-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

AU Data Surprises At Relative Record Highs To NZ

AUD/NZD is tracking lower. After touching close to 1.1090 in early trade we are now back to 1.1060, down slightly for the session. Short term moves could be dictated by broader risk appetite, particularly by cross yen flows, which the A$ may show greater sensitivity to relative to NZD. However, the fundamental skew for the AUD/NZD still looks higher.

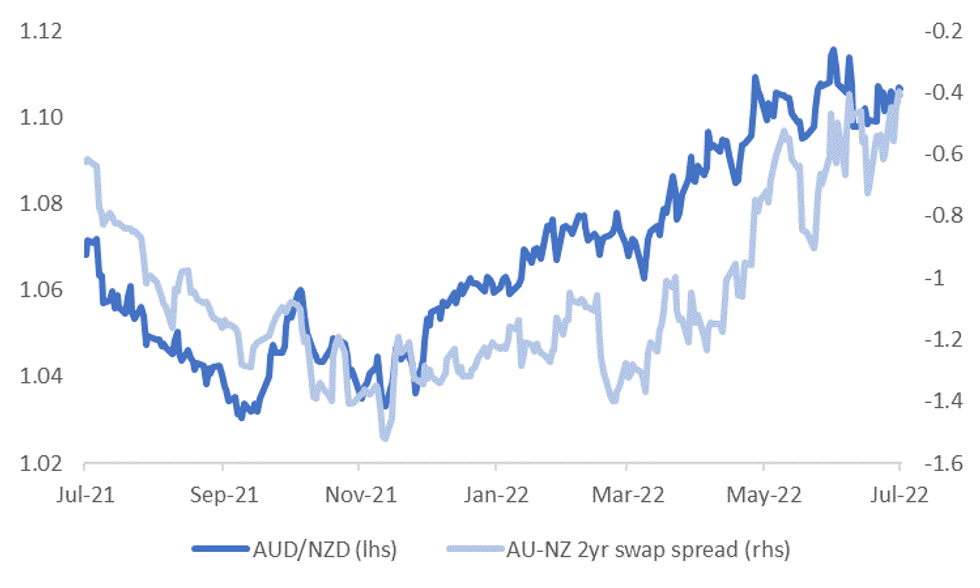

- The first chart plots the AU-NZ 2yr swap spread, which pushed back to -40bps, overlaid against spot AUD/NZD. This is highs in the spread going back to June last year.

- In the government bond space, the spread picture less supportive for AUD but remains on a positive trend.

Fig 1: AUD/NZD & AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

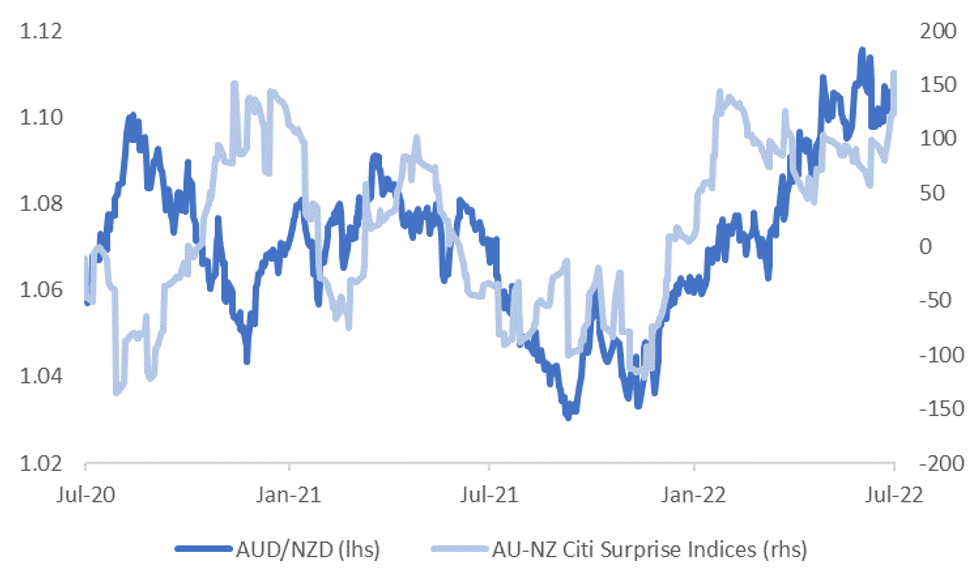

- Relative data surprises remain heavily skewed in AUD's favor. The second chart overlays AUD/NZD against the relative AU-NZ Citi EASI differential. This differential is at record highs. Since 2021 the correlation with the AUD/NZD cross has also been quite reasonable.

- Earlier today, the ANZ Truckometer dipped -2.7% in June. The Bank noted "...suggests it’s a line ball call whether GDP managed to grow at all in the quarter." It added that "there are lots more GDP indicators to come."

- The Citi AU EASI has been buoyed by yesterday's record trade surplus figures, but other data has generally painted a more upbeat picture relative to NZ.

- Importantly, NZ is more reliant on Australian growth, than the other way around.

- This should keep AUD/NZD dips supported, note the 50-day MA come in at 1.1037, while previous highs - 1.1150/75 could be eyed on the topside.

- Next week in NZ the main focus will be on Wednesday's RBNZ decision (+50bps hike expected), while in Australia, Westpac consumer sentiment and NAB business confidence is due Tuesday, followed by June jobs data on Thursday.

Fig 2: AUD/NZD & AU-NZ Citi EASI Differential

Source: Citi/MNI - Market News/Bloomberg

Source: Citi/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.