI data.

Canada GDP: Canadian July GDP is anticipated to contract on the month by -0.1% after almost stalling in June at +0.1% m/m. GDP is eyed at a buoyant +4.2% y/y in July, slowing 0.5pp from the previous month.

Friday

Germany Labour Report: Despite crumbling consumer and economic sentiment, the German labour market remains robust into August. The unemployment rate should remain around 5.5%, however an upside surprise would be largely due to the inclusion of Ukrainian refugees being accounted for.

France Flash Inflation & Consumer Spending: French CPI is expected to stall at +6.6% y/y in the harmonised September flash.

Italy Flash Inflation: Italian inflation will likely accelerate further in September, projected to increase 0.3pp to +9.4% y/y and double the month-on-month pace to +1.6%.

Eurozone Inflation & Unemployment: With hot German and Italian inflation prints on the menu, both core CPI and headline are set to soar to fresh highs in September. Consensus is looking for core to reach +4.7% y/y (up 0.4pp) and headline to reach +9.7% y/y (up 0.6pp).

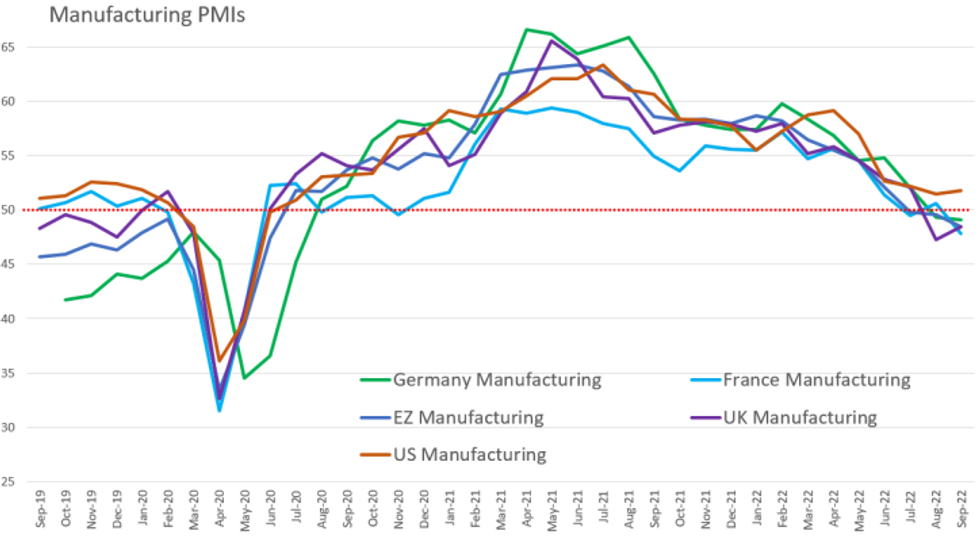

This data in conjunction with Friday’s flash PMIs slipping further into contraction all but confirm that the ECB faces a sticky situation hiking into a recession. Any signs of easing inflation are largely anticipated to be on the back of easing energy costs, whilst broad-based inflationary pressures continue to worsen.

US Personal Income/Consumption & Chicago PMI: US personal income and spending are forecast at +0.3% m/m and +0.2% m/m in August, both signifying a 0.1pp uptick from July. MNI’s Chicago PMI is also due on Friday afternoon, after stalling at 52.2 in August. The final Michigan sentiment index and inflation outlooks for the month will also be released.

Downbeat manufacturing PMIs set the stage in the September flash estimates. Source: MNI / Bloomberg / S&P Global

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 26/09/2022 | 0700/0900 |  | EU | ECB de Guindos Speaks with AED in Madrid | |

| 26/09/2022 | 0730/0930 |  | EU | ECB Panetta Speaks at Bundesbank | |

| 26/09/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/09/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/09/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 26/09/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 26/09/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/09/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 26/09/2022 | 1600/1700 |  | UK | BOE Tenreyro Speaks on Climate Change | |

| 26/09/2022 | 1630/1230 |  | US | Dallas Fed's Lorie Logan | |

| 26/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2022 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester | |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/09/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/09/2022 | 0035/2035 |  | US | San Francisco Fed's Mary Daly | |

| 28/09/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE | |

| 29/09/2022 | 0700/0900 |  | EU | ECB Panetta Intro at ECOFIN Hearing | |

| 29/09/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/09/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/09/2022 | 0800/1000 |  | EU | ECB de Guindos Speech at BIS/Bank of Lithuania | |

| 29/09/2022 | 0800/1000 |  | IT | PPI | |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly | |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.